SEP 19, 2024

Crypto Markets Rally Following Federal Reserve’s Big Rate Cut

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about the global stablecoin ecosystem.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +5.63% | $63,617.64 |

$63,617.65

+5.63%

| |

Ether

ETH | +7.13% | $2,477.13 |

$2,477.13

+7.13%

| |

Fantom

FTM | +32.1% | $0.6491 |

$0.6491

+32.1%

| |

IoTeX

IOTX | +26.6% | $0.043031 |

$0.043031

+26.6%

| |

Storj

STORJ | +15.3% | $0.40723 |

$0.40723

+15.3%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Sept. 19, 2024, at 2:10 pm ET. . All prices in USD.

Takeaways

- The Federal Reserve cuts rates: The Federal Reserve announced Wednesday it will cut the federal benchmark interest rate by a half-percentage point (50 basis points), lowering the range to between 4.75% and 5%. Crypto markets responded well to the move, with the price of bitcoin pushing past $63,000.

- US crypto legislation still possible this year: US senator Cynthia Lummis (R-WY) said in an interview Tuesday she thinks crypto legislation could be passed during the lame-duck session of Congress.

- US spot bitcoin ETFs pull in $187 million in inflows: US spot bitcoin ETFs drew $187 million in inflows Tuesday, marking the fourth consecutive day of inflows after a significant drawdown.

- Republicans ask for clarity on crypto airdrops: US representative Patrick McHenry (R-NC) and other top Republican lawmakers sent a letter to SEC chair Gary Gensler asking for clarity on crypto airdrops.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto Rallies

It marked the first interest rate cut in more than four years and signaled the Federal Reserve is ready to ease up on its fight against inflation.

The move marked the first time since 2008 the Federal Reserve had cut interest rates by 50 basis points at one meeting. Many analysts had expected a quarter-point percentage cut, but cooling inflation and a soft labor market allowed Federal Reserve chair Jerome Powell to be more aggressive. In August, the Consumer Price Index (CPI), a key inflation metric, dropped to 2.5% year-over-year, roughly hitting Powell’s 2% inflation target.

The long-anticipated move sparked the broader markets. And crypto prices also rallied, with bitcoin pushing to roughly $63,500 and ether increasing to roughly $2,350 respectively.

A low interest-rate environment is widely viewed as a greenshoot for risk assets including crypto, but it remains to be seen if a rate-cutting campaign will ultimately shoot bitcoin and other cryptocurrencies to all-time highs.

Lummis Says Congress Will Address Crypto Legislation in 2024

“I really do think we’re going to get something done during the lame-duck (session),” she said during an appearance at a policy discussion Tuesday at Georgetown.

“We just can’t wait anymore,” she added. “Europe is way ahead of us.”

Lummis hinted that US lawmakers have continued their efforts with the Senate Agricultural Committee, with the hope they could reach a bipartisan framework agreement before ironing out the details before the end of 2024.

Lame-duck Congress sessions, which occur after an election but before the next wave of elected officials are sworn in, are typically reserved to finalize the budget and finish business from previous sessions.

Rep. Patrick McHenry (R-NC), who led the digital assets bill passed in the US House earlier this year, said any crypto regulation would have to be linked to a larger spending package.

"There are seeds that you plant that may not grow in your timeframe," he said.

Spot Bitcoin ETFs Charge Back

The hot streak, which brought in more than $500 million combined, hit after a rough patch from August 27 to September 6, when combined spot bitcoin ETF outflows totaled more than $1.2 billion.

Fidelity’s FBTC led the way with inflows totaling some $57 million, while Bitwise BITB and Ark Invest’s ArkB brought in $45.5 million and $42.4 million, respectively. BlackRock’s IBIT ETF posted positive inflows for the first time in more than three weeks Monday but posted no flows the following day. Grayscale’s high-fee GBTC also had zero flows on the day.

Republicans Ask for Clarity on Crypto Airdrops

"By creating a hostile regulatory environment, including making assertions about airdrops in various cases and increasing warnings for additional enforcement actions, the SEC is putting its thumb on the scale and precluding American citizens from shaping the next iteration of the internet," they wrote.

The SEC has argued that airdrops as a “sale of distribution or securities.” But it’s unclear how they will treat them moving forward.

Emmer and McHenry’s letter included a specific set of questions, including asking Gensler to distinguish the difference between airdrops and other traditional rewards programs such as airline miles or credit card points. The lawmakers requested a response by September 30.

-The Gemini Team

data as of 5:16 pm ET on Sept. 18, 2024.

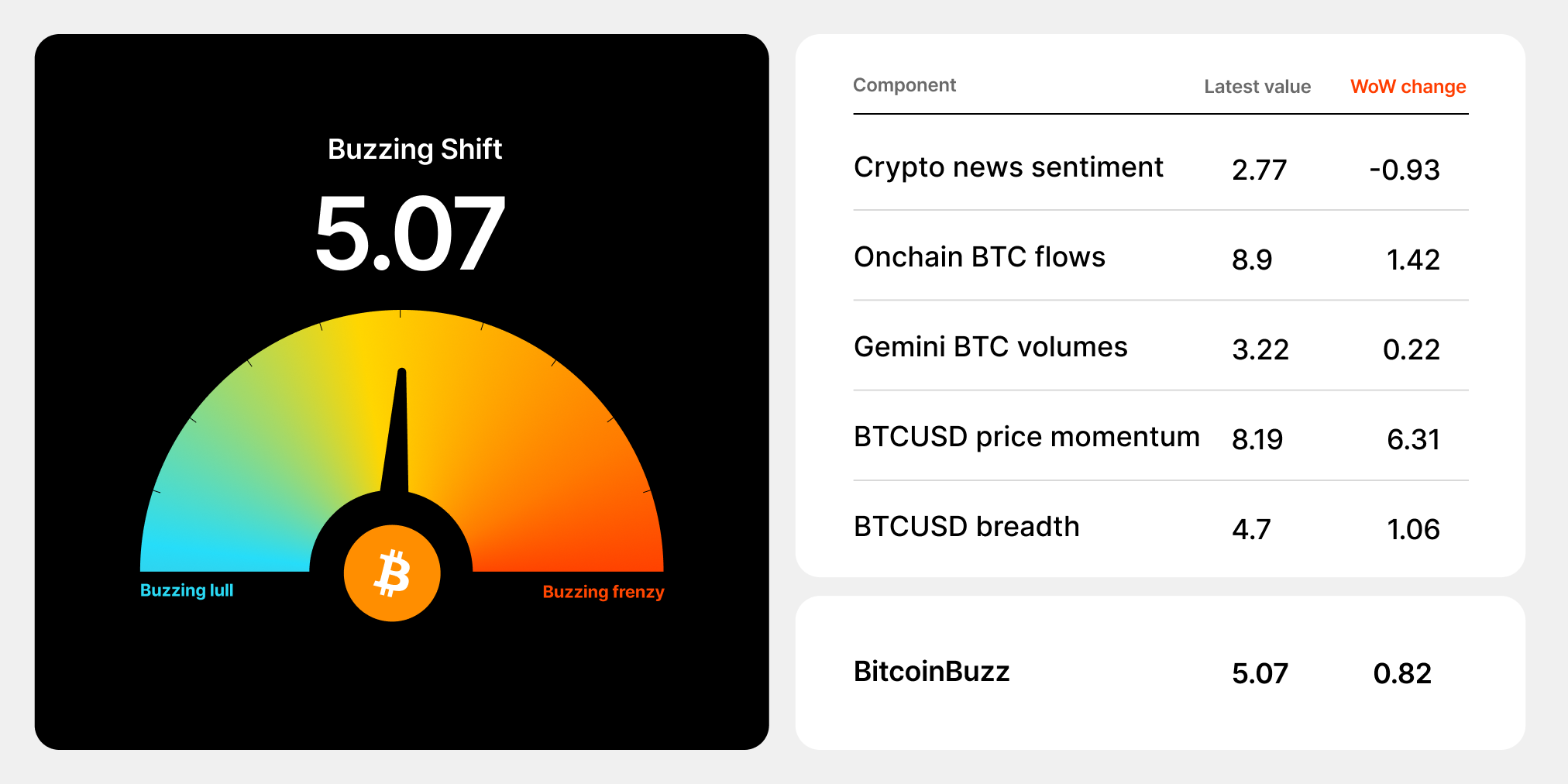

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

The Global Stablecoin Ecosystem

Despite the rapid growth of digital assets, some concerns surrounding their volatility remain. Stablecoins address the desire for a solution that effectively bridges the gap between fiat currency and cryptocurrency. Stablecoins, or digital assets that hold largely consistent values, unlock extensive utility in decentralized finance (DeFi) and the wider blockchain ecosystem. The main types of stablecoins are fiat-collateralized and crypto-collateralized, while algorithmically managed and commodity-collateralized stablecoins are also emerging and driving innovation.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026