OCT 20, 2023

Weekly Market Update - Friday, October 20, 2023 - Bitcoin Jumps Following Fake ETF News, GBTC Discount Narrows, and ECB Moves Closer to a Digital Euro

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore the basics of liquidity pools.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +10.50% | $29,503 |

$29,503

+10.50%

| |

Ether

ETH | +4.19% | $1,562 |

$1,562

+4.19%

| |

Zebec Protocol

ZBC | -25.90% | $0.00652 |

$0.00652

-25.90%

| |

Solana

SOL | +25.60% | $26.827 |

$26.827

+25.60%

| |

Render

RNDR | +14.40% | $1.965 |

$1.965

+14.40%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, October 20, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- False ETF news gives bitcoin a boost: Crypto markets were frenzied on Monday after Cointelegraph posted an unconfirmed tweet that the SEC had approved a spot bitcoin ETF. Bitcoin prices jumped over $2,000 USD in minutes before the news was deemed false.

- GBTC discount to NAV continues to tighten: The discount between shares of Grayscale’s Bitcoin Trust (GBTC) and the fund's net asset value is at its lowest level in almost two years. After starting the year at a nearly 50% discount, GBTC’s discount has moved to ~13%, reflecting increased expectations that a bitcoin spot ETF will be approved in the near future.

- Uniswap introduces 0.15% swap fee: The move was described as an effort to “sustainably fund operations.” UNI is trading about even over the past seven days following the news.

- The European Central Bank moves closer to a digital euro: The EU's central bank announced that it had moved from the investigation phase to the preparation phase of its digital euro project. ECB president Christine Lagarde tweeted that they “envisage a digital euro as a digital form of cash that can be used for all digital payments.”

- Treasury yields continue upward trajectory, and Powell sees strength in the US economy: US treasury yields have continued to put pressure on equities, with the 10-year treasury touching 4.98% for the first time since 2007. Fed Chair Jerome Powell suggested that the continued strength of the US economy may warrant further tightening, but didn’t foreshadow an immediate policy shift.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

False Spot Bitcoin ETF News Sends BTC Sharply Higher Before Paring Gains

Crypto markets went into a frenzy on Monday morning after Cointelegraph posted a tweet stating that the Blackrock iShares Spot Bitcoin ETF. Despite no source being included in the tweet, a number of news outlets and prominent names in the crypto space tweeted the same headline shortly thereafter. Following the tweet, crypto prices moved sharply higher, particularly bitcoin (BTC).

In a matter of minutes, jumped from below $28k USD to touch $30k USD, while $100 million USD worth of shorts on the move. The rumor was quashed shortly after, that their application was still under review, and retraced most of the move, briefly trading back below $28k USD.

Despite the rumor being false, the swift move higher displayed the market’s eagerness for a spot bitcoin ETF approval and offered a potential glimpse of what might occur when an official approval is announced.

As the week progressed, continued its upward trend crossing $30k USD for the second time this week on Thursday evening. is trading around $29.5k USD as of Friday morning.

The crypto market narrative is now firmly focused on a spot bitcoin ETF with continuing to outperform, adding another 10% this week as of Friday. is above 52%, its highest level since April 2021, while the slid lower to 0.0542.

GBTC Discount Continues to Narrow as Odds of ETF Approval by Early 2024 Hit 90%

discount to net asset value (NAV) reached its lowest level in 22 months this week, following the news that its loss in court over Grayscale's application to convert its GBTC fund into a spot bitcoin ETF. GBTC currently has .

After trading near a at the start of the year, the discount has closed around -13% as of Friday, reflecting increased expectations that a bitcoin spot ETF will be approved in the coming months. Bloomberg analysts have also of approval by January 10, 2024, to 90%.

Uniswap Introduces 0.15% Swap Fee to Fund Operations

Uniswap, the largest decentralized exchange by trading volume, announced the introduction of for a select number of tokens starting this week, in an attempt to is trading about even over the past seven days.

European Central Bank a Step Closer to Launching a Digital Euro

The European Central Bank (ECB) announced on Wednesday that they are of its digital euro project, after completing the investigation phase which began in October 2021. This next phase is slated to last about two years.

that “While we haven’t yet decided whether to issue a digital euro, we’re getting ready. We envisage a digital euro as a digital form of cash that can be used for all digital payments, coexisting with physical cash, leaving no one behind.”

US Treasury Yields Continue to Increase and Powell Sees Potential for Further Tightening

US treasury yields have continued to put pressure on equities, with touching its highest level since 2007. The deepening bond market sell-off has which are further weighed down by the ongoing conflict in Israel and Gaza. The and are down ~1.5% and ~3%, respectively, since Monday.

, Fed Chair Jerome Powell suggested that he was content to leave interest rates where they are for longer, but that the continued strength of the US economy may warrant further tightening. He added that rising market interest rates, including the increase in bond yields, may be doing the Fed’s job for it by helping tighten market conditions.

Powell said he is happy with the inflation path since the summer. The odds of future interest rate hikes at upcoming Fed meetings decreased as a result, in November sitting under 2%, and the probability of a hike in mid-December around 20%. Despite this, US treasury yields rose with the 10 year yield increasing to 4.9%.

-From the Gemini Trading Desk

data as of 6pm ET on October 19, 2023.

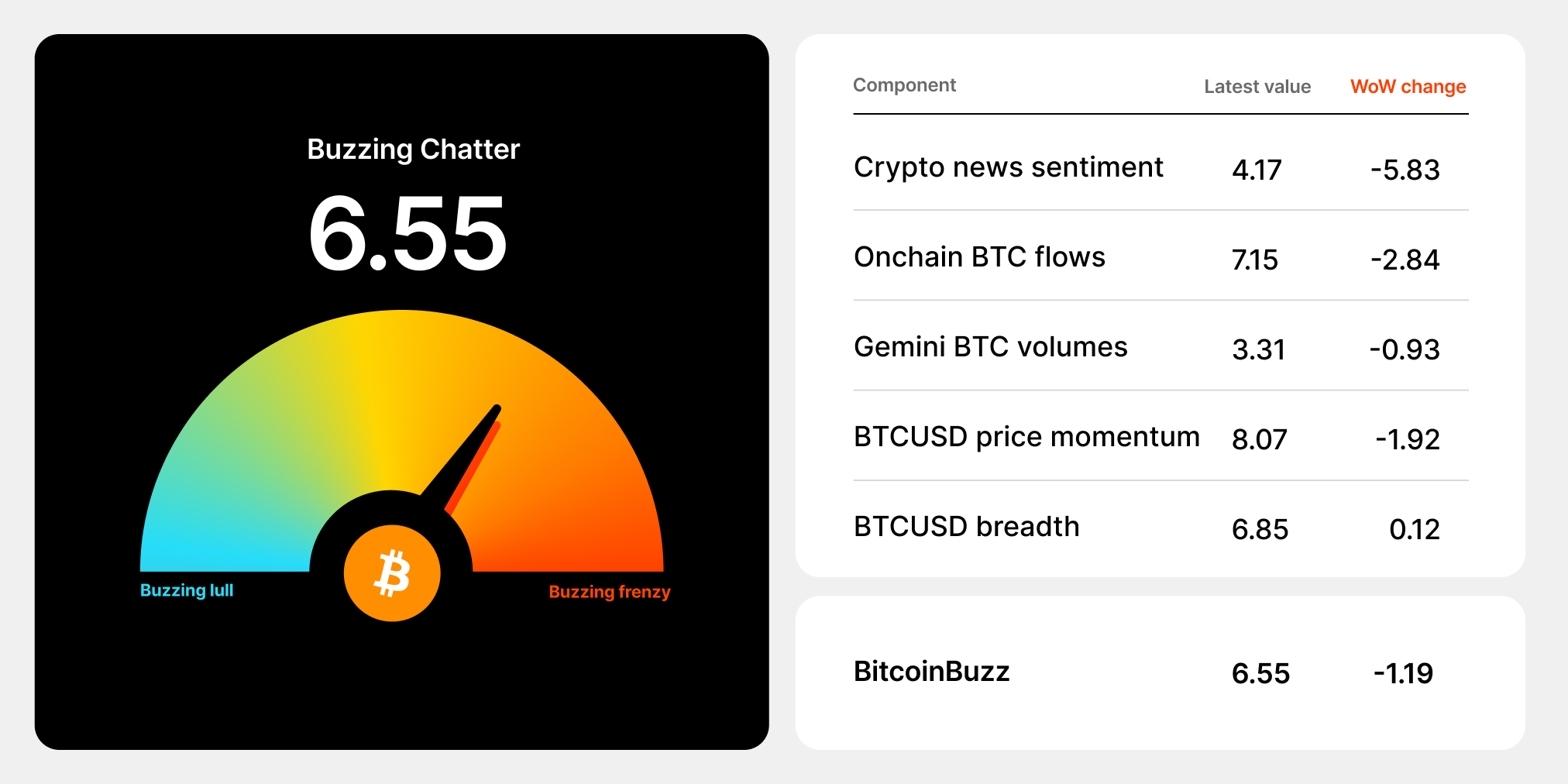

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Crypto Liquidity Pools

Crypto play an essential role in the ecosystem. They are a mechanism by which users can pool their assets in a decentralized exchange’s (DEX) to provide asset liquidity for traders to trade crypto more easily. At a high level, liquidity pools provide , speed, and convenience when trading on DeFi platforms.

Prior to the rise of , crypto market liquidity was a challenge for DEXs across the Ethereum ecosystem. Early on, DEXs were a new technology that usually sported a complicated interface and a relatively low volume of buyers and sellers, making it challenging to find sufficient liquidity on a regular basis.

AMMs were developed to fix this problem of limited liquidity through the creation of liquidity pools, which offer liquidity providers an incentive to provide supply. Traders can then trade directly with these pools through the use of .

What is the purpose of a liquidity pool?

Liquidity pools aim to solve the problem of illiquid markets by incentivizing users to provide crypto liquidity on a specific platform. Known as liquidity providers, these users are incentivized with a share of platform trading fees.

Trading on liquidity pool protocols like does not require the matching of buyers and sellers. Instead, users can exchange their tokens and assets with a liquidity pool, trading tokens provided by liquidity providers.

Seasoned traders in traditional or crypto markets are well aware of the potential downsides of entering a market with thin liquidity. Whether it’s a low cap crypto or penny stock, slippage is often a concern. is the difference between the expected price of a trade and the price at which the trade is actually executed. Slippage is most common during periods of higher , and can also occur when there isn't enough volume at the selected price to maintain the expected for a large trade.

How do liquidity pools work?

Crypto liquidity pools are designed in a way to incentivize liquidity providers to stake their assets in the pool. Most liquidity providers from the exchanges on which they pool tokens. When a user supplies a pool with liquidity, the provider is often rewarded with . LP tokens can be valuable assets in their own right, and can typically be used throughout the DeFi ecosystem.

Usually, a crypto liquidity provider receives LP tokens in proportion to the amount of liquidity they have supplied to the pool. When a pool facilitates a trade, a fractional fee is proportionally distributed among the LP token holders.

Liquidity pools maintain fair market values for the tokens they hold by employing AMM algorithms, which maintain the price of tokens relative to one another within any particular pool. Liquidity pools in different protocols may use algorithms that vary slightly. Uniswap liquidity pools, for example, use a to maintain price ratios. This algorithm helps ensure that a pool consistently provides crypto market liquidity by managing the cost and ratio of the corresponding tokens as the demand increases.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026