SEP 22, 2023

Weekly Market Update - Friday, September 22, 2023 - Mt. Gox Repayments Delayed for a Year, Fed Holds Rates Steady, and Optimism’s Third Community Airdrop

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore crypto airdrops.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +1.38% | $26,685 |

$26,685

+1.38%

| |

Ether

ETH | -1.40% | $1,596 |

$1,596

-1.40%

| |

Immutable X

IMX | +33.40% | $0.6538 |

$0.6538

+33.40%

| |

Orchid

OXT | -21.80% | $0.0633 |

$0.0633

-21.80%

| |

Aave

AAVE | +16.70% | $63.96 |

$63.96

+16.70%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, September 22, 2023, at 11:40am ET. . All prices in USD.

Takeaways

- Bitcoin has an up-and-down week as Mt. Gox delays repayments: Bitcoin (BTC) started the week off rallying from $26.5k USD to $27.4k USD before paring its gains by Friday. Mt. Gox trustees delayed repayment of more than 140,000 BTC and other cryptos by a year, extending the deadline to October 2024.

- Fed holds rates steady as one more hike expected this year: In line with expectations, the US Federal Reserve held its target benchmark interest rate at 5.25%-5.5%. One more hike is expected by the end of 2023, with interest rate cuts anticipated starting next year.

- Judge blocks the SEC from immediately reviewing Binance.US software: The SEC faced a setback in its case against Binance.US, as a judge blocked the agency from immediately reviewing the exchange’s software. A follow-up hearing is slated for October 12.

- Optimism completes third community airdrop and plans private sale: Optimism (OP) airdropped ~19.4 million OP tokens (about $27 million USD) to eligible users. The team also announced a private sale of 116m OP tokens (about $162 million USD) to seven buyers.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Rallies Early in the Week as Mt. Gox Trustees Delay Repayments

rallied higher to begin the week, breaking back above $27k USD for the first time this month, before failing to break through resistance at $27.4k USD. BTC sat around $26.7k USD as of Friday morning.

BTC began to tick up following a rumor that Mt. Gox, the defunct crypto exchange, repayments by the October 31, 2023 deadline set earlier this year. On Thursday it was reported by the trustees for the firm that these repayments have now been pushed back by 12 months to October 31, 2024. The Mt. Gox trustees 141,686 BTC and 143,000 Bitcoin Cash (BCH) as part of the repayment plan.

continues to lag behind BTC in recent weeks and has now hit its lowest level on the ETHBTC pair since July 2022 as it on Wednesday. BTC dominance has also moved back , a significant increase from the start of the year at ~41%.

Fed Keeps Rates Steady, But One More Hike Expected in 2023

The Federal Reserve kept its in the 5.25%-5.5% range on Wednesday, as expected. One more hike before year end is expected, however, with sitting at 5.6%. That hike may happen either at the Fed’s November or December meeting.

Looking ahead to 2024, two quarter-point rate cuts next year, down from a full percentage point cut estimated back in June. The expected decrease in interest rate cuts was one of the more surprising outcomes from Wednesday's meeting, with Fed Chair Jerome Powell reiterating the Fed’s commitment to achieving . US equities finished the day in the red following Powell’s comment. On Wednesday, the lost -0.94%, while the dropped by -1.46%, with both indices continuing to drop on Thursday.

Judge Blocks SEC From Immediately Inspecting Binance.US Software

The Securities and Exchange Commission (SEC) was dealt a temporary blow this week in their ongoing lawsuit against Binance.US after a judge for immediate inspection of the trading platform’s software. The SEC had told the court that Binance.US was not cooperating with its investigation into the exchange. The judge has now for October 12.

The setback will add to the frustration of the SEC which has started to see pushback against their crypto-targeted litigation in recent months, most notably losing its case against and . Nevertheless, the head of the SEC’s Crypto Assets and Cyber Unit reiterated this week that they against crypto exchanges and decentralized finance (DeFi) projects.

Optimism Completes Third Community Airdrop and Plans Private Sale

, the layer-2 blockchain, this week with ~19.4 million OP tokens (about $27 million USD) airdropped to eligible users.

The project also announced on Wednesday that they would be selling 116m OP tokens (~$162 million USD) in . The tokens, which will be sold to seven buyers, are subject to a two-year lockup period and are being sold for treasury management reasons according to the team. down ~6.5% over the past seven days.

-From the Gemini Trading Desk

data as of 5:00pm ET on September 21, 2023.

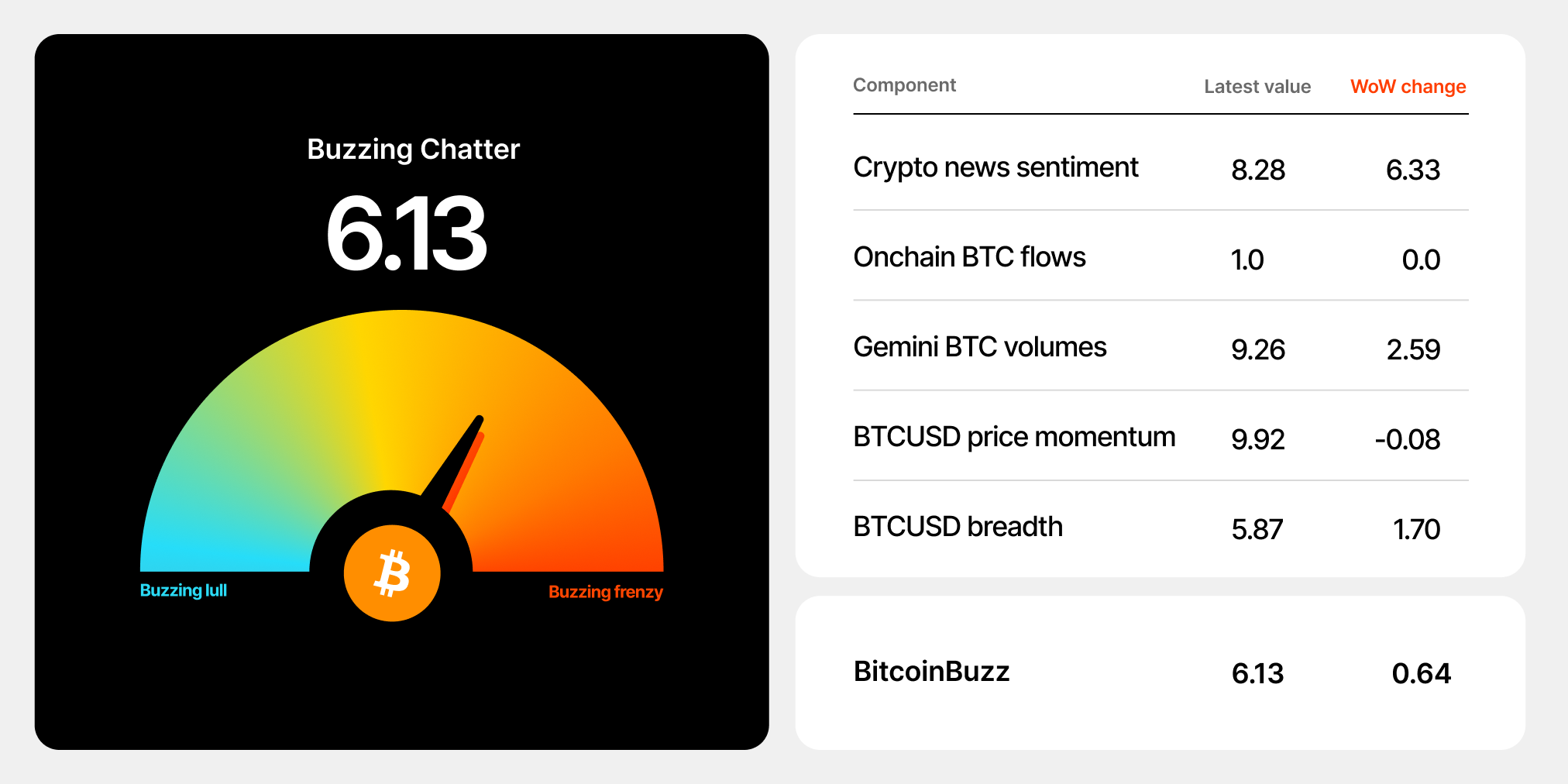

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Crypto Airdrops

A crypto airdrop is an initiative undertaken by a crypto project with a native to distribute its crypto to current or potential users — usually for free — in a digital asset giveaway.

Airdrops serve multiple purposes: marketing, creating , and helping to establish equitable governance mechanisms by decentralizing a platform’s crypto holdings. Crypto airdrop recipients are typically determined based on prior or current participation in another existing network such as Bitcoin or , or through a or wallet.

How Do Crypto Crypto Airdrops Work?

Receiving coins or tokens via an airdrop is a relatively simple process. Often, you just need to provide a valid receiving wallet address to the project that is distributing the tokens. Some initiatives require that you engage with the party carrying out the airdrop by sharing a promotional social media post, completing a survey, or subscribing to a mailing list. It’s also possible to receive an airdrop simply by being a user of an exchange participating in a crypto airdrop.

Why Do Crypto Airdrops Happen?

Crypto airdrops distribute free cryptocurrencies or tokens in exchange for minimal effort on the part of the recipients.

Airdrops are often intended to help a new crypto project kickstart the process of gaining both visibility and network participation. By widely distributing free coins or tokens to new recipients, a network can grow more quickly. Once a widely distributed crypto airdrop occurs, many people will own the new crypto, potentially heightening general awareness of a particular project, increasing its popularity, and democratizing its ownership.

Governance Token Airdrops

More recently, crypto airdrops have taken place as distribution mechanisms, where users of particular platforms are retroactively rewarded with governance tokens in exchange for their early network participation.

Governance tokens give holders voting rights in the community-based decision-making process of a decentralized platform. Governance token airdrops have become a common trend in the DeFi ecosystem with participation from popular platforms like , , and .

The governance token airdrop model was popularized when the protocol Uniswap created its own in 2020, and airdropped 400 UNI tokens to anyone who had previously used the exchange. All in all, 400 UNI (worth about $1,400 USD at the time) were distributed to more than 250,000 accounts — airdropping a grand total of more than $350 million USD.

The Uniswap airdrop was notable for its retroactive distribution structure. It also established blockchain airdrops as an effective way for platforms to distribute tokens to their community as a reward for their participation.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026