JUL 25, 2024

Spot ETH ETFs Surpass $1B in Volume on First Day of Trading, Crypto Rallies After Biden Drops Out

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about spot ether ETFs.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +1.73% | $64,413.90 |

$64,413.90

+1.73%

| |

Ether

ETH | -8.33% | $3,114.91 |

$3,114.91

-8.33%

| |

Terra

LUNA | +46.2% | $0.00004346 |

$0.00004346

+46.2%

| |

Lido DAO Token

LDO | -19.8% | $1.534 |

$1.534

-19.8%

| |

Fetch.ai

FET | -16.3% | $1.17994 |

$1.17994

-16.3%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Wednesday, July 25, 2024, at 2:55 pm ET. . All prices in USD.

Takeaways

- US Spot ETH ETFs received net inflows of $107 million in their debut Tuesday: The launch could drive ethereum prices up in the long run, although inflows may be lower compared to spot bitcoin ETFs.

- Bitcoin briefly surged above $68,000 before pulling back: The volatility came as President Joe Biden pulled out of the race and the tech market faced a wider sell-off.

- Marathon Digital was fined $138 million for breaching a non-circumvention agreement with Michael Ho: Marathon remains the top bitcoin mining firm by market capitalization.

- Germany's sale of 50,000 BTC from a piracy case led to $124 million in missed profits: surged post-sale in part due to an assassination attempt on Donald Trump, highlighting the risks of timing in asset liquidation.

- BlockFi has sold its FTX claims, facilitating a final distribution of 100% of customer and unsecured creditor claims: The distribution marks a significant step toward concluding its bankruptcy process.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

US Spot ETH ETFs Go Live, With Day One Net Inflow of $107 Million

The approval follows a lengthy process and comes after the SEC approved spot bitcoin ETFs in January.

Of the $1 billion, a net inflow of $106.7 million was recorded. A significant portion of the outflow, totaling $484 million, reportedly originated from Grayscale's Ethereum Trust (ETHE). BlackRock iShares Ethereum Trust ETF (ETHA) received the most inflows, totaling $267 million.

That was due entirely to Grayscale’s ETHE, which saw $327 million in net outflows. It was the only approved spot ether ETF to experience outflows.

Some analysts have predicted that spot ether ETFs could eventually drive the price of ether significantly higher, although inflows will likely not match those of bitcoin ETFs. It remains to be seen how spot ether ETFs will perform over time in comparison to their bitcoin counterparts. The price of ether had dipped around 11% over the past five days, settling at $3,132.86 as of 3:25 pm ET on Thursday.

Biden Withdraws from Presidential Race, Bitcoin Wobbles

The rise in bitcoin’s value positively influenced other major cryptocurrencies, with ether momentarily exceeding $3,500. ADA and SOL also each gained up to 5%.

Bitcoin’s gains began late Sunday after President Joe Biden announced on X that he would not run in the upcoming November election. A few hours later, Biden endorsed vice president Kamala Harris, Biden’s decision affected the betting odds on Polymarket, causing Donald Trump’s chances of victory to drop and Harris’s odds to rise.

Trump's supportive stance on cryptocurrencies has attracted substantial backing from the crypto community.

Additionally, Trump’s appearance at the Bitcoin 2024 conference in Nashville this week has further lifted market sentiment, with rumors circulating that Trump could announce his plans to launch a strategic US Bitcoin reserve.

Marathon Digital Fined $138 Million for Breach of Agreement

Michael Ho, former co-founder of US Bitcoin Corp and current chief strategy officer at Hut 8, won a unanimous jury verdict in his favor against Marathon Digital Holdings.

In 2020, Ho developed a growth strategy for Marathon which included plans for a large bitcoin mining facility. According to the law firm representing Ho, Marathon executed this strategy without compensating Ho for his proprietary information, thus breaching their agreement.

Marathon Digital continues to lead the bitcoin mining industry with a market capitalization of $6.77 billion, significantly ahead of its nearest competitor, CleanSpark. The company is also growing its mining capacity – having doubled its operational hashrate YoY in June.

German Government Misses $124 Million in Paper Gains Through Sale

This sale generated over $740 million in profit compared to the $2.13 billion purchase cost in January. However, the timing proved costly as bitcoin prices surged by more than 16% immediately after, driven by news of the assassination attempt on Donald Trump.

If Saxony had sold its bitcoin in March, when it reached around $74,000, they could have realized a $1.5 billion profit. The subsequent 12% drop in bitcoin’s price during the sale period also contributed to a loss of potential profit.

The Dresden Public Prosecutor's Office initiated "emergency sales" in June due to fears of a potential value drop exceeding 10%. They stressed that enforcement agencies must sell seized assets promptly to fund criminal proceedings rather than waiting for potential price increases.

BlockFi Sells FTX Claims as Bankruptcy Resolution Nears

According to a statement, Mohsin Y. Meghji, BlockFi plan administrator and managing partner at M3 Partners, reported this development to the US Bankruptcy Court for the District of New Jersey on Monday.

Earlier this year, BlockFi reached a preliminary settlement of $874.5 million with the FTX and Alameda Research estates, which allowed preparations to begin for distributions to BlockFi creditors. This sale marks the final stage of the company’s winding down, as it will enable final distribution of 100% of eligible customer and general unsecured creditor claims in fiat funds.

With BlockFi having paused customer withdrawals in November 2022 and subsequently filed for Chapter 11 bankruptcy, the bankruptcy court had approved BlockFi's repayment plan in September last year for its 10,000 creditors.

In May, the platform also shut down its website and announced it would begin crypto repayment distributions through Coinbase starting in July, with batches processed over the following months. Fiat claims, however, are not being managed by Coinbase, but rather by Kroll and its payment partner, Digital Disbursements.

-From Team Gemini

data as of 2:55 pm ET on July 25, 2024.

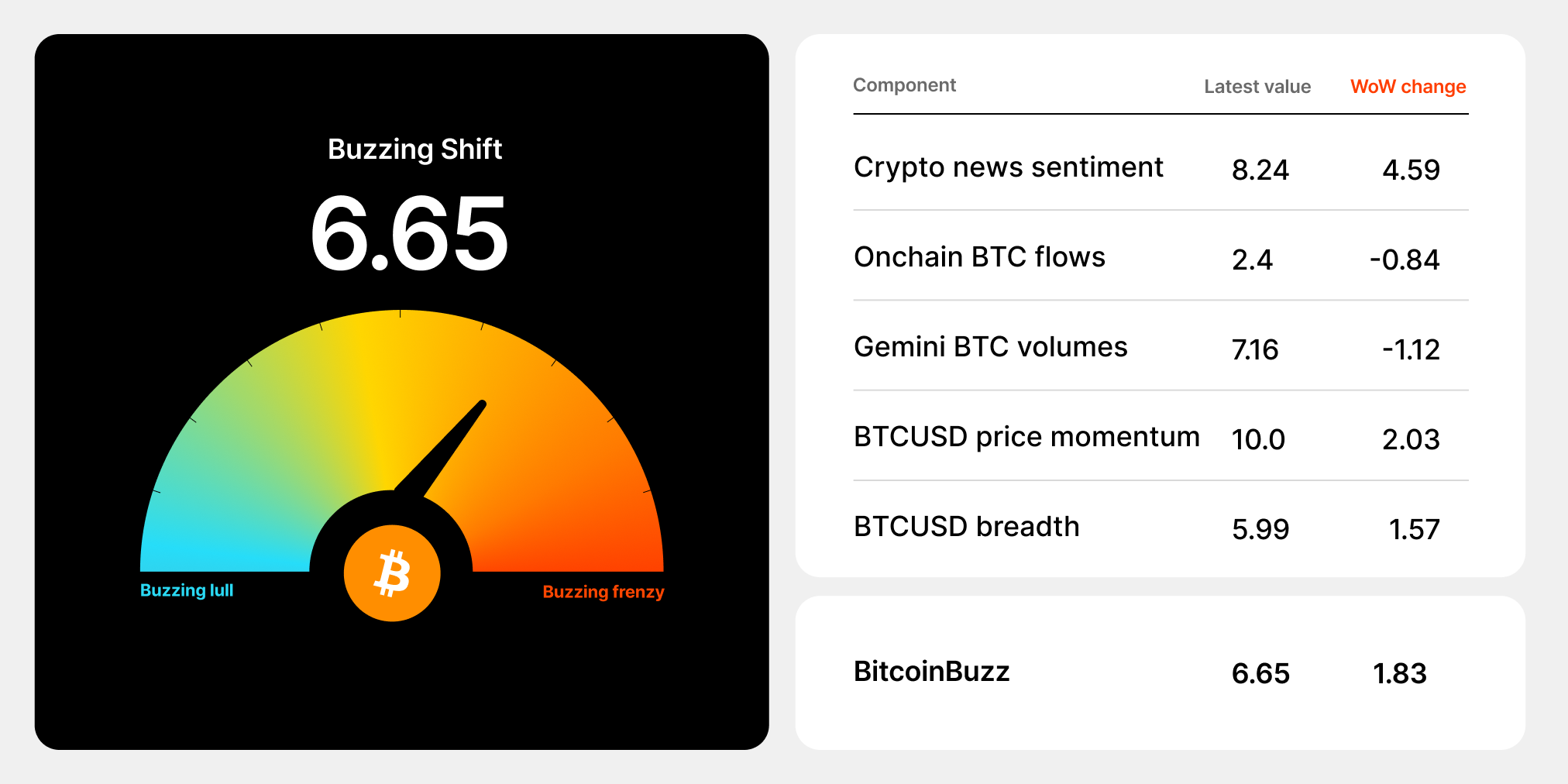

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Learning the Basics of Spot ETH ETFs

A spot ether ETF allows investors to gain direct exposure to ethereum (ETH) without purchasing and storing the cryptocurrency in a digital wallet.

Unlike ether ‘futures’ ETFs, which have been traded since 2023 and only offer exposure to futures contracts, spot ether ETFs offer exposure to the underlying asset itself. Spot ether ETFs are now listed on major exchanges, potentially introducing the asset to a wider swath of investors.

In May, the United States Securities and Exchange Commission (SEC) approved the first eight spot ether ETFs, ending lingering doubt that the enforcement agency would restrict asset managers from launching the anticipated new financial product.

The move sparked considerable debate about the impact the ether ETFs will have on the price of ether, and marked a monumental milestone for the digital assets ecosystem. For the first time, retail investors without a digital wallet could essentially back a blockchain that enables decentralized apps and smart contracts on its network.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026