JAN 12, 2024

Spot Bitcoin ETFs Start Trading, Ether Is on the Rise With its Own ETF Conversation Starting, Inflation Ticks Up in December as Markets Await Interest Rate Cuts

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss who invented Bitcoin, and why.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +0.70% | $43,690 |

$43,690

+0.70%

| |

Ether

ETH | +19.10% | $2,642 |

$2,642

+19.10%

| |

Ethereum Name Service

ENS | +81.30% | $25.153 |

$25.153

+81.30%

| |

Maker

MKR | +23.90% | $2,081 |

$2,081

+23.90%

| |

Lido DAO

LDO | +19.20% | $3.705 |

$3.705

+19.20%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, January 12, 2024, at 11:50am ET. . All prices in USD.

Takeaways

- Spot bitcoin ETFs begin trading on US exchanges: On Wednesday, the SEC approved 11 spot bitcoin ETFs, and trading launched on Thursday. The approval of US-based spot bitcoin ETFs marked a historic day for bitcoin and crypto as a whole, opening the door to an entirely new set of retail and institutional investors. As trading started Thursday morning, BTC rose to $49k before paring back gains to sit below $45k by Friday morning. Over $4.6 billion traded across all spot bitcoin ETFs on Thursday, likely setting a record for the highest day-one volume for a single type of ETF.

- Ether surges as focus shifts to potential ether ETF: Ether (ETH) had been struggling in comparison to BTC over the past few months as attention centered around the bitcoin ETF applications, with the ETHBTC pair hitting its lowest level since April 2021 at 0.04788. However, following Tuesday’s bitcoin ETF head fake, the pair jumped to 0.052 suggesting a rotation out of BTC and into ETH for a catch up play and an expectation that the narrative will shift toward a potential ether ETF approval later this year. This was further evident on the actual approval Wednesday, with the ETHBTC continuing to rally higher, currently trading near 0.06 as of Friday morning.

- Inflation ticks up as interest rate cuts expected in 2024: US equities rose steadily this week as investors awaited inflation data released on Thursday. Thursday’s data showed a mild 0.3% increase in the consumer price index (CPI) for December, reflecting a 3.4% yearly increase. Estimates had been for a 0.2% December increase and a 3.2% annualized increase.

- Altcoins perform well as total crypto market cap nears $1.8 trillion: Much of the wider crypto market saw price appreciation this week, with some leveraged ETH and BTC plays showing good returns. Ethereum Classic (ETC) is trading up more than 55% over the past seven days, while Lido DAO (LDO) added 20% over the same period. The total crypto market capitalization is now approaching the $1.8 trillion mark, its highest level since April 2022, prior to the Terra/LUNA collapse.

- Circle, USDC issuer, files for initial public offering (IPO): On Thursday, Circle announced that it had filed a confidential S-1 document with the SEC, as it seeks to launch an initial public offering (IPO). While the announcement was light on details, Circle had previously announced in 2021 that it planned to go public via a SPAC, with a $9 billion valuation as of February 2022.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

SEC Approves 11 Spot Bitcoin ETFs for Trading on US Exchanges

Spot bitcoin ETFs led the conversation this week, with the market eagerly awaiting an expected approval message from the US Securities and Exchange Commission (SEC). The crypto community as the official SEC X account published a post saying: “the SEC grants approval for #Bitcoin ETFs.” This initially sent the price of sharply higher, nearing $48k.

The excitement was short lived, however, as on his X account that the SEC account had been “compromised, and an unauthorized tweet was posted.” This caused the price of BTC to quickly retrace and drop below $45k. While theories on the SEC account compromise swirled, the market didn't have to wait much longer, , the , with trading starting on Thursday.

The now live for trading are: VanEck Bitcoin Trust (HODL), Grayscale Bitcoin Trust (GBTC), BlackRock’s iShares Bitcoin Trust (IBIT), ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Invesco Galaxy Bitcoin ETF (BTCO), WisdomTree Bitcoin Fund (BTCW), Franklin Bitcoin ETF (EZBC), Fidelity Wise Origin Bitcoin Trust (FBTC), and Valkyrie Bitcoin Fund (BRRR).

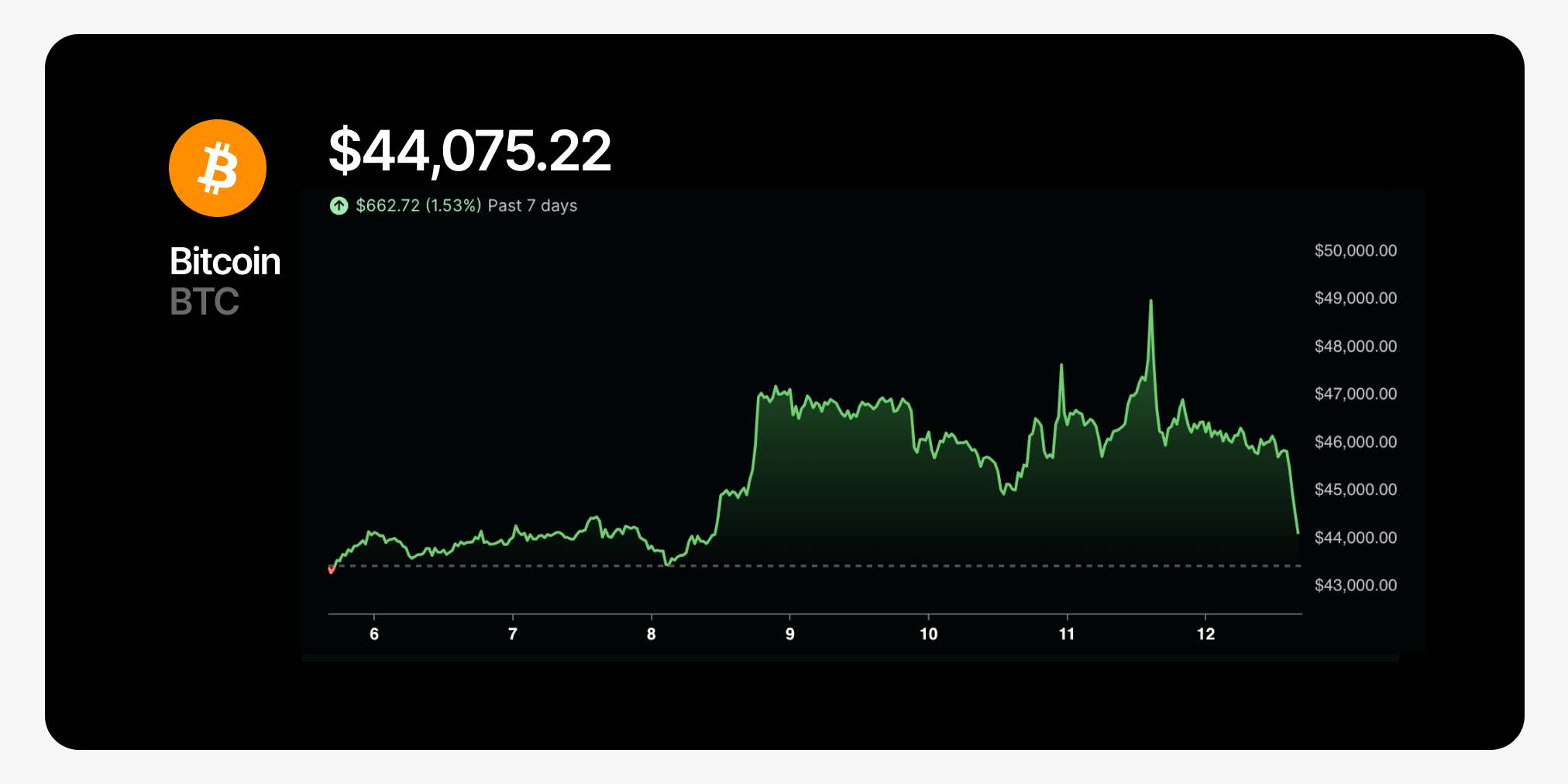

Bitcoin Prices Have Volatile Response to ETF Approval, Peaking Around $49k Before Retracing Below $45k Range

The approval of US-based spot bitcoin ETFs marked and crypto as a whole, opening the door to an entirely new set of retail and institutional investors. Following approval on Wednesday, the price action on was relatively muted and remained within its recent trading range, initially climbing to $47k shortly after the news and trading below the $45k level by Friday morning.

As trading on the spot bitcoin ETFs started Thursday morning, rose to $49k before paring back gains to sit around $46.5k level Friday morning. More than across all spot bitcoin ETF products on Thursday, likely setting a record for the for a single type of ETF. GBTC accounted for about half of Thursday’s spot bitcoin ETF volume.

Ether Surges as Focus Shifts to Potential Ether ETF

The initial false bitcoin ETF announcement on Tuesday perhaps tipped traders’ hands as began to rally following the SEC’s social account hack and false bitcoin ETF announcement. ETH had been struggling in comparison to BTC over the past few months as attention centered around the bitcoin ETF, with the hitting its lowest level since April 2021 at 0.04788.

However, following Tuesday’s bitcoin ETF head fake, the pair jumped to 0.052 suggesting a rotation out of BTC and into ETH for a catch up play and an expectation that the narrative will shift toward later this year. This was further evident on the actual approval Wednesday, with the continuing to rally higher and trading above 0.05650. By Friday, ETH was even stronger, with the ETHBTC pair nearing 0.06.

Inflation Ticks Up, Potentially Complicating Interest Rate Outlook for 2024

US equities rose steadily this week as investors awaited inflation data released on Thursday. Thursday’s data in the consumer price index (CPI) of 0.3% in December, reflecting a 3.4% yearly increase. Estimates had been for a 0.2% December increase and a 3.2% annualized increase. US equities fell in response, but began to creep back up on Thursday afternoon.

The data as it plans to start lowering interest rates later this year. Nevertheless, the Fed to start lowering interest rates by March.

Altcoins Perform Well as Total Crypto Market Capitalization Nears $1.8 Trillion

Much of the crypto market saw price appreciation this week, with some leveraged ETH and BTC plays showing good returns. is trading up more than 55% over the past seven days, while added 20% over the same period.

The is now approaching the $1.8 trillion mark, its highest level since April 2022, prior to the Terra/LUNA collapse.

Circle, USDC Issuer, Files For Initial Public Offering

On Thursday, Circle announced that it had with the SEC, as it seeks to launch shares for public sale. While the announcement was light on details, Circle had previously announced in 2021 that it planned to go public via a SPAC, as of February 2022. The deal eventually fell through. The now-planned IPO is subject to SEC review and market conditions, according to Circle’s press release.

-From the Gemini Trading Desk

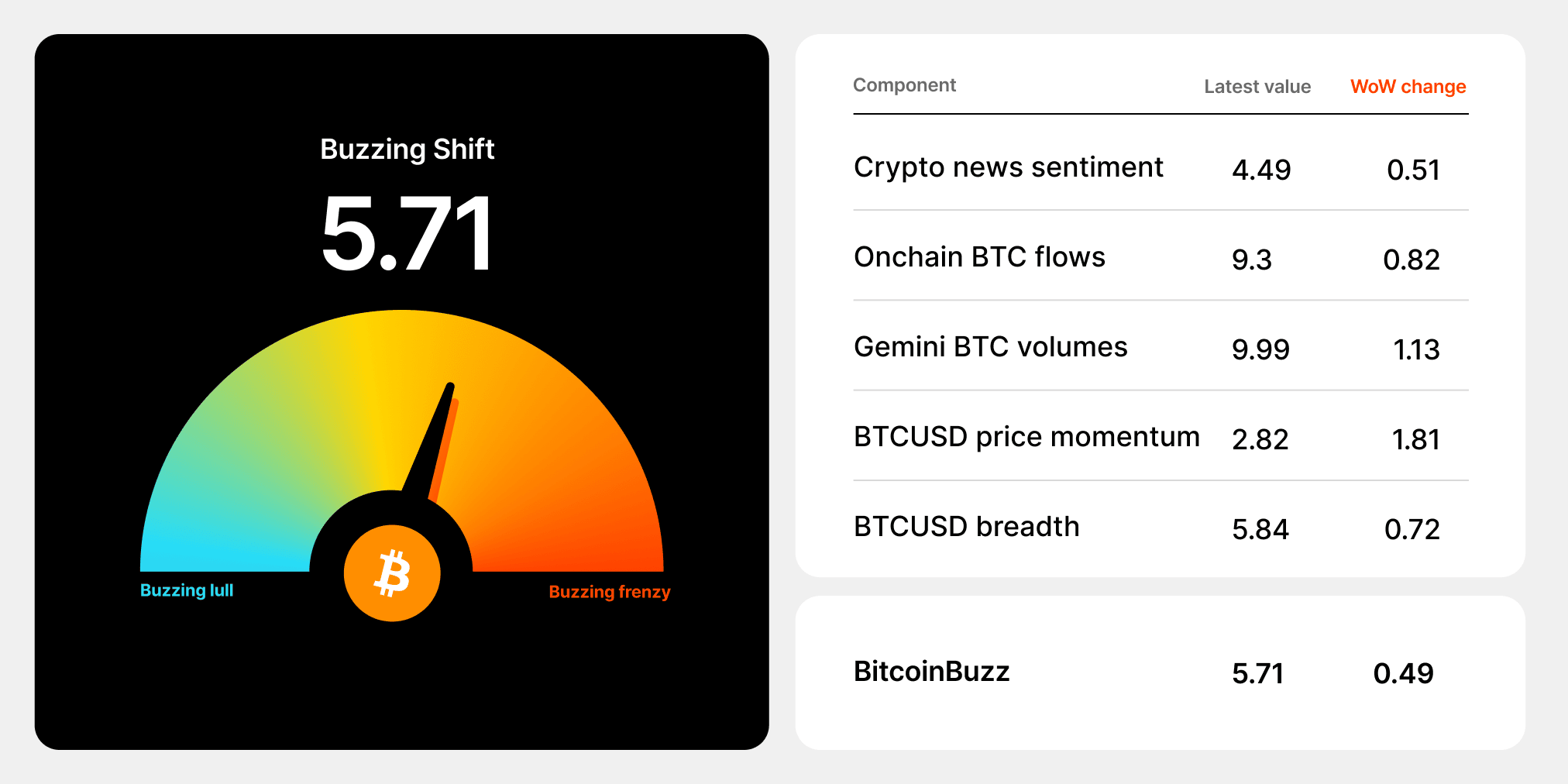

data as of 5:10pm ET on January 11, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Who Invented Bitcoin and Why?

With the first US-based bitcoin ETFs live for trading, this week we go back to the origins of Bitcoin to explore who invented it and some of the impetus behind the revolutionary digital currency.

is a digital currency that was designed to challenge historical norms that govern the way is issued and the means by which transactions are conducted online. The core principle that makes Bitcoin so revolutionary is its embrace of — on both the technical and operational level.

does not have a CEO or a central banker at its helm and, in fact, is not controlled by any single person or entity. Nonetheless, Bitcoin was created by someone (or group of people) and is governed by a variety of community stakeholders through a system that is referred to as .

Why did Satoshi Nakamoto invent Bitcoin?

Bitcoin was invented by a person or group of people using the pseudonym . Nakamoto, whose real identity has never been uncovered, announced that they were working on a “new electronic cash system that’s fully peer-to-peer, with no trusted third party” on in October 2008.

Nakamoto’s decision to reveal Bitcoin to this mailing list suggests something important about the — many of the cryptographers on the list had previously discussed a form of electronic money that was private, secured by , and not controlled by a entity. However, previous attempts to create such a currency were thwarted by a common obstacle known as the : the challenge of ensuring that digital coins could not be spent twice without relying on a trusted intermediary.

Physical cash is difficult to spend twice, because using it to purchase goods requires handing it over to the merchant. Further, governments heavily police counterfeiting operations. Digital files, however, are easily copied. So the cryptographers were stumped — how can you prevent the copying of digital coins without a bank, company, or government acting as the counterfeit police? Instead of a trusted third party, Satoshi Nakamoto solved this problem by creating a decentralized system that relies on cryptography to produce proof that coins have only been spent once. In other words, Satoshi’s attempt at electronic cash wasn’t the first digital currency project — the Bitcoin notes the important contributions made by other cryptographers such as Wei Dai and Adam Back — but it was the first and most successful decentralized example.

!

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026