JUL 10, 2025

Bitcoin Surges Past $116K To Hit Record High, BlackRock’s Spot Bitcoin ETF Surpasses 700K BTC, and Strategy Plans $4.2B Raise

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn about custodial vs. non-custodial wallets.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +5.88% | $115,973.80 |

$115,973.80

+5.88%

| |

Ether

ETH | +14.20% | $2,946.42 |

$2,946.42

+14.20%

| |

Aave

AAVE | +11.90% | $314.3298 |

$314.3298

+11.90%

| |

Uniswap

UNI | +12.70% | $8.4941 |

$8.4941

+12.70%

| |

Ethereum Name Service

ENS | +8.86% | $21.25 |

$21.25

+8.86%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of July 10, 2025, at 5:45 pm ET. . All prices in USD.

Takeaways

- Bitcoin hits another all-time high: The pushed to nearly $117,000 on Thursday, blowing past a previous high set Wednesday. With the latest upward move, bitcoin has risen 24% year-to-date and more than doubled in value over the past year.

- BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed 700,000 BTC in assets under management just 18 months after launch: IBIT now holds 56% of all US spot Bitcoin ETF assets, with total industry AUM at around 1.25 million BTC.

- Strategy has initiated a plan to raise up to $4.2 billion by issuing its 10% Series A Perpetual Stride Preferred Stock: The capital will reportedly support general corporate needs, including fresh bitcoin purchases, and may cover dividends.

- ReserveOne will merge with M3-Brigade Acquisition V Corp to go public at a valuation of $1 billion: The new entity plans a diversified yield-focused crypto portfolio, anchored by bitcoin while also including ETH, SOL and other popular tokens.

- Japanese firm Metaplanet added 2,205 bitcoin, valued at around $239 million, bringing its treasury to 15,555 BTC: The firm has secured the number five spot for largest publicly-traded bitcoin holders.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Hits Another All-Time High

Bitcoin has now increased about 24% year-to-date, well ahead of traditional indices including the NASDAQ and S&P 500, which have both risen about 7% during the same timeframe.

Over the past year, the price of bitcoin has nearly doubled; it was at roughly $57,000 at the same time last year. Increased institutional adoption and demand from investors who view bitcoin as a reliable store of value has played a big role in the upward price action. The latest rally coincided with a broader tech rally this week, with Nvidia becoming the first company to hit a $4 trillion market cap.

The beginning of summer has been busy for crypto. On Wednesday, the US Senate held a hearing to discuss the future of a crypto market structure bill. And the Republican-controlled House is expected to attempt to advance a bill regulating stablecoins next week, paving the way for President Donald Trump to sign the bill into law.

BlackRock’s IBIT ETF Tops 700,000 BTC in AUM

The fund added approximately 1,510 BTC in net inflows following the 4th of July holiday, and as of July 7, had pushed above 700,000 BTC, worth more than $76 billion. IBIT continues to outperform all other US spot bitcoin ETFs, capturing roughly 56% of the industry’s combined holdings.

IBIT’s nearest competitor, Fidelity’s FBTC, holds just over 200,000 BTC. Grayscale’s GBTC, after converting to an ETF, has seen its BTC balance drop to 184,226 coins from its peak before the conversion. Since their debut in 2024, US spot bitcoin ETFs have collectively amassed more than $50 billion in net inflows, with IBIT alone accounting for nearly $53 billion of that total. IBIT also dominates daily trading volumes, accounting for roughly 80% of bitcoin traded through ETFs on Monday.

Strategy Launches $4.2 B ATM Offering of 10% Stride Preferred Stock

Shares will be offered gradually, with the company calibrating each sale based on prevailing market prices and trading volumes. Proceeds from the STRD offering are primarily earmarked for purchasing additional bitcoin. Strategy also retains the option to use net proceeds to pay dividends.

This launch of the initiative coincides with the firm’s first pause in bitcoin purchases in three months, as disclosed in a recent SEC filing. Strategy holds 597,325 BTC for a total outlay of roughly $42.4 billion and current market value of more than $65 billion. In Q2, Strategy reported $14.05 billion in unrealized gains on its digital assets. In the same quarter, the company also raised $6.8 billion through at-the-market sales of common stock (MSTR) and its three preferred share series.

ReserveOne to Go Public via $1 B SPAC Deal Backed by Galaxy, Pantera

The deal values the company at approximately $1 billion and provides $298 million in SPAC trust capital, alongside $750 million in PIPE investments from industry heavyweights such as Galaxy Digital, Pantera Capital and others.

Expected to complete in Q4, the merged company will trade under the ticker RONE and will manage a diversified crypto portfolio anchored by bitcoin while also including ETH, SOL and other popular tokens. The firm’s strategy will be focused on yield generation through institutional-grade staking and lending programs. The board of the company will also feature influential figures including Tether co-founder Reeve Collins and former US Commerce Secretary Wilbur Ross.

Metaplanet Adds 2,205 BTC, Maintaining Fifth‑Largest Corporate Holder Status

The deal was carried out at an average price of about $108,237 per coin. Metaplanet maintains its position as the fifth‑largest publicly traded corporate bitcoin holder globally.

In Q2, Metaplanet generated roughly $7.6 million in revenue, which reflected more than a 42% increase YoY due to growing income from its crypto treasury operations. The board has also reportedly set an ambitious target to expand its holdings to over 210,000 BTC by the end of 2027. The firm’s strategy of building a bitcoin‑centric financial model is designed to drive both revenue growth and shareholder value.

-Team Gemini

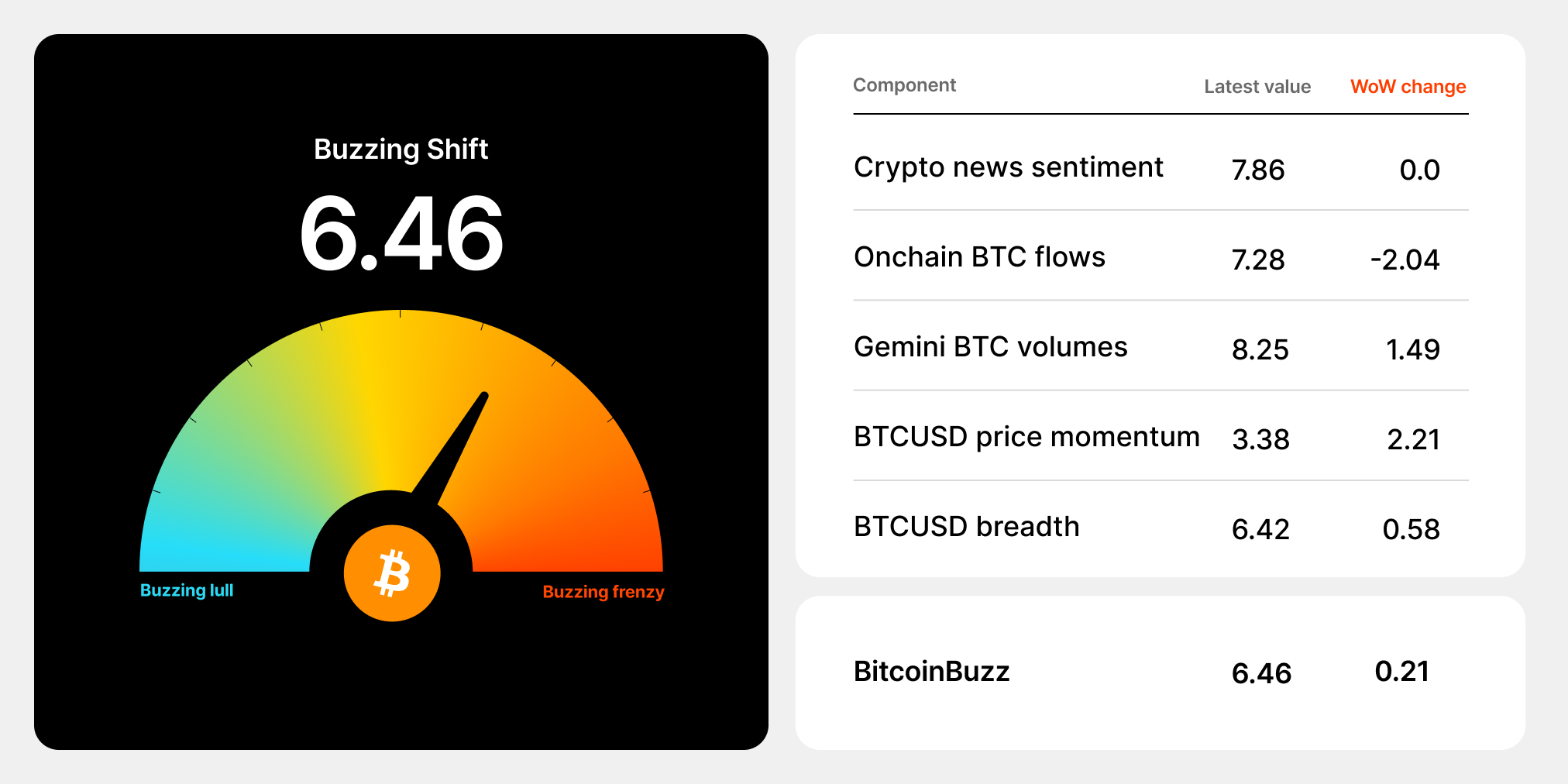

data as of 5:21 pm ET on July 8, 2025.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Custodial vs. Non-Custodial Wallets

Once you’ve purchased cryptocurrency, you must decide whether to use a custodial vs. non-custodial wallet to store your funds.

With a non-custodial wallet, you have sole control of your private keys, which in turn control your cryptocurrency and prove the funds are yours. While there is no need to trust a third party when using a non-custodial wallet, this also means that you are solely responsible for not losing your keys and requires that you take your own precautions to protect your funds.

With a custodial wallet, another party controls your private keys. In other words, you’re trusting a third party to secure your funds and return them if you want to trade or send them somewhere else. While a custodial wallet lessens personal responsibility, it requires trust in the custodian that holds your funds, which is usually a cryptocurrency exchange.

Most custodial wallets these days are web-based exchange wallets. The following information can help you decide which is right for you.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026