SEP 21, 2016

*UPDATED* Introducing the First-Ever Daily Bitcoin Auction

**UPDATED: Please see our for the most current information regarding our Daily Bitcoin Auction.**

While bitcoin is a tremendous digital asset that promises reduced friction in the financial world, the irony is that bitcoin trading is still incredibly inefficient because bitcoin exchanges are missing certain mechanisms that are commonplace in traditional financial marketplaces. So how do we fix this? By building the first-ever daily bitcoin Auction — now live for trading!

Auctions (also called “crosses,” not to be confused with winner-take-all auctions) are events which allow two-sided trading in large or small blocks with efficient price discovery and reduced price slippage. The goal is to prevent buyers and sellers from missing each other during the trading day. Auctions are universally implemented by traditional asset exchanges like the New York Stock Exchange, Nasdaq, and Bats. In addition, we are confident that our Auction will bring you the benefits of over-the-counter (OTC) trading without the overhead, hassle, and lack of transparency of these archaic trading venues.

How Does Auction Benefit Gemini Customers?

Auction is a new mechanism for electronic trading on Gemini that will occur at 4:00 p.m. Eastern Time every day (including weekends and holidays). At first we’ll support only the BTC/USD trading pair, but we’ll open it for all our trading pairs in the coming weeks. Auction aims to facilitate high volumes of trading between customers at a fair price by matching the maximum quantity to be bought and sold.

Auction provides the following benefits to our customers:

- Greater Price Discovery: Auction focuses market participants and economic information at a single moment in the day, resulting in better price discovery.

- Mark-to-Market Benchmark Price: Auction provides an official 4:00 p.m. ET end-of-day price for marking assets to market (e.g., for accounting purposes or for calculating returns).

- Lower Fees: Auction trades receive our and are therefore eligible for up to a 15 bps (0.15%) rebate (unlike OTC trades that can cost upwards of 1–2% per trade).

- Instant Settlement: Auction trades settle immediately and funds are ready for immediate transfer (unlike OTC trades that can require phone calls, emails, specialized paperwork, risk during funds transfer, etc.).

- No Counterparty Risk: Auction trades settle immediately from pre-funded accounts, eliminating the risk that your counterparty will back out of a trade (unlike OTC trades which are typically not pre-funded).

How Does Auction Work?

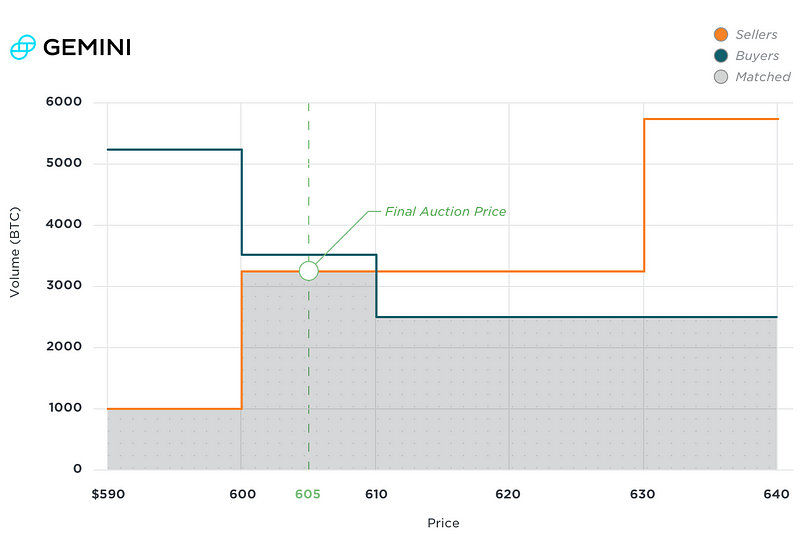

All eligible orders will be filled at the final auction price at 4:00 p.m. ET. The final auction price of each Auction is determined by finding the price at which the greatest aggregate buy demand and aggregate sell demand from all participating orders can be filled (i.e., the price at which the largest quantity can trade). The mechanics of this auction are very similar to the closing auction (or closing “cross”) on the major electronic U.S. stock exchanges (e.g., Nasdaq, NYSE Arca, Bats). For a more detailed discussion, please see .

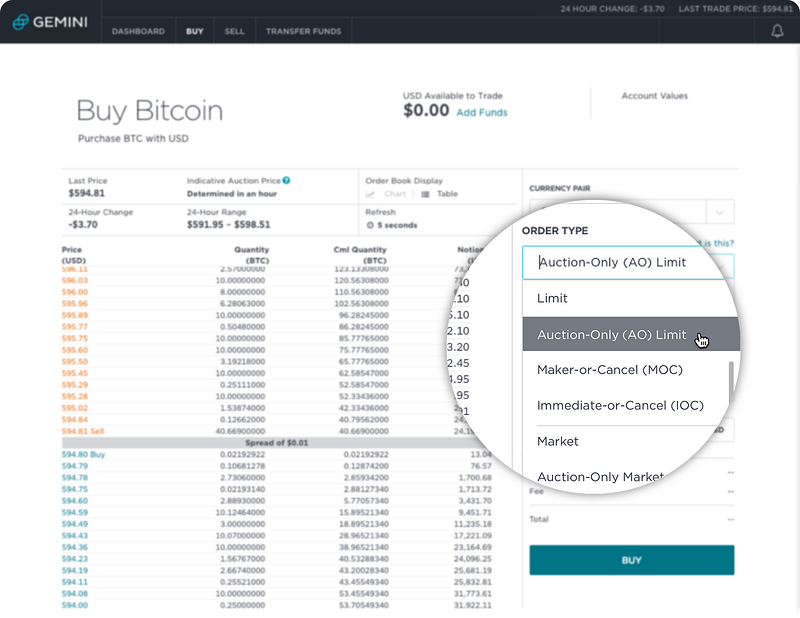

How Can You Participate in Auction?

Easy! Customers can enter Auction-Only Market and Auction-Only Limit Orders to buy or to sell beginning at 5:00 p.m. ET the prior day until 4:00 p.m ET for that day’s Auction. (E.g., for Wednesday’s Auction, you can place orders between Tuesday at 5:00 p.m. ET and Wednesday at 4:00 p.m. ET).

Beginning at 3:50 p.m. ET each day, indicative auction prices are broadcast via both our market data API and our website frontend. A new indicative auction price is calculated every minute until 3:59 p.m. ET based on the order book at that time. (These indicative prices are calculated by simulating the auction process for the order books if Auction were to occur at that time.)

Example Auction:

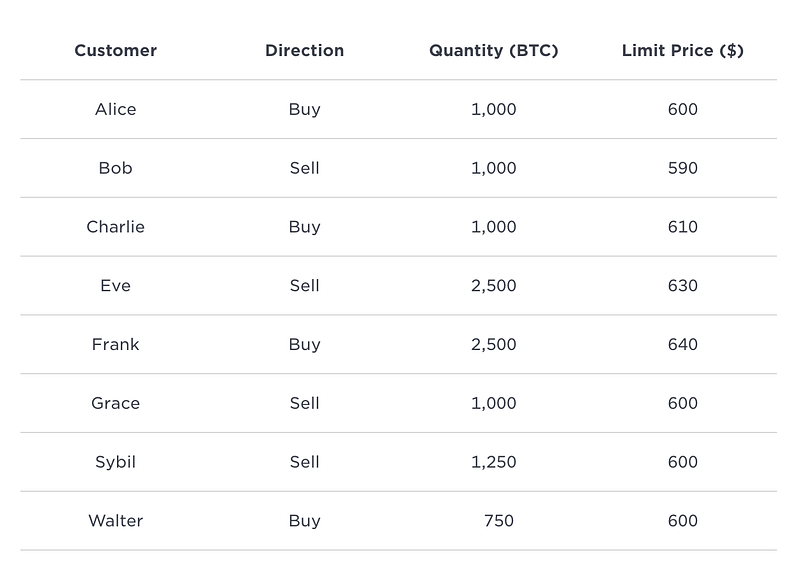

At exactly 4:00 p.m. ET, the Auction-Only order book contains the following limit orders, listed in the order they were submitted:

CustomerDirectionQuantity (BTC)Limit Price

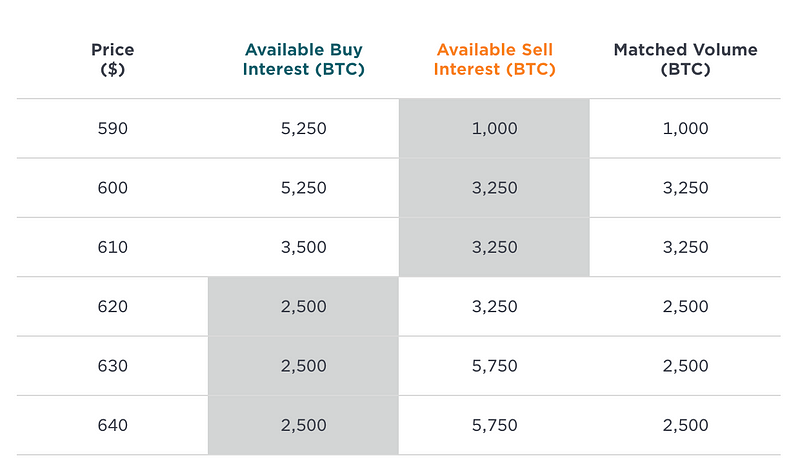

To determine the final auction price, find the price level that maximizes the matched volume (i.e., the price at which the largest quantity can trade). The matched volume at a particular price level is how much interest can cross between buy orders and sell orders, and is therefore the lesser of the available buy or sell interest at that price level.

In this example, the matched quantity is greatest at all prices between $600 and $610. Therefore, the final auction price is determined to be $605 (the midrange between these two prices), with a matched volume of 3,250 BTC. All available sellers who can trade at $605 are fully filled: Bob (1,000 BTC), Grace (1,000 BTC), and Sybil (1,250 BTC). Because the buy interest at this price is greater than the sell interest, one of the buyers is partially filled, based on time priority: Frank receives 2,250 BTC rather than 2,500 BTC, but Charlie is fully filled (1,000 BTC).

Questions?

If you have any questions regarding Auction mechanics or the benefits that Auction may provide you, please check out for a detailed description or contact .

Onward and Upward,

Team Gemini

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026

Gemini 2.0: A Bridge to the Future of Money and Markets

MORE FROM CAMERON WINKLEVOSS

COMPANY

FEB 18, 2021

Gemini Launches Cryptopedia, A Free Crypto Education Platform

COMPANY

OCT 24, 2018

Gemini dollar (GUSD) Is Now Supported by 25 Exchanges

INDUSTRY

SEP 26, 2018