GLOBAL STATE

OF CRYPTO

GLOBAL

STATE OF

CRYPTO

2025 Trends: Data-Driven Insights Into the Crypto Market

2025 Trends: Data-Driven

Insights Into the Crypto Market

After a volatile start to the year, the crypto ecosystem has multiple greenshoots that are likely to propel it forward throughout the rest of 2025 and beyond.

President Donald J. Trump has embraced cryptocurrency by launching a Strategic Bitcoin Reserve, Congress is moving forward with stablecoin and regulatory legislation for digital assets, and corporations are adding more bitcoin to their balance sheets.

In Gemini’s 2025 Global State of Crypto Report, we analyzed the state of the crypto market and attitudes toward digital assets, including the impact of spot bitcoin ETFs, memecoins, how President Trump’s pro-crypto policies have impacted crypto attitudes, whether investors are planning to buy more in the coming year, and more.

To conduct the report, Data Driven Consulting Group surveyed 7,205 consumers in the US, UK, France, Italy, Singapore, and Australia (approximately 1,200 consumers per country) from March 18 to April 10, 2025.

Read more

Ownership

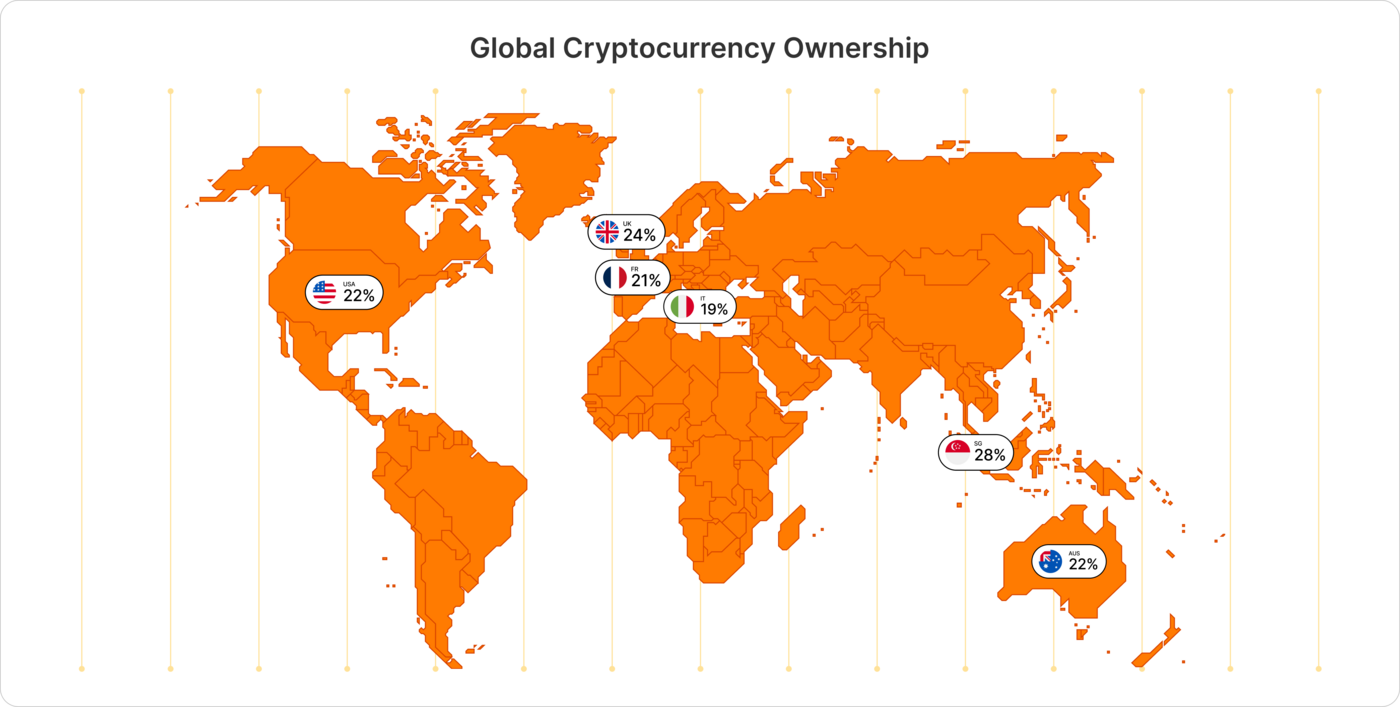

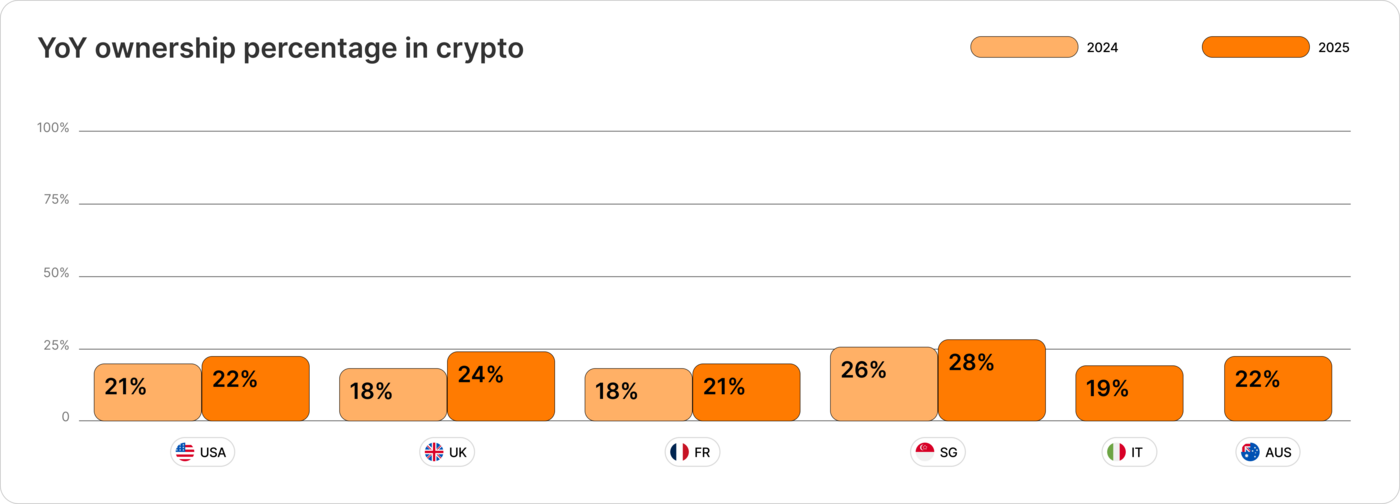

Europe leads the way in crypto ownership growth

After a period of modest growth following the crypto market downturn of 2022, crypto ownership rose in all geographies surveyed over the past year. In particular, crypto ownership in France and the UK surged, reflecting a warming environment for digital assets in Europe.

In 2025, 24% of respondents in the UK said they were invested in cryptocurrency, up from 18% in 2024. It was the biggest year-over-year jump of any of the nations surveyed. It was also the second highest ownership rate recorded, trailing only Singapore (28%).

After a period of modest growth following the crypto market downturn of 2022, crypto ownership rose in all geographies surveyed over the past year. In particular, crypto ownership in France and the UK surged, reflecting a warming environment for digital assets in Europe.

In 2025, 24% of respondents in the UK said they were invested in cryptocurrency, up from 18% in 2024. It was the biggest year-over-year jump of any of the nations surveyed. It was also the second highest ownership rate recorded, trailing only Singapore (28%).

Trump

President Trump’s pro-crypto policies spark global confidence

After pledging to support digital assets during his campaign, President Trump has established a Strategic Bitcoin Reserve, reshaped the SEC with a pro-innovation approach to crypto regulation, and more.

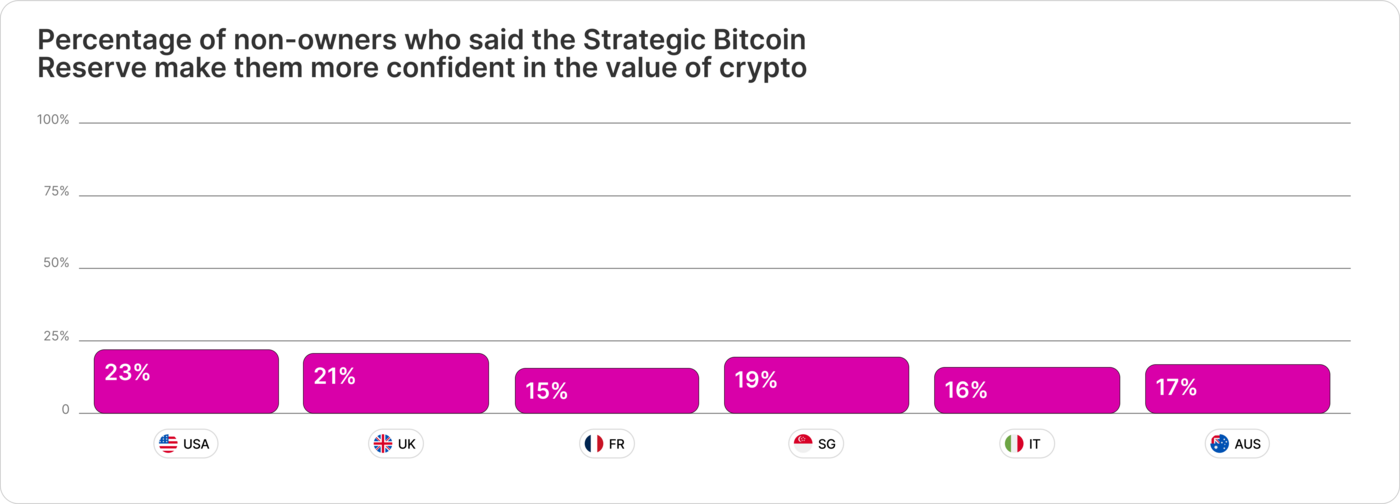

President Trump’s policies are making an impact. Nearly a quarter (23%) of non-crypto owners in the US said the launch of a Strategic Bitcoin Reserve increases their confidence in the value of cryptocurrency.

After pledging to support digital assets during his campaign, President Trump has established a Strategic Bitcoin Reserve, reshaped the SEC with a pro-innovation approach to crypto regulation, and more.

President Trump’s policies are making an impact. Nearly a quarter (23%) of non-crypto owners in the US said the launch of a Strategic Bitcoin Reserve increases their confidence in the value of cryptocurrency.

Memecoins

Memecoin frenzy sparks broader crypto adoption

Onchain Activity

Continues to Grow in APAC

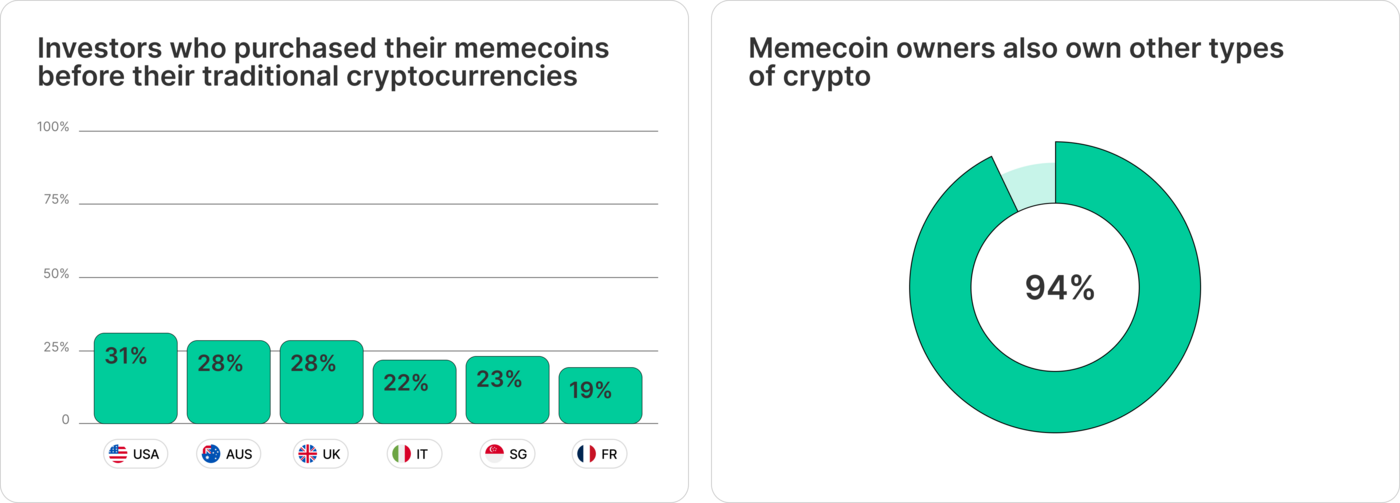

In the US, 31% of investors who own both memecoins and traditional cryptocurrencies report that they purchased their memecoins first, followed by 30% in Australia, 28% in the UK, 23% in Singapore, 22% in Italy, and 19% in France. Globally, 94% of memecoin owners also own other types of crypto, suggesting memecoins are an onramp to broader crypto investments.

In the US, 31% of investors who own both memecoins and traditional cryptocurrencies report that they purchased their memecoins first, followed by 28% in Australia and the UK, 23% in Singapore, 22% in Italy, and 19% in France. Globally, 94% of memecoin owners also own other types of crypto, suggesting memecoins are an onramp to broader crypto investments.

ETFs

Two in five US crypto owners invest in spot crypto ETFs

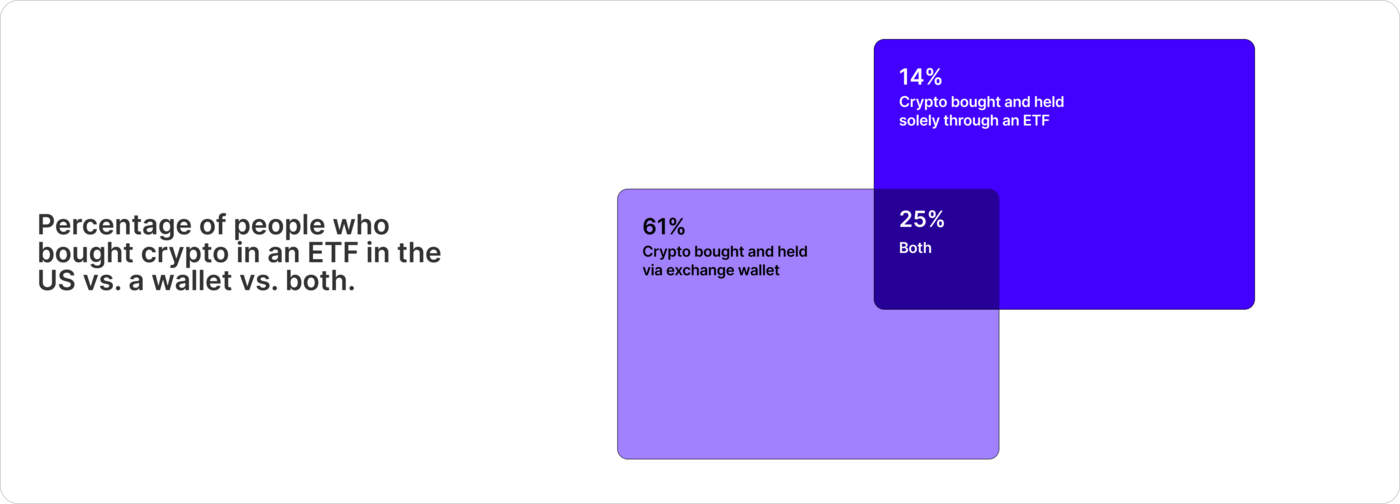

Spot crypto ETFs quickly became the fastest growing ETFs in history after their launch in early 2024, recording hundreds of billions in inflows and helping drive the price of bitcoin higher. In the US, 39% of crypto owners said they are invested in a cryptocurrency ETF, up from 37% in 2024.

Inflation

Crypto is a hedge against inflation

After surging in 2022 and 2023, inflationary pressures in the US dissipated in 2024 and through the first quarter of 2025. But inflation is still very much on the mind of crypto investors in the US. In 2025, 39% of US respondents said they buy and hold crypto as a way to hedge against inflation, up from 32% last year. Other countries surveyed were less concerned.

Age

Half of gen z and millennials invest in crypto

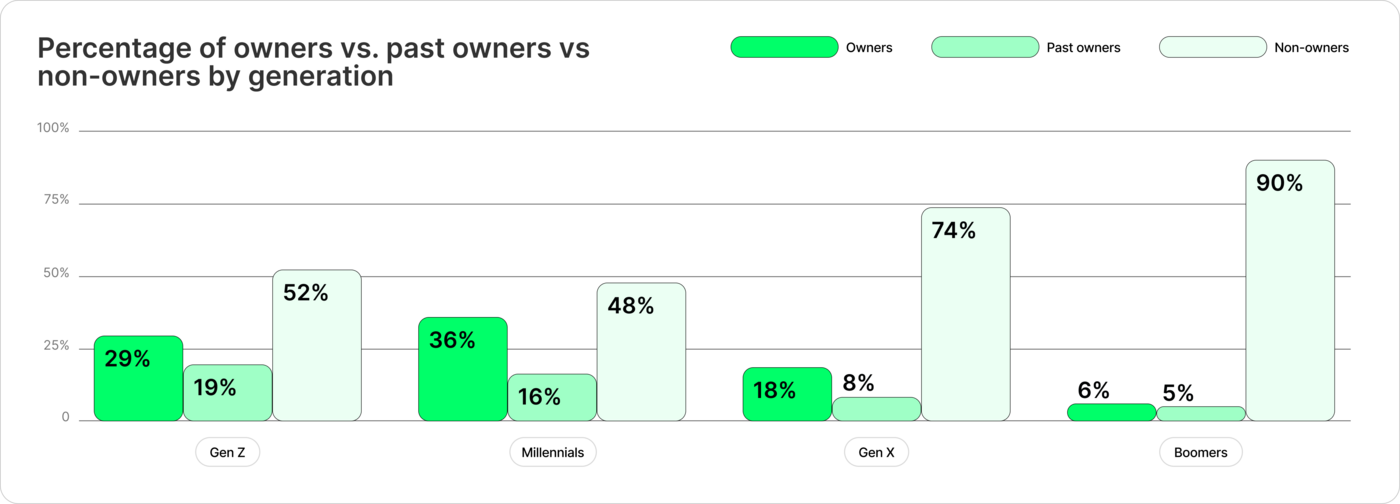

The common narrative is that cryptocurrency ownership skews young. And that’s largely true. About half of Millennials and Gen Z respondents globally said they either currently own crypto or have in the past, at 52% and 48%, respectively. That’s significantly higher than the general global population, at 35%.

Gender

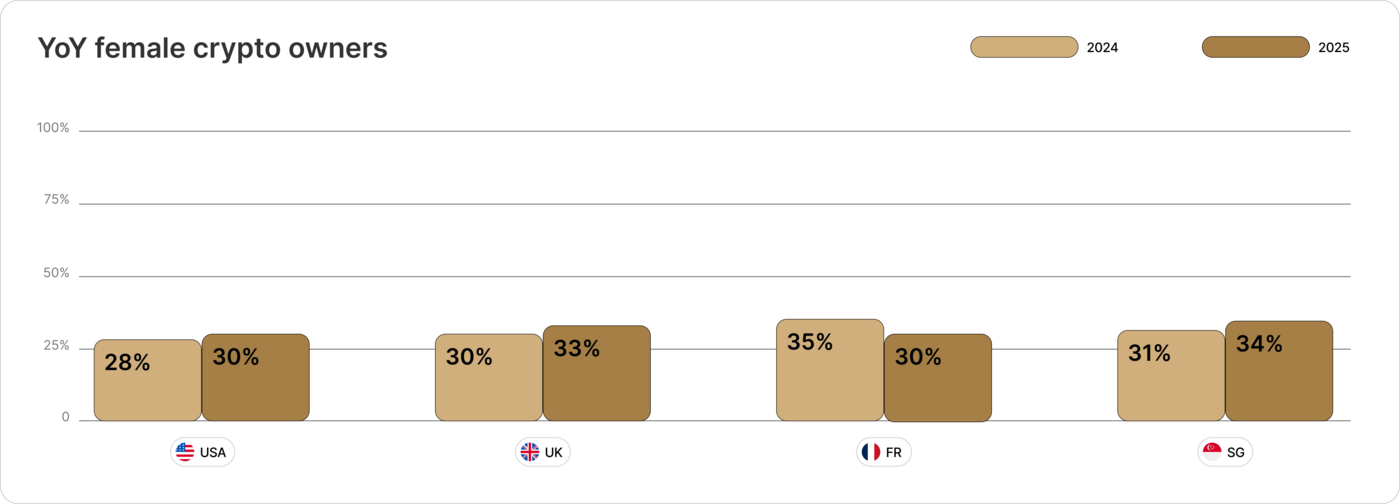

The gender gap for crypto investments is closing

Similar to traditional finance, the crypto ecosystem has long been a male-dominated investment class. But women across the globe have increasingly opted to invest in crypto, narrowing the gender gap in ownership in the majority of countries surveyed.