OCT 17, 2024

Crypto Records ‘Uptober’ Bump, Mt. Gox Delays Bitcoin Repayment, and Spot BTC ETF Inflows Rally

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about Chiliz, a Malta-based fintech company that helps sports fans engage with their favorite teams.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +12.6% | $66,940.14 |

$66,940.14

+12.6%

| |

Ether

ETH | +9.89% | $2,585.40 |

$2,585.40

+9.89%

| |

Storj

STORJ | +43.6% | $0.57283 |

$0.57283

+43.6%

| |

Samoyedcoin

SAMO | +17.7% | $0.0070603 |

$0.0070603

+17.7%

| |

Dogelon Mars

ELON | +14.3% | $0.000000144 |

$0.000000144

+14.3%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Oct. 17, 2024, at 3:02 pm ET. . All prices in USD.

Takeaways

- Mt. Gox has delayed its bitcoin repayment deadline by a year: This delay is viewed as a greenshoot for bitcoin prices, with traders arguing it reduces selling pressure on the broader market. The price of bitcoin was just short of $67,000 by Thursday afternoon.

- US spot bitcoin ETFs saw notable net inflows of more than $555 million on Monday, the highest since June: Spot ether ETFs also saw $17 million in inflows, continuing positive momentum for both investment vehicles.

- Coinbase is pursuing partial summary judgment to obtain SEC documents about crypto regulation: The regulator has previously delayed in responding to a Freedom of Information request made by the exchange over the same issue.

- US spot bitcoin ETFs saw $18.66 million in net outflows on Tuesday, led by Fidelity’s FBTC, which recorded $48.82 million in withdrawals: BlackRock’s IBIT was the only ETF to see inflows, with $39.57 million entering the fund.

- Monochrome will introduce Australia's first spot ETH ETF on Tuesday, following on from the launch of its spot Bitcoin ETF in August: Notably, the Monochrome ether ETF will allow both cash and in-kind redemptions, which could garner interest from institutional investors.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Mt. Gox Delays Repayment Deadline, Bitcoin Rallies

This decision follows a notice shared by the rehabilitation team, stating that numerous creditors have yet to complete the necessary steps to receive their funds, resulting in delays.

The delay has sparked optimism among bitcoin traders, as the market now faces less immediate sell pressure from the anticipated liquidation of the repaid assets. With the release of the news Friday, bitcoin saw positive price action over the weekend and into this week, and is currently trading at around $67,000, marking a nearly 6% bump in October and a 10.6% increase over the past 30 days.

Concerns about large-scale sales by Mt. Gox creditors had weighed on the market, but with the new repayment schedule, investors are likely interpreting this as an opportunity for further price appreciation before the potential sell-off.

US Spot Bitcoin ETFs Record Largest Inflows Since June

This surge in investment marks a key moment in the growth of these funds, with no net outflows reported across the board.

Fidelity’s FBTC saw the most significant inflows, just shy of $240 million, followed by Bitwise’s BITB, which attracted $100 million. BlackRock’s IBIT, the largest spot bitcoin ETF by net assets, logged $79.5 million in inflows. The total trading volume for US spot bitcoin ETFs amounted to over $2.61 billion on Monday, with BlackRock’s IBIT alone accounting for $1.67 billion.

Spot ether ETFs also showed positive movement, reporting net inflows of just over $17 million. For ether, BlackRock’s IBIT led the inflows with $14.31 million, followed by Fidelity’s FETH, which saw $1.31 million. The positive flows come as ether moves into the green this week, climbing more than 10% over the past week.

Coinbase Seeks Court Approval to Access SEC Documents

The exchange had initially filed a Freedom of Information Act (FOIA) request but received pushback from the SEC, which initially claimed exemption from FOIA rules.

The SEC responded by stating it would take three years to review the documents, which Coinbase claims is an excessive delay. The exchange hopes to gain clarity on the regulatory stance of the SEC, especially since the agency has brought numerous enforcement actions against crypto companies, who have claimed that the regulator does not provide clear rules with regards to digital assets.

Last month, SEC head Gary Gensler faced criticism from several US representatives during a congressional hearing. In particular, Tom Emmer said that he regarded the agency's approach to digital asset regulation as “lawless” because of the SEC’s refusal to provide clear guidance to companies in the space.

Australia’s Monochrome Launches Spot Ethereum ETF

This development follows Monochrome's successful launch of a spot bitcoin ETF in August.

The new ETF (ticker IETH) allows investors to redeem funds either in cash or in-kind, which means that investors can opt to cash out in ether. This feature is similar to the mechanism used by spot crypto ETFs in Hong Kong. Globally, several countries have begun approving listings for spot crypto ETFs following the launch of US-based ETFs in January.

Some industry analysts have said that the ETF’s ‘dual-access’ model is what makes the launch significant. By allowing investors to withdraw in ether, the fund’s structure may prevent a capital gains tax event from being triggered, which could garner the interest of institutional investors.

*Disclaimer: Gemini provides custody for Monochrome's spot ether ETF and the firm's spot bitcoin ETF launched earlier this year.

-The Gemini Team

data as of 5:16 pm ET on Oct. 16, 2024.

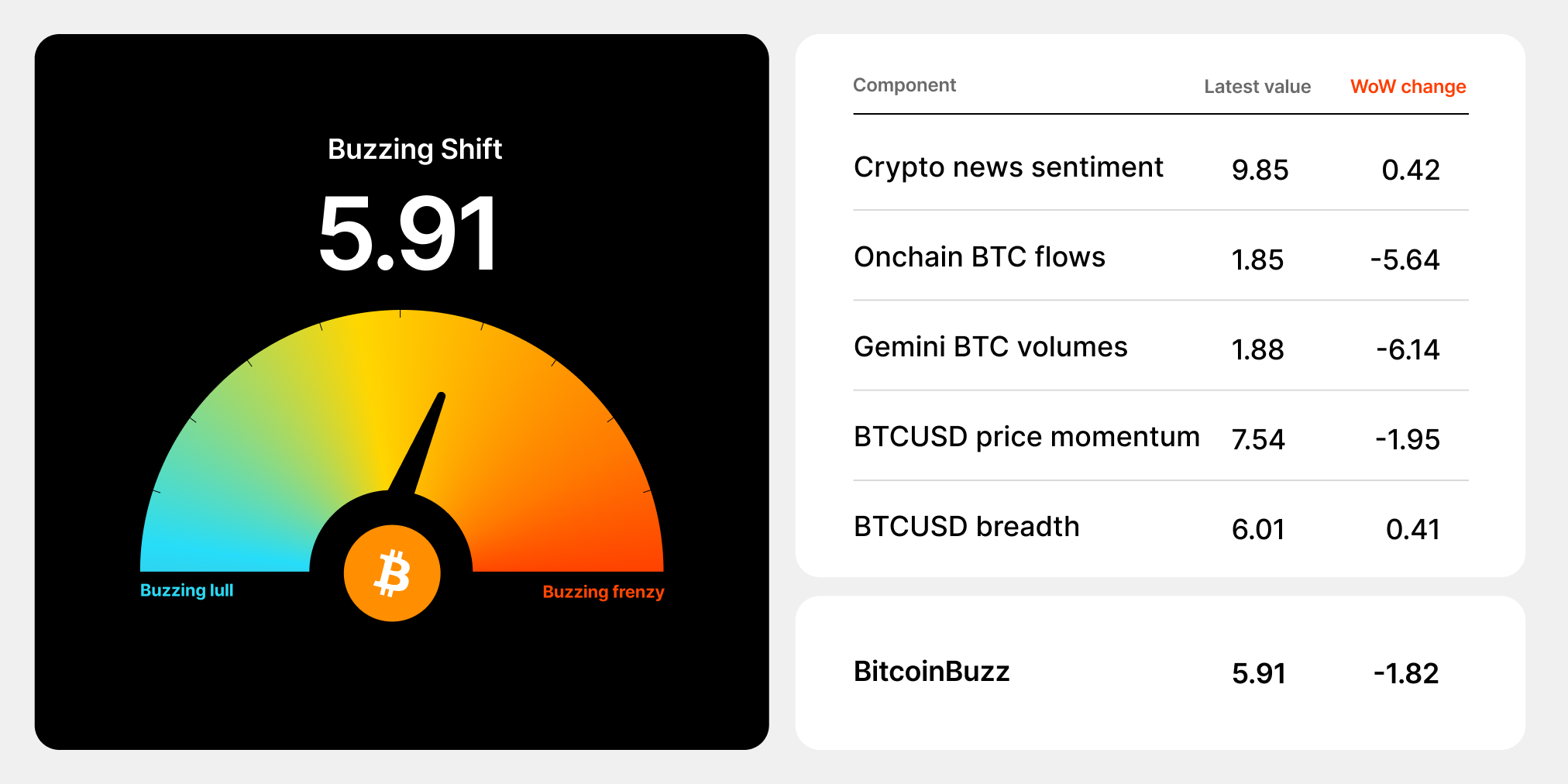

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Chiliz (CHZ): Bringing Blockchain and Crypto to Sports Fandom

Chiliz is a Malta-based fintech provider that is developing new ways for sports fans to engage with their favorite teams and athletes. The primary Chiliz offering is Socios, a blockchain-enabled sports entertainment platform that empowers users with a variety of ways to vote on decisions that directly impact their favorite teams. Conversely, the platform’s rich array of features provides team owners and league operators with new ways of connecting to their followers and generating revenue. The Socios platform is underpinned by the Chiliz Token (CHZ), which serves as a pricing benchmark and medium of exchange across the Chiliz ecosystem.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026