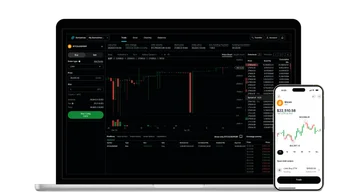

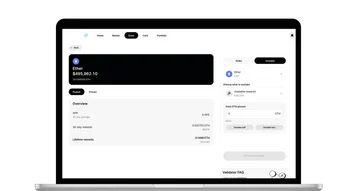

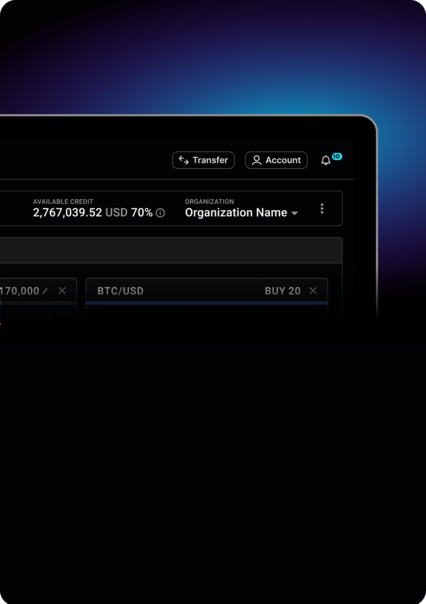

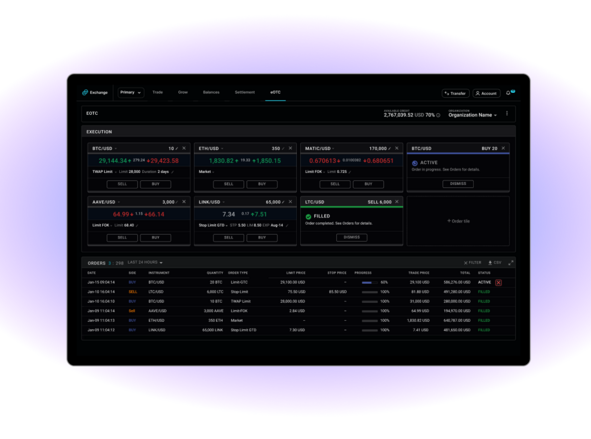

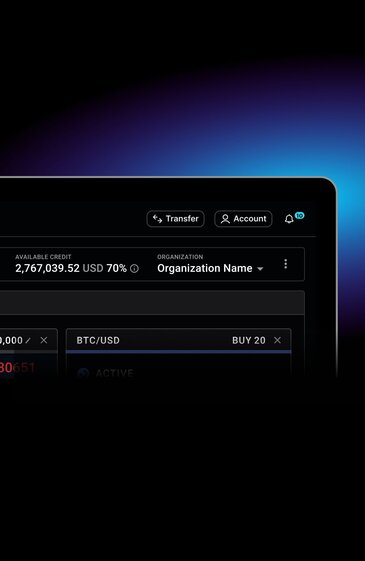

Gemini eOTC is a fully electronic over-the-counter trading platform for institutions¹. It provides real-time visibility into changing asset prices as well as the status and execution details of placed orders.

Watch the demo

Gemini

OTC

A high-touch, white glove over-the-counter (OTC) client experience for spot, options, and other derivatives products.

Our OTC solution is tailor-made for institutional traders and investors.¹ Execute trades by partnering with Gemini’s OTC trading desk or manage your own trading execution strategy through eOTC, Gemini’s automated trading platform.

eOTC: Competitive pricing with optimal execution.

Pricing is sourced from top liquidity providers to pass on tight spreads and deep liquidity to you. When an order is placed, it is executed using the best price across those providers, ensuring optimal price execution.

Delayed net settlement

Through intraday delayed net settlement, institutions can increase capital efficiency and avoid missed opportunities that can result from pre-funding requirements.

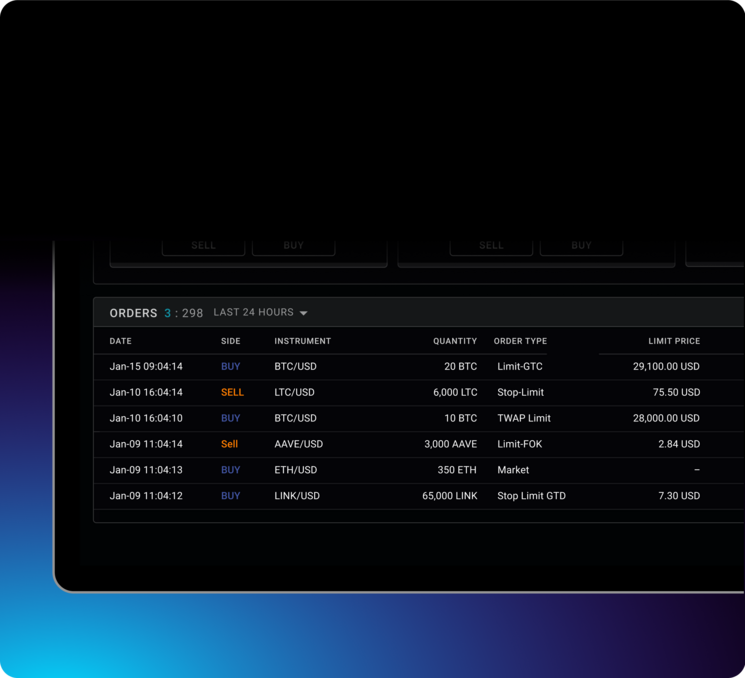

Broad range of order types

We offer a variety of order types, including limit orders, market orders and TWAPs, with full visibility into the status of placed trades.

Delayed net settlement

Through intraday delayed net settlement, institutions can take advantage of fast moving markets, increased capital efficiency, and avoid missed opportunities that can result from pre-funding requirements.

White glove service and 24/7 trading coverage

Our team combines deep expertise across crypto, capital markets, security, and technology to deliver tailored solutions that meet your institution’s unique requirements and objectives.

Commitment to compliance and regulation

We have worked with regulatory stakeholders and lawmakers around the world to help shape thoughtful regulation that fosters both consumer protection and innovation. We have spent considerable time applying for and becoming licensed and regulated in various jurisdictions across the world. This is not the easier path but we believe it is the right one.

Full-reserve exchange and qualified custodian

At Gemini, trust and security are our top priorities. Gemini Trust Company (GTC) is a full-reserve exchange and qualified custodian under the New York Banking Law and is licensed by the New York State Department of Financial Services. Gemini NuSTAR, LLC utilizes the eOTC settlement and wallet infrastructure, which is managed by GTC, which is SOC-2 Type II complaint.

Choose your OTC client experience: Voice, chat or eOTC.

Gemini’s OTC Desk is tailored to the needs of institutions that prefer a more traditional bespoke over-the-counter solution. Voice OTC offers a high touch client experience, with 24/7 trading team coverage and the option to consult with our team on market conditions.

Contact our OTC Desk

Questions?

Answers.

How does eOTC differ from traditional voice OTC trading?

We built eOTC for efficiency and ease of use without compromising the benefits of deep liquidity and competitive pricing that comes with traditional voice OTC trading. With eOTC, you can place an order using different algorithms and strategies, track the status in real-time and retain the history of all the previous trades in one intuitive interface. For institutions with more complex needs or those that need to trade instruments not covered by the eOTC platform, our voice OTC Desk remains available.

Do I need to set up accounts with eOTC’s liquidity partners?

No. Gemini NuStar will serve as the single counterparty for all eOTC trades and settlement–no additional accounts required.

Are there any additional fees or charges to use Gemini eOTC?

No. There are no additional trading or settlement fees when using eOTC or working with Gemini’s eOTC Trading Team.

Is there a minimum trade size?

The minimum trade size is $1,000 notional value per order.

Resources

Gemini OTC Tear Sheet

Gemini eOTC Tear sheet

Institutional Insights

Recent institutional stories and insights from our blog

Gemini

OTC

A high-touch, white glove over-the-counter (“OTC”) client experience for spot, options, and other derivatives products.

Our OTC solution is tailor-made for institutional traders and investors.¹ Execute trades by partnering with Gemini’s OTC trading desk or manage your own trading execution strategy through eOTC, Gemini’s automated trading platform.

Watch the demo

eOTC: Competitive pricing with optimal execution.

Pricing is sourced from the top liquidity providers to pass on the tight spreads and deep liquidity to you. When an order is placed, it is executed using the best price across those providers, ensuring optimal price execution.

Watch the demo

Delayed net settlement

Through intraday delayed net settlement on eOTC, institutions can take advantage of fast moving markets, increase capital efficiency, and avoid missed opportunities that can result from pre-funding requirements.

White glove service and 24/7 trading coverage

Our team combines deep expertise across crypto, capital markets, security, and technology to deliver tailored solutions that meet your institution’s unique requirements and objectives.

Gemini is Highly Regulated

We have worked with regulatory stakeholders and lawmakers around the world to help shape thoughtful regulation that fosters both consumer protection and innovation. We have spent considerable time applying for and becoming licensed and regulated in various jurisdictions across the world. This is not the easier path (it is expensive and time consuming) but we believe it is the right one.

Full-reserve exchange and qualified custodian

At Gemini, trust and security are our top priorities. Gemini Trust Company (GTC) is a full-reserve exchange and qualified custodian under the New York Banking Law. GTC is also licensed by the New York State Department of Financial Services (NYDFS) and is SOC 2 Type II compliant.

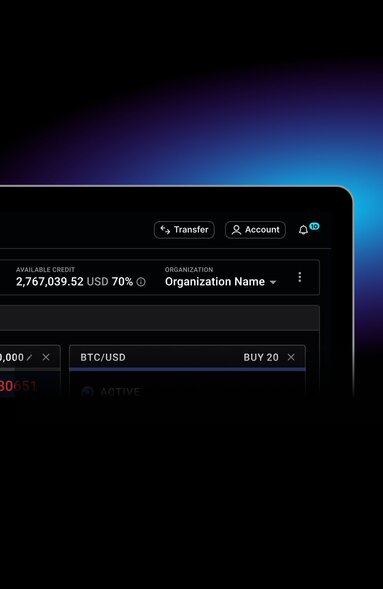

See it in action

In this demo, learn how to navigate eOTC, place orders, track the status of your trades in real-time, monitor your credit limit and more.

Watch the demo

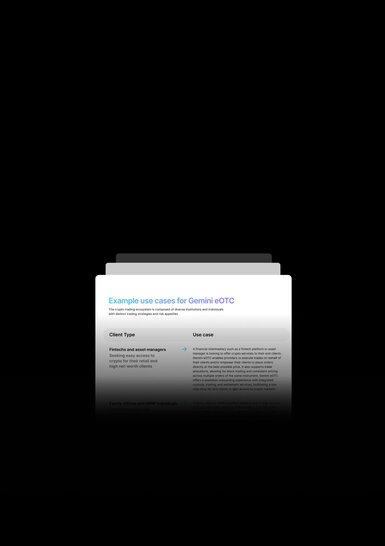

How institutions can use eOTC

In this whitepaper, we discuss challenges facing institutional crypto traders today, key features that address these challenges and use cases for various client segments.

Read the whitepaper

See it in action

In this demo, learn how to navigate eOTC, place orders, track the status of your trades in real-time, monitor your credit limit and more.

Watch the demo

How institutions can use eOTC

Explore challenges for institutional crypto traders, key solutions, and use cases across client segments.

Read the whitepaper

If you prefer a voice OTC experience

Gemini’s Voice OTC Desk is tailored to the needs of institutions that prefer a more traditional bespoke over-the-counter solution. Voice OTC offers a high touch client experience, with 24/7 trading team coverage and the option to consult with our team on market conditions. It’s an execution desk at your fingertips

Contact Voice OTC Desk

1 Gemini eOTC is currently available in 70 jurisdictions including the US (available in all states excluding New York State residents), UK, Ireland and Singapore. Gemini eOTC is offered through an affiliate of Gemini Trust Company, LLC (GTC), Gemini NuSTAR, LLC.

2 Trading credit limits are set by Gemini’s Risk and Compliance teams based on detailed credit assessment and require additional documentation.

Questions?

Answers.

How does eOTC differ from traditional voice OTC trading?

We built eOTC for efficiency and ease of use without compromising the benefits of deep liquidity and competitive pricing that comes with traditional voice OTC trading. With eOTC, you can place an order, track the status in real-time and retain the history of all the previous trades in one intuitive interface. For institutions with more complex needs or those that need to trade instruments not covered by the eOTC platform, voice OTC trading is available.

Do I need to set up accounts with eOTC’s liquidity partners?

No, Gemini NuStar will serve as the single counterparty for all eOTC trades and settlement.

Are there any additional fees or charges to use Gemini eOTC?

There are no additional fees to trade with eOTC nor to settle with Gemini’s eOTC Trading Team.

Is there a minimum trade size?

The minimum trade size is $1,000 notional value per order.

Resources

Gemini Voice OTC Tear Sheet

Gemini eOTC Tear sheet

Gemini

OTC

A high-touch, white glove over-the-counter (“OTC”) client experience for spot, options, and other derivatives products.

Gemini

eOTC

Trade with deep liquidity for optimal price execution of large orders

Our OTC solution is tailor-made for institutional traders and investors.¹ Execute trades by partnering with Gemini’s OTC trading desk or manage your own trading execution strategy through eOTC, Gemini’s automated trading platform.

Watch the demo

Gemini

eOTC

Trade with deep liquidity for optimal price execution of large orders

Gemini eOTC is a fully electronic over-the-counter trading platform for institutions¹. It provides real-time visibility into changing asset prices as well as the status and execution details of placed orders.

Watch the demo

eOTC: Competitive pricing with optimal execution.

Pricing is sourced from top liquidity providers to pass on tight spreads and deep liquidity to you. When an order is placed, it is executed using the best price across those providers, ensuring optimal price execution.

Watch the demo

Delayed net settlement

Through intraday delayed net settlement on eOTC, institutions can take advantage of fast moving markets, increase capital efficiency, and avoid missed opportunities that can result from pre-funding requirements.

White glove service and 24/7 trading coverage

Our team combines deep expertise across crypto, capital markets, security, and technology to deliver tailored solutions that meet your institution’s unique requirements and objectives.

Gemini is Highly Regulated

We have worked with regulatory stakeholders and lawmakers around the world to help shape thoughtful regulation that fosters both consumer protection and innovation. We have spent considerable time applying for and becoming licensed and regulated in various jurisdictions across the world. This is not the easier path (it is expensive and time consuming) but we believe it is the right one.

Full-reserve exchange and qualified custodian

At Gemini, trust and security are our top priorities. Gemini Trust Company (GTC) is a full-reserve exchange and qualified custodian under the New York Banking Law and is licensed by the New York State Department of Financial Services. Gemini NuSTAR, LLC utilizes the eOTC settlement and wallet infrastructure, which is managed by GTC, which is SOC-2 Type II complaint.

See it in action

In this demo, learn how to navigate eOTC, place orders, track the status of your trades in real-time, monitor your credit limit and more.

Watch the demo

How institutions can use eOTC

In this whitepaper, we discuss challenges facing institutional crypto traders today, key features that address these challenges and use cases for various client segments.

Read the whitepaper

Choose your OTC client experience: Voice, chat or eOTC.

Gemini’s Voice OTC Desk is tailored to the needs of institutions that prefer a more traditional bespoke over-the-counter solution. Voice OTC offers a high touch client experience, with 24/7 trading team coverage and the option to consult with our team on market conditions. It’s an execution desk at your fingertips

Contact our OTC Desk

1 Gemini eOTC is currently available in 70 jurisdictions including the US (available in all states excluding New York State residents), UK, Ireland and Singapore. Gemini eOTC is offered through an affiliate of Gemini Trust Company, LLC (GTC), Gemini NuSTAR, LLC.

Institutional Insights

Recent institutional stories and insights from our blog

Questions?

Answers.

How does eOTC differ from traditional voice OTC trading?

We built eOTC for efficiency and ease of use without compromising the benefits of deep liquidity and competitive pricing that comes with traditional voice OTC trading. With eOTC, you can place an order, track the status in real-time and retain the history of all the previous trades in one intuitive interface. For institutions with more complex needs or those that need to trade instruments not covered by the eOTC platform, voice OTC trading is available.

Do I need to set up accounts with eOTC’s liquidity partners?

No, Gemini NuStar will serve as the single counterparty for all eOTC trades and settlement.

Are there any additional fees or charges to use Gemini eOTC?

There are no additional fees to trade with eOTC nor to settle with Gemini’s eOTC Trading Team.

Is there a minimum trade size?

The minimum trade size is $1,000 notional value per order.

Resources

Gemini OTC Tear Sheet

Gemini eOTC Tear sheet

Institutional Insights

Recent institutional stories and insights from our blog

Questions?

Answers.

How does eOTC differ from traditional voice OTC trading?

We built eOTC for efficiency and ease of use without compromising the benefits of deep liquidity and competitive pricing that comes with traditional voice OTC trading. With eOTC, you can place an order, track the status in real-time and retain the history of all the previous trades in one intuitive interface. For institutions with more complex needs or those that need to trade instruments not covered by the eOTC platform, voice OTC trading is available.

Do I need to set up accounts with eOTC’s liquidity partners?

No, Gemini NuStar will serve as the single counterparty for all eOTC trades and settlement.

Are there any additional fees or charges to use Gemini eOTC?

There are no additional fees to trade with eOTC nor to settle with Gemini’s eOTC Trading Team.

Is there a minimum trade size?

The minimum trade size is $1,000 notional value per order.

See all Gemini eOTC FAQs

Resources

Gemini eOTC Tear sheet

Gemini Voice OTC Tear Sheet