SEP 04, 2025

Spot Bitcoin ETFs Rebound, Trump-Backed WLFI Token Begins Trading, and Metaplanet Adds More BTC

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about .

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -2.65% | $109,639.88 |

$109,639.88

-2.65%

| |

Ether

ETH | -4.22% | $4,305.61 |

$4,305.61

-4.22%

| |

API3

API3 | -16.10% | $0.976 |

$0.976

-16.10%

| |

Helium

HNT | -9.80% | $2.3904 |

$2.3904

-9.80%

| |

Chainlink

LINK | -9.75% | $22.39738 |

$22.39738

-9.75%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of September 4, 2025 at 1:45 pm ET. . All prices in USD.

Takeaways

- Spot bitcoin ETF inflows flipped recent spot ether ETF dominance: Spot bitcoin ETFs drew approximately $333 million in net inflows on Tuesday while spot ether ETFs recorded around $135 million in net outflows, reversing a recent trend in which spot ether ETF inflows outpaced spot bitcoin ETFs.

- Strategy has met the S&P 500’s listing and earnings tests after a strong Q2: The S&P Dow Jones Indices committee could vote to add Strategy to the S&P 500 as soon as Friday, with the change going into effect September 19th.

- The native token of the Donald Trump-backed World Liberty Financial began spot trading on exchanges: Roughly 25% of the token supply is available for trading, which launched spot-trading with a market cap of roughly $30 billion.

- Starknet returned to normal block production after a reported outage early on Tuesday that paused onchain activity for two hours: Most RPC providers are now back online while remaining nodes finish upgrades.

- Metaplanet has purchased another 1,009 BTC for $112 million, bringing its total holdings to 20,000 BTC: The Japanese firm has become the sixth largest public corporate holder of , surpassing its original 2024 accumulation goal.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Spot Bitcoin ETFs Reverse Recent Ether ETF Dominance With $333 Million Net Inflows

Bitcoin ETF inflows were led by Fidelity’s FBTC with $133 million in inflows, followed by BlackRock’s IBIT with roughly $73 million.

In August, spot ether ETFs went on a big run, overtaking spot bitcoin ETF inflows. The demand was spurred by new interest in yield-generating DeFi activity and proposed improvements to the Ethereum network. Additionally, corporations have gone on an ether buying spree, mimicking the move from Michael Saylor’s Strategy, to set up their own respective crypto treasury strategies and promote new interest in ethereum.

The price of ether subsequently reached a new all-time-high toward the end of August before a recent drawdown. But there’s ample greenshoots for the world’s second largest crypto entering the final three months of the year, including increasing appetite for staking and other products powered by the Ethereum network.

Strategy Qualifies for S&P 500 Inclusion With Committee Decision Expected Friday

reporting $14 billion in operating income and $10 billion in net income after being allowed to reflect digital-asset appreciation in earnings. The S&P Dow Jones Indices committee could vote to add the company as soon as Friday. If approved, the change would go into effect September 19.

Strategy held roughly 597,325 BTC as of June 30th and reported a YTD “BTC Yield" of 19.7%, a metric the company uses to track bitcoin growth relative to shares. The firm funded its recent purchases through equity and preferred-stock programs. It remains by far the largest corporate bitcoin holder globally.

Strategy met the requirements by carrying a market cap above $8.2 billion, recording daily trading volume of more than 250,000 shares, and posting positive earnings in the latest quarter and on a 12-months trailing basis, among other criteria. If added, Strategy would become the first widely known bitcoin-treasury company in the benchmark, giving further legitimacy to bitcoin as a reserve asset.

Trump’s World Liberty Financial Begins Spot Trading on Exchanges

The DeFi project is making roughly 25% of the token supply available at launch, with each token now trading at around $0.18.

The project has also proposed a plan to allocate all fees generated by the protocol to buying and burning WFL tokens.

The Ethereum-based project reportedly has audited reserves and recently launched its USD1 stablecoin on Solana with a market cap of roughly $2.6 billion. World Liberty Financial describes the stablecoin dollar-redeemable token as designed for fast settlement. It currently ranks as the 5th largest stablecoin according to CoinMarketCap.

Starknet Resumes Block Production After Two-Hour Outage

Developers said they implemented a chain reorganization which removed about an hour of activity and brought the network back to normal functionality. The fix has caused most partners and endpoints to resume service. The protocol previously suffered an outage in April last year, but outages are fairly uncommon for the network.

The incident came less than 24 hours after the network underwent its anticipated “Grinta” upgrade, the purpose of which is to significantly increase the network’s transaction speed and increase decentralization. Some have speculated that the outage could be related to the upgrade. A post-incident review is expected to follow soon, which will lay out the cause and measures taken to prevent similar incidents in the future.

Metaplanet Bitcoin Holdings Reach 20,000 After Increasing Acquisition Targets

The milestone comes only three months after the firm reached 10,000 BTC. Earlier in the year, Metaplanet leadership announced it had increased its year-end target to 30,000 BTC, tripling its initial goal of 10,000.

Metaplanet revealed ambitious financing plans last week, with an $880 million international share offering which will primarily be used for acquiring more bitcoin. CEO Simon Gerovich has indicated the firm may eventually borrow against its BTC reserves to acquire cash-generating businesses. Despite the news, the company’s Tokyo-listed shares dipped slightly after the announcement. Nonetheless, the company’s bitcoin acquisition plans have been a factor in its share price rising roughly 580% YoY.

-Team Gemini

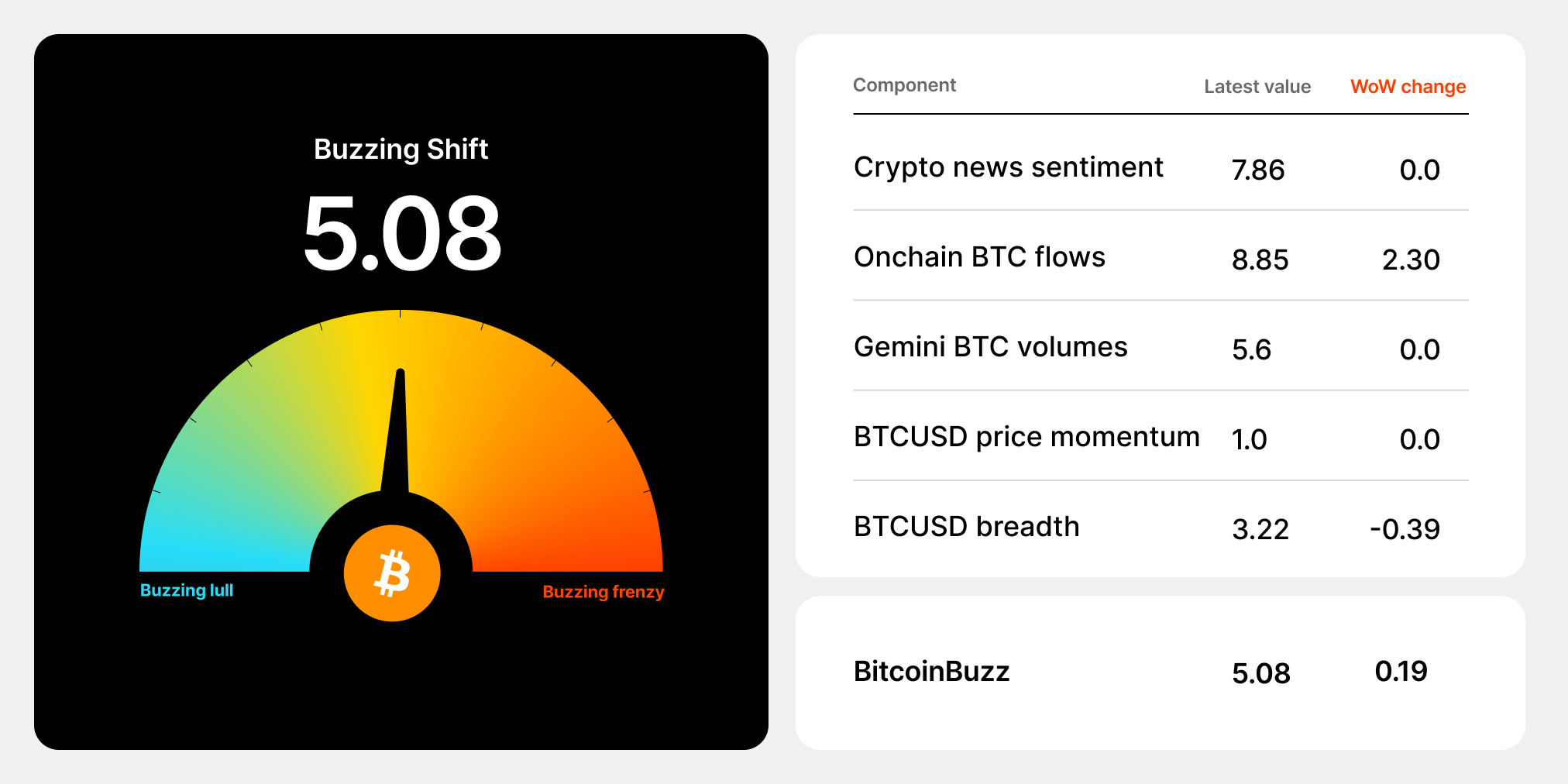

data as of 5:14 pm ET on September 3, 2025.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Is a Bitcoin Mining Rig & How Does It Work?

A Bitcoin mining rig is a specialized computer system designed to validate transactions and secure the Bitcoin network. These machines solve complex mathematical puzzles — and, in doing so, help maintain the blockchain’s integrity. Through Bitcoin’s native currency BTC, miners earn rewards. The payment reward miners receive from solving mathematical puzzles sustains their participation and helps sustain the network’s decentralization.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026