APR 25, 2024

BTC Halving Brings Market Optimism and Record Mining Rewards, Crypto Lobbyists Sue SEC

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the history of Ethereum.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.04% | $64,849.31 |

$64,849.31

+2.04%

| |

Ether

ETH | +2.36% | $3,162.53 |

$3,162.53

+2.36%

| |

Pepe

PEPE | +46.21% | $0.000007839 |

$0.000007839

+46.21%

| |

Galxe

GAL | +32.20% | $4.3071 |

$4.3071

+32.20%

| |

Cryptex

CTX | +26.14% | $5.1484 |

$5.1484

+26.14%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, April 25, 2024, at 2:15pm ET. . All prices in USD.

Takeaways

- Bitcoin miners see rewards cut, Dorsey jumps in: BTC miners collected more than $100 million in revenue for the halving on April 20, the highest total ever recorded in a single day. But now miners face a drop in block rewards that could reshape the industry. And one familiar name is jumping in.

- Speculators hopeful upcoming Fed meeting will leave rates unchanged: US inflation rates have eased slightly in April in conjunction with weakening demand in both manufacturing and service sectors. Meanwhile, crypto bulls hope the Fed holds interest rates steady.

- Bitcoin halving brings fresh interest to spot ETFs: After a period of net outflows prior to BTC’s halving event, spot BTC ETFs in the US have started to rebound.

- Ripple calls for SEC to reduce fine: Ripple has strongly opposed the SEC's proposed $2B fine for selling its XRP token, and a contingent of crypto lobbyists have moved to sue the regulator for expanding the definition of a dealer.

- Tether claims it will freeze addresses linked to OFAC-sanctioned entities: Venezuela's state oil company, PDVSA, used the to bypass US sanctions and continue its oil exports, according to a Reuters report. Now, Tether will be freezing accounts linked to the sanctioned entities.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC Miners Pull in Record Revenue, Dorsey To Step In

during the halving last Friday via mining rewards and transaction fees, shattering a previous single-day record of $78.7 million set March 11-two days before BTC hit an all-time high.

While analysts predict the will continue to rally, the future remains cloudy for the mining industry, which saw rewards cut by 50% to 3.125 bitcoin.

Block CEO and ex-Twitter/X CEO Jack Dorsey figures it’s a good time to jump in. , Dorsey announced that Block, a fintech payments giant, had completed its three-nanometer BTC mining chip and is developing a full BTC mining system.

The goal? Decentralize the BTC mining market, lessening the barrier to entry for miners dependent on hardware.

“Building on these insights and pursuant to our goal of supporting mining decentralization, we plan to offer both a standalone mining chip as well as a full mining system of our own design,” Dorsey wrote.

US Inflation Shows Hopeful Signs of Cooling Ahead of Fed Meeting

US business activity hit a four-month low in April, reflecting weakened demand across manufacturing and service sectors.

The Federal Reserve has raised interest rates by 525 basis points since March 2022, But the Fed has opted to hold rates steady between 5.25% and 5.5% since July 2023, and the price of BTC has more than doubled over the ensuing months.

While inflation pressures persist, speculators are hopeful that Fed officials during their meeting next week will hold rates steady and sound a bullish tone on future cuts.

Inflows to BTC Spot ETFs See Rebound

After experiencing net outflows before BTC’s block-reward halving, spot BTC ETFs in the US resumed net inflows, with significant activity observed the day after the halving. On Monday, more than $62M of inflows were recorded–primarily to Fidelity Wise Origin Bitcoin.

Other spot ETF providers enjoying the post-halving surge include ARK 21 Shares Bitcoin ETF and iShares Bitcoin Trust. and could rise further if the speculated post-halving surge in BTC price occurs.

The halving has already brought some upward movement to BTC price after it dropped by more than 6% in the week leading up to the event. The price of BTC rallied to $67K by Tuesday and, even after dipping,.

Ripple Hits Back Against Proposed SEC Fine

, criticizing the regulatory agency for an attempt to “intimidate” and punish the broader cryptocurrency industry. Ripple's legal team argues that the SEC's actions are misleading and not a faithful application to the law, referencing court cases where other crypto companies prevailed against the SEC.

The SEC has claimed that Ripple made billions of dollars by selling its XRP token, which it considers a security. This legal battle, part of an ongoing saga that began in 2020, continues to shape discussions around cryptocurrency regulation and enforcement.

In related news, , alleging the agency erred when it expanded the definition of a dealer in February.

Tether Says It Will Freeze OFAC-Sanctioned Addresses Linked to Venezuelan Oil

linked to entities sanctioned by the Office of Foreign Assets Control (OFAC) claiming that Venezuela’s state oil company, PDVSA, used cryptocurrencies to circumvent US sanctions.

The report highlighted PDVSA's attempt to shift oil sales to USDT to avoid restrictions on its foreign bank accounts. The US Treasury Department had mandated that PDVSA and vendors wind down transactions by May 31 after

-From the Gemini Trading Desk

data as of 5:15pm ET on April 25, 2024.

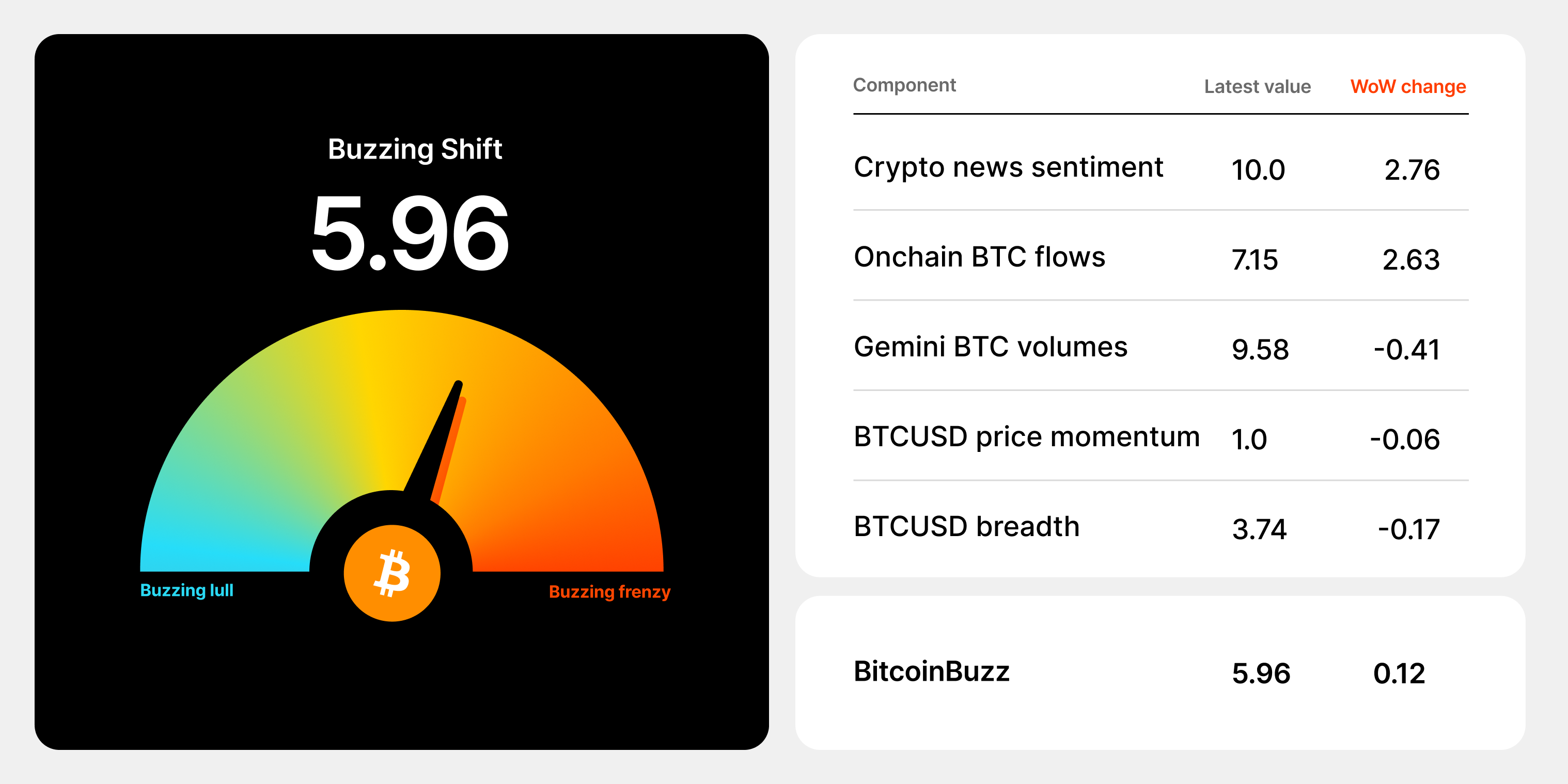

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What is Ethereum, who founded it, and who controls it?

Ethereum has drawn increased attention in recent months as brokerages lobby the SEC to make ETH spot ETFs available to retail investors.

let’s take some time to review ETH, who founded it, and who controls it now:

What is Ethereum?

Ethereum is the open-source blockchain network that popularized decentralized applications (dApps), a new generation of apps that do not rely on centralized authorities like banks or servers to function. Essential to Ethereum’s innovation are smart contracts, code-bound agreements that execute automatically according to predetermined conditions. Smart contracts play a large role in many of the products and services that make up Ethereum’s Web3 ecosystem, replacing roles traditionally played by trusted, centralized parties in overseeing transactions.

While the Ethereum network does leverage its native ether (ETH) currency throughout its network and ecosystem, Ethereum technology itself is better conceptualized as a globally distributed computational environment rather than a cryptocurrency alone. Ethereum-based phenomena like decentralized finance (DeFi) and non-fungible tokens (NFTs) have demonstrated the potential of Web3 throughout a spectrum of sectors and use cases. Upon the project’s launch in 2014, its core tech (including smart contracts and ERC tokens) presented a novel and ambitious concept. Implementing this technology required the input of many different people and groups.

Who founded ETH?

Ethereum was originally proposed by Vitalik Buterin, a Russian-Canadian programmer who remains a de facto figurehead for Ethereum. Inspired by Bitcoin, Buterin released a whitepaper in 2013 describing an alternative blockchain network that would go beyond Bitcoin’s proposed financial use cases to allow developers to create their own decentralized applications (dApps) using a new programming language. The open-ended aspirations enshrined in the Ethereum founder’s whitepaper created a huge buzz among early crypto proponents, and soon after publication several talented developers reached out to Buterin to help bring his vision to life.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026