OCT 27, 2023

Weekly Market Update - Friday, October 27, 2023 - Is the Winter Thawing? Bitcoin Soars, Topping $35k USD, and Third-Quarter US GDP Growth Beats Estimates

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore basic trading order types.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +15.50% | $34,093 |

$34,093

+15.50%

| |

Ether

ETH | +11.30% | $1,785 |

$1,785

+11.30%

| |

Qredo

QRDO | +88.70% | $0.05288 |

$0.05288

+88.70%

| |

Pepe

PEPE | +86.70% | $0.000001207 |

$0.000001207

+86.70%

| |

Chainlink

LINK | +46.20% | $11.142 |

$11.142

+46.20%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, October 27, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Bitcoin hits $35k amid more encouraging ETF news: BTC soared from ~$30k USD to ~$35k earlier in the week, before settling around $34k USD by Friday. Spurring the price action, news began circulating on Monday that BlackRock’s spot bitcoin ETF, with the ticker IBTC, was listed with the DTCC, leading to speculation that the ETF was nearing approval.

- Bitcoin open interest on CME hits all-time highs: Open interest for bitcoin derivatives on the Chicago Mercantile Exchange (CME) hit 100,000 BTC (~$3.4 billion USD). The trend may reflect growing interest in bitcoin from institutional investors as the conversation around a coming spot bitcoin ETF continues to heat up.

- SEC directed to review Grayscale’s spot bitcoin ETF application: A US federal court issued a mandate directing the SEC to review Grayscale's application for a spot bitcoin ETF. Grayscale submitted a registration statement to the SEC on October 19, stating its intention to list shares of its spot bitcoin ETF on the New York Stock Exchange Arca under the ticker GBTC.

- Q3 GDP beats estimates, and treasury yields continue to rise: Third-quarter US GDP showed robust growth of 4.9% on an annual basis, surpassing estimates of 4.7%. Treasury yields continued to rise, putting additional pressure on equities. Yields on the 10-year treasury surpassed 5% on Monday, hitting its highest level in over a decade, but has since dipped to the 4.8% range.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Soars to $35k USD After More ETF Speculation

soared this week as more ETF-related news hit headlines, with prices moving above $35k USD on Thursday before settling around $34k USD by Friday. The market hasn’t seen these prices , when BTC was on its way down from all-time highs of just under $70k USD reached at the end of 2021.

On Monday, news began circulating that BlackRock’s spot bitcoin ETF, with the ticker IBTC, with the Depository Trust & Clearing Corporation’s (DTCC), leading to speculation that the ETF was nearing approval. It was later revealed that the IBTC ticker with the DTCC since August; nonetheless traded to nearly $35k by Tuesday morning. The speedy move from $30k USD to $35k USD may be explained in part by technicals and market positioning, especially with regard to bitcoin derivatives.

also hit a , rising above 54%, and the fell to its lowest level in more than a year.

Open Interest for Bitcoin Derivatives on the CME Hits All-Time High

Amid bitcoin’s positive price action this week, on the Chicago Mercantile Exchange (CME) hit 100,000 BTC (~$3.4 billion USD). Open interest reflects the total value of derivatives contracts, futures and options, held by traders at any given time.

The trend may reflect growing interest in bitcoin from institutional investors as the conversation around a coming spot bitcoin ETF continues to heat up.

Court Mandates SEC Review of Grayscale ETF Application

A US federal court directing the SEC to review Grayscale's application for a spot bitcoin ETF. The mandate stems from the court's initial ruling on August 29, which described the SEC’s denial of Grayscale’s application to convert its Grayscale Bitcoin Trust (GBTC) into a spot bitcoin ETF as

Grayscale to the SEC on October 19, stating its intention to list shares of its spot bitcoin ETF on the New York Stock Exchange Arca under the ticker GBTC.

Q3 GDP Hits 4.9% as US Growth Tops Expectations, and Treasury Yield Continue to Rise

Third-quarter US gross domestic product (GDP) on an annual basis, surpassing estimates of 4.7%. The uptick signifies a continued strong recovery following COVID-related setbacks. The growth was largely driven by increased consumer spending, investment, and exports.

While the stronger than expected GDP numbers may put pressure on the Federal Reserve to keep monetary policy tight, the market is any further interest rate hikes this year. Odds of the Fed keeping rates steady at its next meeting in early November are sitting at near 100%, and the market is pricing in a ~20% chance of a rate hike at its mid-December meeting. In Europe on Thursday, the European Central Bank (ECB) at 4%, after hiking the rate 10 consecutive times.

continued to rise this week, putting additional pressure on equities. Yields on the 10-year treasury surpassed 5% on Monday, hitting its highest level in over a decade. Yields have since dipped to consolidate around the 4.8% range.

With Thursday’s strong GDP numbers and high yields clouding the equity outlook, the is down over 1.5% this week and the is down more than 1.4%.

-From the Gemini Trading Desk

data as of 5:30pm ET on October 26, 2023.

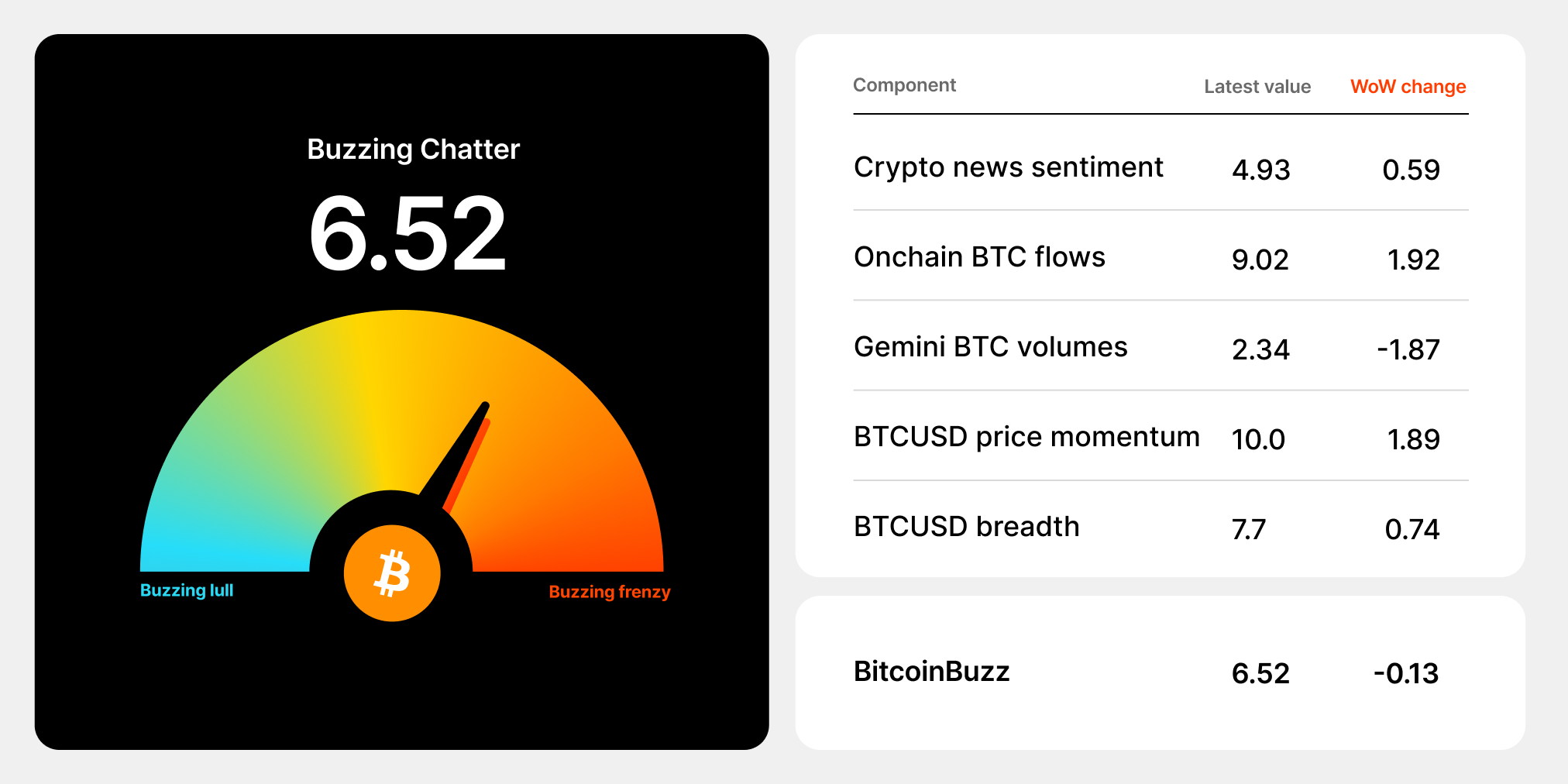

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Exploring Basic Trading Order Types

With the crypto markets heating up once again, this week we explore some of the basic order types that all traders should be familiar with. You can buy or sell most stocks and cryptocurrencies by using three trading basics — market, limit, and stop-loss orders.

Market Orders

A is a command to buy or sell an at the price currently available on the market, and is the most basic type of trading order. If you’re placing a trade yourself via an online platform, hitting the buy/sell button generally fulfills (executes) an order immediately.

A market buy order will execute at the nearest ask price (what someone is willing to sell for) and a market sell order will execute at the nearest bid price (what someone is willing to buy for).

Traders typically use market orders when they want to buy or sell an asset immediately, either to avoid missing a potentially profitable move or to cut their losses. Market orders guarantee that a trader will enter or exit a position as quickly as possible, but they do not guarantee a price.

Market orders are best for very , frequently traded assets such as large-cap stocks, , or well-established , which are typically bought and sold either at or close to an investor’s desired price. In contrast, market orders for traded assets that aren’t bought or sold as often may take longer to fulfill, which means that the price at execution can be far from an investor’s desired price.

Limit Orders

A is a command to buy or sell an asset at a specific price — or better if possible. A buy-limit order is transacted at the limit price or lower, while a sell-limit order is executed at the limit price or higher. However, limit orders are not guaranteed to execute. A limit order will only be filled if the market price of the asset reaches the limit price. Although limit orders don’t guarantee that your order will be fulfilled, they are useful because they can ensure that you do not pay more or receive less than a specific set price.

Limit orders also are useful if you’re not in a rush or are not actively trading. For example, you can specify that you want to buy 100 shares of a particular company’s stock when its price falls to $10 USD, or lower. Or, you can place an order to sell 100 coins of a particular cryptocurrency when its price climbs higher than $10 in order to lock in profits — also called a take-profit order — after having purchased that cryptocurrency for a lesser price.

Stop-Limit Orders

In addition to regular limit orders, there are also what are known as stop-limit orders, which are more conditional and a bit more sophisticated:

- Buy Stop-Limit Order: A stop-limit order combines the characteristics of stop and limit orders and gives the trader more control over the execution of the trade, though, again, it isn’t guaranteed to be executed. A stop-limit order requires setting a stop price (the trigger price for a trade), a limit price (the execution target price of the trade), and a timeframe for execution. After the desired asset reaches the indicated stop price, the limit order is triggered, and the order is subsequently executed only when the asset price is at or better than the specified limit price.

- Sell Stop-Limit Order: A sell stop-limit order is the opposite of a buy stop-limit order. In this case, you may want to sell an asset after it moves below a certain level to minimize your risk in a trade. Unlike buy stop-limit orders, which are placed above market price at the time of the order, sell stop-limit orders are placed below market price.

Stop-Loss Orders

With a stop-loss order, you can instruct your trading platform or broker to sell a security if its price falls below a certain level, which can help guard against unexpected losses. For instance, you can program a sale of a particular company’s stock after it falls in value from your original purchase price, which would minimize your loss.

There are two main types of stop-loss orders:

- Stop-Loss Limit: With a regular stop-loss order, your trading platform or broker will automatically sell your asset once the price reaches your specified level. With a stop-loss limit order, the system will automatically convert the order to a sell when your specified stop (or trigger) price is reached, but will only sell at the limit price you specified. This type of order gives you a chance to avoid a loss if prices drop suddenly, triggering a stop-loss, but then recover quickly.

- Trailing-Stop Order: A trailing-stop order is a variation of a regular stop order. For this type of order, you’d set the trailing amount as a percentage of how much you are willing to lose. A sell trailing-stop order sets the stop price at an amount fixed below the market price with a trailing amount attached. As a price rises in the market, the stop price rises accordingly by the trailing amount. If the stock price falls, however, the stop loss price wouldn't change; instead, the order would revert to a market order once the stop price is reached.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026