OCT 03, 2024

Global Crypto Funds See 10-Week High, but Bitcoin Falls Amid Conflict in Middle East

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about how to earn crypto rewards.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -6.9% | $60,734.04 |

$60,734.04

-6.9%

| |

Ether

ETH | -11.4% | $2,345.21 |

$2,345.21

-11.4%

| |

API3

API3 | -22.8% | $1.272 |

$1.272

-22.8%

| |

Uma

UMA | +18.8% | $2.8544 |

$2.8544

+18.8%

| |

Fetch.ai

FET | -17.4% | $1.35175 |

$1.35175

-17.4%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Oct. 3, 2024, at 2:50 pm ET. . All prices in USD.

Takeaways

- Bitcoin fell following the news of Iran’s retaliation on Israel, and the election of Japan’s new prime minister: The decline comes after a recent rally spurred by the Federal Reserve's rate cut.

- Net inflows into global crypto funds reached $1.2 billion last week, marking their largest increase in 10 weeks: US-based spot bitcoin ETFs contributed $1.1 billion in these inflows, while Ethereum products ended a five-week streak of outflows by adding $87 million.

- Changpeng Zhao, founder of Binance, was released from prison after completing a four-month sentence for failing to establish money laundering controls: Zhao paid a $50 million personal fine and is no longer allowed to hold executive positions at the company.

- Ohio State Senator Niraj Antani introduced a bill that would require all political subdivisions in Ohio to accept cryptocurrency payments for state and local taxes: The proposal also allows state universities and pension funds to invest in cryptocurrencies, positioning Ohio at the forefront of crypto adoption.

- More than 94% of FTX's Dotcom creditors voted in favor of a reorganization proposal: The proposal would see 98% of creditors receiving at least 118% of their claim value.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Crypto Prices Drop After Iran Retaliates Against Israel

Bitcoin has experienced a sharp pullback after enjoying a broad rally, driven in part by the US Federal Reserve's 50 basis-point rate cut nearly two weeks ago.

The selloff, which saw bitcoin fall to around $60,000, has made this week the worst beginning to so-called ‘Uptober’, according to Presto Research.

The selloff was also triggered in part by the election of Shigeru Ishiba as Japan's new prime minister; a move seen as signaling a shift toward tightening monetary policy. Ishiba is expected to support the Bank of Japan's (BOJ) plan for higher interest rates, which has increased uncertainty among investors in the region. The news of Ishiba’s election caused the yen to increase in value and led to a sharp decline of 5% in Japan's Nikkei stock average.

The market skepticism comes shortly after the Fed implemented rate cuts for the first time in more than four years, sparking a short-lived rally in the digital asset sector. Investors will be hoping for another cut at their next meeting in early November, with traders betting they will cut rates by another 50 basis points.

Crypto Funds Saw Largest Net Inflows in 10 Weeks

The positive activity marks the largest net inflow in 10 weeks, fueled in part by expectations of dovish monetary policy in the US and positive price momentum.

Additionally, the recent SEC approval for trading options linked to BlackRock’s spot bitcoin ETF helped improve sentiment. US-based funds made up the majority of the inflows, generating $1.2 billion, with spot bitcoin ETFs accounting for $1.1 billion. Bitcoin investment products saw the majority of net inflows, totaling $1.1 billion globally. Additionally, short bitcoin investment products garnered $8.8 million amid bitcoin’s price increase last week.

Ethereum-based investment products also saw an end to their five-week streak of outflows by gaining $87 million.

Binance Founder Changpeng Zhao Released from Custody After Serving Prison Sentence

Zhao pleaded guilty in November to failing to implement sufficient anti-money laundering measures at Binance.

As part of a settlement agreement, Zhao agreed to pay a $50 million fine, while Binance paid $4.3 billion to address allegations involving violations of anti-money laundering and sanctions laws. This agreement also required Zhao to relinquish his role as CEO of the company and prevents him from having executive roles there in the future.

Binance's CEO is now Richard Teng, a former head regulator for the Abu Dhabi Global Market.

Ohio Senator Proposes Bill to Allow Crypto Payments for State Taxes

The bill mandates that all political subdivisions in Ohio must accept digital assets such as bitcoin, though the specific cryptocurrencies are reportedly still to be determined.

This would not be the first time the state has implemented this initiative. In 2018, Ohio allowed businesses to pay taxes using bitcoin in a short-lived effort led by then-State Treasurer Josh Mandel. However, the initiative ended when the Ohio Attorney General determined that the State Board of Deposits needed to approve the program, which ultimately did not happen.

The proposed legislation would also allow state universities and pension funds to invest in cryptocurrencies. If approved by the board, the proposal would significantly expand Ohio’s involvement with digital assets, and could be a boon to the real-world use cases for the asset class.

More Than 94% of FTX Dotcom Creditors Approve Reorganization Plan

According to a filing by Kroll Restructuring Administration, almost all classes of creditors approved the plan. “Dotcom creditors” is the term applied to clients of FTX who were serviced by their off-shore exchange.

Specifically, 94.48% of creditors in the “dotcom customer entitlement claims” class voted in favor, representing around $6.83 billion in claims. Additionally, just over 89% of creditors in the “US customer entitlement claims” class and 95.88% of the “dotcom convenience claims” class supported the plan, representing $60.99 million and $223.59 million, respectively.

The bankruptcy plan stipulates that about 98% of creditors must receive at least 118% of their claim value in cash, with claims evaluated based on the value of the relevant cryptocurrencies at the time. Voting concluded in August and if confirmed in the upcoming confirmation hearing on October 7th, would see a huge number of creditors of the platform reimbursed.

-The Gemini Team

data as of 5:16 pm ET on Oct. 2, 2024.

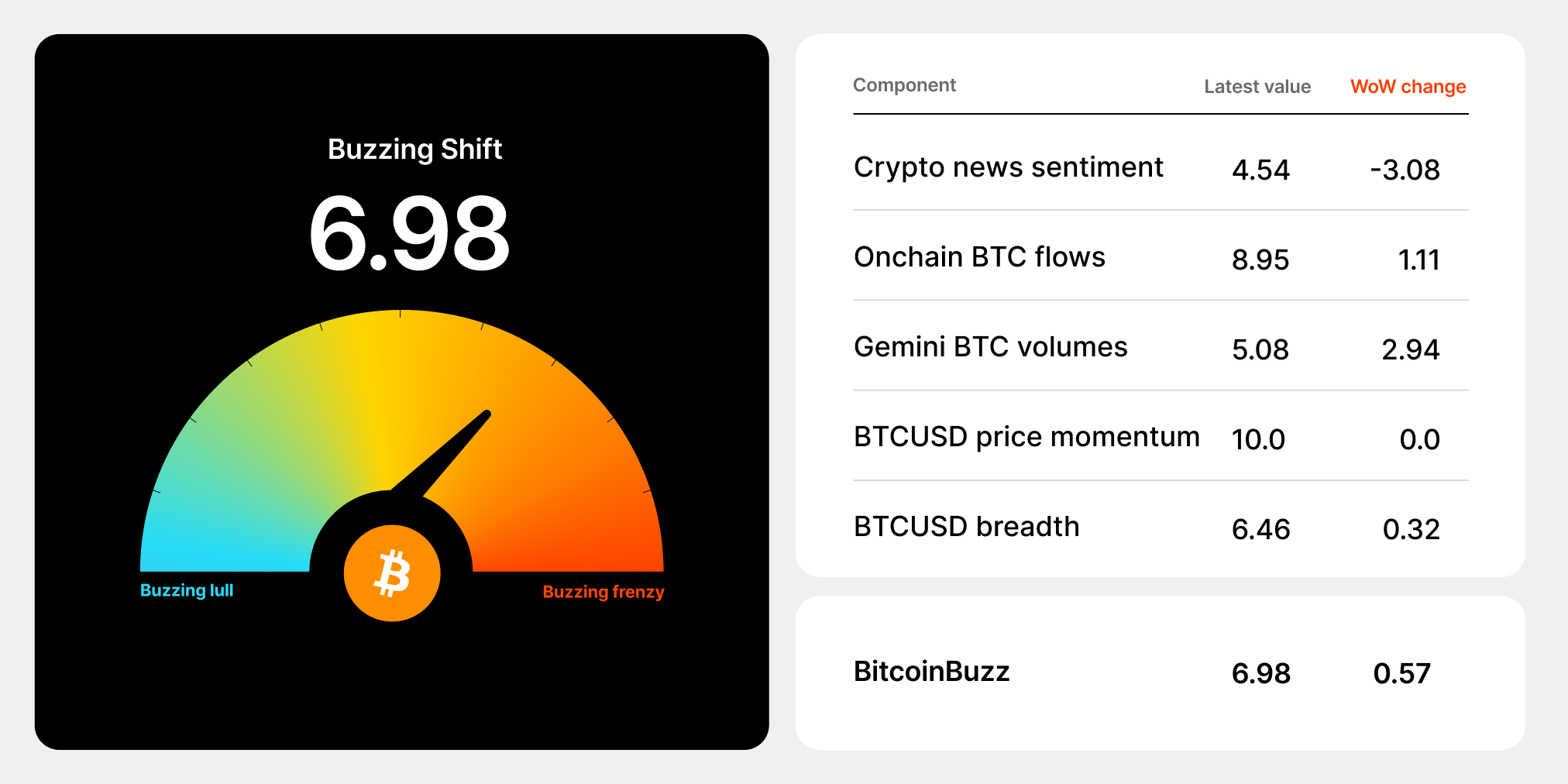

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

How Can I Make Returns or Rewards on My Crypto?

As the blockchain industry evolves, more crypto holders are looking for ways to generate a return on their assets. For some, this process involves minting new tokens that can be sold for profit, while others choose to stake their tokens and earn rewards as validators. Many users are also engaging with centralized and decentralized lending protocols that can generate additional returns through yield farming. Alternatively, some crypto rewards credit cards are now offering bitcoin (BTC) instead of cash or points. Although all of these options present opportunities, investors should always consider the risks associated with each. For example, staking usually requires that assets remain locked in a smart contract, which can expose investors to negative market movements and other staking-related risks. Further, DeFi protocols operate via automated smart contracts that may include vulnerabilities that can threaten security.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026