OCT 02, 2025

Crypto Prices Surge After Weak Jobs Data, Swift Seeks to Add Blockchain to Tech Stack, and WLFI Explores Tokenizing Real-World Commodities

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about liquidity pools.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +8.05% | $119,950.00 |

$119,950.00

+8.05%

| |

Ether

ETH | +12.70% | $4,453.40 |

$4,453.40

+12.70%

| |

Helium

HNT | +17.80% | $2.6199 |

$2.6199

+17.80%

| |

Solana

SOL | +15.84% | $228.086 |

$228.086

+15.84%

| |

Litecoin

LTC | +15.40% | $119.13 |

$119.13

+15.40%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of October 2, 2025 at 12:53 pm ET. . All prices in USD.

Takeaways

- Crypto jumps as “Uptober” arrives: The surged past $120,000 on Thursday after an ADP jobs report released the day prior revealed the United States lost 32,000 jobs in September, all but guaranteeing an October rate cut from the Federal Reserve.

- Global banking network Swift announced plans to integrate a blockchain-based ledger into its infrastructure for 24/7, real-time cross-border payments: Built with Consensys, the prototype will reportedly be refined and developed using feedback from more than 30 global banks.

- World Liberty Financial is reportedly exploring tokenizing real-world commodities paired to its USD1 stablecoin: The commodities will include oil, gas, cotton and timber, with USD1 now sitting at a market cap of nearly $2.7 billion.

- Tether has purportedly increased its bitcoin holdings by 8,889 BTC, valued at roughly $1 billion: The addition takes the stablecoin giant’s bitcoin holdings to roughly $9.7 billion as USDT’s supply climbs to $175 billion to mark an 11% QoQ rise.

- The X account of BNB Chain was allegedly breached and used to send phishing links to its 3.8 million followers: The scam attempted to convince people to connect their wallets to malicious domains, and prompted a warning from Binance founder Changpeng Zhao.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Crypto Begins “Uptober” Surging Following Weak Jobs Data

Bitcoin pushed past $120,000, ether pushed past $4,400, and solana jumped to nearly $230 following the news, marking a positive start to “Uptober” as traders anticipate multiple rate cuts in Q4 given the weak jobs data, which was revised after an initial estimate said the US economy gained 3,000 jobs in September.

Bitcoin has historically climbed higher during the month of October, helping the month earn the “Uptober” moniker with an average monthly performance of 21.9%. November has been even better, with bitcoin prices recording an average monthly gain of 46%. And there are currently a number of tailwinds that could propel prices higher through the end of 2025, including pending crypto ETF approvals and easing monetary policies.

The latest job figures come after the US government failed to reach a patchwork funding deal late Wednesday, leading to a government shutdown. That left market analysts dependent on the ADP jobs report rather than the data released by the US Bureau of Labor Statistics.

Swift to Work With Consensys on Blockchain Cross-Border Payments

The first stage of the plan is to develop a prototype, built in collaboration with Consensys, before developing the prototype into a fully functional ledger for payments.

Development of the final system will incorporate feedback from more than 30 global financial institutions, which are involved in the prototype phase. Some of the institutions participating in the program include HSBC, Bank of America and BNP Paribas. Swift has said that its primary goal will be interoperability and continuing to maintain compliance standards.

Swift has previously experimented with tokenized assets and currently services more than 11,500 financial institutions around the world. If successful, the initiative will add a blockchain-based system to its core infrastructure stack. The firm has not yet released a timeline or expected release date for the platform.

World Liberty Financial Set to Tokenize Commodities and Pair With USD1 Stablecoin

The company made its plans known at Token2049, describing the plan as an institutional-first approach, with tokenized assets including oil, gas, cotton and timber. Tokens will be able to be claimed and will be tied to underlying revenue streams.

The company has been busy, announcing a range of new plans and initiatives. Its stablecoin USD1 will reportedly be made available on the Aptos blockchain, and has nearly achieved a market cap of $2.7 billion. The group also said it is developing a debit card which is expected later this year, as well as a mobile wallet.

The group's other token, WLF, has now achieved a market cap of nearly $5 billion and is ranked among the top largest 30 crypto tokens. The group has yet to give details on when the tokenized commodities offering will launch.

Tether Reserve Adds $1 Billion in Bitcoin, USDT Supply Nears $175 Billion

The addition continues a pattern of recent bitcoin reserve top ups, and the firm reported to have around $8.9 billion in bitcoin around the end of June. The next company attestation of holdings is due later this month and will reveal any changes unaccounted for.

Tether also reports it is accumulating gold, with the group’s CEO, Paulo Ardoino, refuting claims that Tether is selling bitcoin to do so. The firm’s leading stablecoin, USDT, also expanded its supply to nearly $175 billion, which reflects an increase of roughly 11% since last quarter. USDT remains by far the dominant stablecoin, with its nearest competitor, USDC, sitting at a market cap of just under $73 billion.

Despite its original focus being regions where US dollar access is limited, Tether has recently made efforts to expand into the US market, with a new stablecoin called USAT. The company's US division will be led by former White House crypto advisor Bo Hines and focus on adapting its stablecoin products with US regulations.

BNB Chain X Account Hacked to Spread Malicious Links

The links attempted to convince viewers to connect their wallets to malicious domains, which would grant the attackers access to users’ funds. The malicious posts have now been removed, and account control has been restored.

The attack prompted a post from Binance founder Changpeng ‘CZ’ Zhao, who confirmed the attack and warned users not to engage with the links. It is not yet known if any users had their funds drained in the attack, but investigators linked the attack to Inferno Drainer, a malicious platform which is used to create wallet-drainer landing pages that impersonate legitimate websites.

The attack is a prime example of rising prominence of social engineering attacks in the crypto space, where bad actors leverage trust in well-known crypto brands to steal user funds. Some crypto security firms, namely SlowMist, criticized BNB Chain for the breach, and expressed confusion at how gaining access to the account could be possible. No official report has been released since the incident .

-Team Gemini

data as of 5:16 pm ET on October 1, 2025.

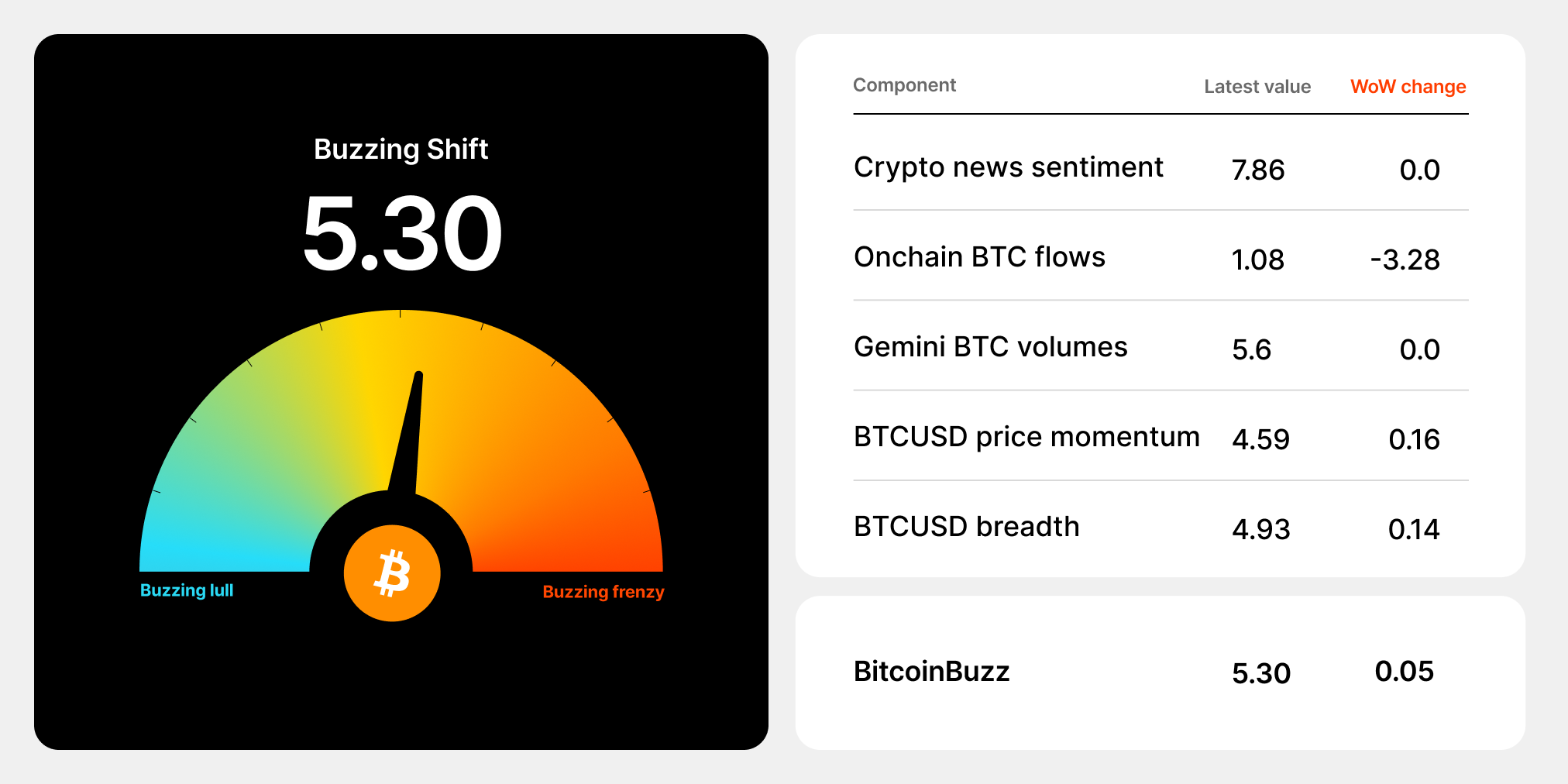

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Are Liquidity Pools?

A liquidity pool is a crowdsourced pool of cryptocurrencies or tokens locked in a smart contract that is used to facilitate trades between the assets on a decentralized exchange (DEX). Instead of traditional markets of buyers and sellers, many decentralized finance (DeFi) platforms use automated market makers (AMMs), which allow digital assets to be traded in an automatic and permissionless manner through the use of liquidity pools.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026