JUN 16, 2023

Weekly Market Update - Friday, June 16, 2023

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — today we explore cryptoart and NFTs.

| ⬇️ 4.44% | $25,475

| ⬇️ 10.10% | $1,662

| ⬇️ 32.70% | $0.05196

| ⬇️ 31.60% | $0.00062

| ⬇️ 28.80% | $2.065

Crypto prices as of Friday, June 16, 2023, at 10:05am ET. Percentages reflect trends over the past seven days. C. All prices in USD.

data as of 5:15pm ET on June 15, 2023.

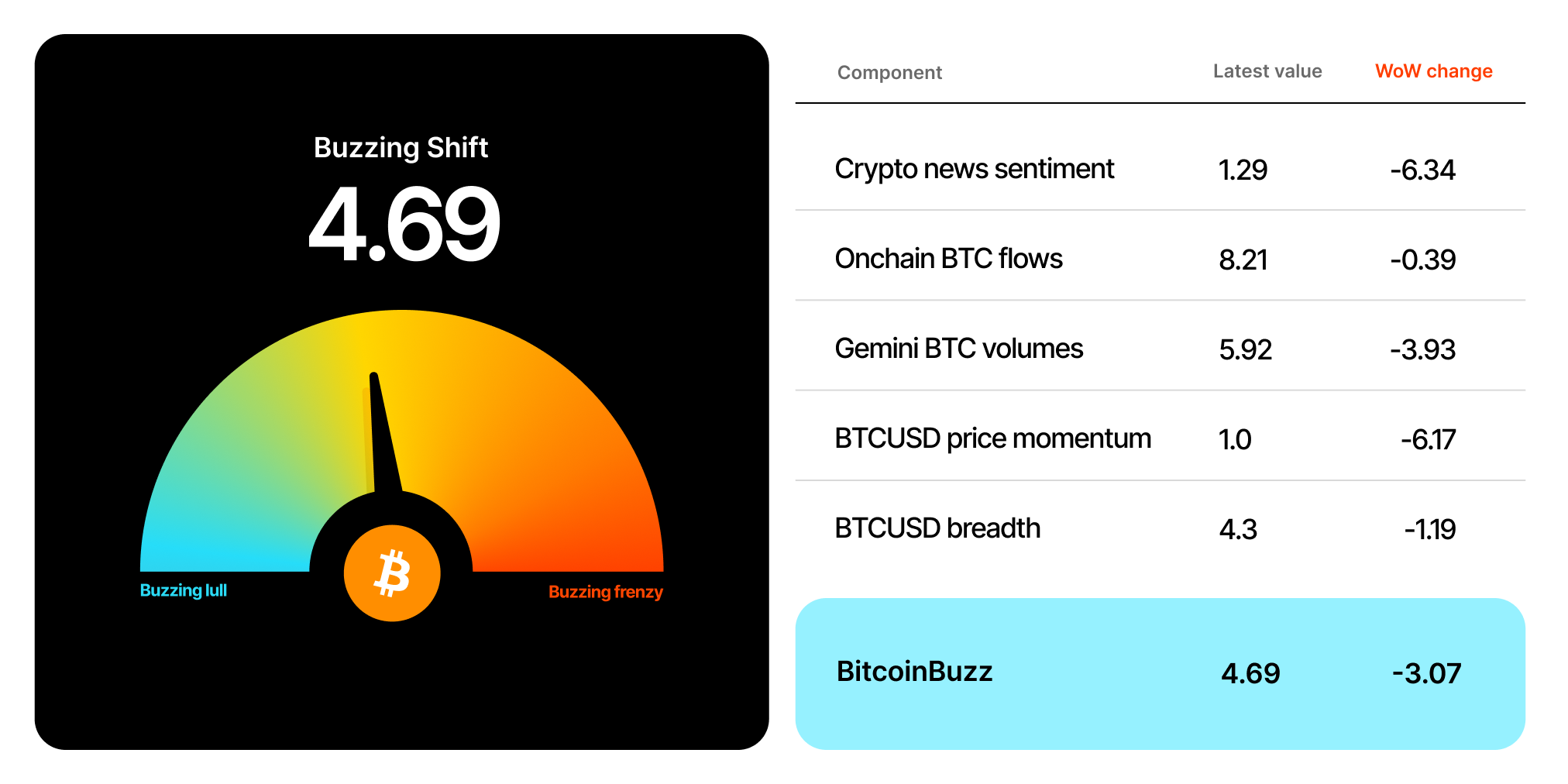

Today, we’re thrilled to include the BitcoinBuzz Sentiment Indicator for the first time in our Weekly Market Update. BitcoinBuzz is a cutting-edge BTC indicator, with a score between 1-10, that offers a comprehensive view of price movements. By harnessing in-depth sentiment analysis, BitcoinBuzz combines news sentiment, on-chain BTC flows, Gemini BTC volumes, BTCUSD price momentum, and BTCUSD breadth.

. Check back every Friday for an updated score!

Takeaways

- The U.S. Federal Reserve held its key interest rate steady at 5-5.25% at its June meeting, ending a run of 10 consecutive rate hikes. The move was supported by cooling inflation, which hit its lowest level in two years.

- Crypto prices failed to rally following the Fed decision and dipped Wednesday night into Thursday morning as Tether (USDT) periodically de-pegged, spurred by imbalances in the Curve 3Pool liquidity pool.

- Little-known crypto company Prometheum emerged onto the scene. Its co-founder testified in Congress that the SEC has provided clear rules for crypto, an opinion that contrasts starkly with the standard crypto industry stance.

- The release of the Uniswap v4 draft buoyed UNI as the company prepared upgrades to its protocol.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Fed Pauses Interest Rate Hikes Amid Cooling Inflation

The , its key interest rate, steady at 5-5.25% on Wednesday, as expected. This is the first “no change” decision after 10 consecutive rate hikes of varying magnitudes. The Fed’s statement and press conference struck a hawkish tone, however, signaling the Fed is if inflation remains stubborn.

The Fed dot plot , indicating two potential further rate hikes by the end of the year. on the prospect of more rate increases later this year but staged a comeback to end slightly in the green at the end of the session on Wednesday.

A day prior to the Fed decision, U.S. consumer price index (CPI) data showed that compared to the same time last year, its lowest level in over two years. Slowing inflation on officials’ decision-making in the U.S. Federal Reserve's federal open market committee (FOMC) meeting that took place on Wednesday.

Crypto Prices Stumble as Stock Markets Add to Gains

Crypto prices continued to decouple from the traditional equity markets this week. Month-to-date and are down ~7.8% and ~10%, respectively, while the and are trading up ~6.8% and ~12.8%, as the recent regulatory scrutiny in the U.S. has put pressure on crypto prices and has weighed down investor sentiment.

Conversely, U.S. stock markets have , hitting 12-month highs. The touched ~4,391 on Wednesday while the closed at ~15,005, levels not seen since April 2022. Stocks continued to rally on Thursday.

Recent stock market gains have been buoyed by semiconductor and software industries in particular, with the continuing to grow. , the world’s largest GPU manufacturer, for example, has seen its stock price surge more than 180% this year.

Tether (USDT) Experiences Intermittent De-peg, Impacting Crypto Markets

abruptly fell late Wednesday, after largely trading sideways following the Fed decision to pause interest rate hikes. The sudden price drop by a liquidity pool imbalance on Curve, which was driven by a selloff of the world’s largest stablecoin, . USDT eventually drifted temporarily from its 1:1 USD peg.

On Wednesday evening, the Curve 3Pool, DeFi for stablecoin trading, became heavily imbalanced. The USDT balance in the pool increased to over 70%, indicating that traders were selling USDT for other stablecoins, and the to ~$0.996 at one point.

Little-Known Prometheum Emerges as a Regulated Crypto Company, Raising Eyebrows

Following last week’s SEC lawsuits lodged against and a concerted call from the industry for more regulatory clarity in the U.S., regarding little-known crypto company Prometheum emerged.

Earlier this week, Prometheum co-founder before the U.S. House Committee on Financial Services to discuss regulatory clarity in crypto. , Kaplan stated that “there is a compliant path forward for crypto in the United States that the SEC has clearly laid out.”

These comments contrast with recent views expressed by the SEC’s latest targets, and . “those who argue for new laws are simply not willing to comply with the existing applicable securities laws and regulation.” That Prometheum has largely flown under the radar thus far, despite being founded six years ago and gaining approval from the SEC and FINRA, has .

Positive Market Reaction to Uniswap v4 Release

The market reacted positively to : Uniswap v4, helping avoid the larger DeFi price drops experienced by the majority of altcoins this week.

Among the major updates in Uniswap v4 is the plugins that will allow developers to create custom liquidity pools. Developers would be able to add new features to pools including on-chain limit orders, dynamically adjusting fees and automatic deposits to lending protocols. There is no official release date for the v4 platform currently, with the code to receive further updates as the team gathers community feedback.

-From the Gemini Trading Desk

Cryptoart, NFTs, and the Art Industry

Cryptoart is digital art that lives on the blockchain in the form of non-fungible tokens (NFTs). This fast-emerging sector is disrupting the art industry for artists, dealers, and investors alike — and creating a far more accessible, equitable, and inclusive art market. Today, we explore the origins of cryptoart and NFT art, as well as how artists may benefit from the proliferation of this new art medium.

From digital art to cryptoart

Emerging around the 1970s, digital art has become one of the more popular subgenres of contemporary art. Digital art may refer to artworks created or enhanced with software, digitally rendered animations, or interactive art consumed through a digital device. There is also “generative” digital art, which artists produce mostly by using algorithms.

Some digital artists use blockchain technology itself as their medium — employing custom software and code, along with a slew of new to create their work. Once it’s on the blockchain, digital art falls into the realm of cryptoart. So what is cryptoart exactly? As with all things crypto, the vocabulary and definitions surrounding this art movement are dynamic and iterative, but there is a baseline distinction: Cryptoart is art on the blockchain — natively published as an NFT.

These rare digital artworks — interchangeably termed crypto-collectibles, NFT art, nifties, or cryptoart — are represented by .

The rise of cryptoart and NFTs

Before NFT art captured the zeitgeist, early projects like Monegraph in 2014 and Rare Pepe in 2016 allowed users to register collectibles on blockchain networks. In 2017, a new vehicle for digital art emerged with Ethereum’s introduction of the , enabling the creation of NFTs and springboarding the cryptoart movement into existence. 2017 saw the rise of , , CurioCards, and Dada.nyc — paving the way for the NFT art movement.

Blockchain enters the mainstream art market

The development of cryptoart has not been limited to the fringes of the internet. In 2018, Christie’s New York became the first auction house to register a sale on a blockchain platform with its $318 million USD sale of the Barney A. Ebsworth collection. This collection featured artwork by landmark American artists Edward Hopper and Georgia O’Keeffe, among others.

.

Mainstream acknowledgment of the reached a tipping point in 2021 with the sale of digital artist Beeple’s “Everydays — The First 5000 Days.” An entirely digital crypto art piece, it sold for $69 million USD at Christie's. The sale made Beeple one of the wealthiest artists alive in the world today.

Now, there are multitudes of NFT art marketplaces such as , OpenSea, , and KnownOrigin, each with unique value propositions. Fine-art specific NFT marketplaces include Maecenas, Masterworks, Artchain.world, Aditus, and Portion.

How artists can benefit from NFT marketplaces

The plethora of online NFT marketplaces is good news for artists and collectors, as these markets are typically more accessible, approachable, equitable, and inclusive than storefront galleries.

The most important benefit for artists may be that they can get paid equitably for their work. In the traditional art model, an artist typically gets 50% of an artwork’s sale price and the gallery takes the other 50%. If the piece is resold, the artist receives no royalties. In the cryptoart world, however, an artist can earn 80% or more of the initial sale price, depending on the venue, and a standard of 10% or more of all secondary sales.

Further, these funds don’t need to be tracked down or negotiated. They are cryptographically secured and guaranteed by autonomous on the blockchain. NFTs automatically authenticate the art and track its and value as it changes hands.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026