AUG 01, 2024

Crypto Falls Amid Escalating Conflict in the Middle East, SEC Amends Complaint Against Binance

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about stablecoins.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -2.34% | $63,342.42 |

$63,342.42

-2.34%

| |

Ether

ETH | +0.47% | $3,127.52 |

$3,127.52

+0.47%

| |

Aave

AAVE | +18.3% | $110.5382 |

$110.5383

+18.3%

| |

Bitcoin Cash

BCH | +12.8% | $400.85 |

$400.85

+12.8%

| |

Storj

STORJ | +12.2% | $0.39924 |

$0.39924

+12.2%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, August 1, 2024, at 3:48 pm ET. . All prices in USD.

Takeaways

- Federal Reserve officials signaled the possibility of a September rate cut during their July meeting: But crypto prices pulled back after Iran pledged it would retaliate against Israel for assassinating Hamas leader Ismail Haniyeh on Iranian soil.

- Donald Trump expressed strong support for cryptocurrency at the Bitcoin Conference in Nashville: Trump pledged to set up a strategic bitcoin reserve, stop the US from selling its bitcoin, and fire SEC chair Gary Gensler if he gets re-elected.

- Cantor Fitzgerald CEO Howard Lutnick announced the firm's plan to establish a Bitcoin financing business with an initial $2 billion investment: The initiative aims to provide leverage to bitcoin investors and strengthen the cryptocurrency ecosystem.

- The nine US spot Ethereum ETFs saw $98.29 million in outflows on Monday, extending their negative flow streak: BlackRock’s ETHA and Fidelity FETH led the inflows, while Grayscale Ethereum Trust faced significant outflows.

- The SEC is looking to amend its complaint against Binance, which could delay a court ruling on the security status of specific tokens: This move involves third-party crypto asset securities and adheres to a court directive for further proceedings.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Fed Signals Possible Rate Cuts, but Middle East Tensions Rattle Crypto Markets

after the personal consumption expenditures (PCE) price index, a key inflation measure, increased by only 0.1% in June. This brought the year-over-year rise to 2.5%, down from 2.6% in May, moving closer to the Fed’s 2% inflation target.

Federal Reserve chair Jerome Powell for the first time hinted at the possibility of cutting rates in September, saying the move is “on the table” if the US continues to make progress on inflation. That would mark the first time the Fed has cut rates in four years.

The announcement did not appear to have much impact on cryptocurrency prices. On Wednesday, bitcoin dropped about 2%, below $65,000, while ether dropped more than 1%, hovering above $3,200.

Trump’s Speaks at Bitcoin Conference, Makes Big Promises

Former US President Donald Trump reiterated his support for cryptocurrency over the weekend at the Bitcoin Conference in Nashville.

During a nearly hour-long speech to a throng of crypto enthusiasts, Trump promised that he would establish a “strategic bitcoin reserve” and halt the sale of the US's current bitcoin holdings if he’s elected in November.

Additionally, Trump stated he would remove the current Securities and Exchange Commission Chair, Gary Gensler – who has long been seen as hostile to crypto. However, it’s unclear if he would have the authority to fire Gensler before his term ends in 2026.

Despite Trump's pro-crypto stance, Trump-themed tokens have not fared well. The MAGA (TRUMP) token has fallen by around 10% over the past week.

Cantor Fitzgerald to Launch $2 Billion Bitcoin Financing Business

This venture aims to provide leverage to investors holding Bitcoin, potentially positioning Cantor Fitzgerald as a significant player in the digital asset financing space.

He highlighted the firm's dedication to building a premier platform for Bitcoin financing, collaborating with top custodians, and supporting the Bitcoin ecosystem. The operation is set to begin with $2 billion, but the firm reportedly plans to increase the financing in $2 billion increments as the business grows.

In addition to this announcement, Lutnick defended Tether, the in which Cantor Fitzgerald acts as custodian. He offered reassurance of Tether's stability and Cantor Fitzgerald's role in ensuring the security and integrity of the most popular stablecoin.

US Spot ETH ETFs Record Fourth Day of Negative Flows

The Grayscale Ethereum Trust (ETHE) was the most affected, with $210.04 million in net outflows, continuing its trend of substantial daily outflows since its launch.

In contrast, BlackRock’s ETHA led the inflows with $58.17 million, followed by Fidelity FETH, which saw $24.82 million in net inflows. VanEck ETHV and Bitwise ETHW recorded $10.91 million and $10.45 million in net inflows, respectively. Grayscale Ethereum Mini Trust also logged $4.9 million in net inflows, while Franklin’s EZET had $2.52 million.

Despite the trend of net outflows, the total daily trading volume for spot ether ETFs was still a healthy $773.01 million on Monday however – indicating notable trading interest in the instruments. The 11 spot bitcoin ETFs in the US, on the other hand, experienced $124.13 million in net inflows on Monday. BlackRock’s IBIT stood out with $205.62 million in net inflows, however, it was the only bitcoin fund to record positive net inflows on that day.

SEC Seeks to Amend Binance Complaint

The SEC expressed its intent to seek approval to revise its complaint, focusing on "Third Party Crypto Asset Securities," as detailed in its November opposition to Binance's motion to dismiss. This proposed amendment aims to remove the necessity for the court to decide on allegations concerning whether certain tokens are securities. The specific tokens involved include SOL, ADA, MATIC and ATOM amongst others, which the SEC alleges were marketed and sold as securities on Binance's platform.

The move comes as founder and former CEO of Binance, Changpeng Zhao, continues to serve a four-month prison sentence after pleading guilty to money laundering charges last year. Zhao is due to be released on September 29th this year.

-The Gemini Team

data as of 4:40 pm ET on August 1, 2024.

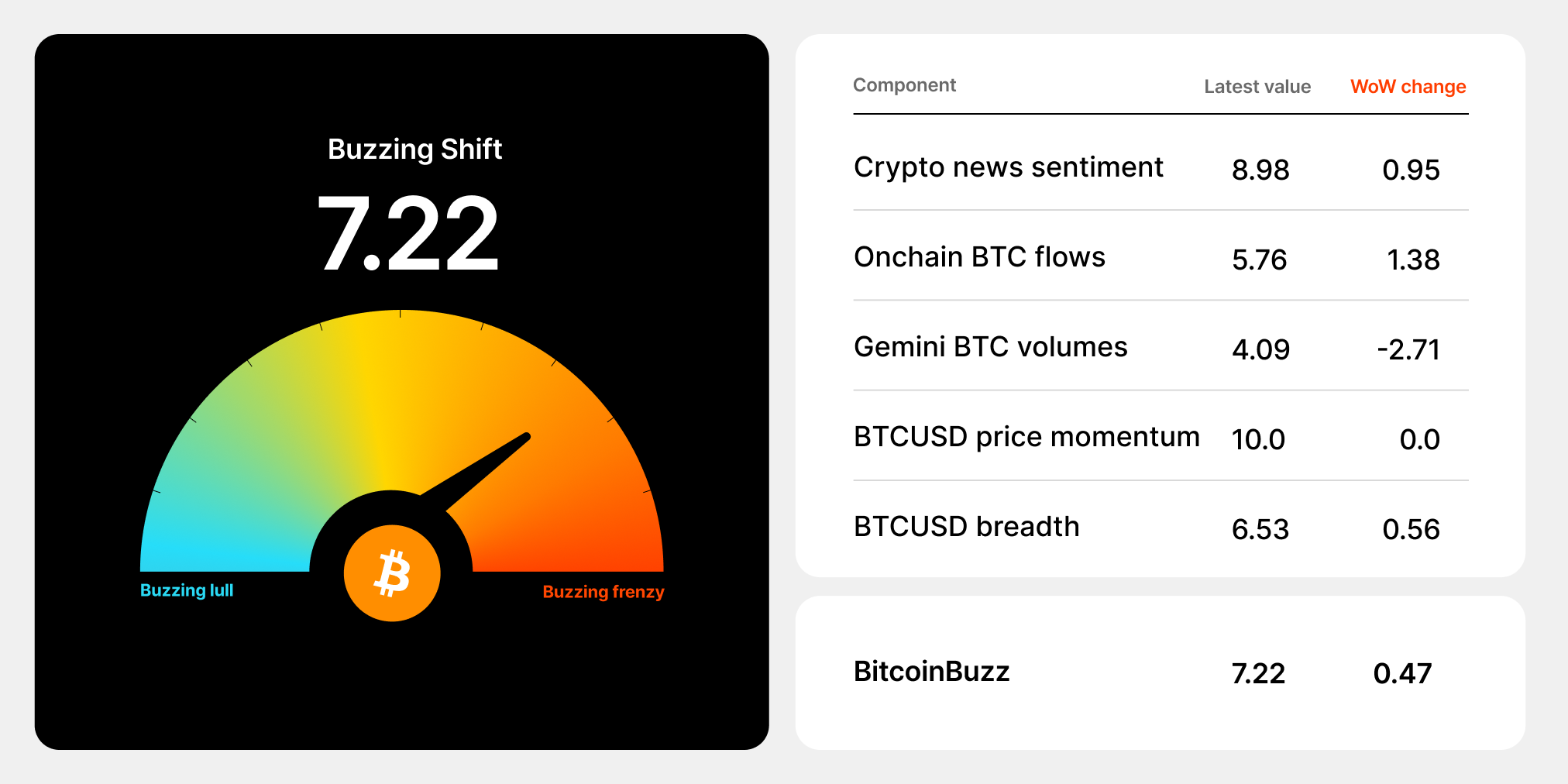

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Are Stablecoins?

As with any emerging asset class, cryptocurrencies are susceptible to market forces. Accordingly, many crypto projects are actively exploring ways to reduce risk and bolster participation in the broader crypto ecosystem. Current solutions go well beyond the buy, sell, and stop orders of conventional markets. Instead, price stability is being built directly into the assets themselves. The result is an entirely new subset of the cryptocurrency market known as stablecoins. These tokens are meant to function the way their name suggests — with stability.

In 2020–21, the stablecoin market exploded, its market cap expanding by almost three times. But, what precisely is driving this appeal?

Stablecoin Taxonomy

Stablecoins are digital currencies minted on the blockchain that are typically identifiable by one of four underlying collateral structures: fiat-backed, crypto-backed, commodity-backed, or algorithmic. While underlying collateral structures can vary, stablecoins always aim for the same goal: stability. Let’s dive into the four primary types of stablecoins.

Traditional Collateral (Off-Chain)

The most popular stablecoins are backed 1:1 by fiat currency. Because the underlying collateral isn’t another cryptocurrency, this type of stablecoin is considered an off-chain asset. Fiat collateral remains in reserve with a central issuer or financial institution, and must remain proportionate to the number of stablecoin tokens in circulation.

For example: If an issuer has $10 million of fiat currency, it can only distribute 10 million stablecoins, each worth one dollar. Some of the biggest stablecoins in this category by market value include Tether (USDT), the Gemini Dollar (GUSD), USDC (USDC), True USD (TUSD), and Paxos Standard (PAX).

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 29, 2026

Tether Launches US-Focused Stablecoin, Fed Pauses Rate Cuts, and Bitcoin Drops Below $84K Amid Broad Tech Pullback

COMPANY

JAN 27, 2026

Gemini Unveils Gemini Credit Card: Zcash Edition

NIFTY GATEWAY STUDIO

JAN 23, 2026