APR 11, 2024

Inflation Data Spikes, BTC Price Fluctuates, and Asia Preps for Spot Bitcoin ETFs

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the halving and its impact on crypto markets.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +4.80% | $70,239.79 |

$70,239.79

+4.80%

| |

Ether

ETH | +5.42% | $3,509.10 |

$3,509.10

+5.42%

| |

Zebec Protocol

ZBC | -24.32% | $0.02986 |

$0.02986

-24.32%

| |

Qredo

QRDO | -24.27% | $0.0566 |

$0.0566

-24.27%

| |

Uniswap

UNI | -18.80% | $8.9884 |

$8.9884

-18.80%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, April 11, 2024, at 3:30pm ET. . All prices in USD.

Takeaways

- Bad news for investors hoping the Federal Reserve will cut interest rates aggressively: The CPI jumped 3.5% in March year-over-year, an increase from February's 3.2% YOY jump and above expectations of 3.4%. Bitcoin (BTC) initially dipped below $67,500 after the CPI release, before clawing back losses to end the day positive and appearing ready to retest the $70K level again.

- BTC price see-saws as halving event approaches: action remains choppy as we approach the Bitcoin halving, which is estimated to take place April 20th. Some investors believe there is too much optimism priced into Bitcoin, and we could see a correction in the days before and after the halving.

- Chinese asset managers ready to adopt spot BTC ETFs: Spot BTC ETFs are likely set to launch in Hong Kong later this month, with the first approvals potentially coming as early as next week. Among the applicants are some of China's largest asset managers. These will mark the first spot BTC ETFs in Asia.

- DeFi crypto company says SEC is suing them: Uniswap Labs said in a blog post Wednesday that the SEC has notified them it will pursue legal action against the company. Uniswap is a DeFi platform that allows users to trade cryptocurrencies peer-to-peer without a centralized exchange.

- TON Price Surges After Distribution Announcement: Toncoin (TON) broke into the top 10 cryptos by market cap this week for the first time after reaching a new all-time high above $7. The surge comes on the heels of a big announcement from the Ton Society, a group of engineers and developers dedicated to growing the TON network.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Inflation data comes in hot, dampening chance of rate cuts

The US consumer price index (CPI) released on Wednesday showed a , which is higher than February's 3.2% YOY jump and above expectations of 3.4%. As a result, the market has reduced its bets on interest rate cuts this year, now only pricing in two quarter-point cuts in 2024. Analysts project a 50% chance of a third rate cut by the end of 2024, a sizable reduction from the six expected at the start of the year.

Risk assets responded poorly to the CPI numbers as major US stock indices such as the S&P 500, Nasdaq, and Dow Jones all ended Wednesday down about 1%. Rates moved higher, especially in the front-end and belly of the curve with the five-year yield higher than the 30-year yield for the first time since September. USD also surged as the euro fell to its lowest level against the dollar since July. Precious metals such as gold and silver, which have outperformed lately, pared back some of their recent gains.

BTC Price Fluctuates as Halving Event Approaches

BTC price action remains choppy as , which is estimated to take place on April 20th. With the price of BTC nearing all-time high levels again this week at $72.6K, something that has never happened right before a halving event, some investors believe there is too much optimism priced into BTC and there could be a correction in the days before and after the halving.

Arthur Hayes, co-founder of crypto exchange BitMEX, : “The narrative of the halving being positive for crypto prices is well entrenched. When most market participants agree on a certain outcome, the opposite usually occurs. That is why I believe Bitcoin and crypto prices in general will slump around the halving.” However, Hayes did note that the event is a bullish catalyst overall and he expects the halving to be positive in the medium term, with prices rallying later in the year like the previous three BTC halvings in 2020, 2016, and 2012.

Chinese Asset Managers Ready to Adopt Spot Bitcoin ETFs

in Hong Kong later this month, with the first approvals potentially coming as early as next week. The launch will mark the first spot BTC ETFs in Asia and could provide a further boost to crypto adoption and BTC prices following the earlier this year.

Among the applicants are some of China's largest asset managers, , which have $500B-plus in combined total assets. The stance on crypto has been mixed across Asia in recent years, with China previously banning crypto trading and mining, but the introduction of ETFs could provide the opportunity for Chinese funds to gain exposure to BTC in a compliant manner.

SEC to file suit against Uniswap Labs in latest bid to rein in crypto

Uniswap Labs has received a Wells notice from the SEC indicating the US enforcement agency will be pursuing legal action against the decentralized cryptocurrency exchange, according to a Uniswap blog post.

“Taking into account the SEC's ongoing lawsuits against Coinbase and others as well as their complete unwillingness to provide clarity or a path to registration to those operating lawfully within the U.S., we can only conclude that this is the latest political effort to target even the best actors building technology on blockchains,” the company said Wednesday.

Uniswap offers a decentralized (DeFi) crypto marketplace that allows users to buy, sell, and trade crypto assets without a centralized network. Hayden Adams, the founder and CEO of Uniswap Labs in his said that he is “annoyed, disappointed, and ready to fight” any SEC action.

The SEC did not specify the nature of the agency’s upcoming enforcement action. It also declined to comment when reached by reporters. But the regulator has taken an aggressive approach to regulating crypto exchanges over the past number of months in an effort to treat digital securities in the same manner as traditional securities.

Toncoin Price Surges after Distribution Announcement

In altcoin news, Toncoin (TON) broke into the top 10 cryptocurrencies by market cap this week for the first time after hitting a new all-time high above $7. The jump in price came after the TON Society announced on Monday to users participating in a voluntary palm-scanning identification program. Their aim is to enable digital identity verification for Telegram users over the next five years. The recent price surge adds to the impressive rise seen by TON since the beginning of the year when it traded at $2.23.

-From the Gemini Trading Desk

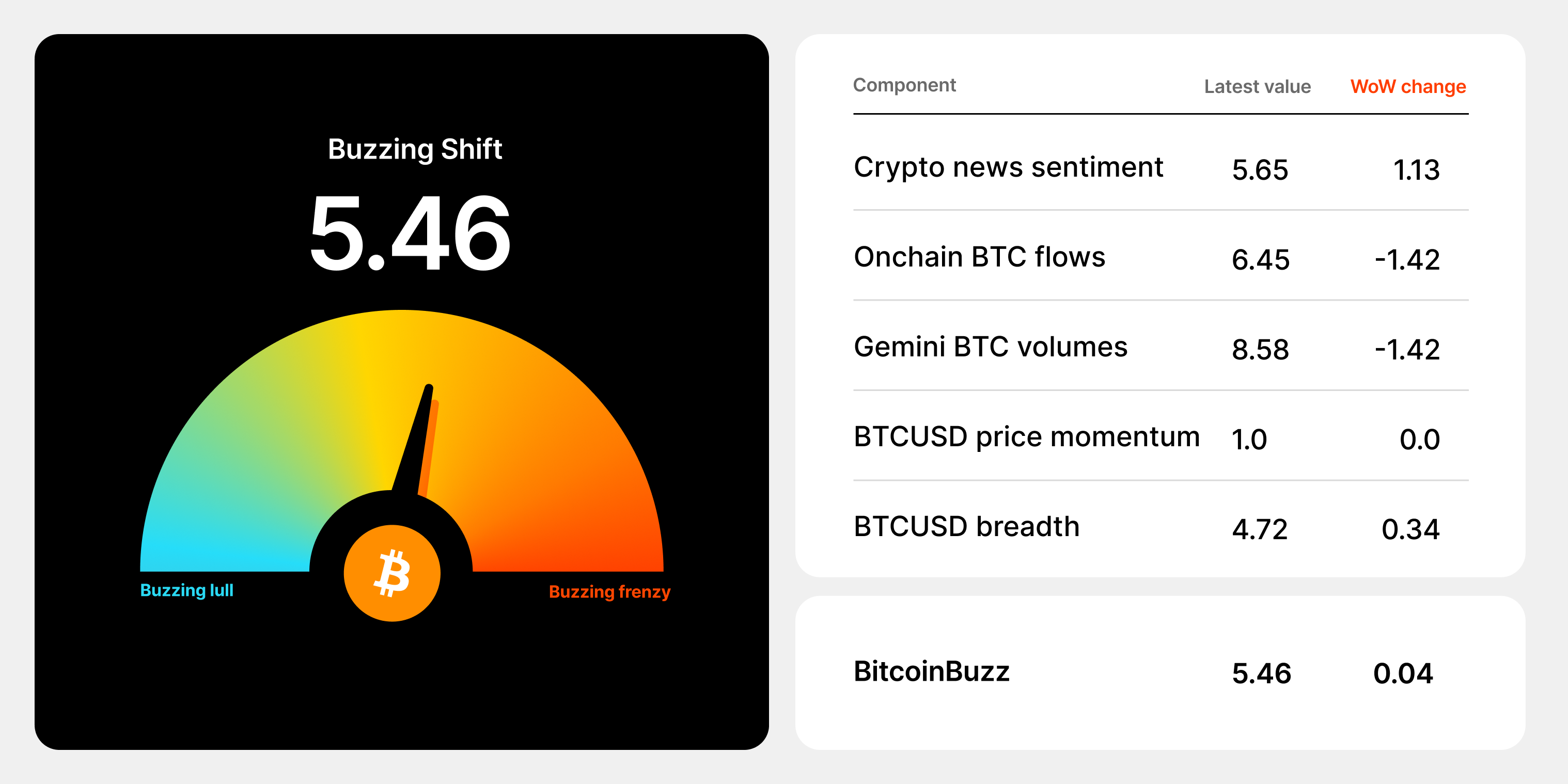

data as of 5:11pm ET on April 10, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Happens After Each Bitcoin Halving?

The Bitcoin halving event is still more than a week away, and analysts have gone back-and-forth on whether a rally or dip will ensue. Meanwhile, BTC miners will see a major impact on their balance sheets regardless of how the price of BTC fluctuates.

To review: Bitcoin halving is a quadrennial event when the cryptocurrency’s underlying blockchain cuts in half the availability of new rewards for miners.

The most immediate effects of the halving are a reduction in Bitcoin miner profitability and a slowdown in the rate of BTC’s total supply growth. These outcomes are effectively two sides of the same coin, since the BTC rewards miners earn for each successfully mined block are the means through which the total and circulating supply increases.

Since the reduction in mining rewards occurs immediately after each 210,000-block cycle, each of these crypto halvings triggers an instantaneous drop in miner revenue. As a result, the number of miners will likely continue to drop as the economic rewards for mining become less attractive, and smaller, less efficient miners are unable to generate a profit through BTC mining.

Past BTC halving dates have been followed by a period of price volatility for BTC and the overall crypto market. It remains to be seen how future BTC halvings will impact price movements, particularly as interest shifts to other crypto projects beyond BTC and institutional crypto investors leave larger footprints within the cryptosphere.

Onward and Upward, Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026