SEP 12, 2024

Soft Inflation Data Paves Way for Rate Cut, Spot BTC ETFs Pull Back

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about interest rates.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.99% | $58,404.28 |

$58,404.28

+2.99%

| |

Ether

ETH | -1.55% | $2,356.40 |

$2,356.40

-1.55%

| |

Fetch.ai

FET | +29.4% | $1.40357 |

$1.40357

+29.4%

| |

Fantom

FTM | +27.2% | $0.4916 |

$0.4916

+27.2%

| |

ApeCoin

APE | +13.13% | $0.741 |

$0.741

+13.13%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Sept. 12, 2024, at 2:35 pm ET. . All prices in USD.

Takeaways

- Inflation stays under control: The Consumer Price Index increased 2.5% in August compared to the previous year, down from the 2.9% bump in July. The latest data indicates the Federal Reserve will likely cut interest rates by 25 basis points next week.

- Bankrupt crypto exchange FTX has reached a $14 million settlement with Emergent Technologies, resolving a dispute over 55 million Robinhood shares: The agreement avoids further legal action and allows Emergent to finalize its bankruptcy proceedings.

- US spot bitcoin ETFs have seen a streak of daily net outflows, with nearly $1.2 billion withdrawn in just eight days: The downturn coincides with broader market volatility.

- The North Carolina Senate has passed a bill prohibiting state participation in any Federal Reserve-sponsored CBDC testing: The bill bans payments to the state using a CBDC. It passed despite a veto by Governor Roy Cooper.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Inflation Increases 2.5%, Setting Scene for Rate Cut

The data marked the smallest annual increase in CPI since February 2021 and came in slightly lower than July’s 2.9% year-over-year mark.

Core CPI, which excludes volatile food and fuel prices, jumped 3.2% in August from the previous year, which was roughly in line with economist forecasts. The price of bitcoin on Wednesday briefly dipped below $56,000, perhaps in part because the inflation dampened the chances of a 50-point rate cut. But it quickly bounced back Thursday, surpassing $58,000 amid a broader market rebound.

Federal Reserve officials are expected to cut rates next week at their policy meeting in hopes of achieving their long-desired “soft landing” following July’s sluggish jobs report. That decision could serve as a greenshoot for crypto assets that have historically performed well when interest rates are lower.

Spot Bitcoin ETFs Experience Longest Run of Net Outflows as Market Volatility Grows

The withdrawals occur as global markets grapple with economic concerns, including mixed US job data and deflationary pressures from China.

With demand for spot bitcoin ETFs surging earlier this year, bitcoin reached an all-time high of $73,798 in March. The recent sell-off, though, has dampened bitcoin's year-to-date rally.

Some analysts subsequently believe that the price of bitcoin is poised to surge over the final three months of 2024 if traders can make it through the traditional lull.

FTX Settles Dispute with Emergent Over $600M Robinhood Shares

The deal reportedly covers administrative expenses and allows Emergent to withdraw its claim on the 55 million shares.

As part of the agreement, Emergent will expedite its bankruptcy resolution in Antigua, and FTX believes this settlement will save litigation costs while securing more value for its creditors. CEO John Ray III confirmed that the deal came as a result of fair negotiations and has been reached in good faith.

After FTX’s collapse in November 2022, multiple parties, including FTX and BlockFi, claimed rights to the shares, which the Justice Department seized in January 2023. FTX founder Bankman-Fried still remains in prison, serving a 25-year sentence for charges including wire fraud and money laundering.

North Carolina Senate Passes Bill Banning CBDC Testing, Overriding Governor’s Veto

The bill bans state payments using a CBDC and blocks state participation in any Federal Reserve pilot programs for CBDCs. It was passed by the Senate after a vote of 27-17 to override Governor Roy Cooper’s veto.

Governor Cooper had previously argued that the bill was “premature” and urged waiting for federal guidelines on digital currencies before taking action. His belief was that regulators should be given time to assess the technology as it develops before enacting a ban.

The legislation comes after the US House passed the CBDC Anti-Surveillance State Act, which seeks to prevent the Federal Reserve from issuing a CBDC directly to individuals. While the concept of a CBDC is being explored in several states, the implementation of one would still likely require congressional approval.

-The Gemini Team

data as of 5:15 pm ET on Sept. 11, 2024.

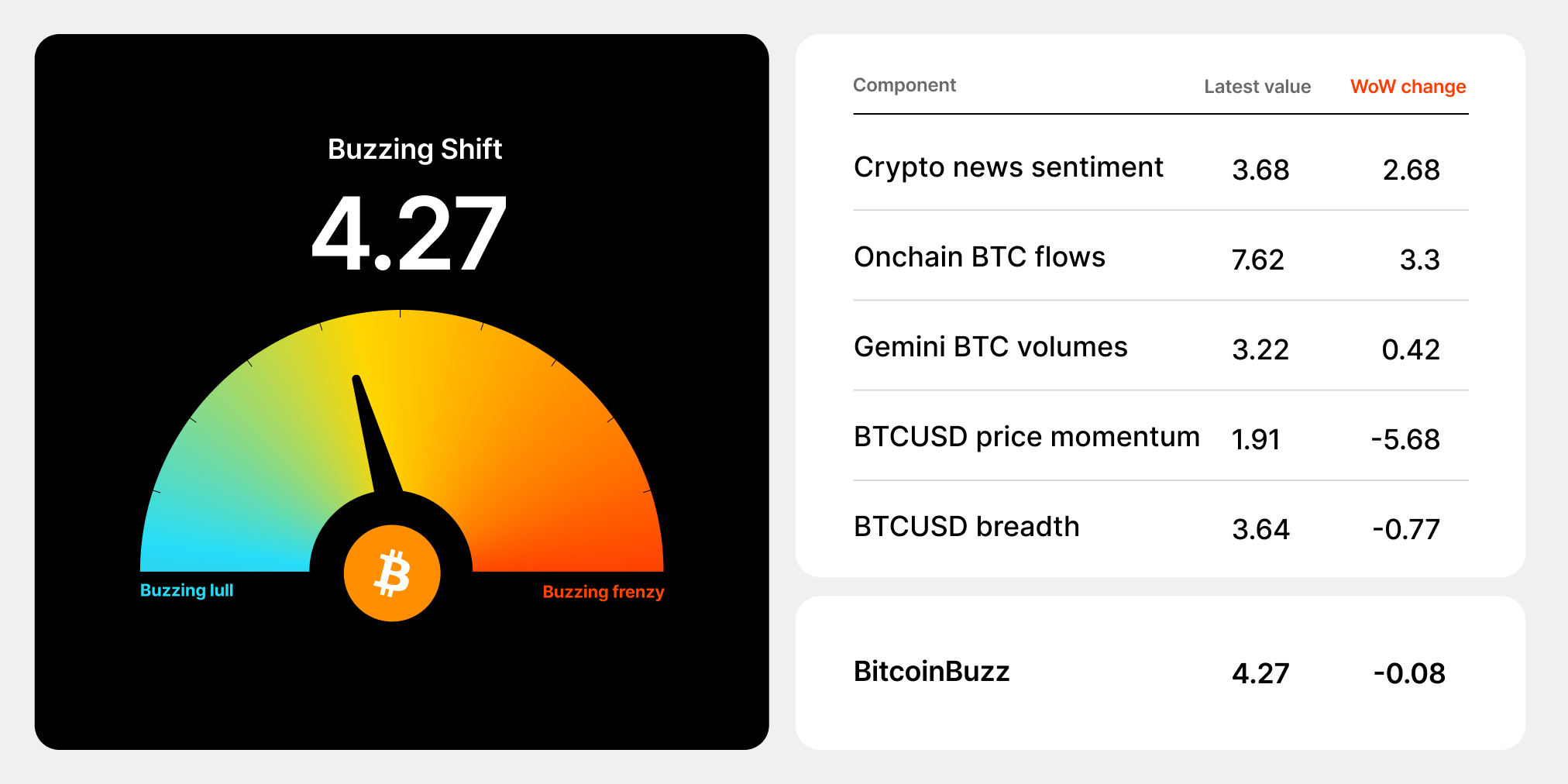

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Understanding Interest Rates

Interest is the cost of borrowing money (or the reward for lending money). Usually, central banks set interest rates, like the Federal Reserve in the U.S. Lending institutions — commercial banks, credit unions, and the like — then calculate interest as a percentage of the principal loan and add it to the total cost of a loan. All industry sectors pay close attention to changes in interest rates, as they affect consumer and corporate debt, the health of financial markets, and the economy as a whole. Borrowing and lending money can generate activity in cryptocurrency markets in two ways. Interest rates might attract new investors to crypto via a recognizable way of thinking about digital assets, while adding a degree of comfort. And for those already holding crypto, interest rates could offer an incentive to lend it, thus contributing to liquidity and the flow of assets.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026