NOV 10, 2023

Weekly Market Update - Bitcoin Extends Gains to $37K Amid More ETF Rumors, Ether Builds Momentum, and Crypto Funds See Flood of Inflows

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss the origins of Bitcoin.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +7.67% | $37,356 |

$37,356

+7.67%

| |

Ether

ETH | +15.40% | $2,096 |

$2,096

+15.40%

| |

Storj

STORJ | +71.70% | $0.7816 |

$0.7816

+71.70%

| |

Immutable X

IMX | +51.70% | $1.0579 |

$1.0579

+51.70%

| |

Chainlink

LINK | +34.40% | $15.251 |

$15.251

+34.40%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, November 10, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Bitcoin rises above $37k as ETF momentum continues: Bitcoin rose throughout the week before settling around the $37k range by Friday. The price of BTC was largely in consolidation mode early in the week, which shifted to an upward trajectory after reports surfaced that an eight-day window had opened for the SEC to approve spot bitcoin ETF applications. BTC gained about 7% over the last seven days and is now up more than 25% over the past month.

- Ether launches past $2,000 and BlackRock begins spot ether ETF process: After lagging behind BTC and surging altcoins, ether (ETH) saw renewed strength this week rallying above $2,000. Further bolstering ETH, BlackRock registered an iShares Ethereum Trust in Delaware, which is an early step in the application process for a spot ether ETF.

- Solana continues to rise gaining ~30%, and Ripple signs deals with Georgia and Dubai: Solana (SOL) built on recent gains this week, rallying another ~30% and topping $50 a token by Friday. SOL is now up over 100% over the past three months. XRP also had a positive week, benefiting from recently announced Ripple partnerships with Georgia and Dubai. XRP is up ~30% over the past month, and has gained over 50% in the past six months.

- Crypto fund inflows surge over past six weeks: CoinShares data showed $767 million net inflows to crypto funds over the past six weeks, recording the most cash injected since 2021’s bull run. The $767 million in inflows surpassed 2022’s total inflows of $736 million.

- Bankruptcy judge approves Celsius reorganization plan: Defunct crypto lender Celsius had its reorganization plan approved by a Bankruptcy Judge on Thursday. The plan would establish a new entity, NewCo, backed by seed funding of $450 million. The new entity aims to be publicly listed and would be focused on Bitcoin mining and staking. The plan would also require sign off from the SEC. Repayments to creditors could start as soon as early 2024.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Breaks Out as ETF Approval Rumors Swirl

extended its rally to the high $37k range this week, before settling around the $37k by Friday. The positive price action came after reports that an eight-day window had opened for the US Securities and Exchange Commission (SEC) of all active applicants. Importantly, the existing window for approval , whereas to fully launch an ETF for trading the SEC would also need to approve an S-1. While the timeline for the S-1 approval process is not explicitly clear, it could occur weeks after the 19-4B process.

BTC futures and perpetual markets were active earlier in the week. on BTC perpetual futures extended on Thursday morning. Futures basis for bitcoin contracts for December likewise , up from mid-single digit percentages a few weeks earlier. Both of these data points imply significant and growing demand for bitcoin derivatives and were commonly seen when FOMO kicked in during the bull market cycles of 2020 and 2021. Moving into Thursday and Friday as the BTC rally cooled the funding rates tightened and moved back to normal.

had been in consolidation mode to start the week, holding around the $35k range. the appearance of a BTC mid-week, as open interest (total value of outstanding derivative contracts) for BTC surpassed $15 billion. This trading pattern saw BTC rise to just under $35.9k on Tuesday, before BTC took another leg up later in the week.

Ether Rises Above $2,000 as BlackRock Initiates Process for a Spot ETF

After lagging behind BTC and surging altcoins, saw renewed strength this week rallying above $2,000 as the general market moved higher on Thursday. The moved above 0.056 on Friday after hitting multi-month lows last week.

Along with the positive market sentiment, ETH was boosted by news that an iShares Ethereum Trust in Delaware, which is an early step in the application process for a spot ether ETF. The step mirrors BlackRock’s process shortly before it applied for its spot bitcoin ETF.

Solana Gains ~30% This Week and XRP Benefits From Ripple Partnership Announcements

built on recent gains this week, rallying another ~30% and topping $50 a token by Friday. Last week, amid SOL’s continued rally, pointed to Solana’s high throughput and growing developer activity as fundamental catalysts for the token’s rally since the FTX fallout. SOL is now up over 100% over the past three months.

also had a positive week, driven by recent Ripple partnership announcements. Last week, Ripple with the nation of Georgia to power its central bank digital currency (CBDC) pilot program. It also announced last week that under the Dubai Financial Services Authority’s (DFSA) virtual assets regime. The approval allows authorized businesses in the emirate to offer XRP to their clients. XRP is up ~30% over the past month, and has gained over 50% in the past six months.

Crypto Fund Inflows Over Past 6 Weeks Hit $767 Million, Surpassing 2022 Total Inflows

, CoinShares data showed $767 million of inflows to crypto funds over the past six weeks, recording the most cash injected since 2021’s bull run. Just last week, crypto investment funds saw net inflows of $261 million, extending the run of positive net flows to six weeks. The $767 million in inflows recorded over the past six weeks of $736 million.

Bitcoin funds were by far , with $842 million invested this year, and $229 million just last week. Geographically, the US dominates the crypto fund market with $158 million of inflows over the past month, ahead of Germany — $63 million, Switzerland — $36 million, and Canada — $9 million.

Celsius Reorganization Plan Approved by Bankruptcy Judge

Defunct crypto lender Celsius had its by a Bankruptcy Judge on Thursday. The plan would establish a new entity, NewCo, backed by seed funding of $450 million. The new entity aims to be publicly listed and would be focused on Bitcoin mining and staking. The plan would also require sign off from the SEC.

The plan would also see the distribution of $2.03 billion in crypto for the benefit of creditors, with repayments potentially starting .

Former Celsius CEO Alexander Mashinsky was in July. He pleaded not guilty and is set to go to trial in September 2024.

ORDI Surges +200% After Binance Listing

gained a whopping +200% this week after being , surpassing $18 per token by Friday. It is now up over 450% this month. Following the price jump and increased volatility, Binance wrote that ORDI was a token that “poses a higher-than-normal risk.”

is connected to Bitcoin Ordinals, which are the Bitcoin equivalent of Ethereum-based NFTs.

-From the Gemini Trading Desk

data as of 5:30pm ET on November 9, 2023.

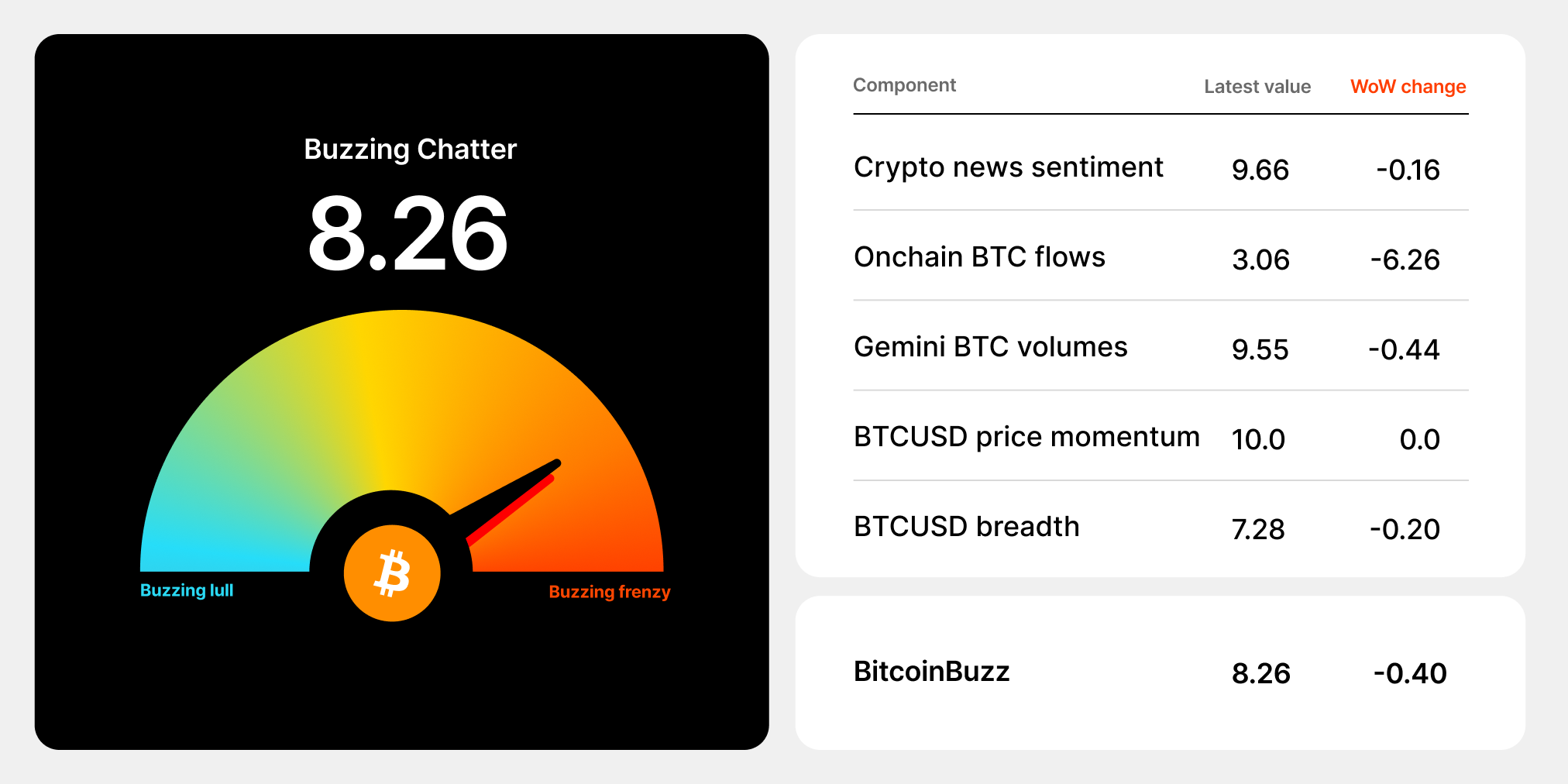

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

The Origins of Bitcoin

With the momentum around BTC continuing to grow amid spot ETF rumors and large crypto fund inflows, this week we resurface our discussion of the origins of Bitcoin.

Most of us think of Bitcoin as the original cryptocurrency, as it spawned an entirely new asset class. While its impact on the financial system and the wider world has been profound, there were a few much lesser known precursors that laid the foundation for the crypto universe. Today, we look back to the roots of Bitcoin. To read more deeply about this topic check out .

What came before Bitcoin?

Bitcoin has played a unique role in creating a movement to decentralize existing, centralized financial services, but it was not the first attempt at creating digital money.

The notion of scarcity with respect to digital money was famously envisioned by when he in 1998. B-Money, another conceptual precursor to Bitcoin proposed by Wei Dai, a computer engineer, , and cryptographer, arose around the same time and is referenced in the Bitcoin whitepaper.

Going even further back, the idea of building cost (or digital scarcity) into a system using was first conceptualized by Cynthia Dwork and Moni Naor in 1993 as a way to protect Internet services from abuse such as spam. In 1997, an English Cypherpunk named Dr. Adam Back implemented this concept into his project Hashcash, a service aimed at limiting spam and denial of service attacks by requiring a sender to generate a Hashcash token by solving a PoW puzzle.

.

Together, Bit Gold, B-Money, Hashcash, and other early examples of digital money and consensus mechanisms set the stage for Bitcoin.

Bitcoin arrives on the scene

was published by the mysterious in 2008 and the network launched in January of 2009 upon the mining of the “” — the first block of the Bitcoin blockchain. Bitcoin created a digital currency that operates in a fully-decentralized, trustless manner that allows users to send monetary value to each other through the Internet without the need for trusted, financial intermediaries.

This was made possible by a major breakthrough in its PoW . Instead of relying on a majority of (known as “”) to reach consensus, Bitcoin relies on the majority of hashrate — the network’s processing power — to reach consensus.

.

Acquiring a majority of the network’s is expensive, making it costly for a miner to tamper with the . Moreover, in doing so, a dishonest miner would forgo the handsome bounties of newly minted bitcoin (known as the “”) that are awarded approximately every 10 minutes to the “winning” miner who correctly solves the PoW puzzle. Therefore, it is assumed that a rational, economically-motivated miner will commit her processing power toward securing the integrity of the blockchain instead of trying to manipulate it and cheat the system.

This incentive structure has turned digital money, a movement once made up predominantly of computer scientists and cryptographers, into an increasingly mainstream phenomenon.

Check out more about the , its , and how it's .

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 27, 2026

Gemini Unveils Gemini Credit Card: Zcash Edition

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026