SEP 26, 2024

BlackRock’s Spot Bitcoin ETF Receives Green Light for Options Trading, Crypto Moves Higher, and Congress Grills SEC Head Over SAB 121

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about central bank digital currencies.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.23% | $65,283.98 |

$65,283.98

+2.23%

| |

Ether

ETH | +6.17% | $2,634.72 |

$2,634.72

+6.17%

| |

Chiliz

CHZ | +24.5% | $0.0697 |

$0.0697

+24.5%

| |

The Graph

GRT | +19.3% | $0.1877 |

$0.1877

+19.3%

| |

STEPN

GMT | +18.8% | $0.15741 |

$0.15741

+18.8%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Sept. 26, 2024, at 2:08 pm ET. . All prices in USD.

Takeaways

- The SEC has approved Nasdaq's request to list and trade options on BlackRock's spot bitcoin ETF: The decision introduces new hedging tools for investors but comes with a 25,000 contract limit which has been criticized by the exchange as “conservative.”

- Crypto investment products saw a second consecutive week of inflows, totaling $321 million, after the Fed's decision to cut rates: Bitcoin investment products led the pack with $284 million in inflows last week.

- More than 40 Republican lawmakers called on SEC chair Gary Gensler to withdraw the crypto custody rule (SAB 121): They argue the rule increases consumer risk and stifles innovation.

- Caroline Ellison, ex-CEO of Alameda Research, was sentenced to two years in prison for her role in the FTX fraud case: Despite her cooperation with law enforcement in the case against Sam Bankman-Fried, the judge ruled that Ellison must still serve time.

- On Monday, OpenAI’s official news account on X was compromised, with hackers using it to promote a fake "$OPENAI" token: The fraudulent post claimed the token would grant access to future beta programs and directed victims to a spoof website.

- PayPal to accept crypto payments: Payments giant PayPal announced Wednesday it would allow business accounts to buy, hold, and sell cryptocurrencies.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

SEC Allows Options Trading on BlackRock’s Bitcoin ETF on Nasdaq's ISE

BlackRock had been pushing for this approval since March, following the launch of several bitcoin-linked ETFs in the US. Earlier proposals faced concerns around market manipulation. Regulators also expressed concerns around introducing more crypto derivatives products to the market, due to their nascency. To address these concerns, the SEC approved an amendment that limits positions on IBIT options to just 25,000 contracts. The limit has been described as "extremely conservative" by Nasdaq.

The regulator also concluded that the exchange’s surveillance systems would be an adequate deterrent for market manipulation.

Crypto Investment Products See $321M Inflows After Fed Rate Cut

The interest follows the Federal Reserve's decision to cut interest rates by 50 basis points.

Bitcoin investment products led the charge, pulling in $284 million, while short bitcoin products saw an additional $5.1 million. However, ethereum-based products continued to buck the trend with a fifth consecutive week of outflows, logging $29 million last week. The outflows from ethereum were largely driven by Grayscale's Ethereum Trust (ETHE).

The rate cut enacted by the Federal Reserve has likely had a positive impact across the crypto market, with the total market cap up $150 billion since the announcement. As of Thursday evening, the price of bitcoin had pushed up 2.63% over the past week, surpassing $65,000 before pulling back.

Republican Lawmakers Demand SEC Rescind Controversial Crypto Custody Rule

The rule, introduced in March 2022, requires crypto custodians to report digital assets as liabilities on their balance sheets. Lawmakers argue that the rule deviates from traditional accounting practices and could in fact increase risks to consumers while hampering financial innovation.

President Biden vetoed an attempt to prevent the bill from passing in July this year, but the group, including House Financial Services Committee Chair Patrick McHenry (R-NC) and Senator Cynthia Lummis (R-WY), continue to fight for it to be undone. The debate has further fueled frustrations regarding the SEC's approach to regulating crypto, including its overreliance on litigation to set industry standards, a tactic that has faced criticism from federal judges in recent court hearings.

Former Alameda Research CEO Caroline Ellison Sentenced to Two Years in Prison

The 29-year-old will also have $11 billion confiscated and will serve three years of supervised release after prison. Judge Lewis A. Kaplan made clear his belief that Ellison had been “exploited” by Sam Bankman-Fried, and acknowledged her cooperation with law enforcement in building the case against him.

Ellison also stated that she was unable to extricate herself from the fraudulent scheme, attributing much of her involvement to her desire to appease Bankman-Fried, with whom she had a romantic relationship. Ellison has 45 days to voluntarily surrender herself to begin her prison sentence, during which she will serve a minimum of 75% of her time before being eligible for parole.

The sentence is in sharp contrast with the severity of Bankman-Fried’s sentence of 25 years in prison, which was given earlier this year. The ex-CEO of FTX formally appealed his sentence this month and has requested a new trial, arguing that the judge had bias against him.

OpenAI X Account Hacked to Promote Scam

The post fraudulently announced the launch of an "$OPENAI" token associated with OpenAI, claiming it would serve as a bridge between artificial intelligence and blockchain technology.

The scam post misled a number of OpenAI's nearly 54,000 followers on X, suggesting that holders of the token would gain access to upcoming beta programs. It also included a link to a fraudulent website mimicking OpenAI’s legitimate site, though the URL did not match OpenAI’s official domain. The site encouraged visitors to connect their crypto wallets, likely in an attempt to steal funds. The misleading post has since been deleted.

PayPal Adopts Crypto

"Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers," PayPal senior vice president of blockchain, cryptocurrency, and digital currencies Jose Fernandez da Ponte. "We're excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly."

Now, US merchants will also be able to transfer crypto to eligible third-party addresses. And business accounts will be able to send and receive supported tokens from external blockchain addresses.

PayPal has implemented crypto more and more over the past few years. In 2020, the company allowed PayPal and Venmo accounts to buy and sell crypto. Three years later, they launched their own US stablecoin and have since used it to facilitate no-fee transfers abroad through its Xoom platform.

-The Gemini Team

data as of 5:11 pm ET on Sept. 26, 2024.

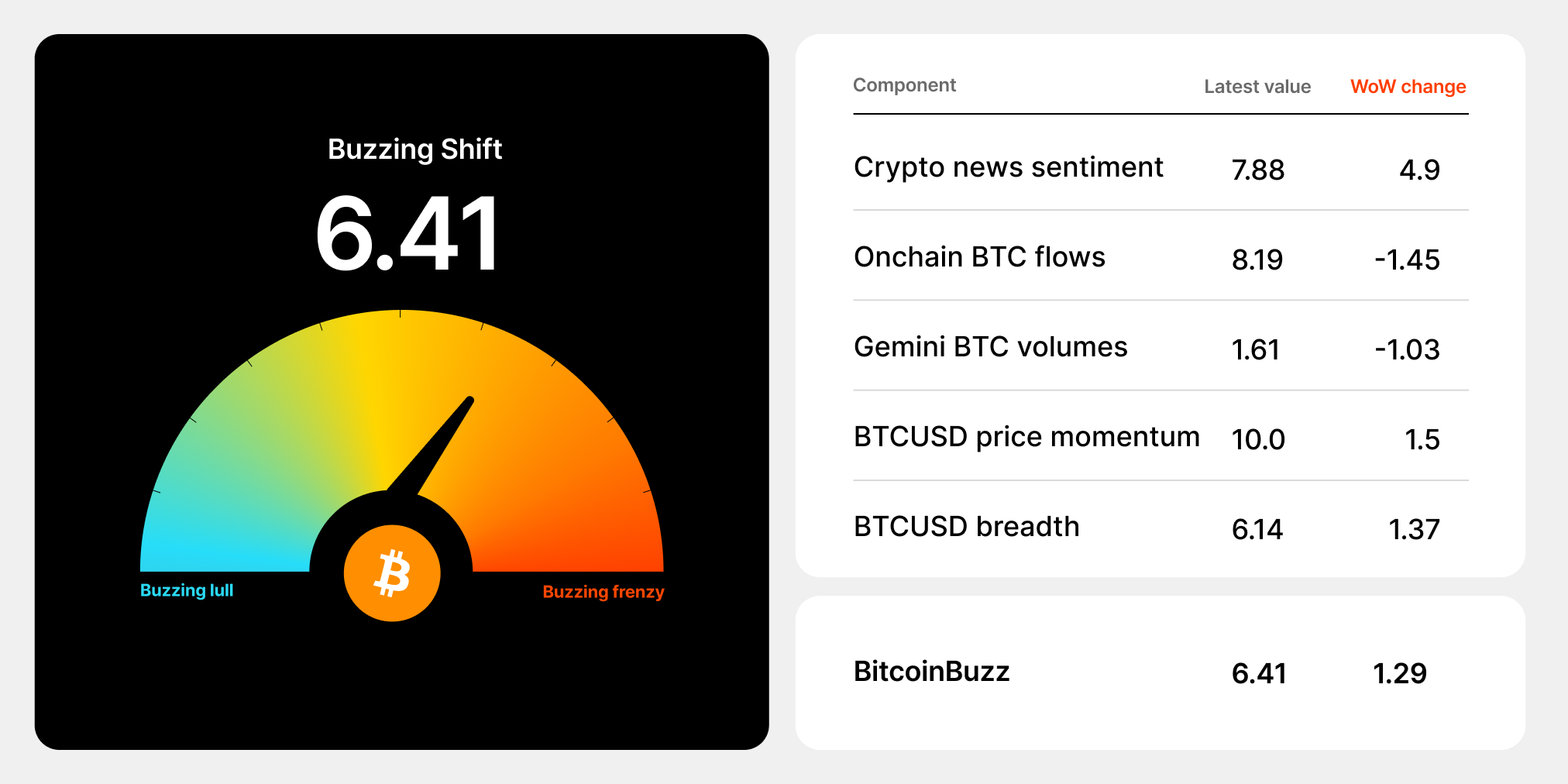

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What Are Central Bank Digital Currencies?

Central banks are responding to the rise of cryptocurrencies and other digital payment technologies by exploring adoption of central bank digital currencies (CBDCs). A CBDC is a digital representation of central bank-issued money that can be built on a blockchain or distributed ledger. Despite potentially sharing some architecture with cryptocurrencies, CBDCs are not considered cryptocurrencies because of certain technical differences and because they are controlled by a central authority.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026