MAY 13, 2022

Understanding Stablecoins: They’re Not All Created Equal

The crypto ecosystem is a diverse tapestry of tokens, protocols, projects, and applications. At Gemini, we believe in making crypto more accessible and easier to understand as the industry continues to develop ever more quickly. Knowledge and education are central to that effort, and today we want to highlight a mainstay in the crypto landscape: stablecoins.

Volatility is nothing new in the crypto universe, or indeed in the financial world as a whole. Recently, however, volatility in the crypto markets has brought more attention to stablecoins, which are intended to avoid significant price swings. Simply stated, stablecoins are cryptos that aim to remain, well, stable.

What Are the Different Types of Stablecoins?

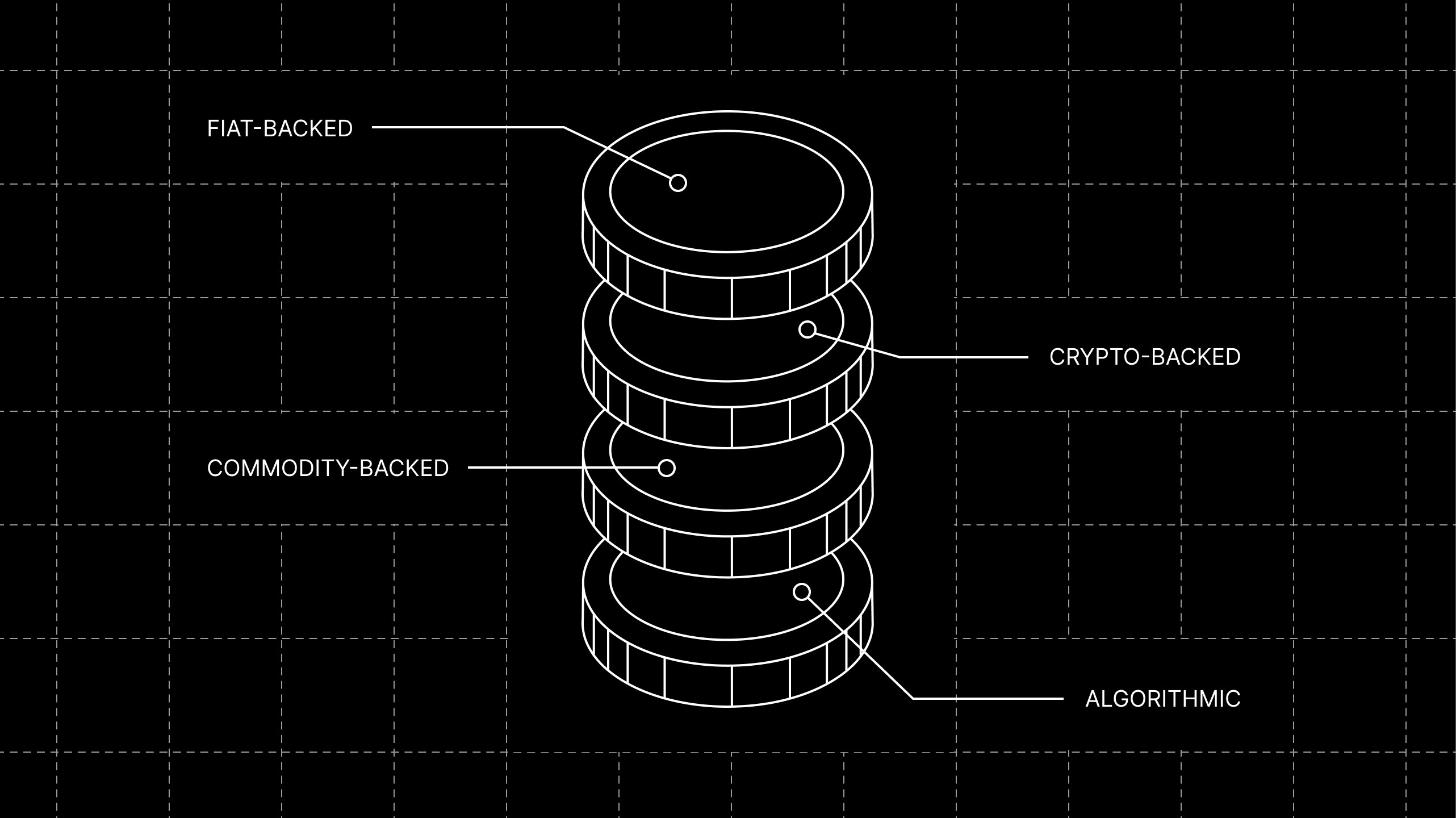

Whether the purpose is to retain a peg to the price of a fiat currency, a commodity, or some other asset, stablecoins are meant to maintain a predictable value. There are four main ways stablecoin issuers do this. Stablecoin collateral structures can be , , , or .

Some stablecoins, like , are pegged to a fiat currency and are backed 1:1 by fiat and cash equivalents. In these cases, one stablecoin can always be redeemed for fiat, like U.S. dollars in the case of GUSD. Illustrating our deep focus on compliance and security, we believe in being transparent with how we back GUSD. All reserves backing GUSD are held in accounts with State Street Bank and Trust, Signature Bank, and Goldman Sachs Asset Management. Every month, the reserve balance is examined by BPM LLP, an independent registered public accounting firm, to verify GUSD’s 1:1 backing, with BPM’s monthly attestations for review on our website.

Algorithmic stablecoins, for example, maintain their peg differently. Rather than being backed 1:1 by a specific asset, their price stability is maintained by the use of algorithms and smart contracts that manage the supply of tokens in circulation. In this model, the stablecoin’s algorithm may automatically expand or contract the number of tokens in circulation in order to meet a specific price target for the stablecoin.

Evaluating Stablecoins

Stablecoins can act as important conduits between the legacy financial system and the burgeoning world of crypto. The immediately apparent advantage of stablecoins is their utility as a medium of exchange, effectively bridging the gap between fiat and crypto. By minimizing price volatility, stablecoins can achieve a utility wholly separate from the ownership of other, better-known cryptos like bitcoin and ether.

It’s crucial to understand the risks associated with stablecoins that are not fiat-backed. The different types of collateral structures offer varying risk profiles, and it's vital to be aware of those differences before investing in any stablecoin.

At Gemini, we’re on a mission to unlock the next era of financial, creative, and personal freedom. We want to provide you with resources to make the ecosystem more accessible. Education is central to that effort.

We invite you to dive deeper into stablecoins with our article on , and explore the .

Onward and Upward!

Team Gemini

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026