JUL 28, 2023

Weekly Market Update - Friday, July 28, 2023 - Crypto Bills Move to House Floor, the Fed Raises Rates, and US Beats Growth Expectations

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore real-world smart contract use cases.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -1.28% | $29,499 |

$29,499

-1.28%

| |

Ether

ETH | -0.70% | $1,879 |

$1,879

-0.70%

| |

Gala

GALA | -12.70% | $0.02378 |

$0.02378

-12.70%

| |

Injective Protocol

INJ | -11.60% | $8.2308 |

$8.2308

-11.60%

| |

Pepe

PEPE | -9.82% | $0.000001377 |

$0.000001377

-9.82%

|

*Percentages reflect trends over the past seven days. . All prices in USD.

**Crypto prices as of Friday, July 28, 2023, at 11:20am ET.

data as of 5:00pm ET on July 27, 2023.

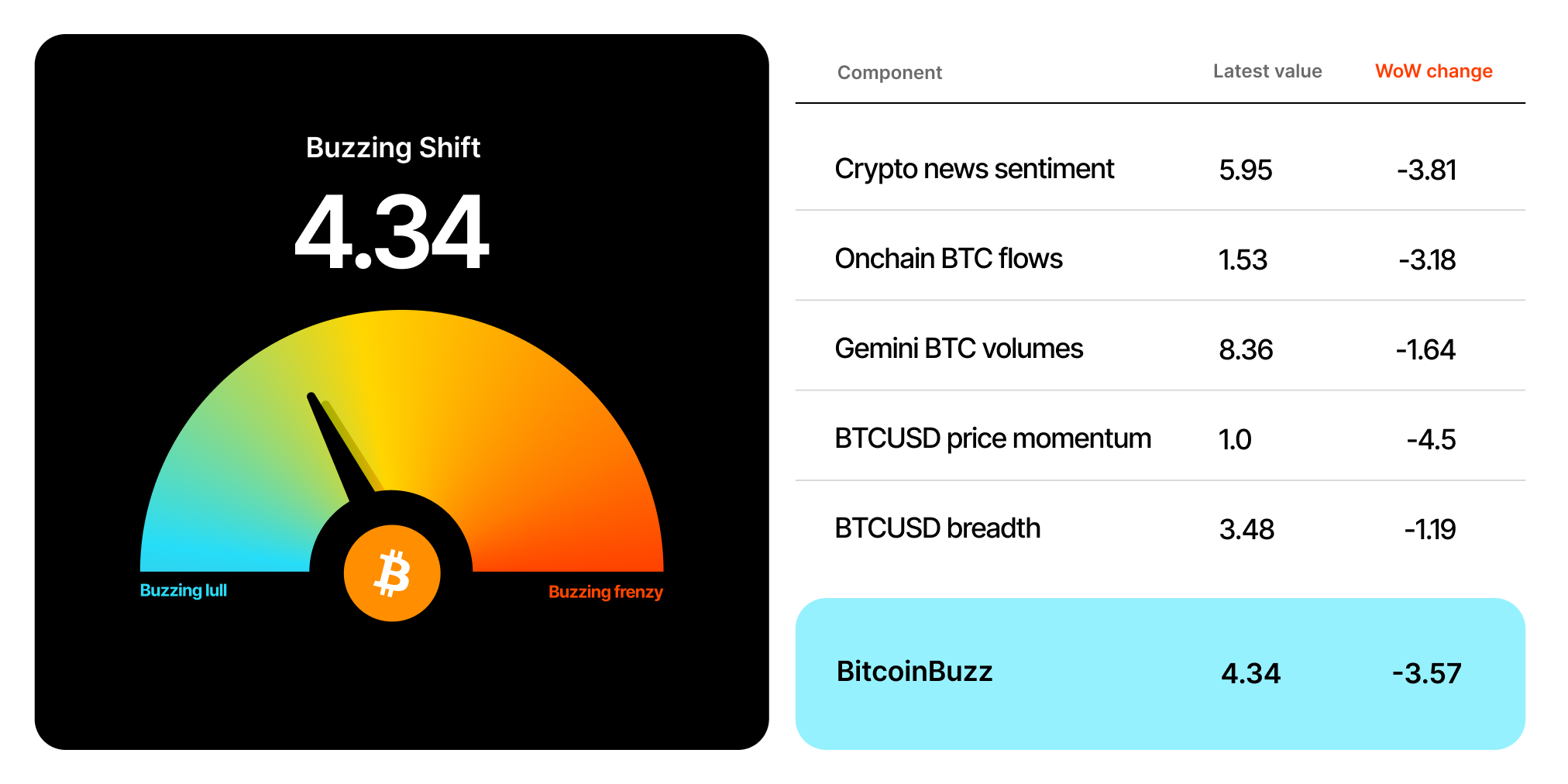

After about a month in the Buzzing Chatter range, the BitcoinBuzz Sentiment Index cooled off this week, moving back into a Buzzing Shift. All BitcoinBuzz components saw a dip, with BTCUSD price momentum seeing the biggest decline as prices struggled throughout the week, remaining below the psychological $30k USD level.

News sentiment also took a hit as that Binance CEO Changpeng Zhao revealed in an internal message that affiliates may have engaged in wash trading on Binance.US.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Takeaways

- Fed raises rates once more: The US Federal Reserve increased its key interest rate another 25 basis points to between 5.25%-5.50%, the highest level since March 2001. Fed Chairman Powell played down the potential for a recession, but left the door open to future rate hikes. A day later, the European Central Bank (ECB) followed suit with its own interest rate 25 basis point hike.

- US economy continues to show strong growth despite slowdown fears: The US economy grew 2.4% annually in the second quarter of 2023, buoyed by business investment and consumer spending. The economic numbers were better than expected and shows continued economic activity in the US in the face of a higher interest rate environment.

- Bitcoin drops amid Binance wash trading report: Bitcoin (BTC) has struggled to hold its $30k USD support level since last week. Adding to the downward pressure was a Wall Street Journal report claiming that Binance CEO Changpeng Zhao revealed in an internal message that Binance affiliates may have engaged in wash trading.

- Crypto bills head to US House for first time: On Wednesday, the US House Financial Services Committee voted in favor of two crypto-related bills, sending standalone crypto legislation to the House floor for the first time.

- Twitter becomes 𝕏, and Dogecoin pops: Elon Musk followed through with a major rebrand of Twitter, with the blue bird replaced by the new 𝕏 logo. He also added the Dogecoin symbol to his profile, fueling speculation that he plans to incorporate crypto payments into the new ecosystem.

- Worldcoin launches with an eyeball scanner: Worldcoin (WLD), a crypto project founded by OpenAI CEO Sam Altman, launched on Monday. The company’s offerings include an eyeball scanner, a World ID to provide “proof of personhood,” as well as a new WLD crypto token.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

US and EU Raise Key Interest Rates, US GDP Stronger Than Expected

After a brief pause in June, the U.S. Federal Reserve by another 25 basis points on Wednesday, bringing the Fed’s key interest rate to 5.25%-5.5%, its highest level since March 2001. In a statement, Fed Chairman Jerome Powell signaled that to come but is no longer expecting them to cause a recession. He reiterated that there is still a long way to go to , and that it is “likely to require a period of below-trend growth and some softening of labor market conditions."

The next day, the European Central Bank (ECB) followed suit with , bringing the European Union’s interest rate to its highest level since 2000. ECB President Christine Lagarde acknowledged the deteriorating eurozone economy, but indicated that a rate hike pause is possible. The fell back below 1.10 vs. the dollar after the rate decision on Thursday.

Also announced Thursday, in the second quarter of 2023, indicating that the U.S. is still defying recession fears. Consumer spending grew at a slower pace (1.6% in 2Q vs. 4.2% in 1Q). Business investment, however, rose sharply to 7.7% annually vs. 0.6% annually last quarter. Overall, the GDP report demonstrates the U.S. economy continues to expand amid the ongoing rate hike cycle.

Bitcoin Hovers Below $30k Support as WSJ Reveals Binance Wash Trading Claims

has struggled to hold its $30k USD support since last week, remaining below that level all week. It saw a decisive break lower on Monday morning as the price suddenly dropped below $29k USD. The decline followed a claiming that Binance CEO Changpeng Zhao had said in an internal message that Binance affiliates may have engaged in wash trading on Binance.US several years ago.

The revelations are another blow to the exchange which alleging securities law violations, which include wash trading.

had slowly recovered throughout the week, pushing back above $29.5k USD following the Fed meeting on Wednesday, before dipping again. has continued to trade in line with BTC with the range bound between 0.063-0.064.

Crypto Legislation Heads to Full House for First Time, With Some Bipartisan Support

On Wednesday, the U.S. House Financial Services Committee voted in favor of , sending standalone crypto legislation to the House floor for the first time.

The Financial Innovation and Technology for the 21st Century Act, , passed committee with bipartisan support, and would of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), which has been a point of contention for some time. The bill also seeks to define the standards for .

The Blockchain Regulatory Certainty Act, , which passed along party lines, would exempt blockchain developers and blockchain service providers from specific financial reporting and licensing requirements, if they do not control customer funds, according to .

The two bills were proposed by the Republican majority. They now move to the House floor for approval, and would need subsequent approval from a Democrat-controlled Senate to become law.

Musk Rebrands Twitter to 𝕏, Foreshadows Potential Use of Dogecoin

Earlier this week, Elon Musk followed through with of his social media platform, Twitter. Twitter’s blue bird was replaced with the new 𝕏 logo on the company website, while now points to the official site.

Along with the 𝕏 rebranding, for a time, the symbol for the popular meme token . The move fuelled speculation that Musk plans to incorporate crypto payments into the new 𝕏 ecosystem, with DOGE potentially playing a pivotal role. The news helped DOGE avoid the broader market declines this week, with the token posting gains over the past 7 days.

OpenAI Founder’s Worldcoin Crypto Project Launches

, the controversial crypto project founded by OpenAI CEO Sam Altman, . The new project’s main offering is the introduction of its World ID, described as a digital passport proving that the holder is a human and not an artificial intelligence robot.

The project uses a device called an Orb to scan users' eyeballs and generate a unique digital identity. This creates a World ID which then grants the holders “.”

The project has said it has but plans to scale up operations to following launch, offering tokens to entice people to sign up. After some initial volatility directly after launching on a number of exchanges, the price appears to be settling around the $2.20 USD level. The project has a total supply of 10 billion tokens. , the maximum circulating supply at launch is 143 million tokens, with 100 million of those being loaned to liquidity providers for market making.

-From the Gemini Trading Desk

Real-World Use Cases for Smart Contract and dApps

We’ve discussed smart contracts and the role they play in the decentralized finance (DeFi) ecosystem a number of times in our topic of the week. This week we dig into some real-world use cases for this important DeFi building block.

As a reminder, a is self-executing code that carries out a set of instructions, which are then verified on the blockchain. They are a core technological element of many decentralized applications (dApps). A key characteristic of smart contracts is that they are , meaning they can reduce or even eliminate the need for third-party intermediaries. Read on to learn how smart contracts are impacting the worlds of finance, real estate, healthcare, gaming, and more.

Smart Contract Use Cases in Finance

Providing an alternative to traditional financial services is a key smart contract use case. DeFi dApps provide parallel services to the banking and financial services industry — like , borrowing, trading, and a host of other financial services — along with entirely new types of products and decentralized business models that can offer considerable benefit and utility for users. With the increased transparency furnished by smart contracts (along with 24/7 functionality, and reduced costs), dApps have the potential to lower the barriers to entry into the financial services arena for people all over the world.

NFTs and Smart Contracts: Blockchain Technology in Gaming

Blockchain technology in gaming is commonly driven by — unique digital assets that represent in-game content. NFTs rely on smart contracts. These tokens are unique, rare, and indivisible, while the blockchain networks that underpin NFTs facilitate player ownership, provable scarcity, interoperability, and immutability. Together, these characteristics of blockchain in gaming have the potential to drive mainstream adoption and a more equitable value model.

Smart Contracts and Blockchain in the Legal Industry

Perhaps one of the most promising real world smart contract use cases is their potential to function as — the kind that inform most of today’s business engagements. Technology has been driving innovation in the legal industry, most recently with the advent of e-signatures for binding legal agreements.

The widespread use of bespoke smart contracts for myriad types of transactions that can lower costs and increase transaction speeds may be closer than you think. Some U.S. states have started to allow the use of smart contracts and blockchain in the legal industry in certain contexts. Arizona, for example, allows enforceable legal agreements to be created via smart contracts, and California allows marriage licenses to be issued via blockchain technology.

Blockchain in Real Estate

Through , smart contracts are advancing the fractional ownership of assets and thus lowering the barrier to entry for investment for many by merging blockchain and real estate transactions.

Smart contract technology can also rework the documentation and transaction processes by incorporating blockchain in real estate transactions. For example, the Republic of Georgia (in the Caucasus region) has been developing a blockchain-based land title registry since 2016, and similar projects are underway in other jurisdictions such as the United Arab Emirates (UAE).

.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026