OCT 06, 2023

Weekly Market Update - Friday, October 6, 2023 - SBF Goes on Trial, Ether Futures ETFs Start Trading, and Judge Rebuffs SEC’s Ripple Appeal

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss Ethereum and blockchain use cases.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +4.01% | $27,947 |

$27,947

+4.01%

| |

Ether

ETH | -1.52% | $1,646 |

$1,646

-1.52%

| |

Avalanche

AVAX | +16.40% | $10.82 |

$10.82

+16.40%

| |

Solana

SOL | +15.80% | $23.59 |

$23.59

+15.80%

| |

Render

RNDR | +14.90% | $1.768 |

$1.768

+14.90%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, October 6, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Bitcoin and ether have another rollercoaster week: Following a pop early in the week as the US Congress narrowly avoided a government shutdown, bitcoin and ether were up and down, settling around $27.5k USD and $1,600 USD, respectively, by Friday.

- Sam Bankman-Fried’s saga continues as trial starts: SBF’s criminal trial began this week in New York City. In opening statements, the defense argued that “Sam didn’t defraud anyone,” while the prosecution described SBF’s crypto empire as a “house of cards … built on a lie.” The trial is expected to last up to six weeks.

- Ether futures ETFs go live for trading: The first ether (ETH) futures-based exchange traded funds (ETFs) were launched on Monday by VanEck, ProShares, and Bitwise Asset Management. The total volume traded on the first day came in just under $2 million USD.

- Judge rejects SEC’s attempt to appeal Ripple ruling: The SEC faced a setback this week as a federal judge dismissed its bid to appeal the highly publicized Ripple ruling that deemed XRP sold on public exchanges is not a security. XRP rallied over 5% following the news.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Another Up-and-Down Week for Bitcoin and Ether as US Narrowly Avoids Government Shutdown

and both rallied higher over the weekend as US lawmakers of the federal government at the 11th hour. Heading into last weekend it was looking increasingly likely that a shutdown was going to start Sunday, before a bill was passed and signed into law on Saturday night, which funds the government until November 17.

As markets opened in Asia on Monday morning, jumped almost $1k USD in a single 5 minute candle, before pushing higher throughout the morning reaching a high of ~$28.6k, its highest level since mid-August. However, mirroring the numerous short-lived rallies over the past month, much of the move quickly reverted within a couple of days.

Sam Bankman-Fried Goes on Trial, Accused of Stealing Billions in Customer Funds

The criminal trial of Sam Bankman Fried (SBF), the founder of Alameda Research and FTX, in New York City. He faces seven counts, including wire fraud, securities fraud, and conspiracy to commit securities fraud connected to the collapse of FTX.

SBF is accused of in customer funds to cover losses at Alameda, purchase luxury real estate in the Bahamas, and make political donations. SBF to all charges. Mark Cohen, his defense attorney, said in his opening statement that Adding that “there was no theft.” The prosecution said that SBF’s empire was a The trial is expected to last up to six weeks.

The First ETH Futures ETFs Go Live for Trading

The first futures-based exchange traded funds (ETFs) were by VanEck, ProShares, and Bitwise Asset Management, with a total of six funds going live for trading. The total volume traded on the first day of launch was muted, with the six new funds collectively amassing just under $2 million USD.

The ProShares Ether Strategy ETF saw the , locking in $878k USD. The lead up to the launch of the ether futures ETFs may have contributed to ETH’s price increase, with the price rallying up to $1,755 USD on Sunday, before easing back down to the by Friday.

Ripple Prevails Again, as Judge Rejects SEC’s Attempt to Appeal July Ruling

The U.S. Securities and Exchange Commission (SEC) was dealt another blow this week as a its bid to appeal the highly publicized Ripple ruling that deemed XRP sold on public exchanges is not a security. rallied over 5% following the news.

Despite the setback, the SEC continues to pursue its other crypto cases. On Tuesday, the regulator asked a federal judge to to have their lawsuit dismissed.

Private Sector Employment Cools, While Nonfarm Payrolls Soar

This week saw contrasting employment numbers between the private sector and overall nonfarm payrolls.

released mid-week showed far fewer private sector jobs added in September than expected (89k vs. 160k), since January 2021. Similarly, the ISM Non-Manufacturing Index, which in the manufacturing and service sectors, for September, but was in line with expectations.

In contrast, the US Labor Department on Friday that came in far stronger than expected: showing an increase of 336k for the month, compared to expectations of 170k.

Expectations for another interest rate hike in November on Thursday, but increased again to above 30% following Friday’s numbers.

On Tuesday, the yield on the hit its highest level since 2007, peaking at 4.884% before easing following softer US economic data pushing yields back down to 4.714% on Wednesday. By Friday, yields rose again following the stronger than expected jobs data, sitting at ~4.816.

-From the Gemini Trading Desk

data as of 6pm ET on October 5, 2023.

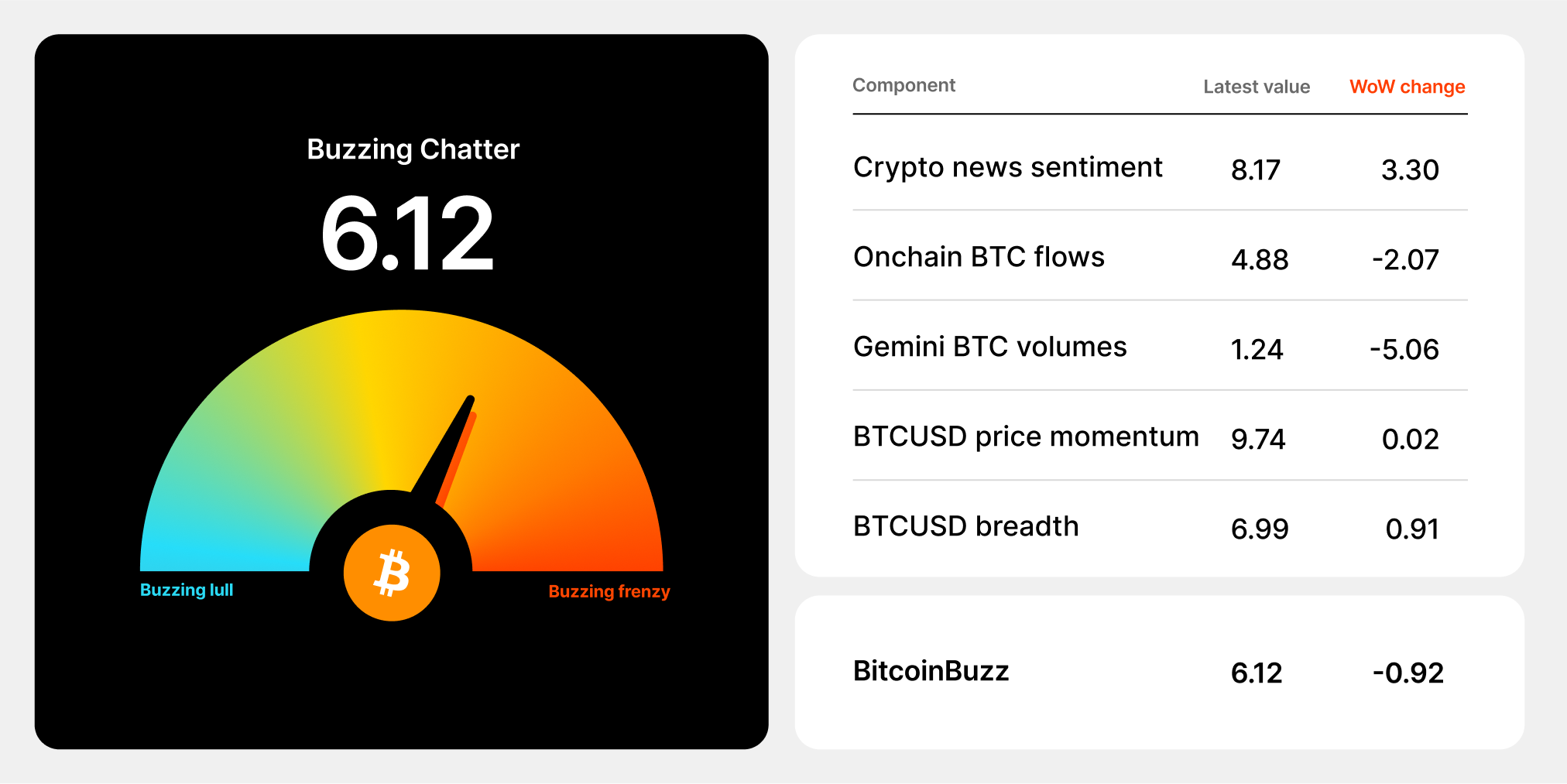

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Ethereum and Blockchain Use Cases

The Ethereum blockchain is powered by its native cryptocurrency — — and enables developers to create new types of ETH-based tokens that power dApps through the use of smart contracts. The most common ETH-based cryptocurrencies are built on the . Ethereum smart contracts are self-executing contracts that facilitate, verify, and enforce transactions on the blockchain, and are a key innovation in Ethereum and blockchain.

Ethereum’s permissionless blockchain — which allows for the creation and development of applications without oversight from a central authority — creates a space for experimentation. There have been thousands of dApps built on Ethereum, millions of users, and many billions of dollars generated. Let’s get into some of the major use cases that have arisen on Ethereum so far.

Decentralized Autonomous Organizations (DAOs)

An early use case unearthed by Ethereum developers, are blockchain-based organizations that operate without central authorities. They are governed by rules coded in software and administrative decisions are voted upon by a community of stakeholders.

DAOs were one of the first innovations tested on Ethereum and remain influential today. While the in 2016 was a watershed moment in blockchain history, DAOs remain open-source and community-governed.

Ethereum Token Launches

are token sales that function similarly to the traditional Initial Public Offering (IPO). Ethereum-enabled startup fundraising played a huge role in the growth of blockchain and crypto throughout 2017 and 2018. While Ethereum’s use of crowdfunding to bolster its protocol’s development in 2014 was novel, token launches exploded during what is known as . This increase in funding for crypto startups presented a paradigm shift in the way innovative startups raise funds.

Non-Fungible Tokens on Ethereum

are unique, indivisible, and provably scarce digital assets that are useful in gaming, art, and ensuring the provenance of luxury goods. Hype over NFTs began in late 2017 with the launch of , but since then, the applications for the technology have grown rapidly. NFTs have attracted an increasingly mainstream audience to cryptocurrency and blockchain technology.

Stablecoins

are cryptocurrency tokens pegged to another asset, typically a . For example, there are stablecoins backed by fiat currencies like the U.S. dollar and commodities like gold, while other stablecoins maintain their value algorithmically. Other stablecoins are backed by a balanced basket of major cryptocurrencies. Stablecoins are used as a reliable store of value in the cryptocurrency ecosystem, a against price volatility for crypto traders, and as a stable, global currency for people whose local fiat currency is devalued due to economic or political instability. Today, many have their own stablecoins.

Decentralized Finance

platforms are reinventing traditional financial products and services, adding programmable, decentralized, and censorship resistant features to create brand new financial products. For example, DeFi platforms offer , interest on crypto holdings, decentralized exchange (DEX) mechanisms, stablecoins, and composable features that maximize passive earning opportunities.

.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026