DEC 14, 2023

What the 4th Bitcoin Halving Could Mean for Bitcoin and Crypto

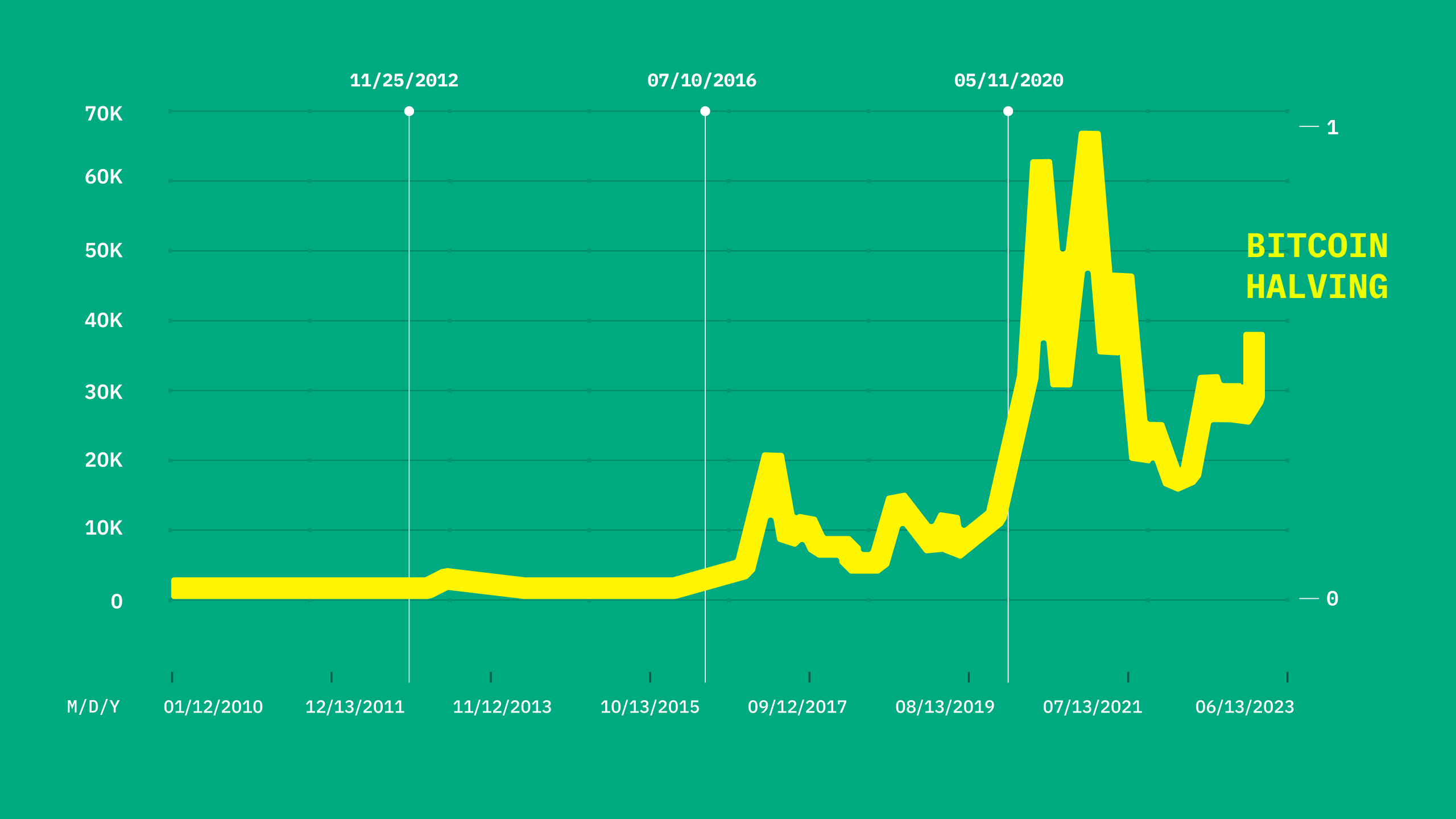

Bitcoin halving events occur roughly once every four years. Thus far, in the network's almost 15-year history, the price of bitcoin (BTC) has increased significantly in the period following each halving event. With the fourth Bitcoin halving expected to arrive in April 2024, here, we explore what a halving is and what it could mean for the price of bitcoin and crypto.

What is the Bitcoin Halving and Why is it Important?

The supply schedule of bitcoin is deflationary with a finite supply of 21 million bitcoin coded into the network’s source code. This feature differentiates it from all fiat currencies and many other cryptos. Bitcoin’s supply schedule dictates that every time a miner successfully writes a new block to the blockchain (i.e., solves the ), that miner receives a set number of bitcoin called the "block reward."

2024 Crypto Trend Report

This blog is part of our 2024 Crypto Trend Report series.

If this block reward never changed, the supply of bitcoin would increase forever. To encode Bitcoin’s deflationary nature, every 210,000 blocks — roughly every four years — the block reward is reduced by half, an event often referred to as the “the halving” or "the halvening."

Genesis: When Bitcoin launched in 2009, the initial block reward was 50 bitcoin.

First Halving: On November 25, 2012, the first halving occurred, halving the block reward from 50 to 25 bitcoin.

Second Halving: On July 10, 2016, the second halving occurred, halving the block reward from 25 to 12.5 bitcoin.

Third Halving: On May 11, 2020, the third halving occurred, halving the block reward from 12.5 to 6.25 bitcoin.

Fourth Halving: The next halving is expected to happen in April 2024 and will reduce the block reward from 6.25 to 3.125 bitcoin.

The block reward will continue to undergo halvings until it reaches 0, which is estimated to happen sometime in the year 2140. At that point in time, there will be a total of 21 million bitcoin in circulation.

This reduction in the supply of bitcoin, about every four years, has played a significant role in price swings following a halving event. Could we see a similar dynamic this time around?

How Have Previous Halvings Impacted the Price of Bitcoin?

The halving certainly isn’t the only factor that can impact the price of bitcoin. Just this year we’ve seen the impact national monetary policy and other developments like the emergence of a spot bitcoin ETF can have on prices. Nevertheless, the halving is a notable event for investors and forms one of the main pillars in bitcoin’s investment case.

As we can see in the chart below, the price of bitcoin saw a parabolic rise in the periods following each of its three previous halving events.

Will we see a similar increase in price following the fourth Bitcoin halving coming in a few months? Nothing is certain, but if history is any guide we could be in for a wild ride.

Onward and Upward!

Team Gemini

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026