SEP 27, 2022

Gemini and Betterment Partner to Bring Diversified Crypto Portfolios to Investors

Today, we are excited to announce a partnership with Betterment, the , to begin offering crypto investment portfolios to customers across its retail and Betterment for Advisors offerings.

Betterment’s forthcoming crypto offering will enable customers to invest in curated crypto portfolios constructed from digital assets listed on the Gemini Exchange, and we will act as Betterment’s crypto custodian. By integrating with Gemini, Betterment customers will be able to gain exposure to the crypto asset class to further diversify their long term investment portfolios on a platform that they already know and trust.

Starting next month, Betterment customers will have access to expert-built crypto portfolios, assembled by Betterment, through their accounts, and Betterment for Advisors’s partners will have the ability to offer crypto to their clients. Betterment has over 730,000 customers across all of its business lines and offerings.

"We are delighted to expand our institutional partnerships through this Betterment integration," said Paget Stanco, Principal, Business Development at Gemini. "Through our suite of institutional products, we provide crypto infrastructure solutions to a growing number of asset managers, financial institutions, and platforms on a global scale. Our partnership with Betterment further cements Gemini as a leader in providing efficient access to crypto.”

Gemini’s Betterment partnership comes on the heels of a number of exciting institutional announcements. In July, we announced that our to seamlessly connect their bank accounts, and that we are serving as .

To learn more about Gemini’s full stack of institutional crypto offerings, . To learn more about Betterment’s crypto offerings please visit .

Onward and Upward!

Team Gemini

This content is for general informational purposes only and is not investment advice. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. You should consult a qualified, licensed advisor before engaging in any transaction. Past performance is no guarantee of future results. Digital assets are not legal tender and are not backed by the U.S. government. Digital assets are not subject to Federal Deposit Insurance Corporation (FDIC) insurance or Securities Investor Protection Corporation (SIPC) protections.

Updated: October 6, 2022.

RELATED ARTICLES

COMPANY

JUL 03, 2025

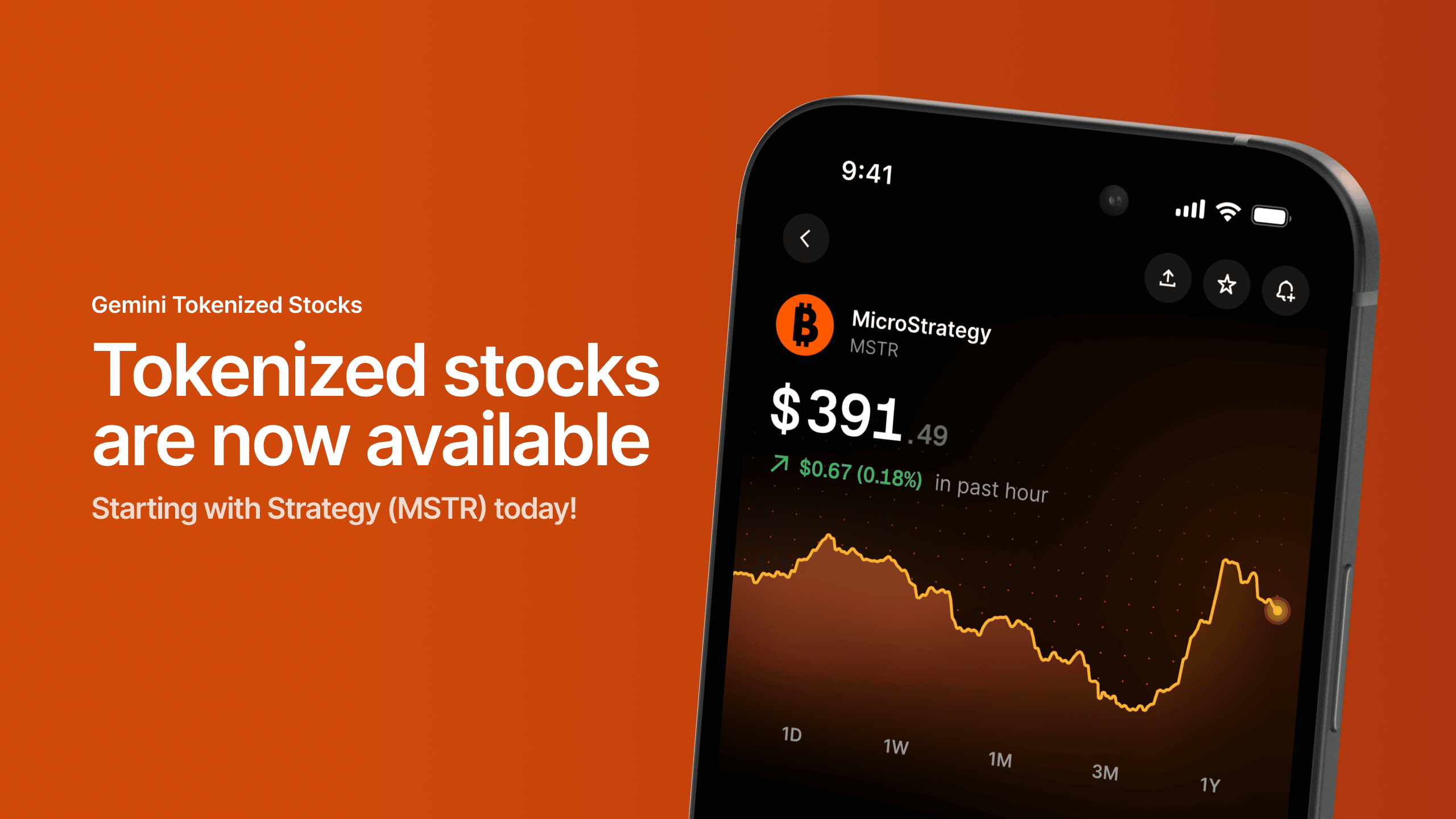

Gemini Releases New Batch of Blue Chip, TradFi, and Other Tokenized Stocks for EU Customers

WEEKLY MARKET UPDATE

JUL 03, 2025

Bitcoin Gains Ahead of Holiday, Circle Files for Banking License, and Strategy Continues BTC Buying Spree

COMPANY

JUN 27, 2025