JUL 31, 2025

SEC Approves In-Kind Crypto ETF Redemptions, Tron Inc. Registers to Raise $1 billion for TRX Purchases, and Crypto Policy Report Goes Live

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about stablecoins and how they work.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -0.45% | $118,430.45 |

$118,430.45

-0.45%

| |

Ether

ETH | +1.95% | $3,788.54 |

$3,788.54

+1.95%

| |

Fetch.ai

FET | -7.12% | $0.68662 |

$0.68662

-7.12%

| |

Uniswap

UNI | -5.46% | $9.7172 |

$9.7172

-5.46%

| |

IoTeX

IOTX | +3.32% | $0.030633 |

$0.030633

+3.32%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of July 31, 2025, at 12:24 pm ET. . All prices in USD.

Takeaways

- SEC gives green light to in-kind redemptions for spot crypto ETFs: The SEC voted in favor of allowing in-kind redemptions for qualified spot bitcoin and spot ether ETFs on Tuesday, continuing the agency’s recent shift toward encouraging innovation and offering clarity for digital assets.

- White House releases crypto policy report: The White House working group appointed by President Donald Trump offered official recommendations this week on which crypto policy initiatives should move forward in Congress, how to integrate crypto into the US banking system, strengthen the dollar, treat crypto taxes, and more.

- Fed leaves interest rates unchanged again: Federal Reserve chair Jerome Powell opted to leave interest rates unchanged on Wednesday despite pressure from the Trump administration to bring rates lower.

- PayPal will soon launch “Pay With Crypto:" PayPal announced that merchants will be able to automatically convert more than 100 crypto funds into fiat or PayPal’s PYUSD stablecoin.

- Tron Inc. has registered to issue up to $1 billion in mixed securities to fund purchases of TRX tokens: The Nasdaq‑listed firm holds over 365 million TRX following a recent merger and plans equity and debt offerings under the shelf registration with the SEC.

- MARA Holdings posted record revenue of $238.5 million in Q2, surpassing analyst forecasts: The miner produced 2,358 BTC and boosted its hashrate to 57.4 EH/s, with plans to hit 75 EH/s by the end of the year.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

SEC Approves In-Kind Redemptions For Spot Crypto ETFs

The move marked a big win for institutional investors that had sought approval for in-kind redemptions for months to help potentially lower costs, reduce the chances of spot price tracking errors, and increase efficiency.

"It's a new day at the SEC, and a key priority of my chairmanship is developing a fit-for-purpose regulatory framework for crypto asset markets,” SEC chairman Paul Atkins said in a release. "Investors will benefit from these approvals, as they will make these products less costly and more efficient."

The approvals will allow institutional investors offering spot bitcoin and spot ether ETFs to redeem the shares directly in bitcoin or ether rather than cash, eliminating the need to move money back-and-forth between fiat currencies and crypto. It also sets a promising precedent for future crypto ETFs, which could now potentially offer in-kind redemptions from their launch.

In addition to the in-kind redemption ruling, the SEC also gave the green light for IBIT, Blackrock’s leading bitcoin ETF fund, to increase position limits for options traders. Overall, it approved in-kind redemptions for IBIT, Blackrock’s spot ether ETFs, as well as ETFs from ARK21, Fidelity, VanEck, Franklin Templeton, and others.

White House Releases Crypto Policy Report

with the working group appointed by President Donald Trump offering recommendations on which policy initiatives should move forward in Congress, how to modernize the US banking system to work with crypto, strengthen the dollar, treat crypto taxes, and more.

The first section recommends that Congress ‘eliminate existing gaps in regulatory oversight by providing the CFTC authority to oversee spot markets for non-security digital assets” and “embraces DeFi technology and recognizes the potential of integrating such technology into mainstream finance.”

The policy sheet also provides a directive the SEC and CFTC to “immediately enable the trading of digital assets at the Federal level by providing clarity to market participants on issues such as registration, custody, trading, and recordkeeping and Allow innovative financial products to reach consumers without bureaucratic delays through the use of tools like safe harbors and regulatory sandboxes.”

Fed Keeps Interest Rates Unchanged, Bitcoin Falls

The decision initially rattled crypto markets, with the price of bitcoin dropping below $116,000 before rallying back toward $117,000 late in the day.

President Trump has recently applied public pressure on Powell to begin lifting rates amid relatively steady inflation figures and low unemployment. In a post on Truth Social, Trump said he expects Powell to cut rates in September. But in his press conference following the decision, Powell said it’s still unclear if Trump’s aggressive tariff policies will have an impact on inflation. Two Fed board members disagreed with Powell’s decision, arguing for a cut of 25 basis points, marking the first time in decades members broke from the chair’s decision.

The Federal Reserve’s goal is to keep inflation at around 2%.

“Our obligation is to keep longer-term inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem,” Powell said. “Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen.”

PayPal to Enable Merchants to Accept Over 100 Cryptocurrencies

Shoppers will reportedly be able to use wallets such as Phantom and MetaMask to pay in bitcoin, ether, tether and a large number of other tokens. Once a transaction is completed, PayPal plans to instantly convert the crypto into either fiat currency or PayPay’s own PYUSD stablecoin for merchant settlement.

The new feature is designed to reduce payment costs and delays for small businesses, which can face fees exceeding 10%. PayPal says it will charge merchants a 0.99% transaction fee for crypto payments, and those opting to hold proceeds in PYUSD will earn approximately 4% interest on their balances. This rollout follows PayPal’s broader strategy to integrate digital assets into its payment infrastructure.

Tron Inc Files $1 Billion Shelf for TRX Treasury Strategy

The proceeds will be deployed primarily to acquire additional TRX tokens and to back other token‑related initiatives, subject to market conditions and board approval. The company completed a reverse merger just weeks ago, bringing in $100 million paid entirely in TRX, and now reports a balance of over 365 million tokens. At the time of writing TRX is currently at a price of $0.33.

The firm’s shelf filing allows it to join the ranks of other public companies enhancing their digital asset accumulation strategies, both for hedging and for revenue-increasing opportunities. TRX remains a much thinner market than both bitcoin and ether, but the move could allow Tron Inc to take advantage of its higher transaction speed for DeFi opportunities such as yield generation. As the first major firm to align its Nasdaq listing explicitly with a single token strategy, Tron Inc will be watched closely by investors.

MARA Q2 Revenue Tops Estimates on 50% BTC Price Surge

The reported performance represents a 74% YoY increase and was higher than analysts predicted. With 2,358 BTC mined, the company’s production remained steady. MARA’s energized hashrate, representing active mining rigs, climbed 57.4 EH/s, with the firm reiterating its goal of reaching 75 EH/s by the end of 2025.

Beyond mining operations, MARA holds approximately 50,000 BTC on its balance sheet, worth around $6 billion at current prices, and actively manages about 31% of those holdings through loans and yield-enhancing strategies. By using bitcoin as a productive asset rather than only a hedge, MARA is strengthening its longterm position in the sector. MARA shares reportedly jumped by 4% as a result of the announcement, reflecting strong investor enthusiasm for its dual focus on both production and strategic asset deployment.

-Team Gemini

data as of 5:18 pm ET on July 30, 2025.

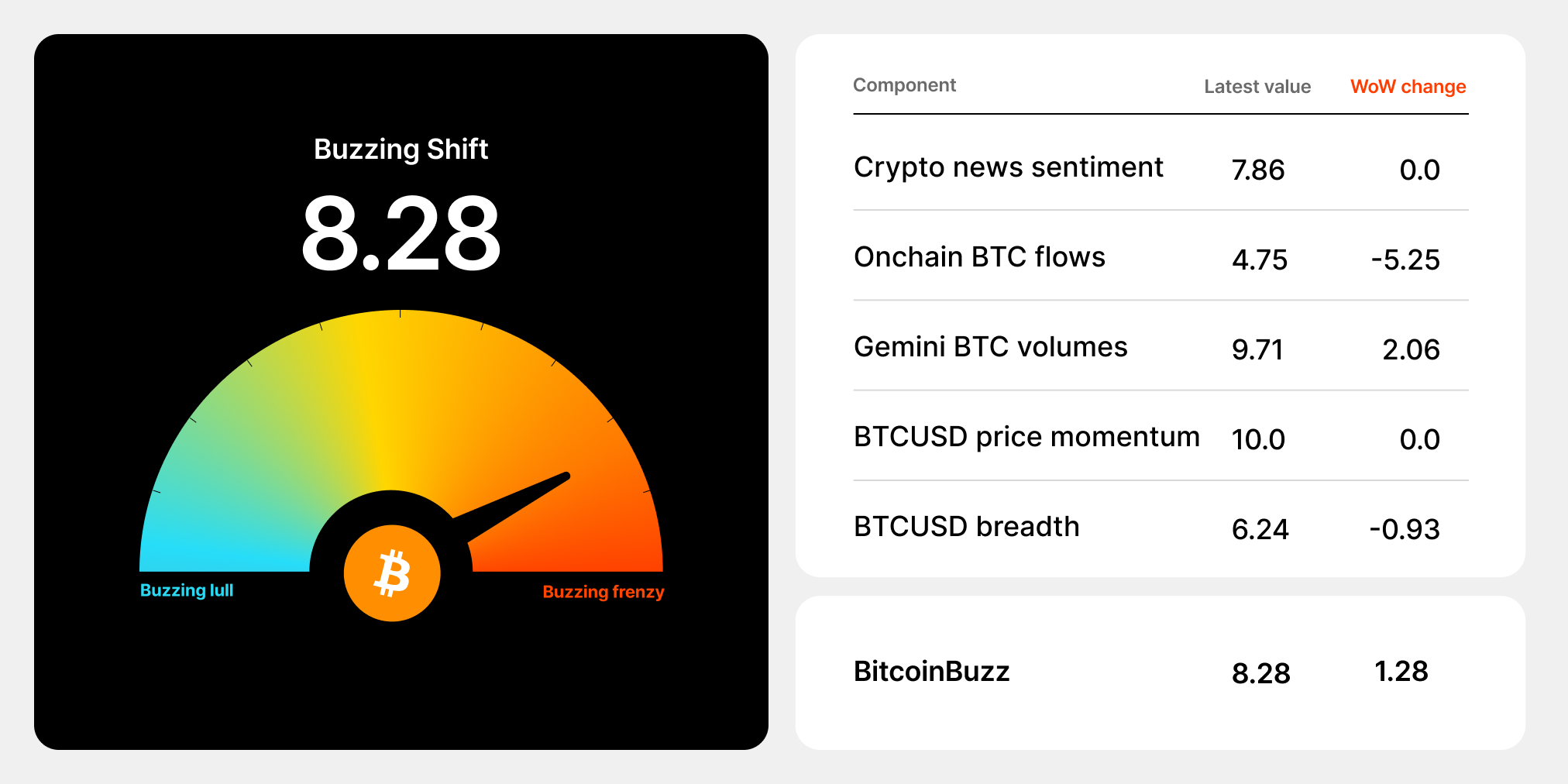

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Are Stablecoins and How Do They Work?

Stablecoins are growing in popularity with both crypto and traditional markets. They are a type of crypto asset, but one that offers a way to bridge the gap between fiat currencies like the U.S. dollar and cryptocurrencies. Because they are price-stable digital assets that behave like fiat but maintain the mobility and utility of cryptocurrency, stablecoins are a novel solution to crypto volatility: price stability is built directly into the assets themselves. There are four primary stablecoin types, identifiable by their underlying collateral structure: fiat-backed, crypto-backed, commodity-backed, and algorithmic stablecoins.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026