AUG 15, 2024

US Inflation Slows, Election Odds Swing, and 3AC Moves to Sue TerraForm Labs for $1.3B

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about NFTs and the art industry.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -3.07% | $57,615.44 |

$57,615.44

-3.07%

| |

Ether

ETH | -1.08% | $2,558.32 |

$2,558.32

-1.08%

| |

Curve

CRV | +23.01% | $0.2528 |

$0.2528

+23.01%

| |

Fantom

FTM | +12.83% | $0.3721 |

$0.3721

+12.83%

| |

Injective

INJ | +10.89% | $17.882 |

$17.8882

+10.89%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, August 15, 2024, at 2:20 pm ET. . All prices in USD.

Takeaways

- Inflation cools again: Consumer prices in the US increased just 2.9% in July compared to the previous year, the slowest mark in three years, according to the US Department of Labor.

- Kamala Harris has overtaken Donald Trump in odds to win the US presidential election on Polymarket: Harris's campaign has reached out to the crypto industry, but it's unclear where she stands on regulating digital assets.

- Three Arrows Capital’s liquidators have filed a $1.3 billion lawsuit against Terraform Labs: The suit, stemming from losses during the 2022 Terra network collapse, alleges market manipulation by Terraform.

- Tether hit back at a $2.4 billion lawsuit from Celsius Network, deeming it unfounded and asserting its compliance with prior agreements: The dispute revolves around the liquidation of bitcoin assets to offset Celsius's debt.

- US spot ETH ETFs experienced $4.9 million in net inflows on Monday, ending a three-day streak of outflows: Grayscale’s ETHE logged zero flows, while VanEck’s ETHV was the only ETF to report negative flows.

- Grayscale has launched a new fund investing in MakerDAO’s governance token (MKR): The token saw a price increase following the announcement, with the fund structured as a closed-end product available to accredited investors.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Inflation Pulls Back Again, Building Case for September Rate Cut

giving the Federal Reserve ample reason to cut the benchmark federal funds rate at their next meeting in September. The Fed uses CPI, which excludes volatile food and fuel prices, as a key gauge to measure inflationary pressures on the economy. They have held rates at 5.3% since July 2023, the highest mark in roughly two decades.

Cryptocurrency prices had a muted reaction to the positive report Wednesday, with bitcoin and ether staying relatively flat. Both are widely viewed as “risk assets” that perform better when interest rates are lower. But bitcoin has faced continued selling pressure from defunct exchange Mt. Gox distributing billions in repayments to creditors. On Wednesday, a wallet associated with the US government sent almost $600 million bitcoin previously seized from Silk Road to a Coinbase Prime wallet.

Despite the recent volatility, bitcoin and ethereum have had a positive 2024 so far, rising 28.8% and 8.1% year-to-date, respectively.

Harris Election Odds Surpass Trump on Polymarket

Over the weekend, Harris's odds of winning the election climbed to 52%, surpassing Trump, whose chances have dropped to 46%. The change comes after election prospects had grown significantly for Trump, in the wake of concerns surrounding President Joe Biden’s health.

As the election draws closer, Harris's campaign has begun engaging with the cryptocurrency community, a sector that has become increasingly relevant in political discussions. But she has yet to take a position on the asset class after spending the past four years in an administration widely seen as hostile toward the industry. Meanwhile, Trump, who has positioned himself as a pro-crypto candidate continues to express his support for Bitcoin, after having recently spoken at Bitcoin Nashville.

Although Harris and her running mate, Tim Walz, have yet to make public statements on cryptocurrency directly, Walz's tenure as Minnesota governor saw the enactment of legislation aimed at tightening regulation around cryptocurrency kiosks. Trump has also criticized the idea of the US selling its cryptocurrency holdings, arguing that the nation should instead focus on building out the country’s crypto assets.

3AC Liquidators Sue Terraform Labs for $1.3B Over 2022 Crash Losses

This lawsuit follows a previous claim in June 2023, where the liquidators sought the same amount from 3AC’s founders, Su Zhu and Kyle Davies.

In May 2022 the Terra network’s algorithmic stablecoin, terraUSD (UST), and its associated token, LUNA, collapsed, erasing around $40 billion in value. The fallout led to 3AC filing for bankruptcy in July 2022, citing significant losses tied to Terra’s collapse.

The liquidators are accusing Terraform Labs of market manipulation relating to LUNA and terraUSD through artificial inflation of their prices, which led 3AC to invest in these assets before they ultimately collapsed in value.

Tether Denounces Celsius's $2.4B Lawsuit as Unfounded

The legal battle revolves around approximately $2.4 billion in bitcoin, which Celsius alleges Tether improperly liquidated over two years prior to Celsius's bankruptcy.

The lawsuit, lodged on August 9, contends that Tether violated the terms of their mutual agreement. Tether, on the other hand, maintains that its actions were justified under a 2022 contract stipulating that Celsius must furnish additional bitcoin as collateral amid declining prices. Upon Celsius's failure to fulfill these collateral obligations, Tether asserts it acted on Celsius's directive to liquidate the Bitcoin, consequently settling their substantial debt of $815 million.

US Spot ETH ETFs See $4.9M Inflows, Marking Reversal After Consecutive Outflows

The Grayscale Ethereum Trust (ETHE), which recently converted into an ETF, notably logged zero flows for the first time since its conversion.

Fidelity’s FETH led the pack with $3.98 million in net inflows, followed by Bitwise’s ETHW, which reported $2.86 million in inflows.

The introduction of these products follows the success of spot bitcoin ETFs and has generated considerable interest amongst investors, although speculators are still waiting to observe what the long term impact on the price of ether might be.

Grayscale Launches New Fund Focused on MakerDAO’s Governance Token

MKR experienced a price increase with the release of the news, reaching around $2,150.

The newly introduced Grayscale MakerDAO Trust is available to both individual and institutional accredited investors – structured as a closed-end fund, meaning direct withdrawals are not allowed.

It’s not the first foray into private single-asset funds for tokens for Grayscale; firm already has similar funds for Chainlink (LINK) and Basic Attention Token (BAT). However, the move to launch one for MKR could prove beneficial for Grayscale’s positioning in the crypto asset management sector. As it stands, Grayscale is the largest crypto fund manager globally, managing over $25 billion in assets as of August 1st.

-The Gemini Team

data as of 5:20 pm ET on August 15, 2024.

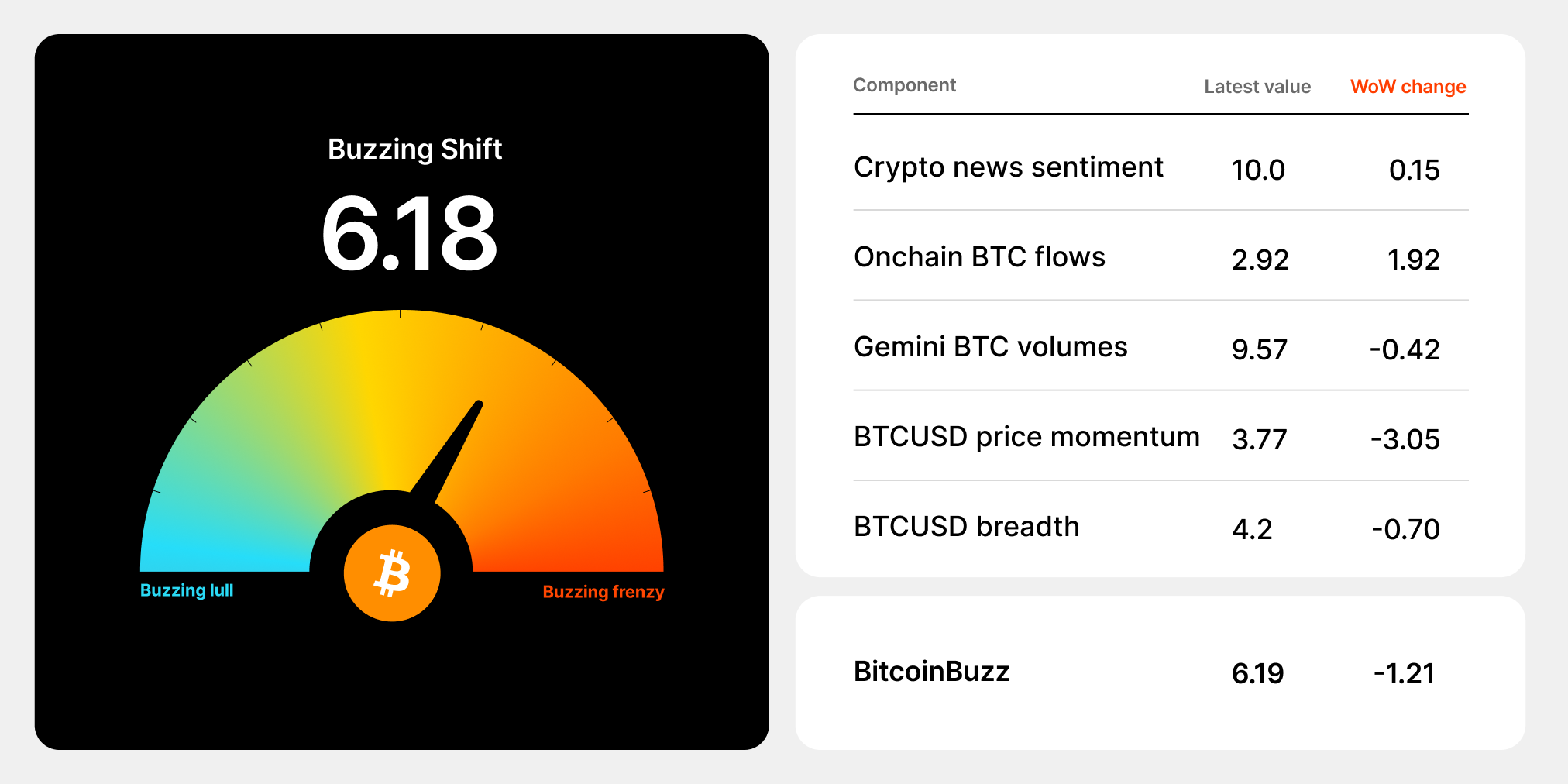

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

NFTs and the Art Industry: A Cryptoart Revolution

Before diving into the finer details of contemporary cryptoart, it’s helpful to take a brief look at the history of digital art prior to the emergence of non-fungible tokens (NFTs). Digital art is one of the more popular subgenres of contemporary art, and has been around since the 1970s. It’s a catch-all term for a number of phenomena. Digital art may reference works created or enhanced with software, digitally rendered animations, or interactive art consumed through a digital device. There’s also “generative” digital art, which artists produce mostly by using algorithms.

Some digital artists are using blockchain technology itself as their medium — employing custom software and code, along with a slew of new decentralized applications (dApps) to create their work. Once it’s on the blockchain, digital art falls into the realm of cryptoart. So what is cryptoart exactly? As with all things crypto, the vocabulary and definitions surrounding this art movement are dynamic and iterative, but there is a baseline distinction: Cryptoart is art on the blockchain — natively published as an NFT.

These rare digital artworks — sometimes called crypto-collectibles, NFT art, nifties, or cryptoart — are represented by unique and provably rare tokens. Because they are native to the blockchain, NFT artworks can be bought, sold, and owned with cryptographic security and veracity. Each is unique and the decentralized, open nature of blockchain technology allows for transparent proof of this.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026