AUG 14, 2025

Bitcoin Touches New All-Time High, ETH ETFs Record First $1 Billion Net-Inflow Day, and New Inflation Data Hits Markets

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about Polygon.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +1.33% | $118.029.82 |

$118,029.82

+1.33%

| |

Ether

ETH | +20.20% | $4,607.75 |

$4,607.75

+20.20%

| |

Chainlink

LINK | +28.0% | $22.80441 |

$22.80441

+28.0%

| |

Aave

AAVE | +15.40% | $315.0767 |

$315.0767

+15.40%

| |

Solana

SOL | +14.50% | $196.158 |

$196.158

+14.50%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of August 14, 2025 at 11:38 am ET. . All prices in USD.

Takeaways

- The Consumer Price Index, a closely watched inflation measure, hit 2.7% in July, roughly in line with analyst estimates: Following the news, the price of bitcoin hit a new all-time high above $124,000 late Wednesday before pulling back below $120,000 on Thursday morning when PPI, the Producer Price Index, jumped 0.9% from the previous month, well above the 0.2% estimate.

- US spot ether ETFs recorded more than $1 billion in net inflows in a single day, the largest since the products launched: BlackRock’s ETHA led with $640 million and Fidelity’s FETH added just shy of $277 million, pushing cumulative ETF inflows to $10.83 billion.

- BitMine Immersion Technologies filed to boost its at-the-market equity program from $4.5 billion to $24.5 billion to finance further ether purchases: The firm is already the largest public Ethereum treasury and recently surpassed holdings of 1.15 million ETH.

- Bullish Raises $1.1B in IPO: Institution-focused crypto exchange Bullish raised $1.1 billion in an IPO this week after selling 30 million shares at $37 apiece. The company opened trading on the NYSE on Wednesday at around $90, approximately 143% above the IPO price.

- ALT5 Sigma announces deal for $1.5B in World Liberty tokens: The company closed two stock offerings of 100 million shares at $7.50 apiece, with Eric Trump set to join ALT5's board of directors.

- Terraform Labs founder Do Kwon pleaded guilty to charges relating to the collapse of the TerraUSD stablecoin: He claimed he knowingly defrauded purchasers, and entered a plea deal under which will reportedly recommend up to a 12-year sentence.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Mixed Inflation Data Pushes Bitcoin Back From All-Time High

In response, markets immediately priced in a higher chance of of the Federal Reserve reducing rates in September, with CME suggesting the probability of a cut now stands at 93.9%. That was viewed as a positive signal for bitcoin prices, with some traders reportedly adjusting their short-term price predictions for bitcoin to more than $130k.

The hit a new all-time high above $124,000 late Wednesday before pulling back below $120,000 on Thursday morning when PPI, the Producer Price Index, jumped 0.9% from the previous month, well above the 0.2% estimate and the highest mark in three years. This data indicates that the producers have been absorbing some of the tariff costs, though it's still unclear whether it will fully trickle down to consumers in the coming months.

Nonetheless, US spot bitcoin ETFs have been performing well, with funds reporting daily net inflows in the first half of the week led by Blackrock’s IBIT. Sustained daily inflows showcase bitcoin’s growing maturity as an institutional asset, with Kazakhstan’s Fonte Capital launching Central Asia’s first spot bitcoin ETF on Tuesday, custodied by BitGo. The growing roster of nations with spot bitcoin ETFs are poised to continue bringing fresh capital into the market.

Spot Ether ETFs Record Over $1B in Single-Day Inflow

The surge was led by BlackRock’s iShares Ethereum Trust (ETHA), which took in just under $640 million, followed by Fidelity’s FETH with $276.9 million.

Ether’s price also climbed on the same day to reach its strongest level since December 2021, as regulatory signals helped lift risk appetite. Markets have seemingly grown more convinced of an approaching Federal Reserve rate cut, and increasing ETH ETF inflows might signal renewed institutional interest in the second-largest cryptocurrency.

With the SEC’s recent clarification that liquid staking tokens (a popular DeFi product) are not securities, institutions might feel more comfortable in making allocations to the Ethereum-powered sector. As it stands, Ethereum remains by far the most popular network for DeFi activity, with a 61% market share according to DeFi Llama.

BitMine Files to Expand ATM Offering to $24.5B to Fund Further ETH Buys

The company initially launched a $2 billion ATM in early July and expanded that to $4.5 billion later in the same month. This latest increase signals a more bullish approach to its ether purchasing approach, but the firm has said that the funds will also be used to acquire bitcoin and expand its mining operations.

The filing comes hot on the heels of an aggressive buying push that took BitMine past the 1 million ETH mark with the firm disclosing a recent 317,000 ETH purchase that brought its total to about 1.15 million ETH. The treasury is worth around $5 billion at current prices, and makes BitMine the largest ETH holder globally.

Bullish Pulls in $1.1B in NYSE Debut

The company opened trading on the NYSE on Wednesday at around $90, approximately 143% above the IPO price. The stock pushed to as high as $118 before settling around $75 per share as of Thursday afternoon. Cathie Wood’s ARK Invest indicated it would purchase $200 million shares in the offering, helping bolster demand.

Backed by Peter Thiel, Bullish focuses on institutional crypto buyers as it looks to capitalize on the recent surge in publicly-traded companies with crypto treasuries. They join a recent wave of crypto-focused companies to join the public markets, following stablecoin giant Circle and eToro, another crypto exchange.

ALT5 Sigma Purchases $1.5B in World Liberty tokens

As part of the deal, the company launched two direct stock offerings of 100 million shares at $7.50 apiece. Eric Trump and World Liberty Fincancial co-founders Zach Witkoff and Zak Folkman will join the company's board of directors as part of the deal.

ALT5 becomes the latest company to create a corporate crypto treasury strategy that doesn't include bitcoin buying. Notably, Tom Lee's Bitmine Immersion has announced plans to raise up to $24.5 billion to purchase ether, with others tapping Solana and other altcoins for their own respective corporate crypto treasury strategies.

Terraform Founder Do Kwon Pleads Guilty to Conspiracy and Wire Fraud

In court, prosecutors outlined a plea deal requiring Kwon to forfeit up to $19 million and pay restitution.

The plea resolves two of the counts, which had laid out multiple additional charges including securities and commodities fraud. As part of the agreement, federal prosecutors additionally said they will ask the court to impose a recommended maximum sentence of 12 years. Kwon’s defense lawyers separately state that other charges are still pending in South Korea.

In a court filing, Kwon stated that he participated in a scheme to mislead purchasers about the stability and backing of UST and that he used international and interstate wires in the scheme. His guilty plea is the conclusion of one of the most significant collapses in the history of the crypto space.

-Team Gemini

data as of 5:16 pm ET on August 13, 2025.

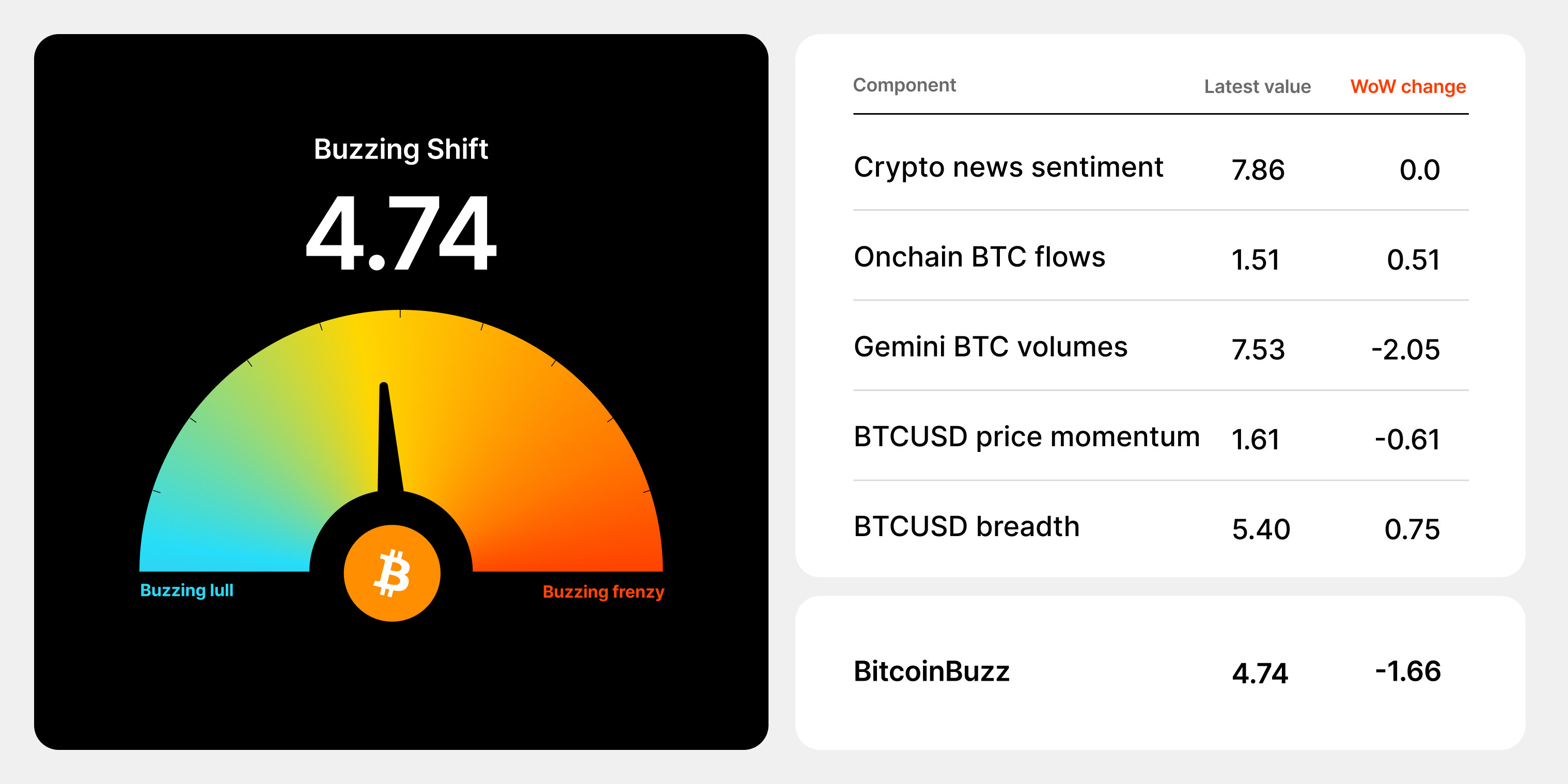

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Polygon (MATIC): The Swiss Army Knife of Ethereum Scaling

Polygon is a Layer-2 scaling solution created to help bring mass adoption to the Ethereum platform. It caters to the diverse needs of developers by providing tools to create scalable decentralized applications (dApps) that prioritize performance, user experience (UX), and security. Polygon achieves this in large part due to the underlying technical architecture of its Proof-of-Stake (PoS) Commit Chain and its More Viable Plasma (MoreVP) L2 scaling solution. Polygon’s PoS blockchain serves as a Commit Chain to the Ethereum mainchain, attracting over 80 Ethereum dApps to its platform that transact without instances of the network congestion common to Ethereum and other Proof-of-Work (PoW) blockchains.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026