MAY 09, 2024

FTX Customers To Be Paid Back, Robinhood Receives Wells Notice, and Marathon Digital To Join S&P SmallCap 600

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we dive into key components of an anti-money laundering program.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +5.93% | $62,119.07 |

$62,119.07

+5.93%

| |

Ether

ETH | +1.21% | $3,005.00 |

$3,005.00

+1.21%

| |

Render Token

RNDR | +39.27% | $11.115 |

$11.115

+39.27%

| |

Livepeer

LPT | +25.18% | $15.6022 |

$15.6022

+25.18%

| |

API3

API3 | +17.17% | $2.537 |

$2.537

+17.17%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, May 9, 2024, at 11:45am ET. . All prices in USD.

Takeaways

-

FTX customers to get money back: Lawyers for bankrupt crypto exchange FTX said customers will receive the funds lost when FTX went bankrupt in November 2022, plus interest. The payout will likely take months and still requires approval from a bankruptcy judge.

-

Regulator cracks down on Robinhood: The SEC has issued a Wells Notice informing the crypto arm of Robinhood that it will face an enforcement action. Robinhood maintained the crypto token assets in question are not securities and expressed readiness to contest any charges.

-

Grayscale's Bitcoin Trust (GBTC) reverses four-month outflow trend, BTC remains stable: The ETF saw significant new inflows and contributed to a positive shift in the overall spot Bitcoin ETF market. Meanwhile, the price of BTC remained stable over the past week as investors settle into what one analyst described as “post-halving boredom.”

-

Binance CEO Richard Teng calls for release of Tigran Gambaryan: Nigerian authorities have detained the crypto exchange’s compliance officer for alleged illegal transactions.

-

Hacker responsible for stealing $125M from Poloniex in November moves $35.3M worth of Ether and Bitcoin: Some funds were moved to the sanctioned mixer Tornado Cash in an attempt to obscure the origins of the stolen funds.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

FTX To Return Money to Customers

As part of the plan, FTX creditors and thousands of customers expect to receive 118% of the assets held on FTX via cash payments.

"We are pleased to be in a position to propose a chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors,” FTX CEO John J. Ray III said in a statement.

The news comes roughly 17 months after FTX went bankrupt, with customers losing some $8 billion almost immediately. FTX founder Sam Bankman-Fried resigned as CEO soon afterward. In March, Bankman-Fried was sentenced to 25 years in prison for a litany of fraud and conspiracy violations he committed while CEO.

After FTX collapsed, Ray, who had previously overseen Enron’s unwinding, took over as CEO, saying the mess he inherited was “unprecedented.” But FTX lawyers were able to pool together money the company had amassed through successful investment in startups and digital currencies that have soared in value since the exchange went under.

Lawyers have not settled on an exact timeline for the payouts, but the plan is likely to take months and still needs sign off from the federal judge overseeing the bankruptcy.

There’s one other major downside for FTX customers. If they held BTC at the time of the bankruptcy, they would be entitled to a payout of BTC’s value in November 2022 (about $18K) and not the current price of BTC (about $62K).

Robinhood Receives SEC Enforcement Notice

“After years of good-faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business,” Robinhood chief legal, compliance, and corporate affairs officer Dan Gallagher said.

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

The SEC has maintained that most cryptocurrencies should be regulated as securities, a stance that has led to ongoing disputes with major crypto platforms.

“The potential action may involve a civil injunctive action, public administrative proceeding, and/or a cease-and-desist proceeding and may seek remedies that include an injunction, a cease-and-desist order, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation, and limitations on activities.”

Grayscale BTC Trust Ends Outflow Streak

Since January 11th, GBTC has seen an average daily outflow of $218M, totaling over $17.5B. However, the pattern shifted May 3rd, when GBTC registered an inflow of $63M. The landscape for spot Bitcoin ETFs in the US has also altered, with net positive inflows of $378.3M after a week of declines.

Additional inflows on May 6th brought GBTC's total to $66.9M. The resurgence in inflows highlighted a broader positive trend in the US spot BTC ETF market, with major contributions from industry leaders like BlackRock’s iShares and Fidelity Investments.

Marathon Digital Soars With Inclusion in S&P SmallCap 600

The news comes after S&P Global announced the Bitcoin mining company would be included in the S&P SmallCap 600 index.

Concurrently, the company disclosed a new bonus plan in an SEC filing, proposing up to $32.9M for top executives, including CEO Fred Thiel. Marathon Digital’s stock jumped 18% on Friday following the news.

Despite this week's gains, Marathon Digital’s stock remains down roughly 14% year-to-date. Bitcoin mining firms face increased costs as a result of BTC reward halving last month.

Binance CEO Calls for Release of Detained Employee

Teng said Gambaryan was in Nigeria as a financial crime expert for policy discussions, not as a negotiator or decision-maker. Gambaryan, alongside Binance's Africa regional manager, Nadeem Anjarwalla, faces charges linked to alleged illegal transactions by Binance, with Anjarwalla having escaped custody in March.

Teng emphasized Gambaryan's extensive background in fighting financial crimes with US agencies and criticized the Nigerian authorities for setting a concerning precedent by detaining a foreign company’s employee.

Poloniex Hacker Transfers Stolen Assets to Tornado Cash

Blockchain data reveals that the hacker transferred 1,100 ETH, valued at approximately $3.3M, to the sanctioned coin mixer Tornado Cash in multiple batches of 100 ETH. Additionally, the hacker relocated 501 bitcoin, worth about $31M, to an unlabelled wallet on April 30th.

Despite these movements, the hacker still possesses around $181M in various cryptocurrencies. Tornado Cash, known for its ability to obscure the origins of crypto tokens, was sanctioned by the US Treasury in 2022 following criminal misuse by the North Korean hacking group Lazarus and others.

-From the Gemini Trading Desk

data as of 11:15 am ET on May 9, 2024.

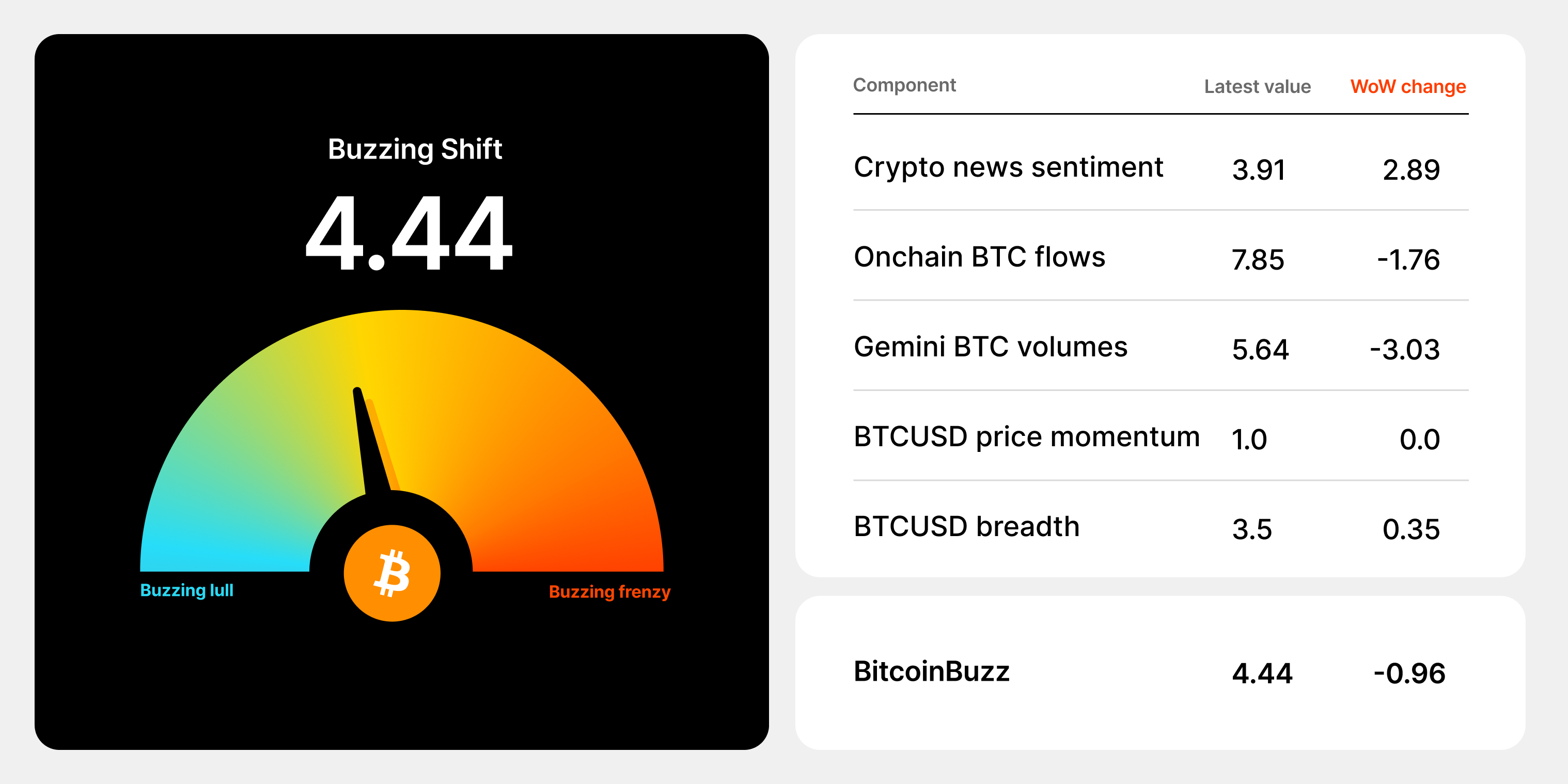

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Key Components of an Anti-Money Laundering Program

Anti-Money Laundering (AML) refers to the set of processes, regulations, and rules that combat money laundering, terrorist financing, theft, and other financial fraud. Some of the notable illegal activities that AML programs target include tax evasion, market manipulation, public fund misappropriation, and trading in illicit goods. Global AML regulators have fought money-laundering operations for decades, and AML imperatives also apply to the financial technology (FinTech) sector and cryptocurrencies.

Individual jurisdictions, led by AML watchdogs like the Financial Action Task Force (FATF), develop their own measures to combat domestic money laundering. Policies can vary greatly from country to country. A key facet of most Anti-Money Laundering compliance programs is the Know-Your-Customer (KYC) process for verifying customers’ identities in the financial services industry and FinTech sector. AML is the broader umbrella program that denotes the other measures money service businesses take to prevent and combat money laundering and other financial crimes.

In general, a financial institution’s AML program should adhere to its local Anti-Money Laundering laws, but the following employees generally all play a role in the creation and execution of an AML program:

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026