JUN 02, 2021

Consensus Roundup: Gemini Credit Card and Institutional Solutions Take Center Stage

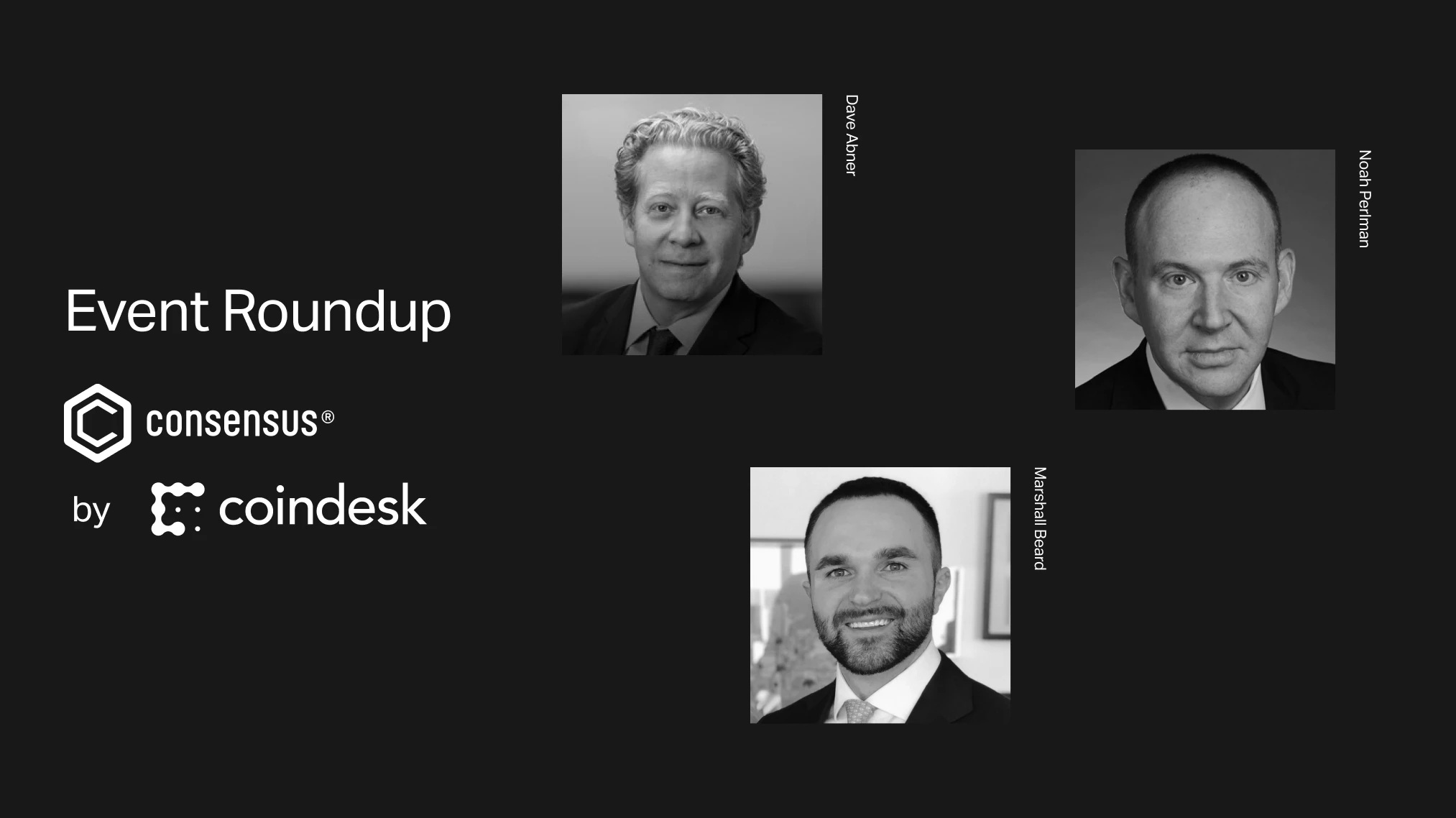

Last week, Gemini leaders took the virtual stage at Coindesk’s Consensus 2021 to discuss a range of topics including the emergence of mainstream crypto products, how exchanges are harnessing a surge of institutional interest, and the development of the crypto industry in Colombia.

We are honored to contribute leading voices to important conversations happening throughout the crypto community as our industry goes mainstream.

Noah Perlman, Gemini’s Chief Operating Officer, was joined by Mastercard executive Jess Turner on a panel about the emergence of crypto products for everyday use. They spoke about the Gemini Credit Card, for which Mastercard will be the , and the growth of consumer-first products that can help catapult crypto into the mainstream.

Noah outlined how the Gemini Credit Card will expose a broad retail audience to crypto without changing their day-to-day behavior, allowing users to seamlessly earn crypto rewards on the dollars they spend. He added that more than half of those on the 250,000+ strong waitlist are not existing Gemini customers, suggesting that people are seeking risk-free exposure to crypto. The card rolls out this summer to U.S. residents in every state and will grant up to 3% back on purchases anywhere Mastercard is accepted — for early access to the card.

Moving from retail to the institutional front, our Global Head of Business Development, Dave Abner, dove into Gemini’s expansive institutional offering that includes custody, clearing, and trade execution services. He noted the central role education will play in broader institutional adoption, adding that he anticipates the crypto exchange traded product market alone will grow to $100 billion to $200 billion over the coming years.

With unified offerings — like — Dave explained how Gemini works alongside institutions seeking to harness novel opportunities in crypto that will continue to emerge over the next decade. to our institutional team to learn more.

Borders have not quelled the institutional crypto buzz, as our Head of Strategy and Corporate Development, Marshall Beard, outlined on a panel about crypto in Colombia. Highlighting our partnership with Bancolombia, Marshall noted the major role crypto can play in the Latin American country following the launch of its regulatory sandbox. With our regulation- and security-first mindset, Marshall expressed the potential for Gemini to work closely with the Colombian crypto ecosystem to build trust, and support crypto products that can empower Colombians to take control of their financial lives.

With the conversation as vibrant as ever, we are thrilled to continue to contribute innovative ideas and solutions to discussions that will help propel the crypto ecosystem forward.

Onward and Upward!

Team Gemini

RELATED ARTICLES

COMPANY

JAN 08, 2026

Gemini Predictions™ Unveils Contracts for Sporting Events

COMPANY

JAN 08, 2026

Trade Crypto With up to 5x Leverage: Gemini Margin Trading Is Here

WEEKLY MARKET UPDATE

JAN 08, 2026