FEB 02, 2024

Fed Votes to Hold Interest Rates Causing Stocks to Tumble, SEC Set to Approve Ethereum ETF by May, and Record Breaking Trading Volumes for Solana DEX in Wake of JUP Airdrop

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we introduce crypto trading pairs.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +6.51% | $43,199.82 |

$43,199.82

+6.51%

| |

Ether

ETH | +3.76% | $2,304.44 |

$2,304.44

+3.76%

| |

API3

API3 | +45.71% | $3.269 |

$3.269

+45.71%

| |

Chainlink

LINK | +28.31% | $18.60 |

$18.60

+28.31%

| |

Uma

UMA | -21.81% | $4.4502 |

$4.4502

-21.81%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, February 2, 2024, at 11:40am ET. . All prices in USD.

Takeaways

- Fed announces interest rates to remain unchanged: The Federal Reserve announced that it would be keeping its benchmark interest rate unchanged during its first Federal Open Market Committee (FOMC) meeting of the year. Although expected, stocks began to tumble as the Fed chairman, Jerome Powell, suggested that the central bank would not be cutting rates at the next meeting in March either.

- Tech earnings mixed: Both the S&P 500 and Nasdaq posted their worst day of the year on Wednesday. Losses were amplified on the day due to a few tech giants such as Alphabet, Microsoft, and Advanced Micro Devices underwhelming with earnings. However, Meta was a standout in Friday’s trading as it posted its best quarterly sales growth in more than two years.

- Bitcoin holds firm above $40k despite a turbulent week: A rally at the beginning of the week amidst a potential interest rate drop was short lived, with the Federal Reserve voting to keep the rate unchanged. Despite an initial sell off, Bitcoin remained above $40k, with price action further strengthened by outflows from Grayscale’s GBTC starting to slow. Bitcoin is currently trading around the $42k level.

- SEC on track to give the green light on Ethereum ETF as soon as May: According to a new report by British multinational bank Standard Chartered, the SEC is set to approve Ethereum (ETH) exchange-traded funds (ETFs) by the final deadline for approval on May 23, potentially doubling the current price of ETH. The report expressed strong confidence in an approval, citing the fact that the regulator has not classified ETH as a security.

- JUP airdrop creates record breaking week for SOL, after a substantial $700M airdrop to Solana Wallets: One of the biggest token airdrops ever took place on the this week, as the Jupiter network started distributing roughly $700 million worth of its JUP token to nearly a million Solana wallets. As a result, trading volumes on the decentralized exchange also reached record levels this week, with the Solana-based decentralized exchange (DEX) seeing more volume than Uniswap.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Federal Reserve Continues to Hold Interest Rates at 23-year High

The Federal Reserve its benchmark interest rate unchanged at the 5.25%-5.50% range during its first Federal Open Market Committee (FOMC) meeting of the year on Wednesday.

Although the outcome was widely expected, as the Fed chairman, Jerome Powell, suggested that the central bank would not be cutting rates at the next meeting in March either. Powell reiterated that they will need to see further progress on inflation numbers returning to the 2% target before rate cuts will begin, which we will likely not see before March.

"I don't think it's likely the Committee will reach a level of confidence by the time of the March meeting to identify March as the time to cut rates." The probability of a rate cut at the March meeting has , down to 34% following the FOMC meeting this week.

Nonfarm payrolls in January indicated continued strong as with unemployment remaining low at 3.7%. The report likely reinforces the path for the Fed to hold interest rates at its next meeting in March as it waits for more evidence of the economy cooling to combat inflation.

Tech Earnings Mixed on the Week

After a strong start to the year for equities and indices reaching record highs, , closing down -1.61% and -1.94% respectively. Losses were amplified on the day due to a few tech giants such as Alphabet, Microsoft, and Advanced Micro Devices on Tuesday evening. in Friday’s trading as it posted its best quarterly sales growth in more than two years and announced it is issuing its first ever dividend. Amazon posted better than expected revenue numbers, with its stock rising 7% on Friday. Apple’s stock, however, was hampered on Friday (-2%) by weak guidance on iPhone sales.

Bitcoin Holding Above $40k Despite a Choppy Week Fueled By Interest Rate Uncertainty

After recovering from its recent low of $38.5k last week, at the start of the week, rallying ahead of the FOMC meeting on Wednesday, before selling off alongside equities as details from the meeting emerged.

Another factor behind Bitcoin trading as high as $43.8k this week was that the , helping to ease some of the selling pressure we have seen since the spot bitcoin ETF launches earlier in January.

The price of Bitcoin has tracked the turns of the inflows/outflows for the spot bitcoin ETFs in aggregate. This week saw a solid week of aggregated inflows as GBTC outflows are showing signs of dissipating with +$255M on , +$247M on , +$198M on , and +$38.5M on . Bitcoin is .

New Report Suggests SEC Could Approve Ethereum ETF by May

The price of Ethereum got a boost on Tuesday, with the ETHBTC pair following the outlining their expectation that the Securities and Exchange Commission (SEC) will approve the launch of an Ethereum ETF as soon as May this year. for the SEC to consider the Ethereum ETF applications from VanEck and Ark 21Shares.

Geoff Kendrick, the research head for the report, outlined his expectations that the price of Ethereum will rise to $4,000 by the projected May 23rd approval date and believes the market is currently underestimating the likelihood of an approval.

A Record Breaking Week for Solana DEX this week with Jupiter (JUP) dropping One Billion JUP Tokens in one of the largest Token Airdrops to Date

Jupiter (JUP) carried out to date on Solana this week, distributing 1 billion JUP tokens to nearly a million different qualifying wallet addresses.

In the first hour after launch, the token price , before sliding lower throughout the day and consolidating around $0.60 on Thursday morning. The project currently has a 1.35bn circulating supply, with 250m for the launch pool, 50m for loans to centralized exchange (CEX) market makers and 50m for any immediate need.

Trading volumes on the decentralized exchange also reached record levels this week, with the Solana based DEX .

-From the Gemini Trading Desk

data as of 5:10pm ET on February 1, 2024.

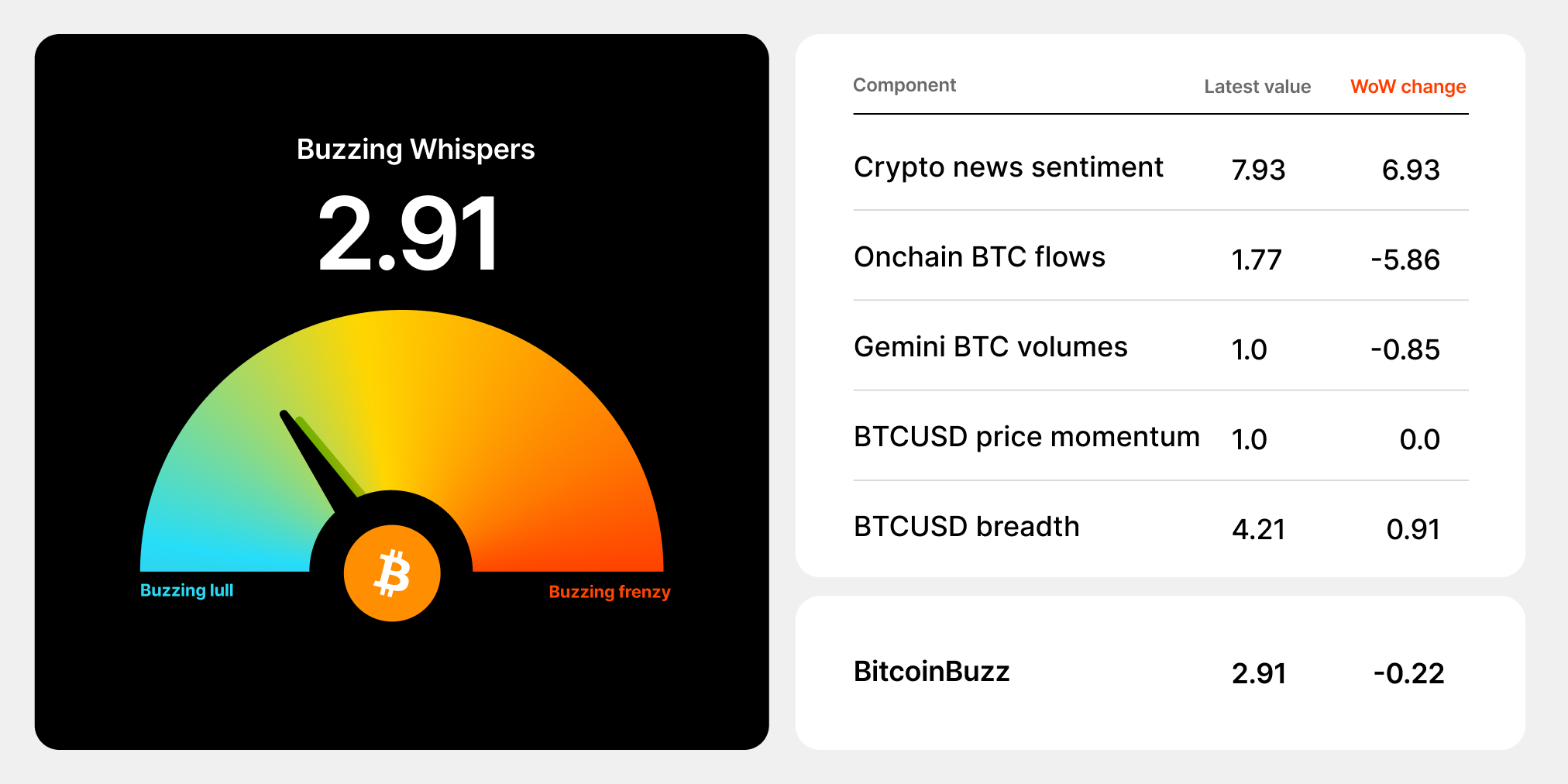

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Unpacking crypto ETFs: What’s all the buzz about?

What is an ETF?

An exchange-traded fund (ETF) is a financial product that is tied to the price of other financial instruments. This structure gives investors a way to gain exposure to an asset or a bundle of assets without buying or owning the asset(s) directly. ETFs can be composed of all kinds of assets including stocks, commodities, and bonds. A digital asset ETF, for example, would allow investors to invest in the underlying digital asset without needing to manage the asset itself or interact with a cryptocurrency exchange.

There are currently almost 3,000 U.S. ETFs on the market that customers can purchase to track the stock market. For example, you can buy a share of the Vanguard Total Stock Market ETF, which aims to track the US Total Stock Market Index.

The history of ETFs

Since 2013, there have been more than a dozen spot bitcoin ETF applications by companies like ARK and BlackRock. The first spot bitcoin ETF was filed by our founders, Cameron and Tyler Winklevoss, in 2013. Spot bitcoin ETFs must be approved by the U.S. Securities and Exchange Commission (SEC). The first spot bitcoin ETFs were approved on January 10, 2024 and it’s expected that the SEC will approve spot Ethereum ETFs on May 23. from Standard Chartered Bank predicts a potential $4,000 target for ETH if it mimics BTC’s pre-approval performance.

What’s the difference between a futures ETF and spot ETF?

A spot ETF is an investment fund that holds a portfolio of assets and can be bought and sold on an exchange throughout the trading day at the current market price. A futures ETF is also an investment fund that holds a portfolio of assets, but instead of buying the assets directly, it invests in futures contracts.

Spot ETFs generally have lower volatility compared to futures ETFs. This is because spot ETFs hold the actual assets, and their value tends to move in line with the performance of those assets. Futures ETFs, on the other hand, can be more volatile due to the leverage and margin considerations involved in trading futures contracts and the potential for price fluctuations in these contracts.

It's important to note that both spot and futures ETFs have their own advantages and considerations, and it's important for investors to carefully evaluate their investment goals and risk tolerance before choosing between them.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026

Trade Crypto With up to 5x Leverage: Gemini Margin Trading Is Here

COMPANY

JAN 08, 2026