JUN 14, 2023

Introducing Gemini's BitcoinBuzz Sentiment Indicator

At Gemini, we provide our users with tools to explore the crypto world, whether they want to trade, store, and stake crypto, or simply learn more about our expansive industry. Today, we are thrilled to unveil the BitcoinBuzz Indicator, a tool to empower crypto enthusiasts and traders with dynamic insights into the world of Bitcoin and crypto.

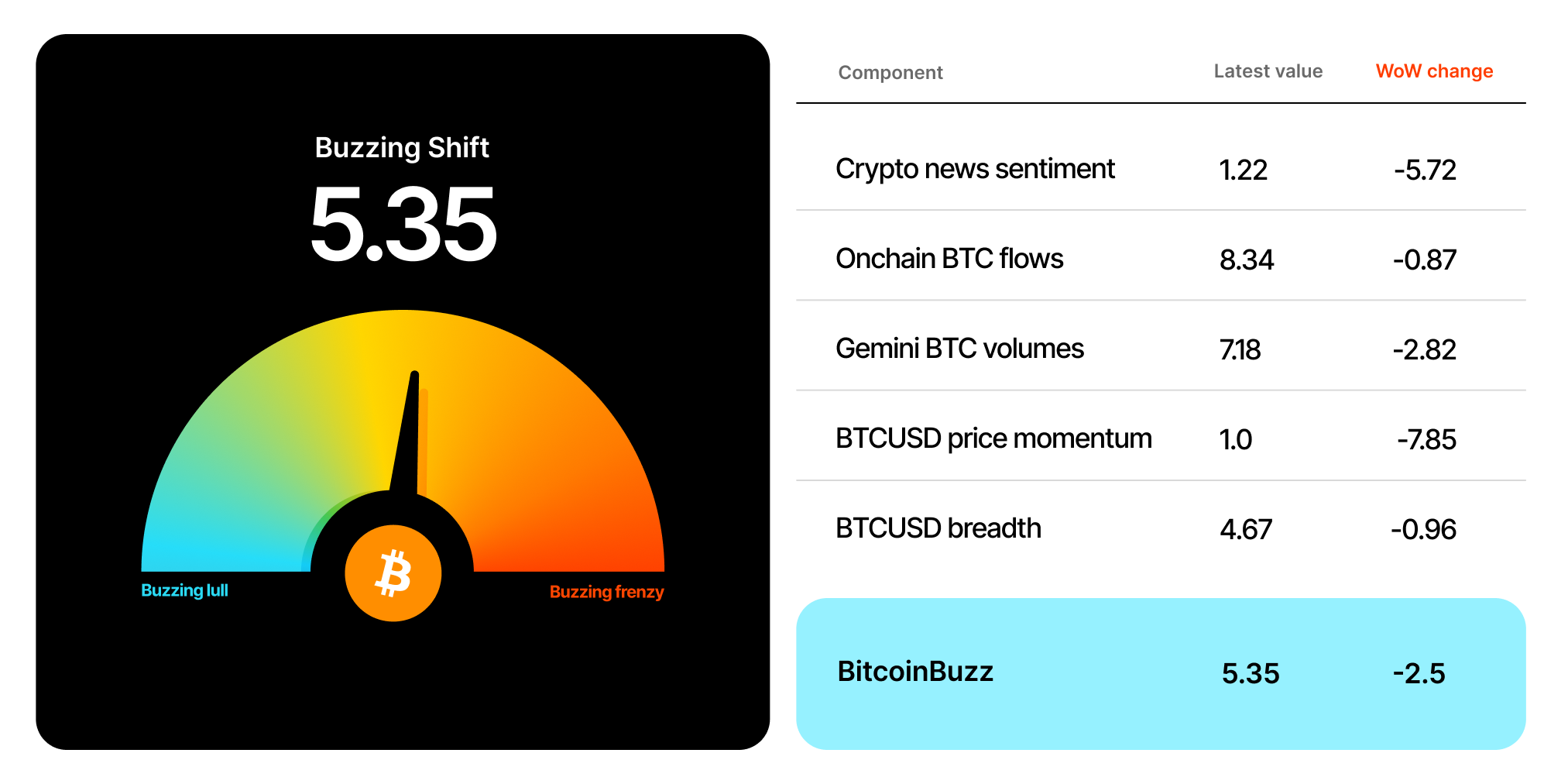

Every Friday, the BitcoinBuzz Indicator* will be included in our Weekly Market Updates. In each Weekly Market Update, we will display an updated BitcoinBuzz dial and its components (more on them below), showing how each has changed over the past week.

What is the BitcoinBuzz Indicator?

BitcoinBuzz is a cutting-edge BTC indicator that offers a comprehensive view of price movements. By harnessing in-depth sentiment analysis, BitcoinBuzz combines news sentiment, on-chain BTC flows, Gemini BTC volumes, BTCUSD price momentum, and BTCUSD breadth.

Together, these components paint a picture of BTC sentiment swings, with a user-friendly score between 1 and 10. While certainly not forward looking, the BitcoinBuzz Indicator offers a clear and concise snapshot of sentiment trends, helping you better understand the rapidly evolving BTC market.

Understanding the Buzz

We’ve divided the BitcoinBuzz scale into 5 categories, ranging from Buzzing Frenzy, reflecting the relative highest potential buzz around Bitcoin, to Buzzing Lull, implying a quiet period for Bitcoin.

BitcoinBuzz Scale

- Buzzing Frenzy: (8.5-10): There is an extremely high level of buzz and excitement surrounding Bitcoin. This represents a state of intense market activity, widespread interest, and a surge of positive sentiment. It suggests a market in a state of euphoria.

- Buzzing Chatter (6-8.5): There is a high level of discussion, attention, and positive sentiment surrounding Bitcoin, suggesting an active and engaged market, with increased awareness and interest among investors. This indicates a market that is abuzz with positive discussions and anticipation.

- Buzzing Shift (4-6): This reflects a transitional phase in market sentiment and buzz surrounding Bitcoin. It suggests a shift or change in the prevailing sentiment, indicating a potential turning point in market dynamics. This category acknowledges the fluid nature of market sentiment and the possibility of a shift in market conditions.

- Buzzing Whispers (2.5-4): This represents a relatively quiet and subdued market environment and discussion around Bitcoin. It suggests a lack of significant attention or enthusiasm, potentially indicating a period of consolidation or decreased interest from market participants.

- Buzzing Lull (1-2.5): This denotes an extremely low level of buzz and interest surrounding Bitcoin. It represents a state of minimal activity, diminished discussion, and negative sentiment. It may indicate a market slump, lack of confidence, or a significant decline in interest and engagement.

BitcoinBuzz Indicator Components

The Indicator score, between 1-10, incorporates various data points, including:

- Crypto news sentiment

- Onchain BTC flows

- Gemini BTC volumes

- BTCUSD price momentum

- BTCUSD breadth

At its core, BitcoinBuzz is a composite indicator that analyzes the variables above to arrive at a single score. A reading above 7 or below 3 suggests extreme market conditions, with higher numbers indicating positive sentiment and lower numbers indicating negative sentiment, as outlined above.

Analyzing and Combining the BitcoinBuzz Components

To distill the content data we collect, we use advanced techniques to extract sentiment from crypto news and combine that with and on-chain data.

Crypto News

Our crypto news sentiment indicator uses word embeddings to determine whether news on BTC is positive or negative. Word embeddings are numerical representations of words that capture their semantic relationships, enabling machines to understand and process language more effectively.

BTC Price and Flows

Onchain BTC flows provide insights into the activities of BTC whale wallets that interact with the Gemini Exchange. Gemini BTC volumes represent an overall view of Gemini Exchange volumes that can reflect overall buying and selling pressure in the market.

BTCUSD momentum helps identify BTC price movements by considering various moving average pairs and short- and long-term volatility. This element combines these moving averages and volatility parameters to arrive at a single risk-adjusted reading of BTCUSD momentum.

BTCUSD breadth measures the strength of BTC's price relative to its 52-week high and low, as well as its distance from the upper and lower . By tracking the relative strength of BTC, a general trend develops to enhance the descriptive nature of the BitcoinBuzz Indicator.

Putting it All Together

These components are subsequently smoothed out using a 30-day exponential moving average to reduce noise and whipsaws. The ultimate BitcoinBuzz Indicator between 1 and 10 is defined by the sum of mean-weighted results of all these components, and is further smoothed using a five-day exponential moving average to account for volatility differences between the components.

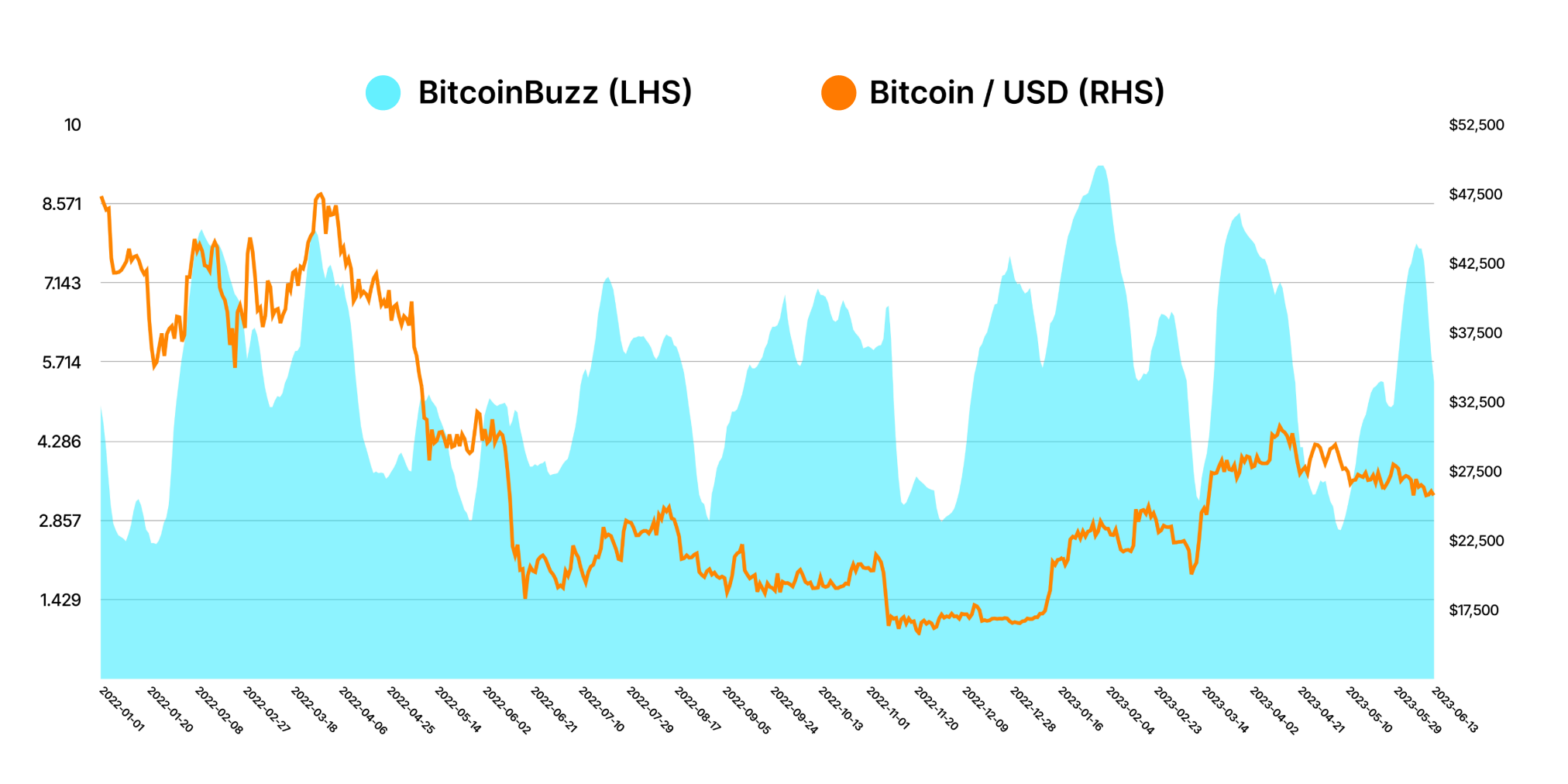

How Has BitcoinBuzz Fared Historically?

The chart below shows the price of bitcoin in orange overlaid on the BitcoinBuzz Indicator score.

Keep an eye out for the BitcoinBuzz Indicator in our Weekly Market Updates, to help you gauge the overall sentiment and momentum of the BTC market over the past week.

Onward and Upward!

Gemini Analytics Team

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026