FEB 09, 2024

Bitcoin Surges Past $47K, Solana Breaks Through $100 Despite Network Outage, Ethereum Name Service Pens GoDaddy Partnership, and Stocks Continue to Break Records

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore layer-2 scaling solutions.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +9.80% | $47,403 |

$47,403

+9.80%

| |

Ether

ETH | +8.06% | $2,487 |

$2,487

+8.06%

| |

Ethereum Name Service

ENS | +21.60% | $21.37 |

$21.37

+21.60%

| |

Gala

GAL | +9.72% | $0.02414 |

$0.02414

+9.72%

| |

Qredo

QRDO | +8.89% | $0.03365 |

$0.03365

+8.89%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, February 9, 2024, at 11:40am ET. . All prices in USD.

Takeaways

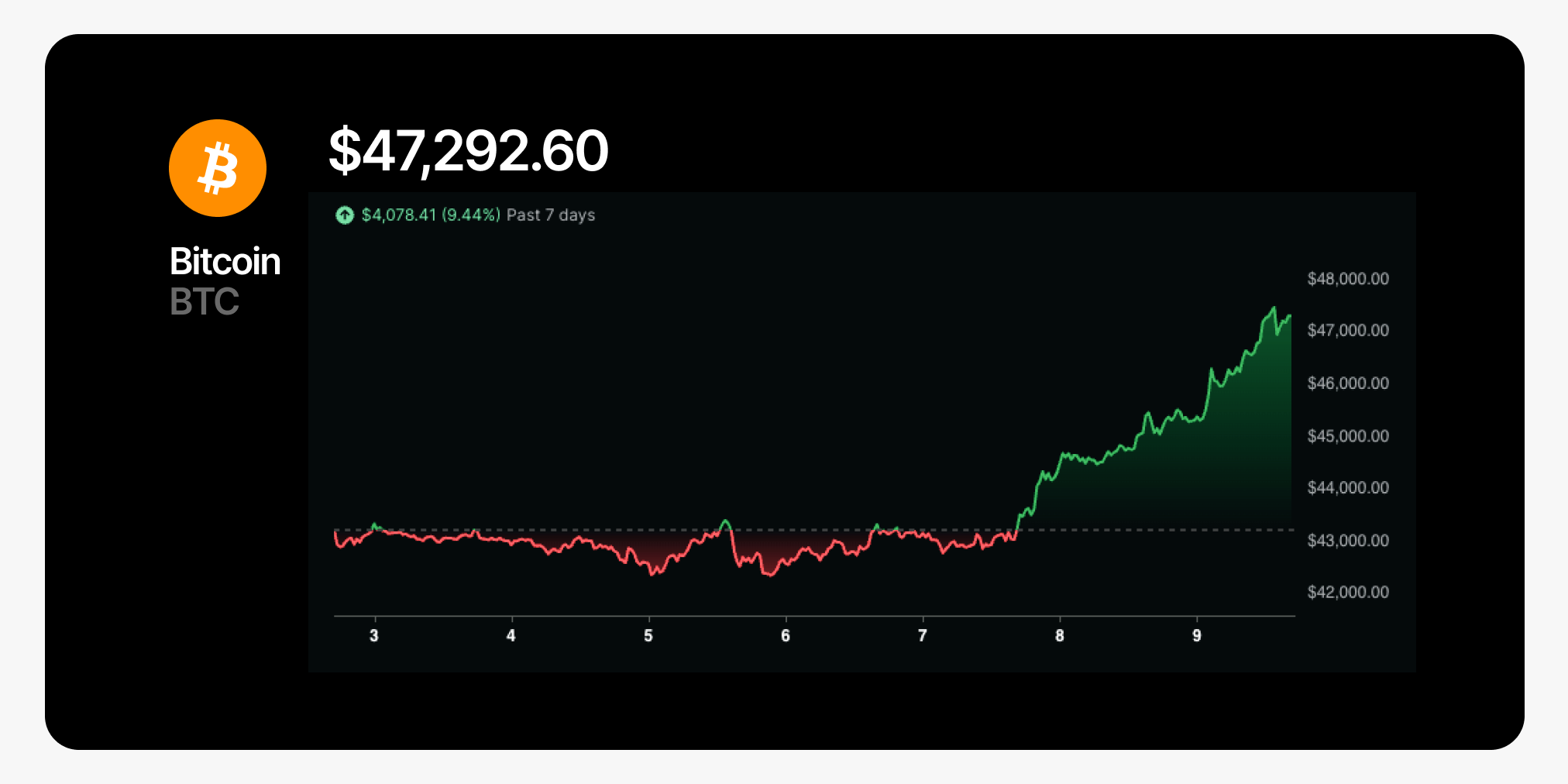

- Bitcoin crosses $47K as ETF inflows steadily outpace outflows: After remaining range bound between $42.5K-$43.5K for the past few weeks, bitcoin (BTC) jumped higher on Wednesday evening and once again broke through the $45K level for the first time since the launch of the spot bitcoin ETFs a month ago. On Friday, BTC rose past $47K. Continued demand for the spot bitcoin ETFs could be helping the move higher and they have been showing more strength this week with inflows outpacing outflows from Grayscale’s GBTC for the ninth consecutive day.

- Solana hovers above $100 despite five-hour outage: On Tuesday, the Solana network experienced a significant outage leaving the network offline for five hours, resurfacing the debate and criticism of Solana being too centralized. The price of SOL initially fell on the news, breaking below the $94 mark. However, the price fought back after the issues were resolved and moved above $100 on Wednesday evening.

- Ethereum Name Service partners with GoDaddy as altcoins perform well: Ethereum Name Service (ENS) saw its price gain over 20% over the past seven days following the announcement of a partnership with domain registrar GoDaddy on Monday that will allow Web3 users to link their .eth names to traditional Web2 domains at no additional cost. Other leading altcoins were also up this week, including Avalanche (AVAX) +3%, XRP +4%, Filecoin (FIL) +6%, and Immutable X (IMX) +8%.

- Stocks break new records and interest rate debate continues: Stock prices continued to add to their strong start to the year with US stock indices posting new all time highs again this week. On Wednesday, the S&P 500 closed within touching distance of the 5,000 mark for the first time ever. The timing of interest rate cuts also continued to be debated this week. Market participants have tapered expectations slightly and are now pricing in five rate cuts for 2024, down from six at the start of the year. However, this is still higher than the baseline scenario put forward by the Fed, which is currently three rate cuts this year.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Surges Past $47K as ETF Inflow Momentum Builds

After remaining range bound between $42.5K-$43.5K for the past few weeks, jumped higher on Wednesday evening and once again broke through the $45K level for the first time since a month ago. By Friday, BTC had pushed above $47K.

Continued demand for the spot bitcoin ETFs could be helping the move higher and they have been showing more strength this week from Grayscale’s GBTC for the ninth consecutive day. , inflows amounted to $226M, led by BlackRock and Fidelity, with each receiving $56M and $130M respectively, while GBTC only saw $81M in outflows. On Thursday, spot bitcoin ETFs posted with $400M pouring into the funds. The nine spot Bitcoin ETFs (excluding GBTC) , moving them in line with Microstrategy, the largest corporate holder of Bitcoin who in January to bring its total holdings to 190,000 BTC.

Solana Remains Above $100 Despite 5-Hour Outage

has seen a huge resurgence in price over the past year, and with its lower fees and increased transaction processing times, the Solana network is one of the leading competitors against Ethereum in the Layer 1 space. The network had been rebuilding its credibility alongside its price following a number of outages since launch, and achieved of uninterrupted service before .

On Tuesday, the network experienced a significant outage leaving the network , resurfacing the debate and criticism of Solana being too centralized. Some users came to the defense of the network stating that it is The price of SOL initially fell on the news, breaking below the $94 mark. However, the price fought back after the issues were resolved and moved above $100 on Wednesday evening.

Altcoins Perform Well as Ethereum Name Service Partners With GoDaddy

saw its price gain over 20% over the past seven days following the announcement of on Monday that will allow Web3 users to link their .eth names to traditional Web2 domains at no additional cost.

Other leading altcoins were also up this week, including Avalanche (AVAX) +3%, XRP +4%, Filecoin (FIL) +6%, and Immutable X (IMX) +8%.

Stocks Continue to Reach New Highs as Interest Rate Cut Timing Debate Continues

Stock prices continued to add to their strong start to the year with US stock indices again this week. On Wednesday, the closed within touching distance of the 5,000 mark for the first time ever, at 4995.05 as the markets pushed higher results and the majority of companies in the index surpassing profit expectations so far this quarter. That 5,000 level was crossed by the S&P 500 on Friday.

The timing of interest rate cuts also , following the Federal Open Market Committee (FOMC) meeting and last week which reduced hopes of the first rate cut coming at the next meeting in March. during an interview on “60 Minutes” on Sunday, reiterated his stance that March may be too early to cut rates as more confidence is needed that inflation is moving down to the Federal Reserve's 2% target. “I think it’s not likely that this committee will reach that level of confidence in time for the March meeting, which is in seven weeks,” he said.

Market participants have tapered expectations slightly and are now , down from six at the start of the year. However, this is still higher than the baseline scenario put forward by the Fed, which is currently three rate cuts this year.

-From the Gemini Trading Desk

data as of 5:10pm ET on February 8, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Layer-2 Scaling Solutions

Layer-2 refers to a network or technology that operates on top of an underlying blockchain protocol to improve its scalability and efficiency. This category of scaling solutions entails shifting a portion of a blockchain protocol’s transactional burden to an adjacent system architecture, which then handles the brunt of the network’s processing and only subsequently reports back to the main blockchain to finalize its results. By abstracting the majority of data processing to auxiliary architecture, the base layer blockchain becomes less congested — and ultimately more scalable.

For instance, Bitcoin is a Layer-1 network, and the is a Layer-2 solution built to improve transaction speeds in this fashion on the Bitcoin network. Other examples of Layer-2 solutions include:

Nested blockchains: A nested blockchain is essentially a blockchain within — or, rather, atop — another blockchain. The nested blockchain architecture typically involves a main blockchain that sets parameters for a broader network, while executions are undertaken on an interconnected web of secondary chains. Multiple blockchain levels can be built upon a mainchain, with each level using a parent-child connection. The parent chain delegates work to child chains that process and return it to the parent after completion. The underlying base blockchain does not take part in the network functions of secondary chains unless dispute resolution is necessary.

The distribution of work under this model reduces the processing burden on the mainchain to exponentially improve scalability. The project is an example of Layer-2 nested blockchain infrastructure that is utilized atop the Layer-1 Ethereum protocol to facilitate faster and cheaper transactions.

State channels: A state channel facilitates two-way communication between a blockchain and transactional channels and improves overall transaction capacity and speed. A state channel does not require validation by nodes of the Layer-1 network. Instead, it is a network-adjacent resource that is sealed off by using a multi-signature or smart contract mechanism.

When a transaction or batch of transactions is completed on a state channel, the final “state” of the “channel” and all its inherent transitions are recorded to the underlying blockchain. The Liquid Network, Celer, Bitcoin Lightning, and Ethereum's Raiden Network are examples of state channels. In the Blockchain Trilemma tradeoff, state channels sacrifice some degree of decentralization to achieve greater scalability.

Sidechains: A sidechain is a blockchain-adjacent transactional chain that’s typically used for large batch transactions. Sidechains use an independent consensus mechanism — i.e., separate from the original chain — which can be optimized for speed and scalability. With a sidechain architecture, the primary role of the mainchain is to maintain overall security, confirm batched transaction records, and resolve disputes.

Sidechains are differentiated from state channels in a number of integral ways. Firstly, sidechain transactions aren’t private between participants — they are publicly recorded to the ledger. Further, sidechain security breaches do not impact the mainchain or other sidechains. Establishing a sidechain might require substantial effort, as the infrastructure is usually built from the ground up.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026