SEP 15, 2023

Weekly Market Update - Friday, September 15, 2023 - Franklin Templeton Joins Bitcoin ETF Race, Industry Leaders in Singapore for Token2049, FTX Gets Approval to Start Liquidating Its Crypto

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore custodial and non-custodial wallets.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +1.74% | $26,325 |

$26,325

+1.74%

| |

Ether

ETH | -0.67% | $1,619 |

$1,619

-0.67%

| |

Storj

STORJ | +45.70% | $0.3582 |

$0.3582

+45.70%

| |

Orchid

OXT | +32.40% | $0.0814 |

$0.0814

+32.40%

| |

ApeCoin

APE | -17.20% | $1.095 |

$1.095

-17.20%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, September 15, 2023, at 11:40am ET. . All prices in USD.

Takeaways

- Franklin Templeton enters spot bitcoin ETF race: The asset manager with over a trillion dollars in assets under custody filed an application with the SEC to launch a spot bitcoin ETF, joining Blackrock, ARK Invest, VanEck and others.

- Web3 enthusiasts descend on Singapore for Token2049: Some of the largest names in the crypto space spoke at Token2049 this week, in what is set to be the largest Web3 conference this year. At the event, messaging app Telegram and the TON Foundation announced a new self-custodial crypto wallet.

- Binance.US executives leave amid regulatory scrutiny: It was reported that the CEO of Binance.US and other executives were leaving and that the company’s workforce would be cut by a third. The moves come as Binance, Binance.US, and founder Changpeng Zhao face suits leveled against them by the SEC and CFTC.

- FTX receives court approval to start liquidating crypto assets: FTX was granted permission from a bankruptcy judge to begin liquidating its crypto to start repaying creditors. The bankrupt exchange can sell up to $200 million USD in assets every week, pending creditor approval. FTX’s major crypto holdings include SOL, BTC, and ETH.

- Markets muted despite inflation numbers a touch above expectations: CPI was up 3.7% from a year ago (3.6% expected), while core CPI increased 4.3% (4.3% expected). Market expectations changed little as a result, with traders seeing a 97% chance that rates will remain unchanged at next week's September 20 Fed meeting.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Franklin Templeton Submits Spot Bitcoin ETF Application

After dipping to $25k USD on Monday, the price of recovered with Franklin Templeton filing for a spot bitcoin ETF. pushed higher throughout the week, reaching ~$26.2k USD by Friday morning. has lagged BTC following this most recent move, dropping to its lowest level on the since July at 0.061.

Franklin Templeton, with ~$1.4 trillion USD assets under management, joined a spot bitcoin exchange-traded fund (ETF) on Tuesday.

This latest application shows that demand for a spot bitcoin ETF continues to grow, as the market expects the US Securities and Exchange Commission (SEC) to approve such applications by the end of 2024 at the latest. Analysts at Bloomberg Intelligence now that a US-based spot bitcoin ETF will be approved by the end of 2023 and a 95% chance by the end of 2024.

Singapore’s Token2049 Likely to Be Year’s Largest Web3 Event

took place in Singapore this week, with over 10,000 attendees. Many of the biggest names in the crypto space were in attendance, including Gemini co-founders Cameron and Tyler Winklevoss, Binance CEO Chanpeng Zhao, and entrepreneur Balaji Srinivasan, among others.

The popular messaging app, Telegram, and the TON Foundation at the event on Wednesday that they will be introducing a self-custodial crypto wallet called TON Space. The price of Toncoin (TON) is this week as of Friday morning.

Binance.US CEO Steps Down Amid Further Job Cuts

On Tuesday, it was announced that Brian Shroder, CEO of Binance.US, , with the company also announcing job cuts totalling one third of its workforce. The latest cuts represent about 100 employees at the firm.

Binance.US has faced increasing pressure from US regulators, with bringing legal action against Binance, Binance.US, and founder Changpeng Zhao. The suits alleged the sale of unregistered securities, operating an illegal exchange, and violation of commodities and securities laws. Following the confluence of regulatory action, Binance.US experienced a large drop in volumes.

, it was reported that two additional executives were leaving the firm, Krishna Juvvadi, Head of Legal at Binance.US, and Sidney Majalya, the company’s Chief Risk Officer.

FTX to Start Liquidating Crypto Following Court Approval

Bankrupt crypto exchange from a bankruptcy judge on Wednesday to begin liquidating its crypto to start repaying creditors, and can sell up to $200 million USD in assets every week, .

According to recent documents, FTX holds in crypto, with Solana (SOL) being the largest holding at $1.16 billion USD and BTC and ETH being the second and third largest at $560 million and $192 million respectively.

has been trending down over the past couple of months after touching ~$30 USD in July to $19 USD on Friday, possibly in anticipation of the FTX news. A large portion of the SOL, however, is currently locked up in a vesting schedule that sets various amounts of SOL until 2028. The bankrupt exchange also reportedly holds around , which includes digital assets, cash, brokerage investments, and Bahamas real estate.

Markets Muted Following New Inflation Data

was up 3.7% from a year ago (3.6% expected), while core CPI increased 4.3% (4.3% expected). The new data did little to change market expectations in relation to further interest rate hikes, that rates will be held steady at next week's September 20 Federal Open Market Committee (FOMC) meeting, while chances of another 25 bps hike in November remain around the 35% level.

Equity markets had a muted reaction to the latest inflation data released Wednesday, with the rising ~0.12% and the ~0.38%.

-From the Gemini Trading Desk

data as of 5:00pm ET on September 14, 2023.

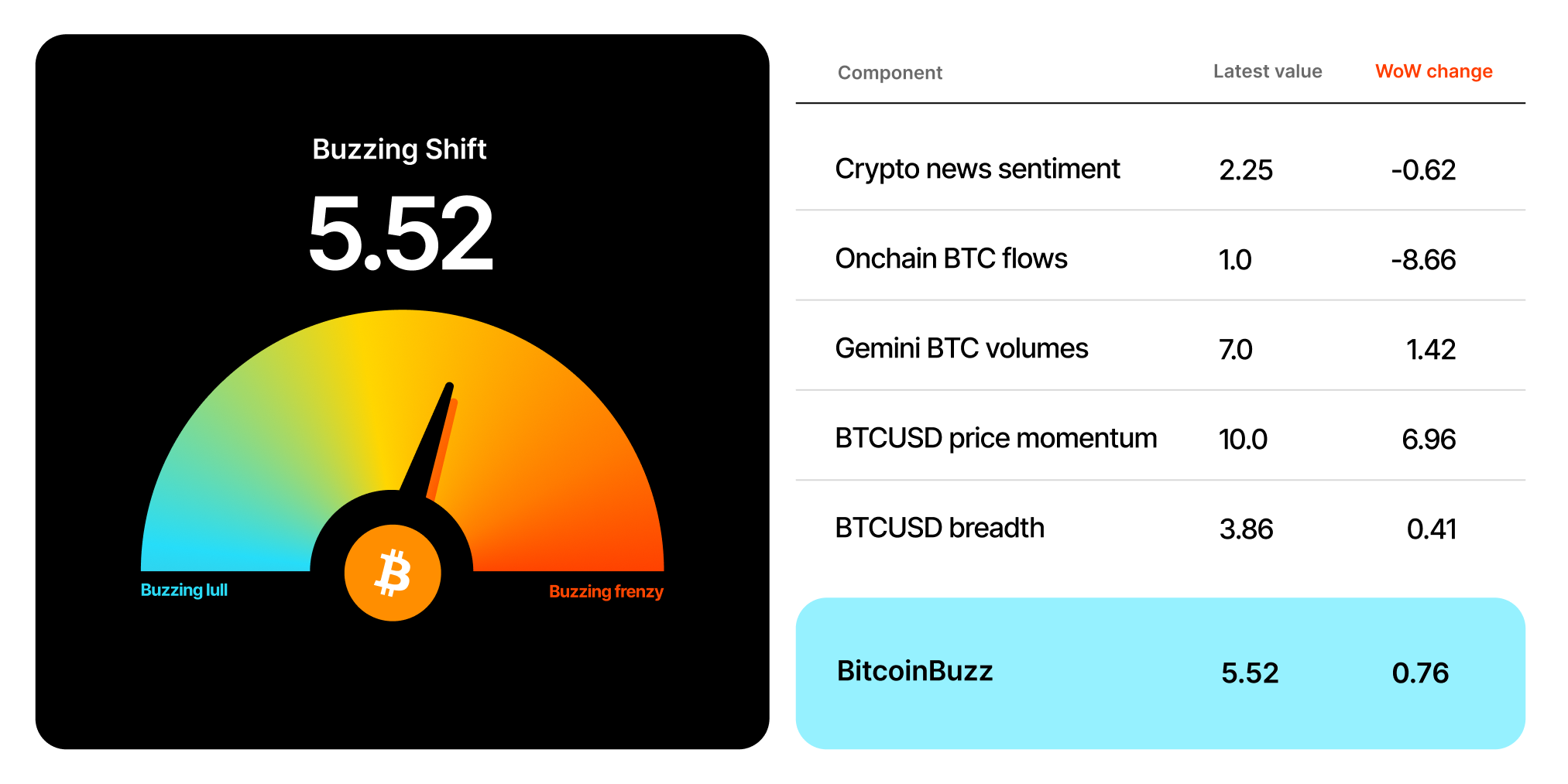

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Custodial and Non-Custodial Wallets

Once you’ve purchased crypto, one of the first decisions you need to make is whether to use a custodial or non-custodial wallet to store your funds.

When using a custodial wallet, another party controls your private keys. In other words, you’re trusting another party to secure your funds and return them if you want to trade or send them somewhere else. While a custodial wallet lessens personal responsibility, it requires trust in the custodian that holds your funds, which is usually a cryptocurrency exchange.

If you're using a non-custodial wallet, you have sole control of your , which in turn control your cryptocurrency and prove that the funds are yours. While there is no need to trust a third party when using a non-custodial wallet, this also means that you are solely responsible for not losing your keys and requires that you take your own precautions to protect your funds.

Custodial Wallets

It’s very likely that the first time you purchase crypto, it will end up in a custodial exchange crypto wallet, like Gemini. In this case, the exchange is your custodian, which holds your keys and is tasked with securely storing your funds. It is crucial that you use a reputable custodial wallet such as those offered by major US crypto exchanges, where customer funds are held in that are highly secure.

Many prefer custodial wallets because of the convenience. Losing your password to a non-custodial wallet could be financially devastating if you do not take sufficient precautions. However, if you forget your exchange account password you’ll likely be able to reset it. Be sure to follow the exchange’s recommended security measures to best protect the digital assets within your crypto wallet.

Non-Custodial Wallets

Non-custodial crypto wallets give you complete control of your keys and therefore your funds. While some people store large amounts of crypto on exchange accounts, some may feel more comfortable with a non-custodial wallet, which eliminates a third party between you and your crypto.

Non-custodial wallets can be browser-based, they can come in the form of software installed on mobile devices or on desktops, or they can be hardware devices, among other options. Although they can take many forms, one of the most secure ways to hold your cryptocurrency is using hardware wallets. These crypto wallets usually look like a USB storage device with a screen and analog buttons.

Turned off when not in use, these hardware, non-custodial crypto wallets must be connected to a computer or mobile device via USB ports or bluetooth to transact. Although they are technically connected to the internet during a transaction, the of the transaction by the private keys is done offline within the hardware wallet itself before being sent online to the blockchain to be confirmed. For this reason, even a malware-infected computer or phone can’t access your funds when you’re using a non-custodial hardware wallet.

Choosing between a custodial wallet and non-custodial wallet is a key decision when it comes to securing your crypto holdings, some may end up even using a combination of the two. Regardless of your choice, be sure to always follow best security practices.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026