SEP 01, 2023

Weekly Market Update - Friday, September 1, 2023 - ETF Ruling Boosts BTC, PEPE Trends Down, X Secures Rhode Island Payments License

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore interest rates.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -0.36% | $25,726 |

$25,726

-0.36%

| |

Ether

ETH | -0.49% | $1,630 |

$1,630

-0.49%

| |

API3

API3 | +40.90% | $1.248 |

$1.248

+40.90%

| |

Maker

MKR | +15.80% | $1,147 |

$1,147

+15.80%

| |

Dogelon Mars

ELON | +13.40% | $0.000000144 |

$0.000000144

+13.40%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, September 1, 2023, at 11:00am ET. . All prices in USD.

Takeaways

- Grayscale ETF ruling boosts BTC: A U.S. Court of Appeals ruled in favor of Grayscale in their lawsuit against the SEC, which challenged the agency’s denial of an application to convert Grayscale Bitcoin Trust (GBTC) to an ETF. GBTC is currently the largest Bitcoin fund with over $16.3 billion USD in AUM. The ruling led to higher prices for BTC.

- PEPE trends down following rug pull rumors: PEPE experienced a sharp drop in price last week as rumors of a rug pull circulated. The anonymous developer who claimed to be in control of the funds now says that the remaining 10 trillion tokens are safe and will remain until a “use or burn arises.”

- X receives Rhode Island payments license: Twitter Payments LLC, the payment branch of X, was approved by Rhode Island for a license request to store, transfer, and exchange Bitcoin and other digital assets on behalf of its users. This marks another step in Elon Musk’s quest to turn X into the “everything app.”

- Powell speech and cooling economic data led to higher market prices: Markets were higher following Jerome Powell’s speech at Jackson Hole last Friday, in which no surprises were indicated. Cooling GDP and jobs data further bolstered these gains.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC Moves Higher on GBTC Court of Appeals Ruling

On Tuesday, a U.S. Court of Appeals in their lawsuit against the Securities and Exchange Commission (SEC), which had denied the company’s application to convert the Grayscale Bitcoin Trust (GBTC) to an ETF.

GBTC is currently the largest Bitcoin fund with as of Thursday. Following the news, Bloomberg analysts have increased the probability that a spot Bitcoin exchange traded fund (ETF) will be approved in the US before the end of 2023 , with a 95% chance of one being approved by the end of 2024.

On Thursday, the until October decisions on filed earlier this summer.

The price of jumped immediately higher on the Grayscale news, moving from $26k USD to . Prices have since cooled as market participants digested the news and potential implications for future ETF approvals, with settling back around $26k USD, below the 200-day moving average of $27.5k USD.

again tracked the market leader on this move, reaching a high of ~$1,745 USD before moving back down to the ~$1,650 USD level, as the continues to trade in a range around the 0.063 level.

PEPE Down Following Rug Pull Rumors

, the popular memecoin which launched earlier this summer, experienced a last week as rumors of a rug pull circulated due to large quantities of PEPE tokens being moved to crypto exchanges from the token’s developers’ multi-sig wallet.

Over the weekend, the official X account for PEPE to explain the situation. The post stated that three former team members were behind the moves, stealing 16 trillion, or 60%, of the 26 trillion multi-sig tokens, and sending them to exchanges for sale.

The anonymous developer who claimed to be in control of the funds that the remaining 10 trillion tokens are safe and will remain until a “use or burn arises''. The price of PEPE is ~10% over the past 7 days as of Friday.

Musk Moves One Step Closer to “Everything App”

On Monday, it was reported that Twitter Payments, LLC, the payment branch of X, for a license request to store, transfer, and exchange BTC and other digital assets on behalf of its users.

This marks another step closer for Musk turning X into the “everything app,” although it is still unclear which crypto payments would be initially supported, if any, and when it may be made available. posted gains this week, potentially pushed higher by the news given Musk’s previous public support for the project.

Markets Boosted by Powell Speech and Cooling Economic Data

Stocks traded higher last Friday following the highly anticipated , in which no major surprises were revealed. The Federal Reserve Chair reiterated that they are “prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

There was also no signal from Powell that rate cuts were on the immediate horizon. The next monetary update will come at the , with the market currently showing a at that meeting, with around a of another rate hike before year end.

On Wednesday, the S&P 500 and Nasdaq both posted their , with prices boosted after GDP data was revised downward , showing that the US economy grew at a slower rate in the last quarter than was previously estimated.

Earlier in the week, following signs of slowdown in the labor market with the number of open jobs in the US , bringing more hawkish data for the Federal Reserve.

-From the Gemini Trading Desk

data as of 5:00pm ET on August 31, 2023.

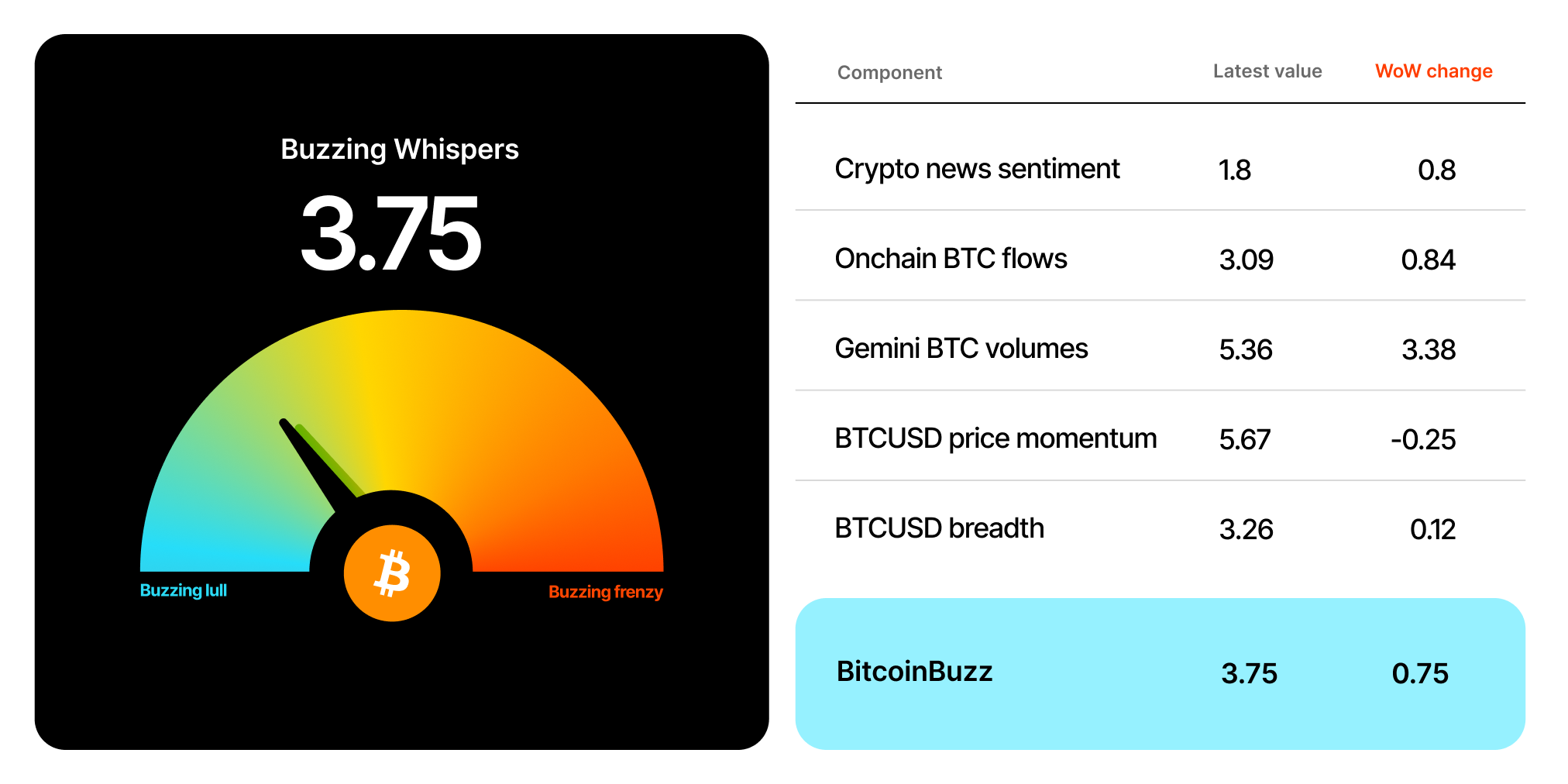

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Interest Rates

Today, we resurface our discussion of interest rates. Interest rates can significantly impact the crypto and wider financial markets, as we’ve seen over the past months. As one of the most important monetary policy tools governments have at their disposal, this week, we provide a high-level overview of what interest rates are and why they matter.

Interest rates represent the cost of borrowing money, or the return lenders receive for lending money. Central banks, like the U.S. Federal Reserve, generally set target interest rates which influence rates throughout financial markets. Based on the number they set, lending institutions — commercial banks, credit unions, and the like — will calculate the interest rate they charge their customers. When setting their rates, lending institutions will also take other variables into consideration, such as a borrower's credit score.

Interest rates are generally quoted as an annual percentage rate (APR) or annual percentage yield (APY). These reflect the rate that a lender charges a borrower for a consumer loan (APR), or the amount a consumer receives from a financial institution when storing their money in different vehicles (APY). Most industries pay close attention to interest rate changes, as they affect consumer and corporate debt, the health of financial markets, and the economy as a whole.

Why do interest rates matter? As an important tool used by governments and central banks to influence economic activity, interest rates matter for a variety of reasons. We touch on some of the main impacts below.

Borrowing and lending: The immediate impact of interest rates is on the cost of borrowing money, and the return on lending money, as explained above. When interest rates are low, borrowing is cheaper, potentially encouraging individuals and businesses to take out loans to invest or spend. Conversely, high interest rates often have the opposite effect, leading to less spending and lower demand.

Consumer and business spending: Lowering interest rates, which we saw the Fed do throughout much of the early 2020s , can stimulate spending and boost economic activity. Keeping rates low for long periods of time, however, can increase inflation as more economic activity pushes prices higher.

Investing: Interest rates can also play a role in investment decisions. Low interest rates often drive individuals and businesses to invest in assets like equities, and crypto, as the potential returns may be higher than other investments. This dynamic could be playing out in real time, as recent signals from the Fed that it may slow rate increases has been accompanied with equities and crypto running higher.

Currency impacts: While this is certainly not an exhaustive list of how interest rates can impact financial markets, another final major impact they have is on the value of fiat currencies. Central banks set their national interest rates at different levels, depending on the economics of each. When a country's interest rates are higher than those of others, its currency may become more attractive to foreign investors seeking higher returns. This can lead to an increase in demand for the country's currency, driving up its value relative to other currencies.

.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026