SEP 18, 2025

Federal Reserve Makes First Rate Cut of 2025, London Stock Exchange Launches Tokenized Private Funds, and PayPal Pushes Crypto Payments

Welcome to our Weekly Market Update.* Explore weekly movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about how to buy crypto with an IRA.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.95% | $117,635.92 |

$117,635.92

+2.95%

| |

Ether

ETH | +4.80% | $4,624.05 |

$4,624.04

+4.80%

| |

Dogecoin

DOGE | +15.10% | $0.28606 |

$0.28606

+15.10%

| |

Avalanche

AVAX | +14.00% | $33.221 |

$33.221

+14.00%

| |

Solana

SOL | +9.46% | $247.98 |

$247.98

+9.46%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of September 18, 2025 at 12:35 pm ET. . All prices in USD.

Takeaways

- Federal Reserve chairman Jerome Powell announced the first rate cut of the year with a 25bps reduction, bringing the federal funds rate between 4% and 4.25%: Markets are reportedly anticipating further cuts in both October and December in response to a slowing job market and moderate inflationary pressures.

- PayPal will let US users send bitcoin, ether and other supported cryptos directly across PayPal and compatible wallets: The rollout will also introduce one-time send/request links for crypto transfers and exempts transfers from IRS 1099-K reporting, according to the company.

- London Stock Exchange Group has launched a tokenization platform to help issuers create and settle tokenized private funds: Investment manager MembersCap has already used the service with further platform features yet to be announced.

- Ethereum’s total stablecoin supply reached an all-time high of $166 billion, up from just under $150 billion a month prior: The growth was largely led by the two leading stablecoins USDT and USDC, which have a combined $135.8 billion worth of tokens on the network.

- Pump.fun generated $3.38 million in daily protocol revenue on Monday, overtaking Hyperliquid: The Solana memecoin launchpad has led a comeback partially fueled by a buyback program which purchases its native token, PUMP.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Federal Reserve Reduces Interest Rates by 25bps in First Cut of 2025

The cut comes after a nine-month pause in funds rates adjustments by the Fed, with analysts describing Wednesday’s cut as a reconciliation of a weakening labor market, with moderate inflation.

“Recent indicators suggest that growth of economic activity moderated in the first half of the year,” read the Fed statement. “Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.”

Traders have reportedly marked a more than 70% chance of further rate cuts in both October and December, with President Donald Trump also applying pressure on the Federal Reserve to accelerate cuts.

pushed above $117,000 following the rate cut, marking its highest price level since August 17.

PayPal Enables Peer-To-Peer Crypto Transfers

The integration is part of a wider effort by the firm which it has dubbed “PayPal World.” The goal is to connect crypto wallets to payment rails.

Another new feature called “PayPal Links” will allow users to generate single-use links to send or request crypto that can be shared via text, chat, or email. The technique will reportedly allow users to send funds easily between their contracts and are said to posit these payments as exempt from IRS 1099-K tax reporting requirements.

PayPal is pushing toward fully integrating digital assets into its products, with the firm previously announcing it plans to expand its crypto payment options for US merchants. Peer-to-peer payments have provided a source of growth for the company, with YoY growth for consumer payment volumes hitting 10% in Q2.

London Stock Exchange Launches Blockchain Platform for Tokenized Private Funds

The platform is built on Microsoft Azure, and allows issuers to service and settle tokenized instruments. The platform has already been used by investment manager MembersCap to raise capital for its tokenized MCM Fund 1.

LSEG has said that its DMI platform is part of a wider strategy which could extend into tokenization of other asset classes. This is likely due to swelling demand for tokenized real-world assets, with some analysts predicting the market to reach a valuation of $30 trillion by 2034.

LSEG is not alone in pursuing an expanded range of tokenized offerings with Nasdaq having recently filed plans to allow tokenized securities trading on their exchange. While Nasdaq’s filing is yet to be approved, it further illustrates the trend of exchanges pushing further into tokenized offerings.

Ethereum Stablecoin Supply Reaches Record High of $166 Billion

Tether’s USDT accounted for the main share of the supply with nearly $88 billion on chain, while Circle’s USDC accounted for roughly $48 billion.

The density of supply on Ethereum highlights its role as a settlement layer for DeFi, and a crucial component of the ecosystem. Some analysts have posited that this could cause a surge in ether demand as its importance to the stablecoin sector grows. The total value of the stablecoin market is now just below $290 billion according to DeFi Llama. Increasing institutional demand for onchain finance and fast settlement is contributing to surging stablecoin use and growing DeFi total value locked (TVL).

Pump.fun Daily Revenue Overtakes Hyperliquid as Memcoin Launchpad Stages Comeback

Pump.fun’s trading volume was nearly $1 billion on the same day. The surge in activity also marks Pump.fun as the third-highest daily revenue earner on the tracker behind Tether and Circle. Hyperliquid has continued to outperform the platform on 7-day and 30-day windows.

Monday was the highest single-day revenue for Pump.fun since February 13 and follows a sharp downturn observed earlier this year. Pump.fun’s protocol revenue dropped to a low of just $206,000 at the beginning of August before its turnaround. The rebound coincided with the launch of an aggressive expansion of the protocol’ buyback initiative, which involves the platform using all prior-day revenue for purchasing the platform’s PUMP token. Since July, the protocol has purchased around 6.7% of the token’s circulating supply.

-Team Gemini

data as of 5:17 pm ET on September 17, 2025.

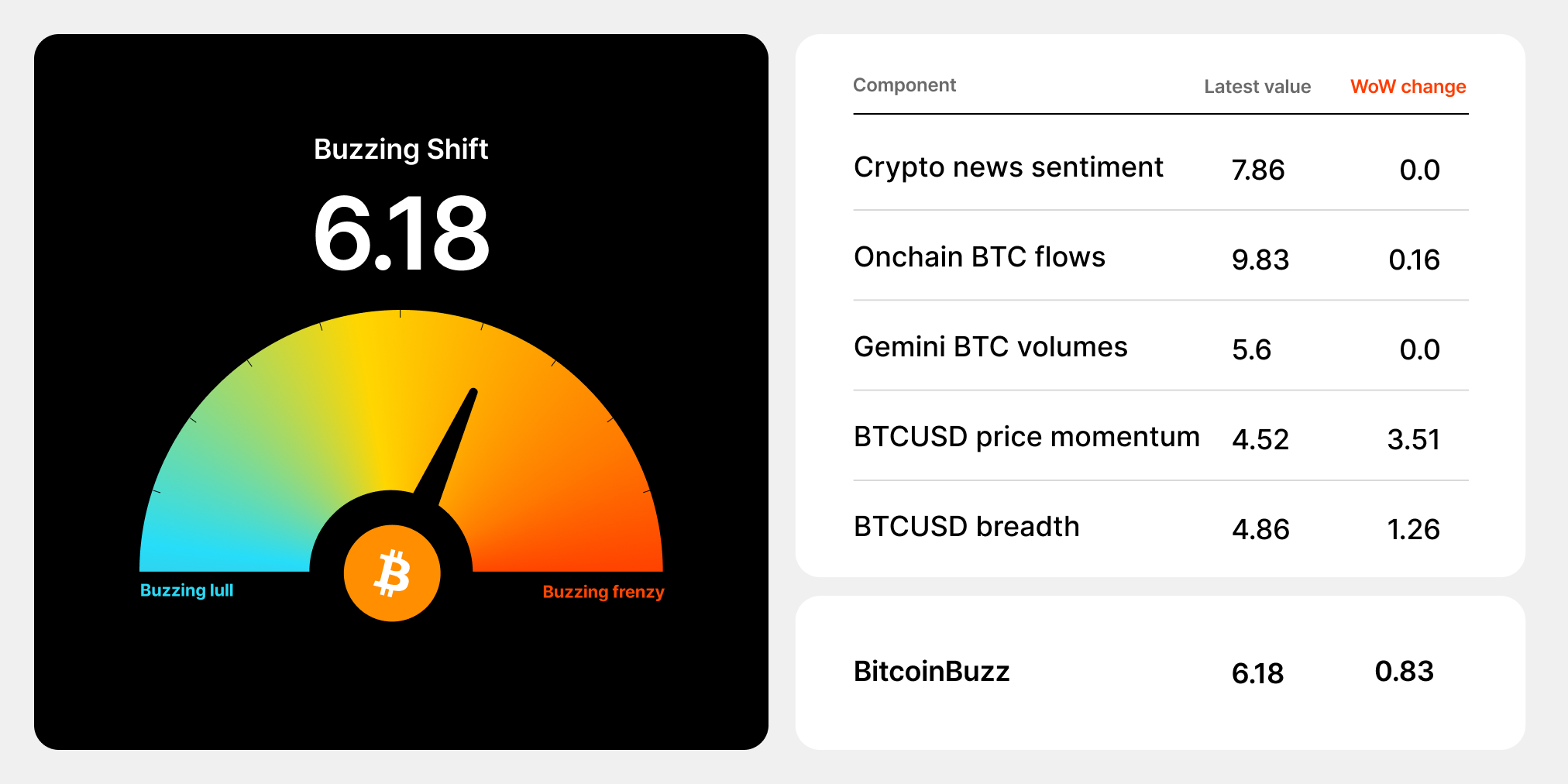

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Buying Crypto with an IRA

IRAs can own bitcoin and other cryptocurrencies. Crypto IRAs offer many advantages, the foremost reason being that the gains made on selling crypto with an IRA are generally not taxable. And if you have a Roth IRA, the profits may come out entirely tax-free at retirement (age 59 ½). For traditional IRAs, the gains are tax-deferred, and owners are taxed as they draw funds out at retirement. These tax outcomes apply to Roth IRAs and Traditional IRAs when buying and selling stocks or mutual funds as well as crypto.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 29, 2026

Tether Launches US-Focused Stablecoin, Fed Pauses Rate Cuts, and Bitcoin Drops Below $84K Amid Broad Tech Pullback

COMPANY

JAN 27, 2026

Gemini Unveils Gemini Credit Card: Zcash Edition

NIFTY GATEWAY STUDIO

JAN 23, 2026