NOV 03, 2023

Weekly Market Update - Bitcoin Forms Golden Cross, Altcoins Surge, Fed Holds Rates, and SBF Found Guilty On All Counts

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore the basics of technical analysis in crypto markets.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.63% | $34,872 |

$34,872

+2.63%

| |

Ether

ETH | +1.50% | $1,808 |

$1,808

+1.50%

| |

SushiSwap

SUSHI | +106% | $1.2736 |

$1.2736

+106%

| |

Geojam

JAM | +79.10% | $0.000753 |

$0.000753

+79.10%

| |

Qredo

QRDO | -28.20% | $0.03833 |

$0.03833

-28.20%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, November 3, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Bitcoin holds on to gains as a golden cross appears: Bitcoin (BTC) consolidated around $35k USD this week after its price action exhibited a “golden cross” on the daily BTC chart. Market observers have suggested that such price action could portend a continued upward trajectory for the leading crypto.

- Sam Bankman-Fried found guilty on all counts: Sam Bankman-Fried, the founder and former CEO of FTX, was found guilty on all seven counts leveled against him. He faces up to over 100 years in prison. The sentencing hearing is tentatively set for March 28, 2024. In closing arguments this week, prosecutors argued that SBF built his FTX empire on a “foundation of lies and false promises” describing him squarely as a liar who fabricated a “pyramid of deceit.” The defense sought to convince the jury that SBF had simply made mistakes that culminated in the collapse of his once $32 billion empire.

- Solana leads altcoin charge as ether lags: Altcoins performed well this week, with Solana (SOL) a notable outperformer, rallying ~24%. Research analysts have pointed to SOL’s high throughput and growing developer activity as fundamental catalysts for the rally. Other notable high-performers include Decentraland (MANA) +16%, Uniswap (UNI) +13%, Cardano (ADA) +11%, Polkadot (DOT) +11% and Ripple (XRP) +11%. Ether (ETH) prices did not follow suit gaining around 1.7% this week.

- Federal Reserve holds rates steady and yields continue to dip: The Federal Reserve held its target interest range between 5.25%-5.5% this week. The Fed did not rule out the possibility of future interest hikes depending on economic data, but most analysts do not expect any additional hikes this year. Treasury yields continued their decline, with the 10-year treasury yield dropping 12 basis points after the Fed meeting.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Consolidates After Hitting Golden Cross

consolidated around $35k USD this week, continuing to hold on to gains after last week’s rally. The October rally pushed the price action of BTC to exhibit on the daily , a widely used technical indicator where the 50 day-moving-average exceeds the 200 day-moving average. that such price action could portend a continued upward trajectory for the leading crypto.

Bitcoin continues to lead crypto amidst the SEC’s ongoing review of the spot bitcoin ETF applications with , further extending its rally to 54% this week.

Sam Bankman-Fried Convicted On All Seven Counts of Fraud

Sam Bankman-Fried, the founder and former CEO of FTX, . After deliberations started on Thursday afternoon, the jury swiftly handed down its verdict a couple hours later on Thursday evening, ending the four-week trial. SBF faces up to over 100 years in prison. His sentencing hearing is tentatively set for March 28, 2024.

In closing arguments this week, argued that SBF built his FTX empire on a “foundation of lies and false promises” describing him squarely as a liar who fabricated a “pyramid of deceit,” of FTX users’ funds. The prosecution focused on contradicting, ambiguous, and non-committal answers from SBF with quotes from past interviews or social media posts.

In contrast, the defense sought to convince the jury that SBF had that culminated in the collapse of his once $32 billion empire. They argued that he had conducted himself without committing crimes or asking associates to commit any.

Altcoins Push Higher With Solana Leading the Charge

Altcoins have also experienced a resurgence in the past week. was a notable outperformer, rallying ~24% this week. have pointed to SOL’s high throughput and continued growing developer activity as fundamental catalysts for the token’s rally since the FTX fallout. Other notable large cap altcoin performers include +16%, +13%, +11%, +11% and +11%.

Notably absent from that list is , which has gained 1.7% since last week. The pair hit its lowest level since May 2021, ~0.05.

Federal Reserve Keeps Rates Steady as Growth Improves; Treasury Yields Decline

The Federal Reserve held its between 5.25%-5.5% at Wednesday’s Federal Open Market Committee (FOMC) meeting, as expected. The Fed did not rule out the possibility of future interest hikes depending on economic data. Most analysts have ruled out any additional hikes for the year’s last FOMC in December. The move comes as inflation at 3.7% as of September 30, well above the Fed’s 2% target.

Economic growth has been strong of late, with third-quarter gross domestic product (GDP) , and September employment growth . Following the meeting, the Fed on economic growth to say that “economic activity expanded at a strong pace in the third quarter,” having previously used the phrase “solid pace.”

October job growth released Friday showed with 150,000 new jobs created, which was below expectations. the Fed would welcome the report.

Treasury yields continued their decline, with the dropping 12 basis points on Wednesday after FOMC to 4.674% after topping 5% last month. Yields fell even further following Friday's jobs report.

Crypto and traditional markets reacted favorably to the Fed's decision to the keep rates steady. rose past $35.5k following the news, the rose just over 1% on Wednesday, and the ended the day up over 1.5%.

-From the Gemini Trading Desk

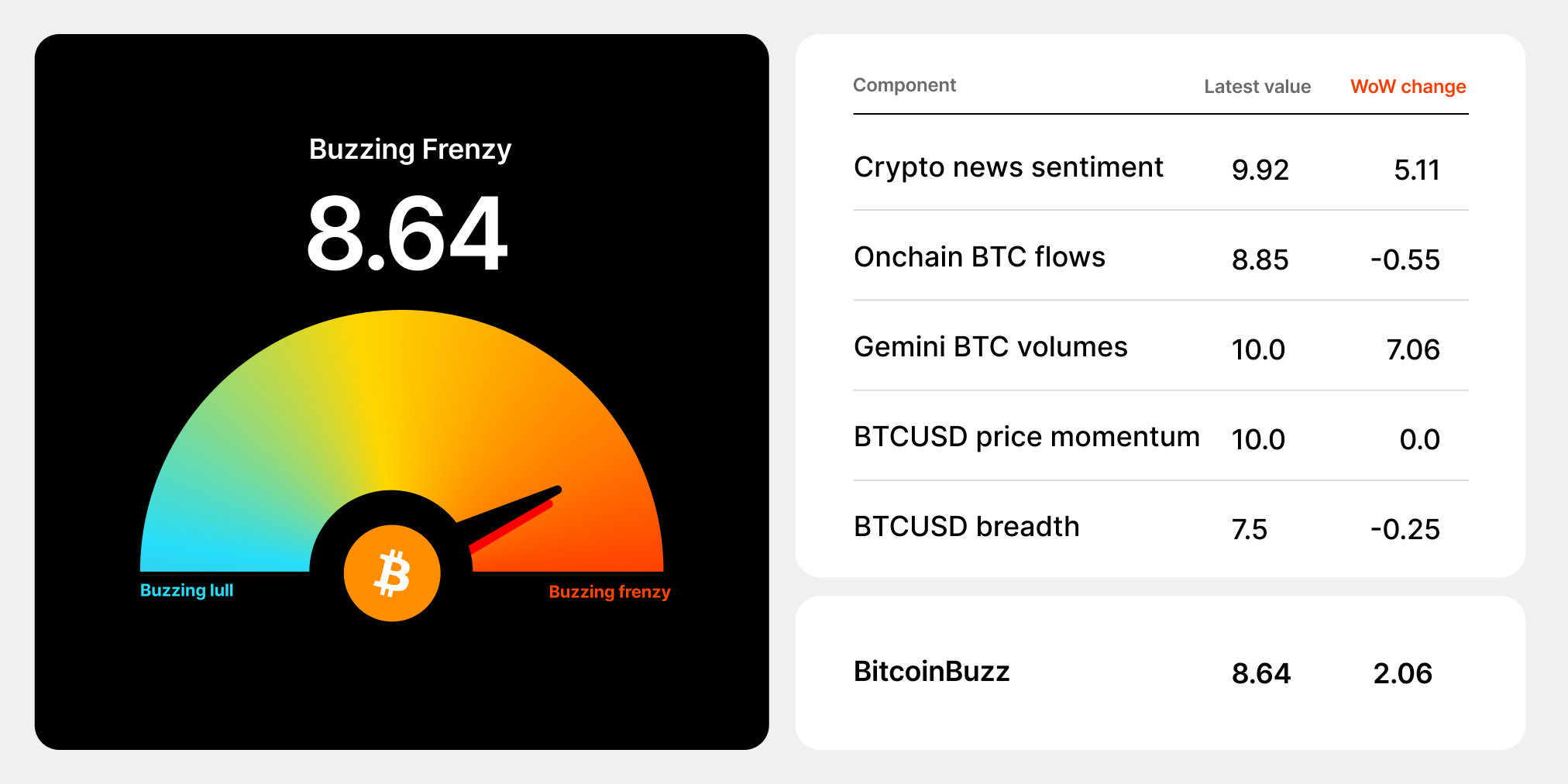

data as of 5:30pm ET on November 3, 2023.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Basics of Technical Analysis in Crypto Markets

Technical and fundamental analysis makes up the backbone of investment research. To determine an asset’s fair or implied value, fundamental analysts look at macro and microeconomic trends, industry conditions, and the competitive landscape. Technical analysts, on the other hand, aim to understand market sentiment by looking for patterns and trends and to predict price movements by examining historical data like price and volume.

Overview of Technical Analysis Tools

Cryptocurrency technical analysis usually relies on charting patterns, statistical indicators, or both. The most commonly used charts are candlestick, bar, and line charts. Each can be created with similar data but presents the information in different and useful ways. Some of the most common include:

- : A technical analysis indicator that measures the change in data points over time by producing a series of averages.

- : A tool used in technical analysis that helps determine whether asset prices are high or low on a relative basis.

- : A momentum indicator used in technical analysis to determine the magnitude of recent price changes.

- : A concept applied to an investment’s annual rate of return; provides insight into that investment's historical volatility.

Other statistical tools that investors may turn to include , , , and .

At its core, technical analysis seeks to find the way to best anticipate trends. For novice crypto investors, these tools might seem involved — and sometimes they are. But, cryptocurrency technical analysis can provide a window into price movements that could help investors make more informed decisions.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 08, 2026

Trade Crypto With up to 5x Leverage: Gemini Margin Trading Is Here

COMPANY

JAN 08, 2026

Gemini Predictions™ Unveils Contracts for Sporting Events

WEEKLY MARKET UPDATE

JAN 08, 2026