SEP 03, 2019

Introducing Sub-Accounts for Institutions

Today, we are excited to introduce sub-accounts for institutions. This feature allows our institutional customers to create and manage multiple accounts under a single master account. Sub-accounting is one of the most commonly requested features by our institutional customers and makes Gemini the world’s first crypto exchange and custodian to support this feature.

Sub-accounts allow institutions to segregate trading strategies, funds, end customers, and more across multiple sub-accounts under the same master account. They also make it easier for institutions to earn volume-based trading fee discounts because volume for an institution is aggregated across all of its sub-accounts.

We believe this feature will be very valuable to a variety of our institutional customers, including hedge funds running multiple trading strategies, Registered Investment Advisors (RIAs) looking to manage segregated accounts, and retail brokers needing to maintain self-directed accounts for their customers.

Here’s a look at how sub-accounts work and the specific features available:

1. Account and User Management

Using either our website interface or API, a master account administrator can create an unlimited number of sub-accounts. Each sub-account can have its own distinct set of users permissioned for specific roles, as well as its own account balance and unique, independently verifiable crypto addresses. A master account administrator can view and perform actions for any user of any sub-account.

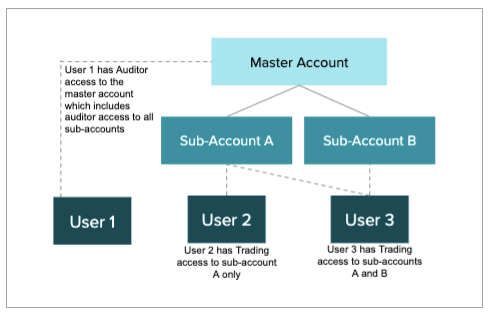

Users can be permissioned at the sub-account level for specific roles on specific sub-accounts or at the master account level for specific privileges across all sub-accounts. See below for some examples.

In this example, there are two sub-accounts under the master account. User 1 has Auditor level access to the master account, which confers Auditor privileges on User 1 for all sub-accounts. User 2 only has Trading access to sub-account A, whereas User 3 has Trading access to both sub-accounts A and B. This means that User 2 may only place trades on behalf of sub-account A, whereas User 3 may place trades on behalf of either sub-account A or sub-account B.

Regardless of permissioning, users only need one set of login credentials. Users can easily toggle between different sub-accounts for which they have permissions via our website interface.

2. API Functionality

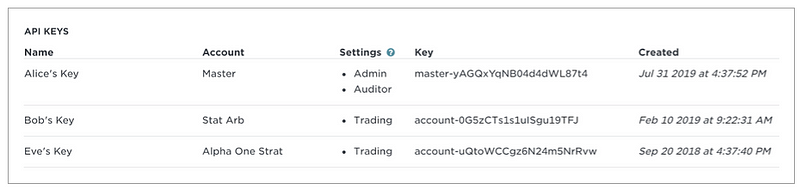

API keys can be created and permissioned at either the master account level or sub-account level. Master account API keys can manage any sub-account simply by specifying the specific sub-account on which an action is to be performed. Specific sub-account API keys may also be permissioned for specific roles on specific sub-accounts. See below for some examples.

In this example, Alice, Bob, and Eve are members of a single institution. Alice’s API key has Admin and Auditor permissions at the master account level, whereas Bob’s API key only has Trading access to the ‘Stat Arb’ sub-account and Eve’s API key only has Trading access to the ‘Alpha One Strat’ sub-account.

All of our existing REST API endpoints are available to master account API keys. For more information, please see our .

3. Instant Fund Transfers Between Sub-accounts

You can instantly transfer crypto or fiat currency between sub-accounts at no charge. Such transfers are internal book transfers or “off-chain” and therefore not broadcast to a given blockchain. As a result, they are instant, free, and private — they cannot be viewed by third parties.

4. Aggregation of Volume for Trading Fee Discounts

When we calculate an institution’s volumes for the purposes of volume-based trading fee discounts, we aggregate the trading volume for all of its sub-accounts. This makes it easier for institutions that use sub-accounts for their trading strategies to earn volume-based trading fee discounts.

5. Offer Gemini Services to your Customers

Institutions can also use sub-accounts to offer Gemini’s services to their own customers. By creating a sub-account for each of your customers you can custody assets, manage balances, and execute trades or other actions on their behalf.

If you have any questions or need help getting started with sub-accounts, please contact us at .

Onward and Upward,

Team Gemini

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026

Gemini 2.0: A Bridge to the Future of Money and Markets

MORE FROM TEAM GEMINI

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 04, 2026