NOV 16, 2025

Gemini Tokenized Stocks Are Now Trading Fee-Free

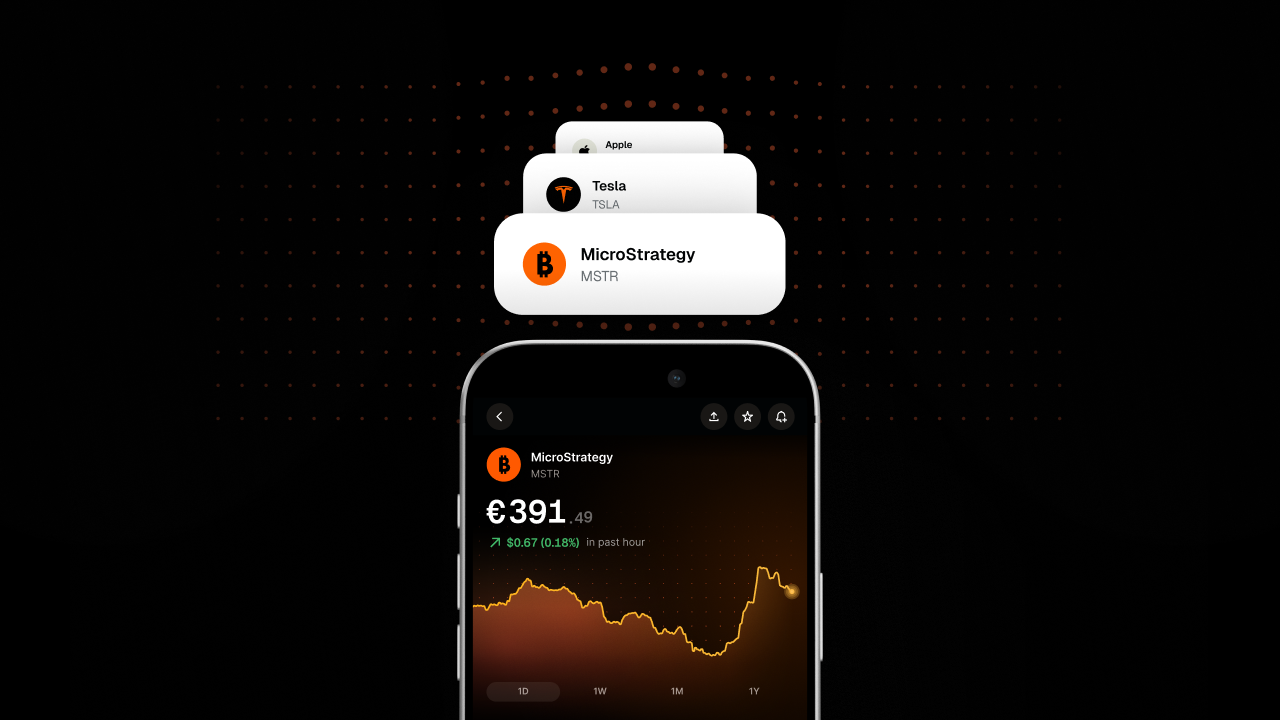

As part of our continuous improvements to tokenized stocks on Gemini, we’re pleased to announce that Gemini1 customers in the European Union can now enjoy tokenized stocks trading with no Gemini fees, offering a frictionless way to gain exposure to traditional equities.

Gemini Tokenized Stocks bring the world’s leading equities onchain, combining the accessibility of crypto with the familiarity of traditional markets. Each token mirrors the value of an underlying share and settles near-instantly in EUR or USD. With no additional fees to trade tokenized stocks, you can diversify your portfolio by purchasing fractions of US equities 24/7/365, all from within the Gemini platform*.

Gemini Tokenized Stocks are minted through our partner Dinari2, a leading provider of tokenized US public equities. By leveraging Dinari’s framework, Gemini ensures that each tokenized stock faithfully tracks the price of the underlying asset while offering a cryptographically secured onchain record.

Take advantage of trading with no Gemini fees and start .

Onward and Upward

Team Gemini

* Gemini includes a spread in the price when you buy or sell tokenized stocks. This allows us to lock in a price to execute the trade during the transaction review period. No trading fee is applied. All purchases and sales will be subject to fees and other conditions as set forth by Dinari.

[1] Tokenized stocks or dSharesTM are made available via a platform operated by Gemini Intergalactic EU Artemis, Ltd, (“Gemini”), which is authorised and regulated by the Malta Financial Services Authority (“MFSA”) under the Investment Services Act (Cap. 370, Laws of Malta). Gemini is authorized to provide the following MiFID investment services: dealing on its own account and with the execution of orders on behalf of other persons. Tokenized stocks offered in Europe are digital derivatives linked to public equity securities.

[2] About Dinari and dShares. Tokenized stocks offered by Dinari, Inc. (“Dinari”) are called dSharesTM. All dSharesTM are backed 1:1 by the corresponding U.S. equity and offer the same economic rights as the underlying security, where permitted. All dSharesTM are held with a regulated custodian and are issued by Dinari, a U.S. SEC‑registered transfer agent. Tokenized stocks offered in Europe are digital derivatives linked to public equity securities. dSharesTM are offered for purchase and sale directly from Dinari, which is not affiliated with Gemini or its affiliates.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake, or hold any digital asset or security or to engage in any specific trading strategy. Gemini makes no representation or warranty of any kind, express or implied, as to the accuracy, completeness, timeliness, suitability or validity of any such information and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Derivatives are complex instruments involving a high degree of risk. These products are not suitable for all investors and require a full understanding of the risks involved and should seek independent advice if needed. Tokenized stocks offer risks associated with a direct investment in public securities. They may experience sharp price fluctuations due to market sentiment, economic conditions, earnings announcements, interest rate changes, and geopolitical events. Such volatility can lead to significant and sudden losses in token value. There may be fees and charges associated with the product which you should carefully consider.