JUN 30, 2023

Weekly Market Update - Friday, June 30, 2023

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — with growing interest around a spot bitcoin ETF, we resurface our origins of Bitcoin discussion.

| ⬆️ 0.01% | $30,147

| ⬇️ 1.12% | $1,851

| ⬆️ 104% | $292.66

| ⬆️ 82.10% | $55.17

| ⬇️ 23.90% | $0.945

Crypto prices as of Friday, June 30, 2023, at 10:30am ET. Percentages reflect trends over the past seven days. . All prices in USD.

data as of 5:00pm ET on June 29, 2023.

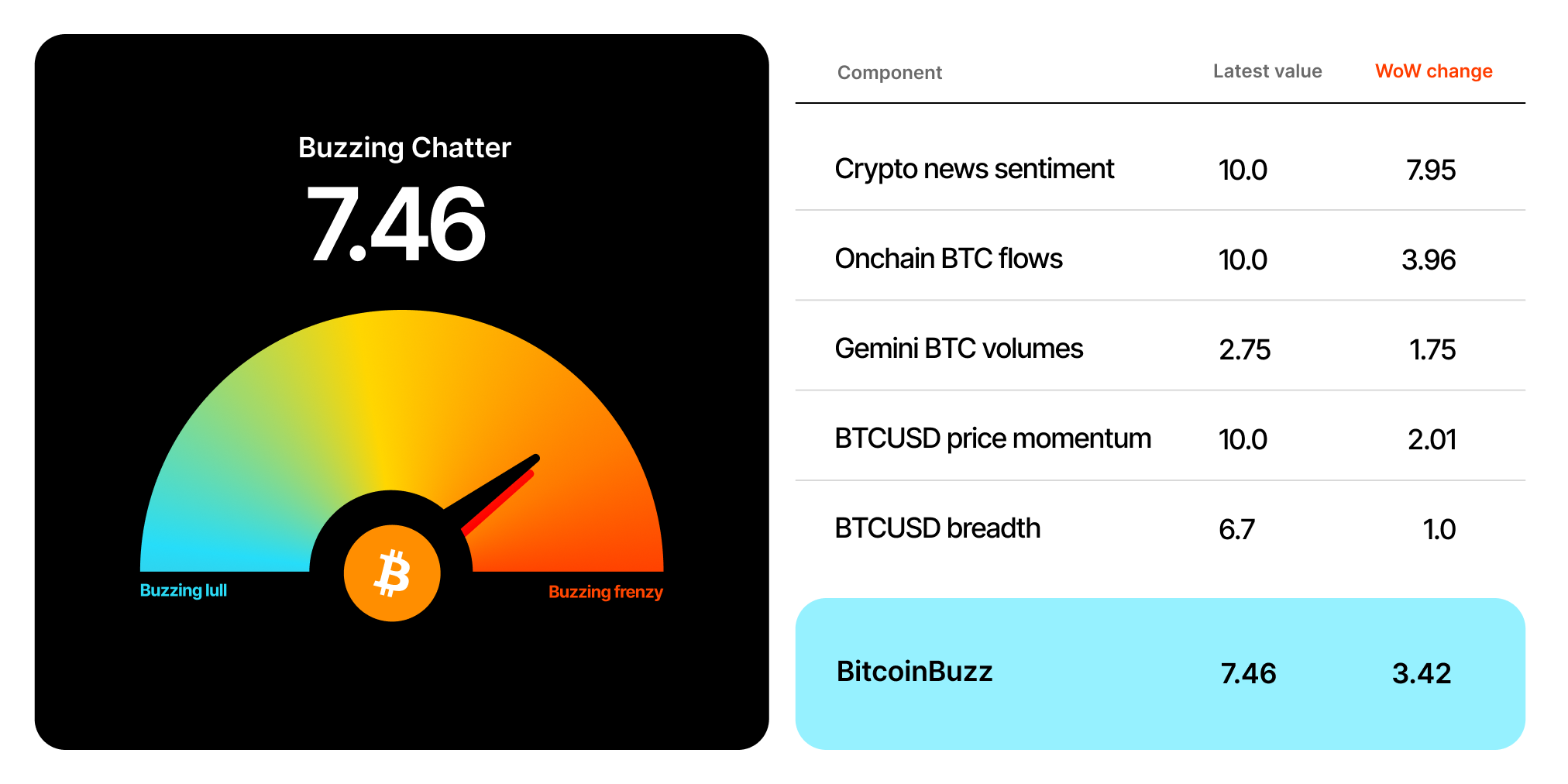

The BitcoinBuzz Indicator recorded a strong increase in Bitcoin sentiment this week, pushing the Indicator out of the Buzzing Shift range into Buzzing Chatter. The Indicator score rose almost 3.5 points to 7.46 after and a flurry of that dominated the crypto news cycle over the past few weeks.

News sentiment had a particularly strong week, increasing from 2.05 to 10. The shift in news sentiment was especially striking as it moved from against major exchanges dominating the news cycle earlier this month, to various traditional financial institutions a spot bitcoin ETF over the past two weeks. Onchain BTC flows likewise increased to the top of the scale, jumping from 6.03 to 10.

To learn more about the BitcoinBuzz Indicator, . Check back every Friday for an updated score!

Takeaways

- Bitcoin Price Largely Stable: Following large price gains last week spurred by a handful of spot bitcoin ETF applications, BTC held steady around the $30.5k USD range. BTC fell a couple percentage points Friday morning, however, after reports that the SEC considered the ETF applications “inadequate.”

- Fidelity Bitcoin ETF: Another large U.S. financial institution joined the bitcoin ETF conversation with a refiled application. A previous Fidelity application to launch a bitcoin ETF was rejected in 2022.

- Leveraged Bitcoin ETF: The first U.S.-based leveraged bitcoin futures ETF launched this week. Volatility Shares’ 2x Bitcoin Strategy ETF (BITX) had $5.7 million USD in net assets as of Thursday.

- Compound (COMP) Rises 70%+: Over the past seven days, Compound (COMP) prices rose to over $50 a token as COMP volumes spiked on exchanges.

- Coinbase Lawsuit: In its answer to the SEC lawsuit filed earlier in June, Coinbase outlined its argument that the tokens listed on its exchange are not securities and therefore fall outside the securities regulator’s purview.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Price Largely Stable After Last Week’s Surge

hovered around the $30.5k USD range for most of the week, after soaring past $30k USD last week on the news that BlackRock, Invesco, and other large traditional financial institutions applied to launch . BTC dominance .

briefly sought to retest $31k USD earlier in the week on rumors that Fidelity was planning to . The Fidelity news was later confirmed, without spurring much further action in the price of BTC.

On Friday morning, prices fell a couple percentage points after a report that the SEC considers The filings helped drive BTC prices up over the past few weeks. sat around $30.2k USD as of Friday morning.

Fidelity Re-Enters the Spot Bitcoin ETF Race

On Thursday, Fidelity joined a handful of other major U.S. financial institutions with the U.S. Securities and Exchange Commission (SEC). A previously filed application by Fidelity was , with the agency highlighting concerns around market manipulation of the underlying BTC markets.

Fidelity joined , and as major institutions seek approval for a spot bitcoin ETF. The approval of a bitcoin ETF would allow retail traders to purchase shares representing the value of BTC on major U.S. exchanges, like the Nasdaq.

Leveraged Bitcoin Futures ETF Goes Live

As buzz around a spot bitcoin ETF continues to grow, the first U.S.-based leveraged bitcoin futures ETF . Launched by Volatility Shares, the 2x Bitcoin Strategy ETF (BITX) started trading Tuesday on the Cboe BZX Exchange. BITX returns ” to 2x the S&P CME Bitcoin Futures Daily Roll Index’s performance on a given day. As of Thursday, the fund’s .

Compound (COMP) Rises Over 70% in a Week Following Volume and Outflow Spike

Over the past seven days, the price of has jumped 70%+, surpassing $50 a token amid seen on Binance. Overall COMP trading volumes across various trading pairs jumped from an average of $10-$15 million USD from June 11 through June 24 on Sunday. The platform further added 276 new users to its ecosystem on Sunday, since January of this year.

is an open-source platform for decentralized lending built on the Ethereum network, which allows participants to lend and borrow various cryptocurrencies.

Coinbase Argues That SEC Has No Purview Over Cryptos Listed on its Platform

In an answer filed Thursday to announced in early June, Coinbase that the tokens listed on its platform are not securities and therefore not regulated by the SEC. , the crypto exchange also argued that its due process rights had been infringed when the SEC brought the case.

Coinbase’s answer marks its first filing in alleging that it operated an unregistered securities exchange, broker-dealer, and clearing agency, and sold unregistered securities.

-From Team Gemini

The Origins of Bitcoin

(originally posted April 28)

With continued interest in the potential of a bitcoin ETF, today we resurface our discussion of the origins of Bitcoin. Most of us think of Bitcoin as the original cryptocurrency, as it spawned an entirely new asset class. While its impact on the financial system and the wider world has been profound, there were a few much lesser known precursors that laid the foundation for the crypto universe. Today, we look back to the roots of Bitcoin. To read more deeply about this topic .

What came before Bitcoin?

Bitcoin has played a unique role in creating a movement to decentralize existing, centralized financial services, but it was not the first attempt at creating digital money.

The notion of scarcity with respect to digital money was famously envisioned by when he in 1998. B-Money, another conceptual precursor to Bitcoin proposed by Wei Dai, a computer engineer, , and cryptographer, arose around the same time and is referenced in the Bitcoin whitepaper.

Going even further back, the idea of building cost (or digital scarcity) into a system was first conceptualized by Cynthia Dwork and Moni Naor in 1993 as a way to protect Internet services from abuse such as spam. In 1997, an English Cypherpunk named Dr. Adam Back implemented this concept into his project Hashcash, a service aimed at limiting spam and denial of service attacks by requiring a sender to generate a Hashcash token by solving a PoW puzzle.

.

Together, Bit Gold, B-Money, Hashcash, and other early examples of digital money and consensus mechanisms set the stage for Bitcoin.

Bitcoin arrives on the scene

The was published by the mysterious in 2008 and the network launched in January of 2009 upon the mining of the — the first block of the Bitcoin blockchain. Bitcoin created a digital currency that operates in a fully-decentralized, trustless manner that allows users to send monetary value to each other through the Internet without the need for trusted, financial intermediaries.

This was made possible by a major breakthrough in its PoW . Instead of relying on a majority of (known as ) to reach consensus, Bitcoin relies on the majority of hashrate — the network’s processing power — to reach consensus.

.

Acquiring a majority of the network’s is expensive, making it costly for a miner to tamper with the . Moreover, in doing so, a dishonest miner would forgo the handsome bounties of newly minted bitcoin (known as the ) that are awarded approximately every 10 minutes to the “winning” miner who correctly solves the PoW puzzle. Therefore, it is assumed that a rational, economically-motivated miner will commit her processing power toward securing the integrity of the blockchain instead of trying to manipulate it and cheat the system.

This incentive structure has turned digital money, a movement once made up predominantly of computer scientists and cryptographers, into an increasingly mainstream phenomenon.

Check out more about the , its , and how .

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026