NOV 14, 2019

Introducing Stop-Limit Orders

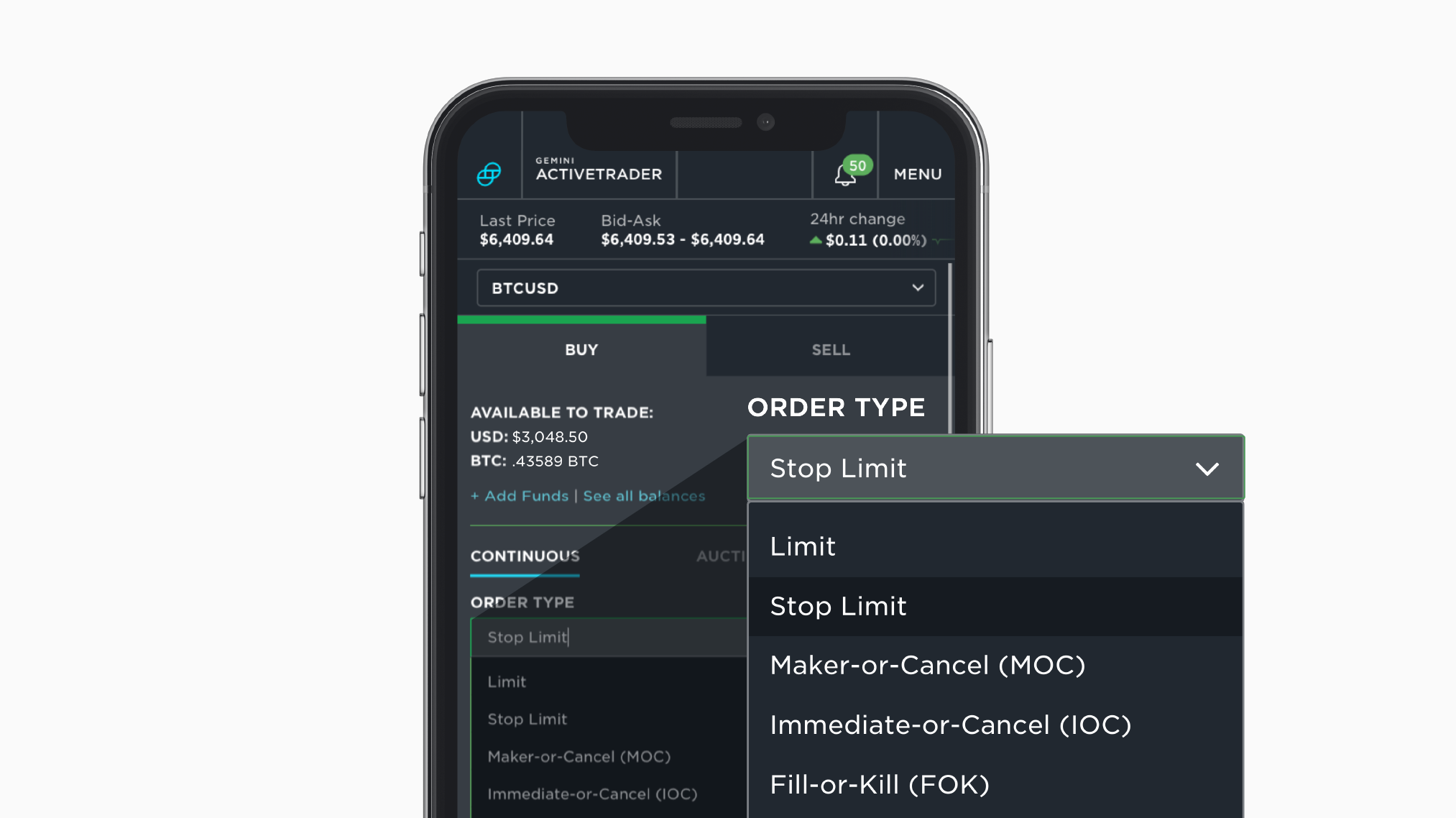

Today we are excited to announce support for Stop-Limit orders — one of the most requested features from our customers to date!

Stop-Limit orders are typically used by traders to help manage risk and are common in marketplaces for traditional asset classes. Stop-Limit orders give traders more control over order execution and trading strategies. Starting today, November 14, you can place buy or sell Stop-Limit orders on all order books using the Gemini ActiveTrader™ interface, as well as our REST and FIX order entry APIs.

How do Stop-Limit orders work?

A Stop-Limit order has a Stop Price, a Side, and a Limit Price. When the Last Trade Price crosses the Stop Price on either the order book or the Gemini Auction, a Limit order will be placed on the Side at the Limit Price associated with the order.

Example 1: Protecting a BTC Position

Let’s say Thomas bought 0.1 BTC when the BTC/USD market was trading at $10,000 on Gemini. Thomas wants to protect his trade from potential loss in the event the BTC/USD market price declines. He might enter an order like this:

- Order Type: Stop-Limit

- Quantity: 0.1 BTC

- Side: Sell

- Stop Price: $9,000.00

- Limit Price: $8,500.00

Once this Stop-Limit order has been placed, he can view his order in the Open Orders table in his ActiveTrader interface. In the event the market price declines from $10,000 to $9,000, a Limit sell 0.1 BTC at $8,500.00 order will be placed on the BTC/USD order book.

Because that order is placed when the market crosses $9,000, Thomas’s order will get filled at or above his Limit Price of $8,500 depending on the liquidity on the BTC/USD order book at that time.

The Limit Price of the order protects Thomas from selling his position at a price less than he intended (i.e., $8,500).

The benefit of placing a Stop-Limit order in this example is that the Limit sell order is automatically placed when the Stop Price is triggered. Order placement that is conditional on market price means you don’t have to be in front of a screen at the time the order is placed.

Example 2: Entering a BTC Position

This is an example of using a Stop-Limit order as part of a trading strategy involving resistance levels.

Let’s say the BTC/USD market is trading at $10,000. Thomas wants to buy BTC, but he only wants to buy in the event of an uptrend, after the market price exceeds a resistance level of $10,500. Thomas may enter an order like this:

- Order Type: Stop-Limit

- Quantity: 0.1 BTC

- Side: Buy

- Stop Price: $10,500.00

- Limit Price: $11,000.00

Thomas is not exposed to downside risk associated with holding the BTC position before this resistance level has been exceeded.

More information on Stop-Limit orders:

- Reference documentation about Gemini order types can be found

- REST API details surrounding order entry for Stop-Limit orders can be found

- FIX API details surrounding order entry for Stop-Limit orders can be found

- To access Stop-Limit orders in ActiveTrader™, please go

- Gemini ActiveTrader™ is a trading view that offers advanced charting, improved trading pair selectors, and deeper order book visibility. If you would like to gain access to ActiveTrader™, please click .

Onward and Upward,

Andrew Page, Product Manager

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026