JUL 13, 2023

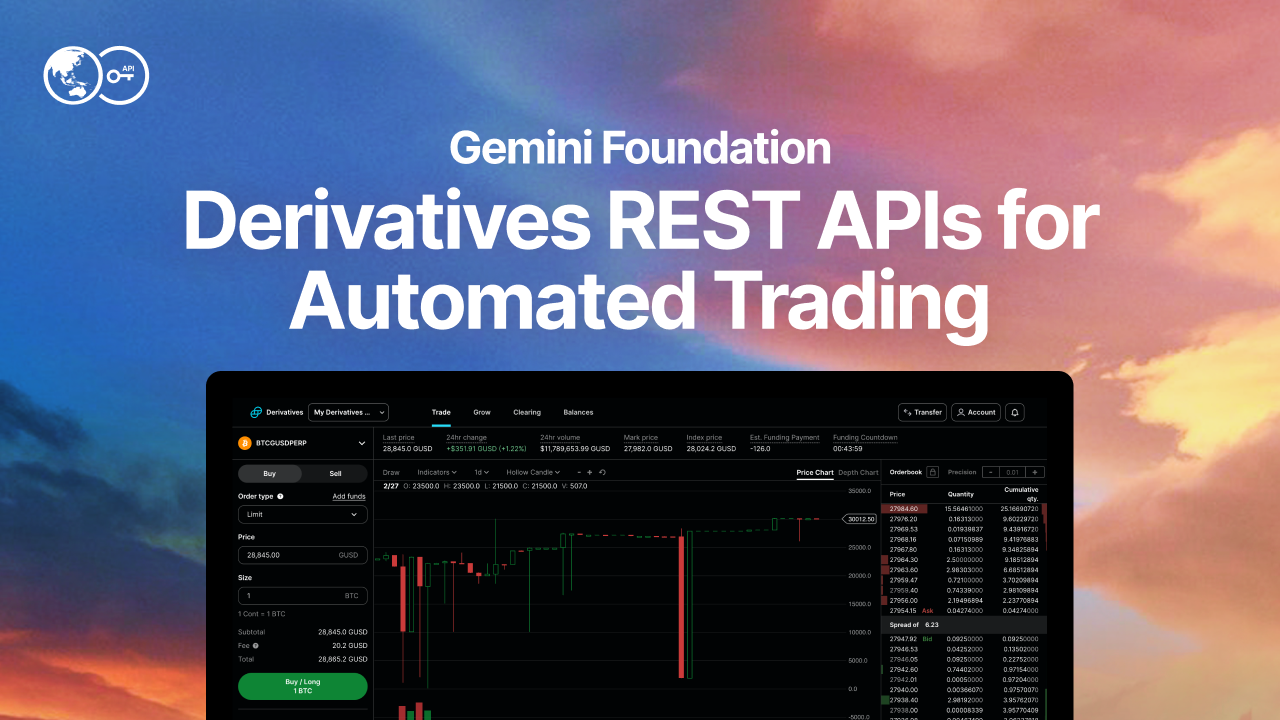

Announcing REST APIs for Automated Derivatives Trading on Gemini Foundation — a Non-US Derivatives Platform

At Gemini, we are committed to continuously enhancing your trading experience. Today, we're thrilled to unveil a set of rich APIs that enable our derivatives traders to automate their trading experiences on Gemini to take advantage of market fluctuations.

Advantages of REST APIs

Gemini's Derivatives trading REST APIs offer a powerful interface for seamless interaction with our platform. By using our REST APIs, you can streamline your derivatives trading activities, maximize time-efficiency, and capitalize on market opportunities with unparalleled precision.

- Automated Crypto Trading: REST APIs empower you to automate your trading strategies, facilitating swift and accurate execution of trades. Use the potential of algorithmic trading and establish automated processes that complement your individualized trading style.

- High-Frequency Crypto Trading: REST APIs enable high-frequency trading, allowing you to seize on rapidly changing market movements. You’ll have access to the pace and flexibility essential for successful high-frequency trading strategies.

- Crypto-Focused Developer-Friendly Environment: At Gemini, we understand the importance of creating a conducive environment for developers. Our REST APIs, designed with developers at heart, can be seamlessly integrated into your custom applications, proprietary tools, or trading bots.

These features pave the way for innovative solutions and tailored customization in the crypto trading space. Harness the power of REST APIs for derivatives trading on Gemini and revolutionize your cryptocurrency trading experience.

Getting started with REST APIs for derivatives on Gemini is straightforward. Simply visit our to access instructions on how to integrate our REST APIs into your trading workflow.

Opening a Derivatives Account

Derivatives trading is available via the ActiveTrader interface. To enable ActiveTrader, simply log in to your Gemini account on your desktop or mobile browser, click on "Account" in the top right corner, and select "ActiveTrader”.

Once you have ActiveTrader set up, you’re ready to create a derivatives account. If you prefer a video walkthrough, watch our .

Alternatively, follow these steps to start trading derivatives today:

- to ActiveTrader via the web

a) If you don’t have ActiveTrader enabled yet, . - Select “Open a Gemini Derivatives account”

- In a single step:

a) Create a new Gemini Derivatives account

b) Read and accept the derivatives-specific Terms and Conditions

c) Read and acknowledge the Risk Disclosure - Transfer GUSD into your Gemini Derivatives account

- Start trading!

Stay tuned as we continue to introduce more developments to improve the trading experience for all our derivatives customers.

Onward and Upward,

The Gemini Foundation Team

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026