MAY 24, 2024

SEC Approves Spot ETH ETFs, US House Passes Landmark Crypto Bill, and Major Banks Reveal Bitcoin Trust Holdings

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we look at how exchanges work.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +3.53% | $67,011.12 |

$67,011.12

+3.53%

| |

Ether

ETH | +26.7% | $3,745.12 |

$3,745.12

+26.7%

| |

Ethereum Name Service

ENS | +63.76% | $23.09 |

$23.09

+63.76%

| |

Pepe

PEPE | +37.55% | $0.00001389 |

$0.00001389

+37.89%

| |

Lido DAO

LDO | +31.16% | $2.11 |

$2.11

+31.16%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, May 23, 2024, at 3:05 pm ET. . All prices in USD.

Takeaways

- SEC approves spot ETH ETFs: After months of speculation, the SEC formally approved the first spot ether ETFs on Thursday. The development sets the stage for institutional investors to pour billions into the space.

- Grayscale CEO departs: Grayscale CEO Michael Sonnenshein announced Monday he was leaving his role after three years running the crypto investment giant. A Goldman Sachs veteran is expected to take his place in August.

- White House opposes crypto legislation: The White House announced Wednesday its opposition to FIT21, a bill that would give the Commodities and Futures Trading Commission (CFTC) power to regulate the crypto market. But the White House doesn't plan to veto.

- Gala Games experiences a major issue: It led to the minting of 5 billion tokens worth $206M and caused a nearly 15% drop in the GALA token price.

- Major banks reveal significant Bitcoin Trust Holdings in Q1: Morgan Stanley, JPMorgan, Wells Fargo, and UBS have shown a growing interest in digital assets within wealth management.

- Venezuelan government will disconnect crypto mining farms from the national grid: They made the move to stabilize the electrical supply after enduring routine blackouts for the past five years.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

SEC Accepts Spot ETH ETFs

, the SEC approved spot ether ETFs from VanEck, Fidelity, Franklin, Grayscale, Bitwise, Ark21 Shares, Invesco Galaxy, and Blackrock. But all still need to undergo the S-1 registration process, which can take a few weeks, before any ether ETFs begin trading. None will be allowed to stake ether for yield.

But earlier this week, Bloomberg raised the approval chances to 75%, helping the price of ether surge more than 30% over the past week.

Grayscale CEO Steps Down, Goldman Exec To Step In

Peter Mintzberg, the global head of strategy for the asset and wealth management division at Goldman Sachs, will succeed him on August 15. In the meantime, Grayscale CFO Edward McGee will assume an interim role leading the firm.

Sonnenshein had an eventful few years at the helm, including pushing the SEC to allow spot BTC ETFs. In July 2022, Grayscale sued the regulator and won after they rejected Grayscale’s original bid, setting the stage for the official launch of spot BTC ETFs in January. But Grayscale Bitcoin Trust (GBTC) has seen $17 billion in outflows since, while fees stayed higher than competitors.

White Houses Objects to Crypto Bill but Won’t Veto

a landmark bill that would set up a comprehensive regulatory framework for the digital asset industry. President Joe Biden said he wasn’t going to veto the bill if it reached his desk, reversing a previous statement.

“The bill in its current form lacks sufficient protections for consumers and investors who engage in certain digital transactions,” the White House statement said. “The administration looks forward to continued collaboration with Congress on developing legislation that includes adequate guardrails for consumers and investors while creating the conditions for innovation, and further time will be needed for such collaboration.”

The bill, dubbed FIT21, would grant the Commodities and Futures Trading Commission (CFTC) broad authority to oversee much of the cryptocurrency space. SEC chair Gary Gensler has already voiced his opposition, arguing it would classify cryptocurrencies as a special class of digital commodities–not investment contracts–that would not fall under the SEC’s purview.

“(FIT21) would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk,” Gensler said in a statement.

Gala Games Hack Leads to $206M Token Minting and Price Drop

The incident had an immediate impact on the platform’s native token, GALA, which saw its price plummet nearly 15%. The token's value dropped from $0.0467 at 3 pm ET to $0.0397 by around 5 pm ET on May 20.

In a 24-hour period, the token’s price declined by around 5.7%, reflecting the broader market’s reaction. Despite the setback, GALA still holds a market capitalization of $1.6B, with a circulating supply of around 38 billion tokens according to CoinMarketCap.

This incident has raised concerns within the Web3 gaming community about the security of the platform. However, as of Wednesday morning, the exploiter in question is reported to have returned $23M of the minted amount to the platform in the form of ETH.

Morgan Stanley and Other Major Banks Disclose Spot BTC ETF Holdings

This investment was likely made on behalf of clients rather than a direct bet on Bitcoin by the bank. Other major banks, including JPMorgan, Wells Fargo, and UBS, also reported holdings in spot BTC ETFs during the first quarter.

These holdings don't necessarily indicate that these banks are betting on bitcoin’s price direction but were likely made at the request of wealth management clients.

Morgan Stanley began allowing clients to allocate to spot BTC ETFs in January, and has gradually taken a more proactive stance toward crypto investment in recent years. The move continues the normalization of digital asset investment in traditional wealth management.

Venezuela Cracks Down on Crypto Mining To Stabilize Power Supply

This decision, reported by a local news outlet, aims to regulate excessive energy consumption and ensure a stable power supply for the population.

Venezuela's National Association of Cryptocurrencies confirmed the prohibition of crypto mining in the country via an X post. The move follows the confiscation of 2,000 cryptocurrency mining devices in Maracay earlier this year, as part of the government’s wider anti-corruption initiative.

The Ministry of Electric Power highlighted the need to offer efficient and reliable electrical service by mitigating the impact of high-energy-consuming crypto mining farms. The country has faced recurring blackouts since 2019, severely impacting economic activity. Other countries, including China and Kazakhstan, have also imposed strict regulations or bans on crypto mining due to similar concerns.

-From Team Gemini

data as of 6:15 pm ET on May 23, 2024.

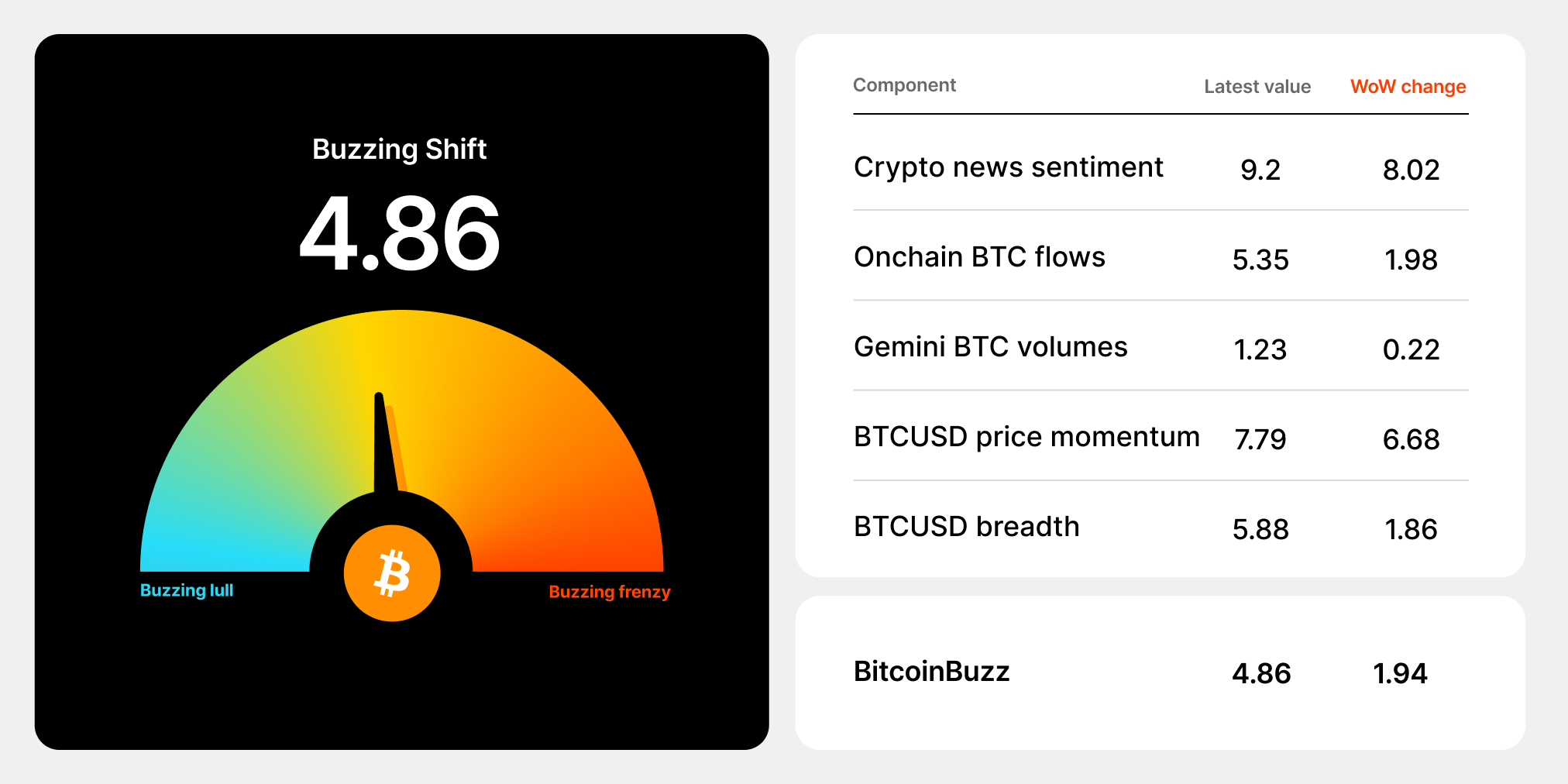

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Is A Crypto Exchange?

A crypto exchange is a platform for buying and selling cryptocurrencies. In addition to trading services, crypto exchanges also offer price discovery through trading activity, as well as storage for crypto. Before crypto exchanges, people were only able to acquire crypto through mining or by organizing transactions in various online and offline forums. Today, there are hundreds of crypto exchanges offering an array of digital assets and varying levels of security and associated fees. It’s up to you to find the exchange and digital assets that suit your particular needs, price range, and security expectations.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 29, 2026

Tether Launches US-Focused Stablecoin, Fed Pauses Rate Cuts, and Bitcoin Drops Below $84K Amid Broad Tech Pullback

COMPANY

JAN 27, 2026

Gemini Unveils Gemini Credit Card: Zcash Edition

NIFTY GATEWAY STUDIO

JAN 23, 2026