AUG 04, 2023

Weekly Market Update - Friday, August 4, 2023 - Ether Futures ETF Applications Filed, US Credit Rating Downgraded, and Curve Struggles After Exploit

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore the use of APIs for trading.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -0.67% | $29,252 |

$29,252

-0.67%

| |

Ether

ETH | -1.74% | $1,844 |

$1,844

-1.74%

| |

Curve

CRV | -15.70% | $0.6139 |

$0.6139

-15.70%

| |

Compound

COMP | -14.20% | $61.17 |

$61.17

-14.20%

| |

Synthetix

SNX | -12.70% | $2.4652 |

$2.4652

-12.70%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, August 4, 2023, at 11:35am ET. . All prices in USD.

Takeaways

- Ether futures ETF applications filed: Six ether futures ETF applications were filed with the US Securities and Exchange Commission (SEC) over the past week. The asset managers filing the applications include Grayscale, VanEck, Bitwise, Volatility Shares, ProShares, and Round Hill Capital.

- US credit rating downgraded: Fitch Ratings downgraded the US government's credit rating from AAA to AA+. Fitch cited fiscal deterioration and repeated down-to-the-wire debt ceiling negotiations creating political instability as some of the reasons for the downgrade.

- US added 187,000 nonfarm jobs in July: While these numbers came in below expectations of 200,000, the unemployment rate dropped to 3.5% in July, compared to 3.6% in June. Wages increased 0.4% from June as year-over-year wage growth held steady at 4.4%.

- Curve exploit leads to over $70 million USD in losses: Curve Finance faced an exploit resulting from a vulnerability with the programming language Vyper. Total Value Locked (TVL) on Curve plummeted from ~$3.25 billion USD to a low of ~$1.69 billion USD.

- Memecoin BALD spikes and crashes in less than a week: The previously-unheard-of memecoin, BALD, saw its market cap spike to ~$85 million USD before dropping to $6.5 million USD in a matter of a few days. Suggestions arose that BALD’s developer was connected to Alameda Research, the trading and research firm linked to FTX and founded by Sam Bankman-Fried.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Remains Range-Bound Between $29k-30k USD

After dipping below its $30k USD support last week, has largely traded in the $29k USD to $30k USD range. BTC briefly dipped below the $29k USD level as developed and potential contagion across some of the largest DeFi protocols became a larger concern.

briefly bounced back Tuesday, rallying to $30k USD as were filed within 24 hours. traded in a similar pattern, winning back nearly all of its weekly losses to $1,878 USD before faltering again. The push higher was not sustained, however, as BTC and ETH retraced, driven by weakness across equity markets following the US government's credit rating downgrade on Wednesday.

Ether Futures ETFs Filed With SEC

Over the past week, were filed with the US Securities and Exchange Commission (SEC), with five of them on Tuesday. The filings come on the heels of the earlier this summer, which are currently under consideration.

A range of , including Grayscale, VanEck, Bitwise, Volatility Shares, ProShares, and Round Hill Capital, many of which have bitcoin ETF applications currently on file with the SEC.

remained largely within the $1,800 USD to $1,900 USD range following the news.

US Credit Rating Downgraded by Fitch

US equities plunged lower on Wednesday after Fitch Ratings from AAA to AA+, surprising investors and from the White House, which called the move “bizarre and baseless.”

fiscal deterioration and repeated down-to-the-wire debt ceiling negotiations creating political instability as some of the reasons for the downgrade. On Wednesday, the posted its worst day since February as it closed -2.21% lower, while the shed -1.38%, the largest drop since May.

US Job Market Grew at Moderate Pace in July

The US Department of Labor announced Friday that , falling below expectations of 200,000. The unemployment rate continued to trend downward, decreasing to 3.5%, compared to 3.6% in June.

Wage growth remained strong, gaining 0.4% from June, and keeping year-over-year wage growth at 4.4%. The after the jobs report as following this week's rally and investors digested mixed quarterly earnings reports.

Curve Exploit Led to $70 Million USD in Losses as TLV Plummets

, one of the largest decentralized exchanges (DEXs), resulting from a vulnerability with the programming language Vyper. The exploit impacted a number of liquidity pools on Curve that use Vyper and .

Following the attack, plummeted from ~$3.25 billion USD to a low of ~$1.69 billion USD on Tuesday as users fled the protocol. CRV, Curve’s native token, ~30% as a result, from ~$0.75 USD before the exploit to a low of ~$0.50 USD. CRV has since rebounded slightly to around $0.60 USD.

CRV saw further sell-side pressure after it was reported that Curve founder Michael Egorov had across various lending protocols backed by 427.5 million CRV tokens. The Block reported that Ergorov via OTC transactions, possibly to reduce his outstanding loans on DeFi platforms to avoid liquidation risk.

Other DeFi protocols underperformed this week following the exploit. , , and have all experienced double digits declines over the past seven days. Still, the contagion has been relatively contained as several prominent traders in crypto have to save Curve Finance by purchasing CRV.

Alleged BALD Rug Pull May Be Connected to FTX-Related Alameda

Memecoin mania saw a on Coinbase’s Ethereum Layer-2 network Base as , a previously-unheard-of memecoin, gained traction on X (previously Twitter). BALD’s market cap , with trading , as that the coin was run by someone within Coinbase.

On Monday, dropped dramatically as a mystery developer , the hallmark of . The following day, Wintermute Head of Research Igor Igamberdiev was , the trading and research firm founded by indicted FTX founder Sam Bankman-Fried. sat at $7.7 million USD as of Friday.

Litecoin Halving Event Muted as Mining Rewards Cut to 6.25 LTC

The halving event came and went without much fanfare. Similar Bitcoin halving events, the latest LTC halving will cut the network's mining rewards . The price of shed more than 10% since Sunday, dropping from ~$96 USD to ~$83 USD by Friday.

-From the Gemini Trading Desk

data as of 5:00pm ET on August 3, 2023.

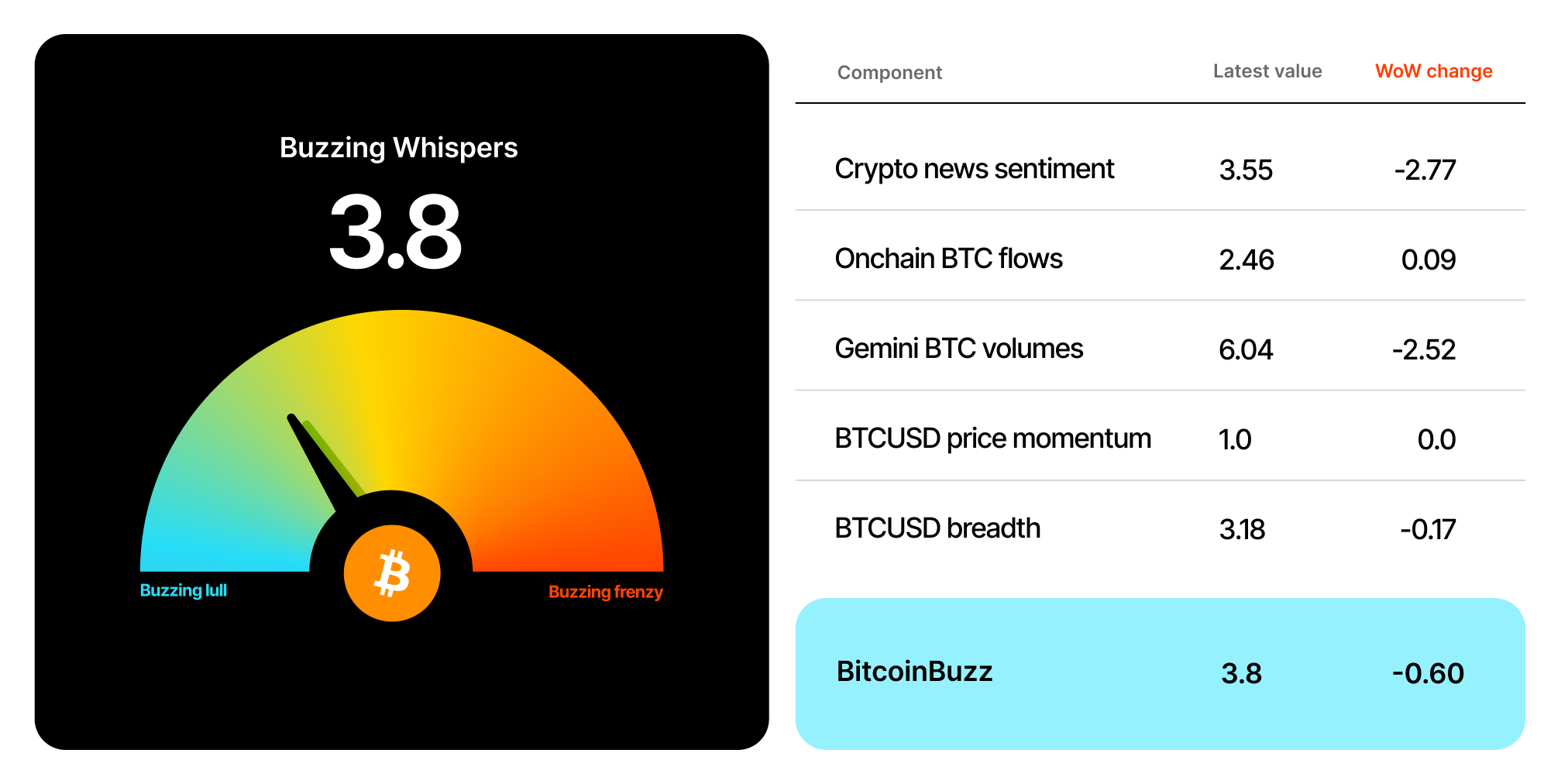

The BitcoinBuzz continued to move lower this week, shifting into the Buzzing Whispers category as prices continue to hover below $30k USD. The main components putting downward pressure on the BitcoinBuzz were crypto news sentiment and Gemini BTC volumes.

News sentiment took a dip as the positive were outweighed by the US government and the Curve exploit that resulted in from the DeFi protocol.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every Friday for an updated score!

Introduction to Trading APIs

An is a software bridge that allows computers to communicate and execute tasks with each other. You can think of it as a language translator for computers. An API links a trader’s account with a broker’s automated trading system to execute trades quickly and efficiently, and to perform or programmable trades in certain scenarios.

APIs have gained popularity as traders realize the benefits of automated trading tools, which allow them to hedge bets into the future, and abandon traditional manual trades. Whether it’s a stock trading API or a bitcoin trading API, the key functions and benefits remain the same.

What Can an API Do?

A crypto exchange’s API acts as an intermediary between you and your broker so you can perform various transactions. These may include buying and selling assets, viewing real-time market data, and executing more sophisticated trading strategies.

Crypto exchanges, for instance, use APIs to offer customers the ability to trade cryptocurrency pairs and carry out basic to high-performance trading through premium trading platforms. Experienced day traders can engage in advanced charting, multiple order types, auctions, and block trading, among other functions.

Who Can Use API Trading?

Anyone interested in trading can use APIs. Traders can use APIs to trade stocks, crypto, commodities, and virtually every other asset under the sun. To develop trading strategies from scratch, traders often use coding software such as Python, C++, or Java.

Algorithmic Trading: Welcome to Robo-Trades

The next level in API trading is algorithmic, or algo, trading where traders define a certain set of instructions or complex mathematical equations (algorithms). Sometimes called “black box”’ trading in reference to heavily guarded and proprietary trading strategies, of equity trades are thought to be executed by machines.

Algo trading has also provided the building blocks for . As its name implies, HFT involves very rapid execution — faster than the blink of an eye — of large orders using powerful computer algorithms.

.

Artificial Intelligence (AI) and API Trading

We can’t discuss algo trading without considering and its growing role in automated trading. You pre-set certain conditions such as price, volume, volatility, and so on for a computer to execute, then use AI machines to track these strategies’ results in order to fine tune them for higher future profits.

As AI provides new insights from analyzing historical data and trading patterns, a growing number of brokers are marrying algo trading with AI — so much so that some wonder whether robots will completely replace human traders in the future.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026