OCT 10, 2024

New HBO Documentary Hints at Identity of Bitcoin Inventor, Crypto Pulls Back Amid Elevated US Inflation Numbers

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about crypto bridging.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -2.71% | $59,001.78 |

$59,001.78

-2.71%

| |

Ether

ETH | -0.47% | $2,337.29 |

$2,337.29

-0.47%

| |

Geojam

JAM | -50.6% | $0.0005176 |

$0.0005176

-50.6%

| |

Uniswap

UNI | +22.4% | $8.0315 |

$8.0315

+22.4%

| |

Chiliz

CHZ | +20.1% | $0.06903 |

$0.06903

+20.1%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Oct. 10, 2024, at 2:33 pm ET. . All prices in USD.

Takeaways

- HBO documentary seeks to unveil Satoshi Nakamoto’s identity: HBO released a documentary, “Money Electric: The Bitcoin Mystery,” on Tuesday that suggests an early Bitcoin developer named Peter Todd invented the cryptocurrency.

- Crypto.com has filed a lawsuit against the SEC after receiving a Wells notice, claiming the agency has overextended its authority: The lawsuit challenges the SEC's stance that most cryptocurrencies are securities and the agency's regulatory practices.

- Bitcoin's price pulled back this week: The US Department of Labor announced that inflation rose 2.4% year-over-year in September, slightly above analyst expectations. Crypto reacted negatively to the news, with bitcoin dropping back below $60,000.

- US spot bitcoin ETFs saw $18.66 million in net outflows on Tuesday, led by Fidelity’s FBTC, which recorded $48.82 million in withdrawals: BlackRock’s IBIT was the only ETF to see inflows, with $39.57 million entering the fund.

- The head of Hong Kong’s Securities and Futures Commission (SFC) says the body plans to approve more crypto exchanges before the end of 2024: The news comes after the regulator received criticism for implementing a strict approach to licensing.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

New HBO Documentary Suggests Peter Todd is Bitcoin’s Founder

An HBO documentary, “Money Electric: The Bitcoin Mystery,” released Tuesday hints that early Bitcoin developer Peter Todd is the cryptocurrency’s founder and man behind the pseudonym Satoshi Nakamoto.

The film provided minimal concrete evidence that Todd created Bitcoin, but focused instead on his technical skills, his love of cryptography, and his relationship with Adam Back, the Blockstream CEO and investor of Hashcash. "Money Electric" director Cullen Hoback also pointed to a 2010 forum post from Satoshi Nakamoto in which Todd responded, arguing that Todd had forgotten to switch his accounts and his post was a continuation of Satoshi’s original post.

"This is going to be very funny when you put this into the documentary and a bunch of bitcoiners watch it," Todd said in the documentary clip while standing alongside Back. "I suspect a lot of them will be very happy if you go this route because it's yet another example of journalists really missing the point in a way that's very funny."

This is not the first time Hoback has made a documentary film about trying to uncover the identity of a secretive figure. For his 2021 HBO documentary “Q: Into the Storm,” Hoback spent three years attempting to find the creator of Qanon.

Crypto.com Sues SEC After Receiving Wells Notice

The platform said the SEC's continued regulatory enforcement against crypto companies forced them into taking legal action.

According to Crypto.com, the SEC is unjustly expanding its jurisdiction over digital assets by labeling most cryptocurrencies as securities. The lawsuit is part of a broader industry pushback against the SEC's regulatory approach, which many crypto companies claim is outdated and unsuitable for digital assets.

The platform is far from the first to take such legal action; Coinbase and Consensys have also previously sued the SEC, similarly challenging the agency’s stance on categorizing cryptocurrencies as securities. The SEC has reiterated the need for crypto exchanges to register with the agency, while firms argue that current regulations are impractical for the digital asset sector.

After Positive Jobs Report, Bitcoin Stalls Out Amid Sticky Inflation Data

The rebound started after the Federal Reserve released its monthly jobs report on Friday, showing 254,000 jobs added in September, significantly surpassing the forecast of 150,000 from Dow Jones.

Memecoins additionally saw significant gains over the weekend as growing social sentiment and increased risk-taking among crypto traders fueled the rally. Conversations and posts regarding a potential "memecoin supercycle," which suggests that meme tokens might drive the next crypto bull run, spread across social media platform X.

But the price of bitcoin and other cryptocurrencies pulled back this week. On Thursday, the US Department of Labor announced that the Consumer Price Index, a key inflation measure, rose slightly more than expected in September, checking in at 2.4% year-over year. That was a 0.2% increase from the previous month and likely decreases the chance of another jumbo 50 basis-point rate cut at the next Federal Reserve meeting.

US Spot Bitcoin ETFs Report Nearly $19 Million in Net Outflows

Fidelity’s FBTC saw the largest outflows of the day, with $48.82 million exiting the fund. While Grayscale’s GBTC, the second-largest spot bitcoin ETF by net assets, also experienced outflows of $9.41 million.

Only BlackRock’s IBIT, the largest spot bitcoin ETF, registered inflows, with $39.57 million flowing in. The other nine bitcoin ETFs saw no movement in either direction. US spot ethereum ETFs saw $8.19 million in outflows after reporting no activity on Monday. Bitwise’s ETHW led the ether ETF took the lead with the outflows, with $4.54 million leaving the fund.

Some industry commentators have chalked this up to the fact that bitcoin is seen by many as a more accessible entry point to the space, compared to the more tech-focused Ethereum network.

Hong Kong to Approve More Crypto Exchanges by Year-End, Says SFC CEO

This announcement follows HKVAX’s recent regulatory approval, with plans to launch by the fourth quarter of 2024. HashKey and OSL, two other exchanges, have already had their licenses upgraded under the updated regulatory framework. If the majority of these 11 platforms have their licenses approved, it would result in an expansion of the digital assets sector in the region.

The SFC’s upcoming regulatory actions come after some have expressed concern over the strictness of Hong Kong's licensing practices for these platforms. Some international exchanges such as OKX and Bybit have even withdrawn their applications due to concerns about the regulator’s heavy-handed approach to licensing.

-The Gemini Team

data as of 5:11 pm ET on Oct. 9, 2024.

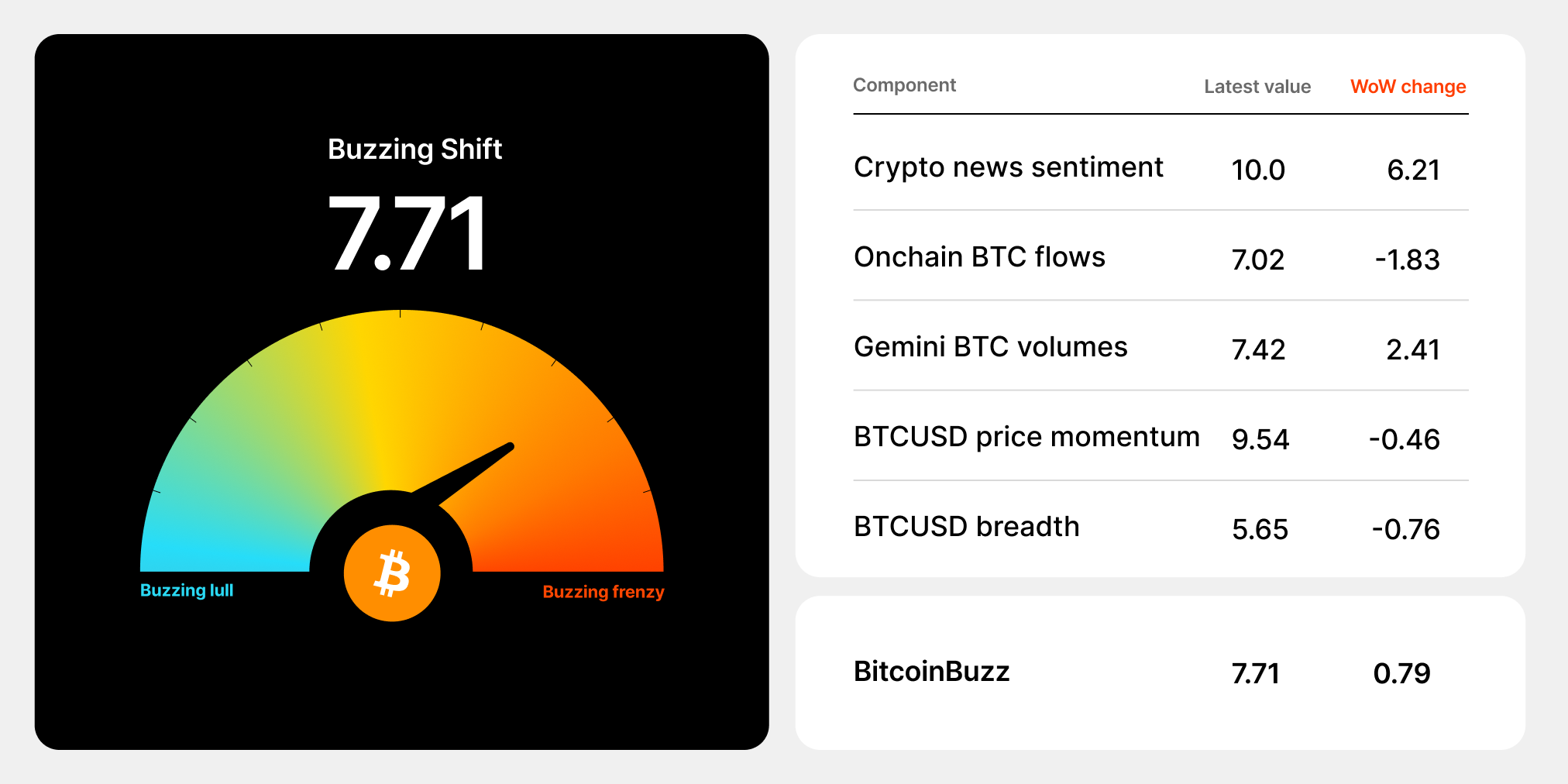

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Is Bridging?

A crypto bridge enables the transfer of assets or data between different blockchain networks, expanding the interconnectivity and interoperability across different protocols. They typically function by locking assets on one blockchain and issuing an equivalent number of "wrapped" tokens on another, ensuring a value of 1:1 between them. Using bridges can also involve risks including security vulnerabilities, and concerns relating to centralization.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026