JUL 11, 2024

US Labor Market Cools, Inflation Pulls Back, and Bitcoin Rebounds After Jarring Drop

Welcome to our Weekly Market Update. Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about the Render Network.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -0.73% | $57,745.93 |

$57,745.93

-0.73%

| |

Ether

ETH | -0.19% | $3,134.20 |

$3,134.20

-0.19%

| |

Cryptex

CTX | -18.5% | $2.405 |

$3.4994

-18.5%

| |

Helium

HNT | -9.38% | $3.0616 |

$3.0616

-9.38%

| |

ApeCoin

APE | -9.32% | $0.732 |

$0.732

-9.32%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Wednesday, July 11, 2024, at 2:05 pm ET. . All prices in USD.

Takeaways

- US labor market and inflation showed signs of cooling in June: The unemployment rate rose to 4.1% and CPI, a core inflation measure, increased just 3.3% year-over-year.

- US House can’t override Biden veto: US lawmakers fell short of the two-thirds majority needed to overturn Biden’s veto of a Congressional resolution to overturn an SEC bulletin that puts additional pressure on firms that custody crypto assets.

- The Labour Party won a decisive victory in the UK general election last week: The win ended 14 years of Conservative rule and left the direction of crypto regulation somewhat uncertain.

- Spot bitcoin ETFs experienced nearly $300 million in net inflows on Monday: It was the highest since early June, with buying led by BlackRock’s IBIT and Fidelity’s FBTC.

- VanEck and 21Shares have updated their S-1 registrations with the SEC to list spot Ethereum ETFs: The ETFs are expected to begin trading shortly after approval, which should come later this summer.

- Doja Cat's Twitter account was hacked to promote a Solana-based meme coin named $DOJA: The breach prompted the star to alert her Instagram followers that she was not responsible for the tweets.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

US Labor Market, Inflation Cool as Job Growth Slows

According to the US Bureau of Labor Statistics (BLS), the economy added 206,000 jobs last month, surpassing the 190,000 forecasted by economists polled by Reuters. However, revisions to April and May data showed employment figures were 111,000 lower than initially reported.

It also jumped just 0.1% from May, the lowest month-over-month increase since August 2021.

Despite widespread expectations of little change, June's non-farm payrolls report indicated an increase in the unemployment rate to 4.1%, the highest since November 2021. The resilient labor market over the past two years has allowed the Federal Reserve to cautiously approach interest rate adjustments as it aims to manage inflation. With easing price pressures, the Fed is closely monitoring employment trends to guide decisions on future interest rate cuts.

Minutes from the Federal Reserve's June meeting revealed that policymakers are increasingly concerned about potential downside risks to the labor market. They noted that a further weakening in demand might lead to a more significant rise in unemployment compared to recent years, where lower demand was primarily reflected in fewer job openings.

US House Fails to Override Biden’s Veto

The US House of Representatives on Thursday voted 228-184 to block the veto, failing to reach the 290 votes needed to send it to the US Senate, where it would need 67 votes.

Last year, the SEC issued Staff Accounting Bulletin No. 121, which forces entities that custody crypto to list them as liabilities on their balance sheets. The crypto industry has argued that the guidance has made it almost impossible for crypto companies to work with traditional banks. That argument seemed to resonate with Congress, with both the House and Senate voting to overturn the bulletin earlier this year. But President Biden subsequently vetoed the bill in May.

“The Administration strongly opposes passage of H.J. Res. 109, which would disrupt the Securities and Exchange Commission’s (SEC) work to protect investors in crypto-asset markets and to safeguard the broader financial system,” the White House said in a statement.

Labour’s Victory in UK Raises Questions for Crypto Regulation

With the Labour Party securing more than the 326 seats required for a majority, the BBC reported they held 412 seats on Friday. In contrast, the Conservative Party, also known as the Tories, were reduced to 121 seats, with two results yet to be declared.

Notably, neither party had addressed the crypto industry in their election manifestos. The Conservative Party, however, had established a clearer stance on crypto, aiming to make the UK a crypto hub, enacting legislation to regulate crypto activities, and consulting on future plans including stablecoin regulations. Members of Rishi Sunak’s former government had also promised further legislation for stablecoins.

Labour has also expressed support for the Bank of England's digital pound plans, with a decision on issuing a central bank digital currency (CBDC) expected by 2026, pending parliamentary approval. Some believe that the stance on crypto shown by Starmer’s new government could have notable implications for the market as a whole.

Bitcoin ETFs See Record $300M Net Inflows Amid Market Pressure

BlackRock’s IBIT led the inflows with almost $180 million, followed by Fidelity’s FBTC. Notably, Grayscale’s GBTC, which has become known for outflows in recent weeks, recorded more than $25 million in inflows.

ETFs from Invesco, Franklin Templeton, Valkyrie, WisdomTree, and Hashdex showed no net activity. This inflow data also comes as bitcoin faces considerable selling pressure from repayments linked to the defunct crypto exchange Mt. Gox and the German government’s recent push to sell 50,000 bitcoin it seized from a film piracy site in January.

Traders will be watching the price of bitcoin carefully over the next few months. As of Thursday, bitcoin was still up more than 30% year-to-date. But the cryptocurrency has pulled back nearly 20% over the past 30 days and is trading well off a high of $73,000-plus reached in March. In the past week alone, bitcoin dipped below $54,000 before bouncing back to $57,846.30 as of 3:02 pm ET on Thursday.

VanEck and 21Shares Prepare for Launch of Spot ETH ETFs

The amended filings, submitted on July 8, are part of their ongoing efforts to secure final approval from the SEC for their respective spot ether ETFs.

VanEck's amendment to its Form S-1 registration and 21Shares' similar filing for its ether ETF did not specify a launch date, stating that trading would begin "as soon as practicable after the effective date" of the registration. On May 23, the SEC had already approved spot ether ETF 19b-4 filings from eight asset managers, including VanEck, 21Shares, and Bitwise, with industry experts suggesting that final approvals could be granted in July.

In a Senate Banking Committee hearing last month, SEC Chair Gary Gensler indicated that the commission might approve the S-1 filings "sometime over the course of this summer," although no specific date was provided. VanEck initially filed for a spot ether ETF in January, following the SEC's approval of spot Bitcoin ETF shares. The approval process for ether ETFs may have been delayed by SEC investigations into whether ether should be classified as a security. However, Consensys’ legal team reported in June that the SEC had dropped the matter.

Doja Cat's Twitter Hacked to Promote Solana-Based Meme Coin

The incident began Monday this week when her account started tweeting crypto content, including a message urging users to "buy $DOJA or else." along with a photo of the singer. The hacker removed Doja Cat's profile picture and description and posted a large number of tweets. In response, Doja Cat informed her 24 million Instagram followers that she was not behind the tweets.

The activity surrounding the $DOJA token was relatively low, with fewer than 15,000 transactions generating over $2 million in volume, according to blockchain records. This event is the latest in a series of hacks targeting celebrity social media accounts to promote Solana-based meme coins. Previous incidents include the hacking of former wrestling star Hulk Hogan's Twitter account, followed by rapper 50 Cent being compromised in a similar scam.

-From Team Gemini

data as of 3:05 pm ET on July 11, 2024.

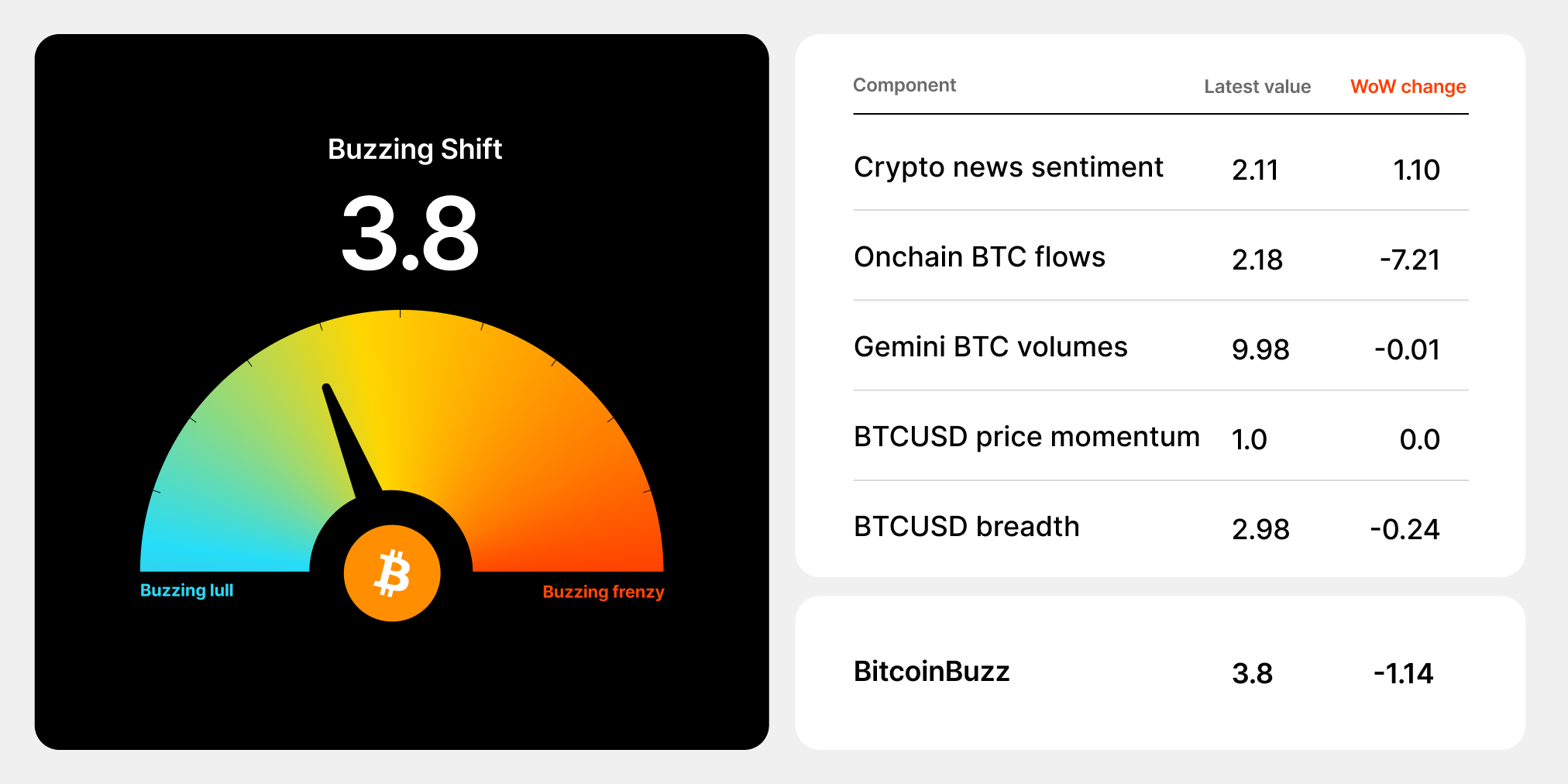

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

The Render Network (RNDR): Decentralized 3D Rendering

The Render Network is a blockchain and crypto-enabled project that enables individuals to contribute unused GPU power to help projects render motion graphics and visual effects. In return, users receive Render token (RNDR), the network’s native utility token. By creating a peer-to-peer (P2P) network upon which people and businesses can tap into underutilized computational power cheaply and efficiently, Render greatly simplifies the standard processes of rendering and streaming 3D environments and other visual effects. As a result, the project is an essential building block for next-generation digital products and services in the metaverse.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026