APR 04, 2024

ETF Outflows, May Rate Cut Doubts Drop BTC Below $65K, Though Anticipated June Cuts May Provide Boost, As Altcoin and Memecoin Upward Streak Slows, and SBF Is Sentenced to 25 Years

Welcome to our Weekly Market Update.* *Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore the topic of staking. *

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -4.53% | $68,865.91 |

$68,865.91

-4.53%

| |

Ether

ETH | -5.76% | $3,395.79 |

$3,395.79

-5.76%

| |

Ox

ZRX | -39.22% | $0.6838 |

$0.6838

-39.22%

| |

STEPN

GMT | -24.74% | $0.31558 |

$0.31558

-24.74%

| |

The Graph

GRT | -17.84% | $0.3458 |

$0.3458

-17.84%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, April 4, 2024, at 2:30pm ET. . All prices in USD.

Takeaways

- ETF outflows and government movement of crypto assets push price of BTC down: As we have seen in recent weeks, the price of BTC declined alongside increasing ETF outflows, as Cathie Wood’s ARK 21Shares Bitcoin (BTC) ETF experienced its first outflows, dropping from above $70K to a low of $64.5K on Tuesday. Further headwinds included the movement of 30,175 BTC by the U.S. government, sparking concerns over whether the assets would be sold or held in custody.

- Equity and crypto markets impacted negatively by May rate cut doubts: U.S. equities and crypto markets dropped this week as the market ruled out a rate cut coming in May, with the expectation that the June meeting will deliver the first rate cut of the year rising to 62.3%. US manufacturing expanded in March, and the personal consumer expenditures price index accelerated in February from the previous month, suggesting the economy is continuing to grow while progress on inflation has stalled.

- Altcoins and memecoins decline in response to BTC drop: Altcoins saw a heavy pullback in the wake of BTC shifting downward. AI-related tokens in particular saw some of the largest declines, while memecoins also experienced a slight correction following their strong run up in the past couple of weeks.

- SBF sentenced to 25 years on seven counts of fraud and conspiracy: Sam Bankman-Fried (SBF), the founder and former CEO of the collapsed crypto exchange FTX, was sentenced to 25 years in prison last week for seven different fraud and conspiracy charges. The FTX exchange was once valued at $32B at the height of the previous bull market before collapsing as it was discovered that over $8B of customer funds had been stolen.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC Drops in Wake of BTC ETF Outflows, Seized Asset Movement

Cathie Wood’s ARK 21Shares Bitcoin (BTC) ETF experienced , albeit small at $0.3M. However, this was followed up on Tuesday with further outflows of $87.5M, which outpaced the outflows from GBTC for the first time since the launch of the spot BTC ETFs.

As we have seen in recent weeks, the price of BTC declined alongside the increasing ETF outflows, dropping from above $70K to a low of $64.5K on Tuesday. Further headwinds that contributed to the price decline this week include the movement of , related to the seized assets from Silk Road. This weighed on the price of BTC, with market participants speculating about the government's plans for the tokens. Currently it is unclear whether the tokens have already been sold, will be sold in the near future, or are just being held for custody.

Markets React to Rate Cut News

U.S. equities dropped lower to start the week as investors revised their expectation of interest rate cuts this year. The S&P 500 posted a 0.72% decline on Tuesday, while the Nasdaq saw a bigger decline of 0.94% as market participants became more cautious about the size and speed of rate cuts.

The market has now pretty much ruled out a rate cut coming in May, with the expectation that the June meeting will deliver the first rate cut of the year rising to 62.3%. The sentiment surrounding BTC has with the revision of U.S. rate expectations. However, some analysts expect that a rate cut in June could positively impact crypto prices.

in March, and the personal consumer expenditures price index accelerated in February from the previous month, suggesting the economy is continuing to grow while progress on inflation has stalled.

After starting the year with the expectation of six rate cuts, the Federal Reserve to cut rates by three-quarters of a percentage point by the end of 2024, moving in line with what the Fed signaled back in December.

Altcoins and Memecoins Draw Downward in Wake of BTC Drop

Altcoins in the wake of BTC shifting downward, with many tokens experiencing double-digit declines. AI-related tokens which have been part of one of the most prominent narratives in recent months saw some of the largest declines, including Render (RNDR) -13.3%, Fetch.ai (FET) -13.9% and Worldcoin (WLD) -18.7%, over the past 7 days.

Memecoins have also seen after their strong runup over the past couple of weeks. One exception is dogwifhat (WIF), which has managed to post a over the past 7 days and crossed the $4bn market capitalization mark.

SBF Sentenced to 25 Years in Prison

Sam Bankman-Fried (SBF), the founder and former CEO of the collapsed crypto exchange FTX, was for seven different fraud and conspiracy charges. The FTX exchange was once valued at $32B at the height of the previous bull market before collapsing as it was discovered that over $8B of customer funds had been stolen, with SBF using the funds to make investments, purchase real estate, and make political donations.

-From the Gemini Trading Desk

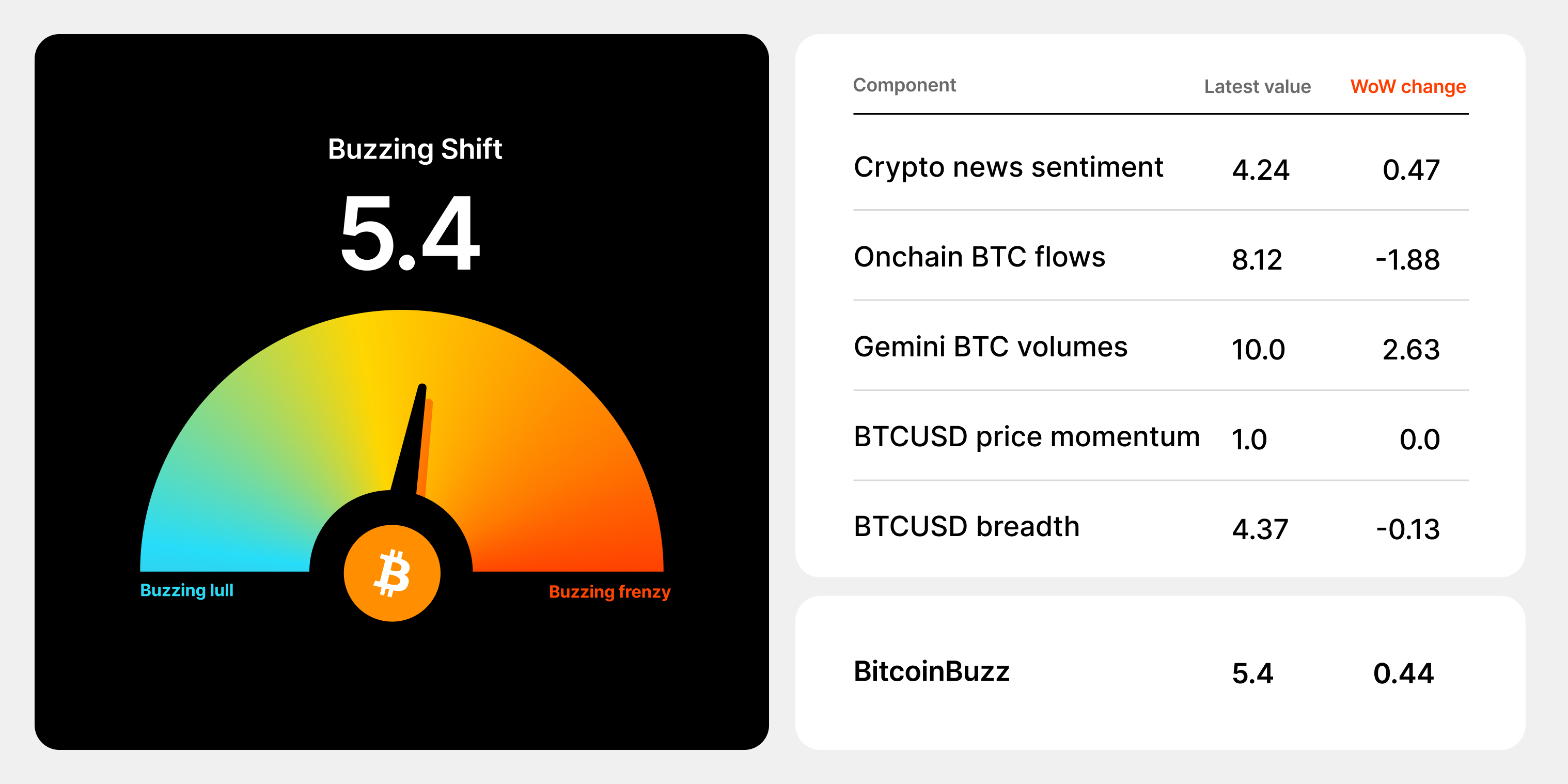

data as of 5:11pm ET on April 3, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What is staking?

Staking is the process of actively participating in the operation of a proof-of-stake blockchain network by holding and "staking" a certain amount of cryptocurrency to support network functions, such as transaction validation or block creation.

Staking involves locking up a specific amount of cryptocurrency in a designated wallet or platform. This locked cryptocurrency is then used as collateral to support network operations and earn rewards in the form of additional cryptocurrency tokens. Common cryptos that can be staked include Ether (ETH), Solana (SOL), and Polygon (MATIC).

What is Proof-of-Stake?

A core element of any blockchain network is its consensus algorithm, the mechanism by which all network stakeholders agree on the validity of the network’s shared data and then secure that data on the blockchain. A blockchain network must achieve consensus before it can move on to a new block of data.

Proof-of-Stake (PoS) offers major advantages in speed and efficiency when compared to Proof-of-Work (PoW) consensus mechanisms. In PoS blockchains, an individual or group is randomly chosen to verify transactions by an algorithm that takes into consideration the number of tokens they have staked, or locked up, on the network as a form of collateral.

Those who are chosen to confirm a block historically receive the transaction fees associated with that block as a reward. The stake acts as a deterrent against malicious activity, since those responsible for the block lose their tokens should fraudulent activity be detected.

Many consider PoS to be crucial as blockchain technology increases its scale and complexity, and sets its sights on applications in sophisticated markets and industries. PoS algorithms are an integral aspect of the blockchain ecosystem.

Onward and Upward, Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026