SEP 29, 2023

Weekly Market Update - Friday, September 29, 2023 - MicroStrategy Buys ~$150 Million Worth of Bitcoin, Bipartisan Group Urges SEC to Approve Bitcoin ETF, and Pudgy Penguins Waddle Into Walmart

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we resurface our discussion of liquidity pools.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +0.56% | $26,838 |

$26,838

+0.56%

| |

Ether

ETH | +4.49% | $1,669 |

$1,669

+4.49%

| |

Storj

STORJ | +23.70% | $0.4368 |

$0.4368

+23.70%

| |

Compound

COMP | +21.90% | $47.29 |

$47.29

+21.90%

| |

Chainlink

LINK | +15.70% | $7.8589 |

$7.8589

+15.70%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, September 29, 2023, at 11:40am ET. . All prices in USD.

Takeaways

- Bipartisan group in Congress urges spot Bitcoin ETF approval as SEC punts: Bitcoin saw a mid-week bump as a bipartisan group of Congressmembers urged SEC chair Gensler to immediately approve a Bitcoin ETF. The SEC delayed a number of spot ETF application decisions as a US government shutdown looms.

- MicroStrategy adds to its bitcoin coffers with purchases totalling ~$150 million: MicroStrategy, one of the largest bitcoin holders, bought 5,445 bitcoins for ~$147.3 million USD, at an average price around $27,053 USD. The purchases were made between August 1 and September 24. The company said it was considering buying even more.

- Leading NFT brand Pudgy Penguins to sell toys at Walmart: The Pudgy Toys collection will be available in 2,000 Walmart stores across America. Each toy comes with a QR code, which once scanned gives the user access to the online virtual Pudgy World.

- Curve founder closes out debt positions on Aave, pushing CRV higher: Curve (CRV) rallied this week, trading up 17%, after Curve founder Michael Egorov paid off his entire debt position on the DeFi lending protocol Aave.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Congressional Group Urges Spot Bitcoin ETF Approval as SEC Delays Decisions on Applications

started the week consolidating just above the $26k USD mark before seeing a brief jump on Wednesday. The bump came after a bipartisan Congressional group to SEC chair Gary Gensler requesting the immediate approval of a spot Bitcoin ETF. , the Congressmembers claimed that the SEC is discriminating against a spot Bitcoin ETF, adding that there is no reason to continue denying applications following the recent .

moved back to the low $26k USD range, however, shortly after the letter was released, as the SEC announced it would on the ARK 21Shares spot Bitcoin ETF until January 2024. A decision wasn’t due until November 11.

It was reported on Thursday that the decisions on spot Bitcoin ETF applications from Blackrock, Bitwise, Invesco, and Valkyrie, as a US government shutdown looms. Nevertheless, saw positive price movement beginning on Thursday, with prices surpassing $27k USD before settling in the high $26k range.

MicroStrategy Buys Another $147.3 million USD Worth of Bitcoin

It was revealed Monday that , one of the largest holders of , for ~$147.3 million USD, for an average price around $27,053 USD. The purchases were made between August 1 and September 24, according to a regulatory filing. 158,245 BTC, worth ~$4.25 billion USD as of Friday.

MicroStrategy also said it was considering selling MSTR shares to , with plans to purchase more BTC with some of the proceeds.

Pudgy Penguins Toys Available at Walmart, Pushing Back Against Growing NFT Skepticism

On Tuesday, Luca Netz, the CEO of leading NFT brand Pudgy Penguins, revealed that its Pudgy Toys collection across the US. Each toy comes with a QR code, which once scanned gives the user access to the online virtual Pudgy World.

The move comes a week after titled “Your NFTs Are Actually — Finally — Totally Worthless,” Despite the decline in prices across the NFT market, Pudgy Penguins has attempted to bridge the gap between the physical and digital world pushing the Web3 narrative forward.

Curve Rallies as Founder Pays Off Entire Aave Debt Position

rallied this week, after Curve founder Michael Egorov on the DeFi lending protocol Aave. CRV is trading up 13% over the past seven days as of Friday morning.

took a massive hit in August following at the end of July, which led to CRV losing ~25% in a single day. The exploit also brought to light Egorov’s large outstanding debt positions that were , which represented 47% of the project's entire circulating supply.

The outstanding debt position led to contagion fears, as a forced liquidation could have caused large losses on a number of DeFi protocols where the debts were held given the illiquidity of the CRV tokens backing the loans. At the time, of his Curve tokens to liquidity providers which helped ease fears.

US Stocks Struggle With Government Shutdown Imminent

The and both hit their lowest levels since the start of June this week, while September looks set to be the worst month of the year. Both indices are down over 3% over the past month. continue to bolster expectations that interest rates may stay higher for longer, adding pressure on global equity prices.

The impending government shutdown, which seems increasingly likely to begin on Sunday, has added further negative sentiment to the market and throughout the month.

-From the Gemini Trading Desk

data as of 5:30pm ET on September 28, 2023.

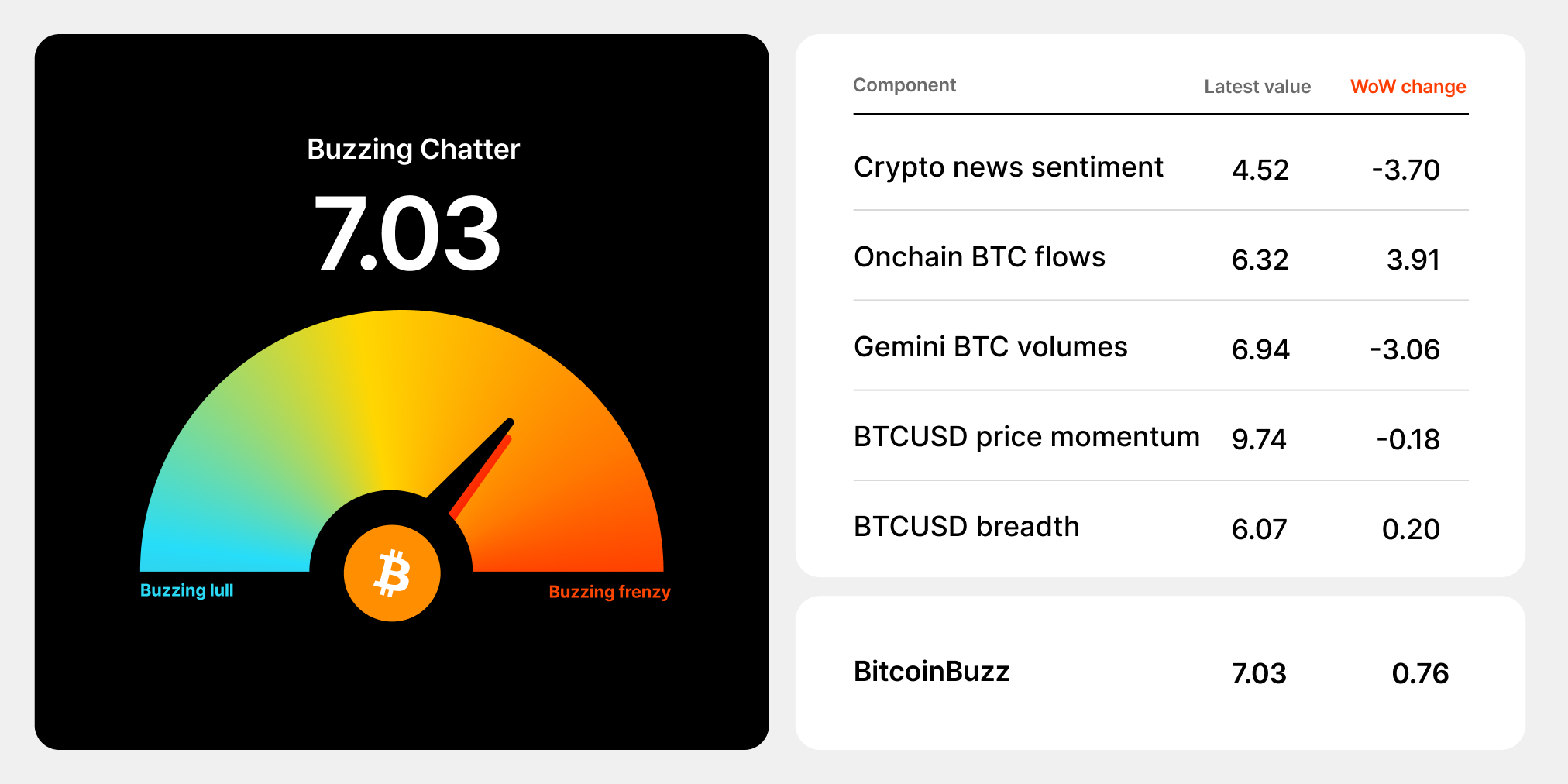

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Crypto Liquidity Pools

Crypto play an essential role in the ecosystem. They are a mechanism by which users can pool their assets in a decentralized exchange’s (DEX) to provide asset liquidity for traders to trade crypto more easily. At a high level, liquidity pools provide , speed, and convenience when trading on DeFi platforms.

Prior to the rise of , crypto market liquidity was a challenge for DEXs across the Ethereum ecosystem. Early on, DEXs were a new technology that usually sported a complicated interface and a relatively low volume of buyers and sellers, making it challenging to find sufficient liquidity on a regular basis.

AMMs were developed to fix this problem of limited liquidity through the creation of liquidity pools, which offer liquidity providers an incentive to provide supply. Traders can then trade directly with these pools through the use of .

What is the purpose of a liquidity pool?

Liquidity pools aim to solve the problem of illiquid markets by incentivizing users to provide crypto liquidity on a specific platform. Known as liquidity providers, these users are incentivized with a share of platform trading fees.

Trading on liquidity pool protocols like does not require the matching of buyers and sellers. Instead, users can exchange their tokens and assets with a liquidity pool, trading tokens provided by liquidity providers.

Seasoned traders in traditional or crypto markets are well aware of the potential downsides of entering a market with thin liquidity. Whether it’s a low cap crypto or penny stock, slippage is often a concern. is the difference between the expected price of a trade and the price at which the trade is actually executed. Slippage is most common during periods of higher , and can also occur when there isn't enough volume at the selected price to maintain the expected for a large trade.

How do liquidity pools work?

Crypto liquidity pools are designed in a way to incentivize liquidity providers to stake their assets in the pool. Most liquidity providers from the exchanges on which they pool tokens. When a user supplies a pool with liquidity, the provider is often rewarded with . LP tokens can be valuable assets in their own right, and can typically be used throughout the DeFi ecosystem.

Usually, a crypto liquidity provider receives LP tokens in proportion to the amount of liquidity they have supplied to the pool. When a pool facilitates a trade, a fractional fee is proportionally distributed among the LP token holders.

Liquidity pools maintain fair market values for the tokens they hold by employing AMM algorithms, which maintain the price of tokens relative to one another within any particular pool. Liquidity pools in different protocols may use algorithms that vary slightly. Uniswap liquidity pools, for example, use a to maintain price ratios. This algorithm helps ensure that a pool consistently provides crypto market liquidity by managing the cost and ratio of the corresponding tokens as the demand increases.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026