JAN 05, 2024

Bitcoin Sees 156% Surge in 2023 as Spot ETF Potential Drives Sentiment, Ethereum Pushes Forward With Robust 2024 Roadmap, Interest Rate Outlook Complicated by Strong Jobs Report, Arbitrum and Sei Start 2024 on the Rise

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss the basics of Layer-1 blockchains and scaling solutions.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +3.14% | $43,346 |

$43,346

+3.14%

| |

Ether

ETH | -3.65% | $2,219 |

$2,219

-3.65%

| |

Ethereum Name Service

ENS | +39.10% | $13.828 |

$13.828

+39.10%

| |

Zebec Protocol

ZBC | +35.20% | $0.01163 |

$0.01163

+35.20%

| |

Loopring

LRC | -25.70% | $0.2553 |

$0.2553

-25.70%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, January 5, 2024, at 11:50am ET. . All prices in USD.

Takeaways

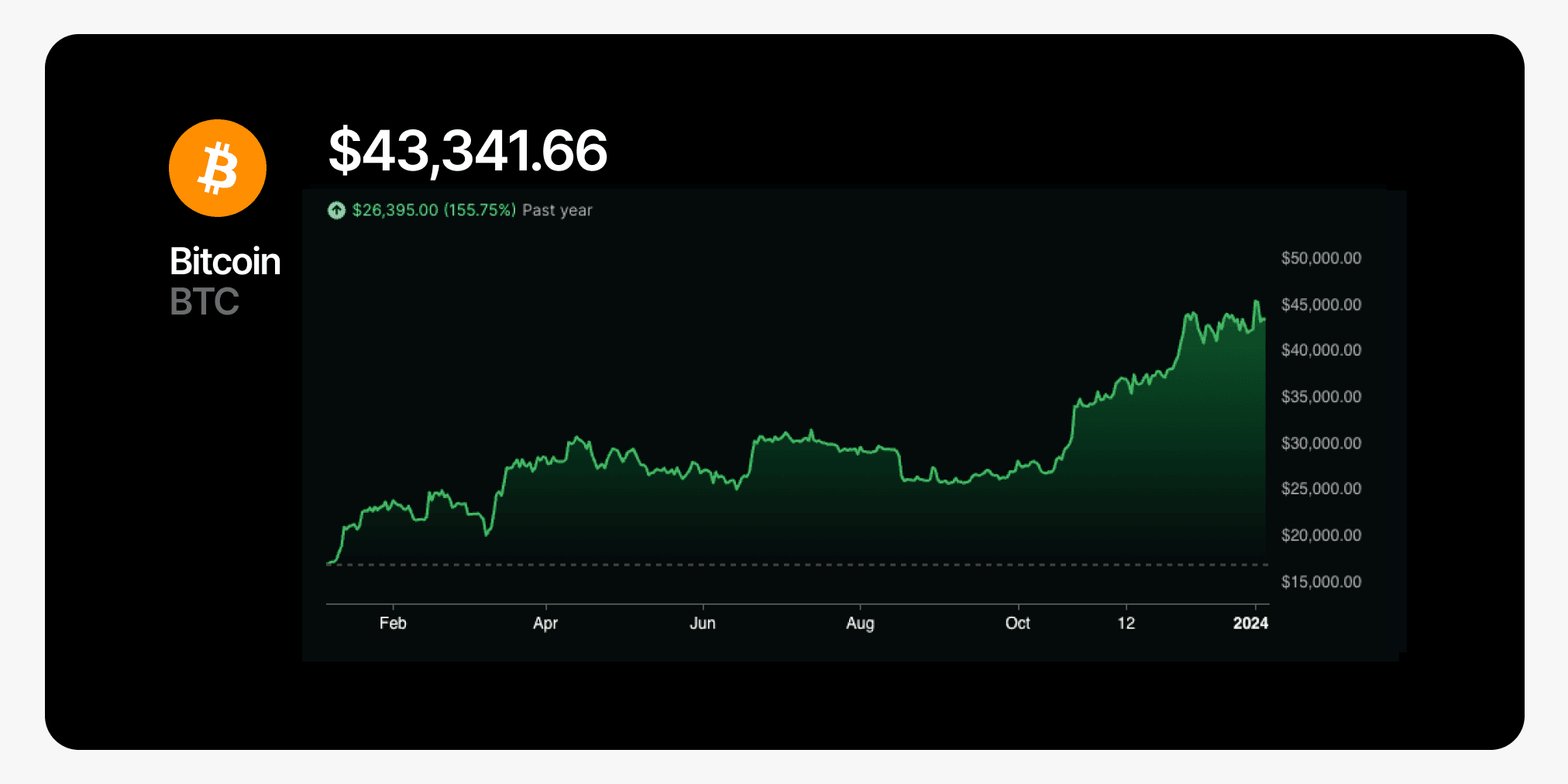

- Bitcoin gains 156% in 2023: Bitcoin (BTC) managed to close out 2023 with an impressive 156% gain, rising from ~$16k to over $42k as the leading crypto asset regained credibility following numerous high profile collapses in the previous year. Throughout the second half of 2023, BTC prices generated strong momentum as confidence grew around the possible approval of a US-based spot Bitcoin ETF.

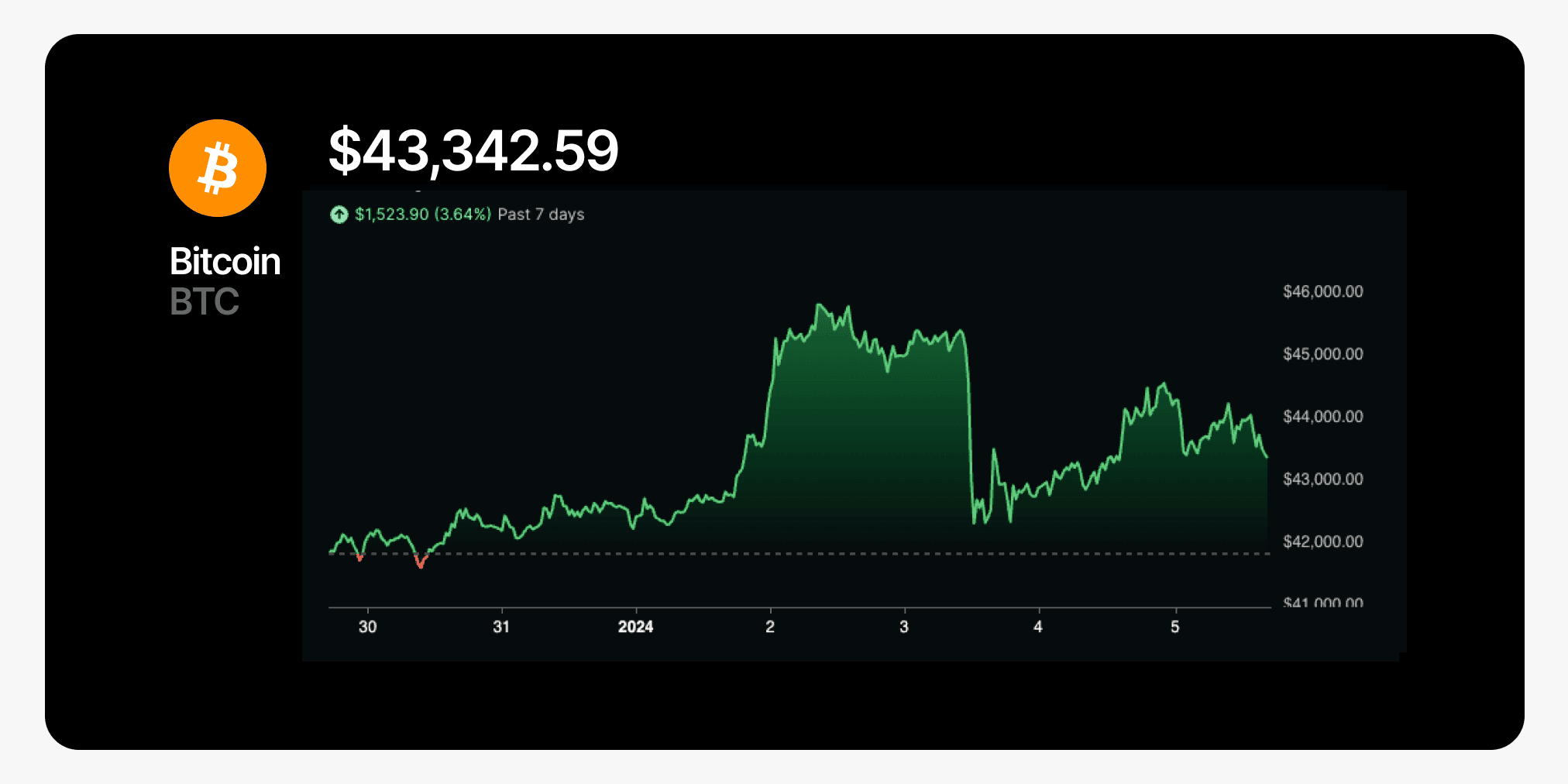

- Despite volatile start to 2024 and negative ETF report, bitcoin remains in the $43k-$44k range: Anticipation of the coming spot bitcoin ETF decision (expected by January 10) was palpable on Wednesday, as BTC abruptly fell more than 10% following dissemination of a Matrixport report suggesting that the SEC could reject all pending ETF applications. As the story developed, there was no source to suggest that a decision to reject the ETFs had been made, and with most evidence so far suggesting there will be an approval announcement before the deadline next week, BTC bounced back to the $44k level.

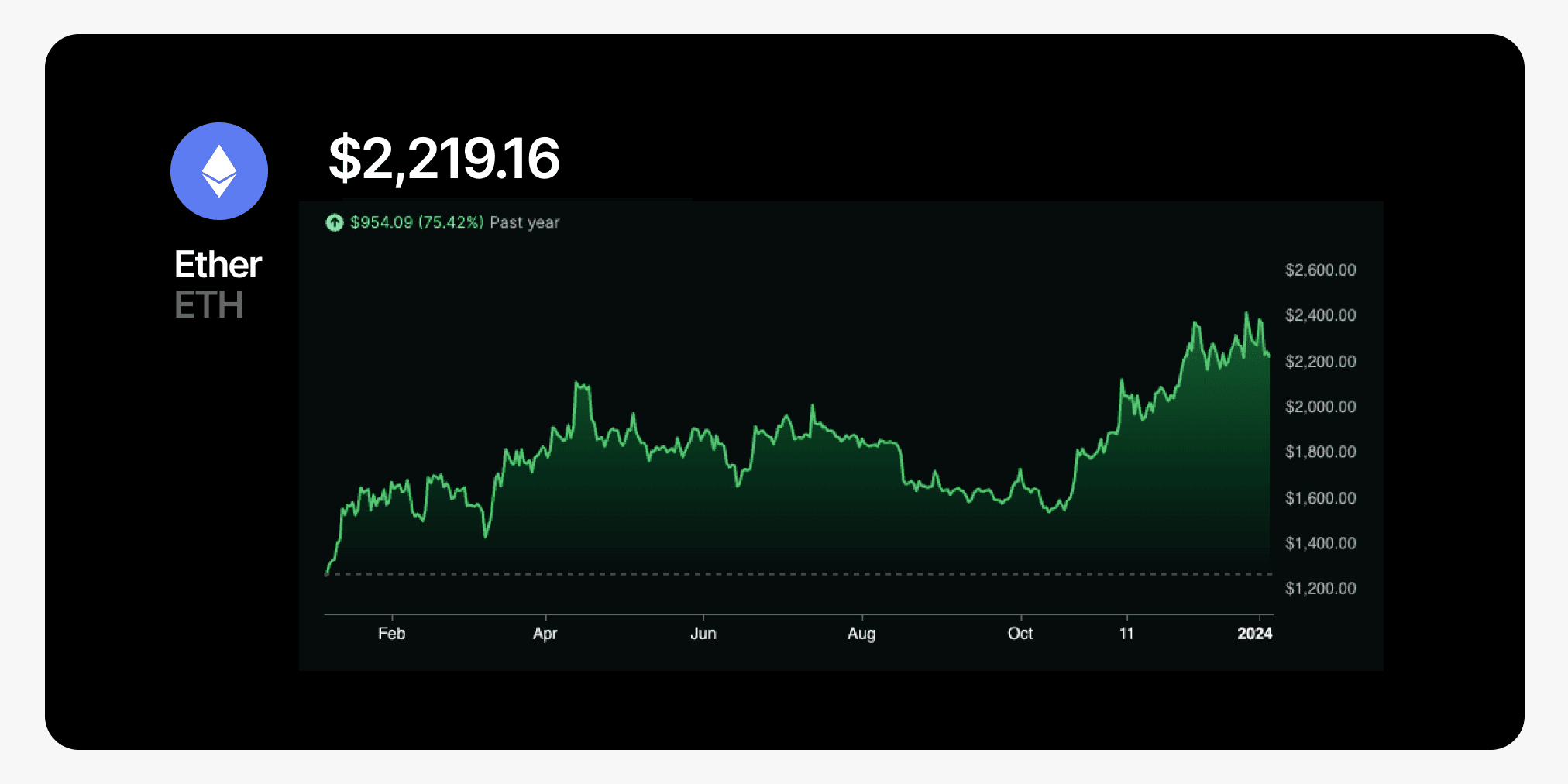

- Ethereum co-founder Vitalik Buterin shares a robust 2024 roadmap: Ethereum will continue its focus on its six main priorities: the Merge, the Surge, the Scourge, the Verge, the Purge and the Splurge. With the approval of a US-based spot bitcoin ETF potentially days away, some market participants are already eyeing up a potential ether ETF this summer as the next catalyst for the second most popular crypto.

- Interest rates expected to fall in 2024, but strong jobs report may delay rate cuts: Minutes from the Fed’s December meeting showed that rates are most likely at their peak with nearly all officials predicting lower rates in 2024. There appears to be disagreement, however, on how long rates will stay at the current elevated levels. On Friday, the final jobs report of 2023 showed that employers added 216,000 jobs in December, well above expectations, and potentially complicating the outlook for a rate cut early in 2024.

- Sei and Arbitrum outperform to start 2024: SEI, the Sei Network’s governance token, is trading up +25% over the past seven days and reached a new all time high above $0.80 as the network continues to see growing adoption. Arbitrum (ARB) was another outperformer this week, gaining +28% over the past seven days, with the token briefly crossing the $2 mark.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Surges 156% in 2023

managed to close out 2023 with , rising from ~$16k to over $42k as the leading crypto asset regained credibility following numerous high profile collapses in the previous year.

Throughout the second half of 2023, BTC prices generated strong momentum as confidence grew around the possible approval of a US-based spot bitcoin ETF. As approaches for the US Securities and Exchange Commission (SEC) to approve or reject a spot Bitcoin ETF, market participants are on edge waiting for any news that could point to how the SEC will rule.

Bitcoin Declines 10% on Bitcoin ETF Rejection Report, Pares Losses as Market Awaits ETF Decision

The anticipation was palpable on Wednesday when a Matrixport report sent to clients all spot bitcoin ETF applications. Although the report was an opinion piece by a Matrixport analyst, a large sell-off ensued following the dissemination of the report and circulation . The decline was exacerbated by built up in the market over the new year, with funding rates on perpetuals at one point. dropped over 10% in less than two hours, from ~$45.3k to ~$40.6k as a cascade of liquidations took place.

, there was ~$700 million worth of liquidations on Wednesday, with bitcoin accounting for ~$168 million of this and ether $113 million. As the story developed, there was no source to suggest that a decision to reject the ETFs had been made, and with most evidence so far suggesting there will be an approval announcement before the deadline next week, the price of bitcoin bounced back off its lows returning to the $43.5k level.

Ethereum Priorities Remain Largely Unchanged in Updated 2024 Roadmap

Last weekend, Ethereum co-founder Vitalik Buterin for the Ethereum blockchain, with a continued focus on six major priorities: the Merge, the Surge, the Scourge, the Verge, the Purge and the Splurge. of what each of these priorities entail: “the Merge (a robust proof-of-stake consensus), the Surge (a goal of 100,000 transactions per second across Ethereum and its Layer 2 networks), the Scourge (mitigating risks around MEV and liquid pooling), the Verge (easier block verification), the Purge (simplifying the protocol), and the Splurge (everything else).”

The price of showed momentum in the first half of 2023, peaking in April at ~$2140 as the much anticipated Shanghai upgrade was completed, allowing users to withdraw staked ETH for the first time. Since then, ETH has been largely overshadowed by BTC and has struggled to find a strong narrative to push its price higher, only moving past its April high in December.

Notably, other Layer-1 blockchains such as , , and have surged recently, adding to the frustration of some ETH proponents as the token remained in the $2,200-$2,400 range.

With the approval of a US-based spot bitcoin ETF potentially days away, some market participants are already eyeing up a this summer as the next catalyst for the second most popular crypto.

Interest Rates Likely to Come Down in 2024, But Strong Jobs Data Complicates Outlook

Minutes from the latest Federal Reserve policy meeting . They showed that rates are and nearly all officials are predicting lower rates in 2024.

There appears to be more disagreement, however, on how long rates will stay at these elevated levels, with some officials warning that rates could stay high for longer than anticipated. On Friday, the final jobs report of 2023 showed that , well above expectations, and potentially complicating the outlook for a rate cut early in 2024.

Stocks faced a shaky start to the year with major US indices in the first trading days of the year. Some of the notable outperformers of 2023 faced a challenging start in the first trading days of the year, with .

Oil prices as in the Middle East have continued to weigh on markets. An explosion at a ceremony in Iran, along with the shipping disruptions in the Red Sea, the escalation of Israel's war with Hamas following the killing of the Hamas deputy leader, and a shutdown of Libya’s top oilfield could all lead to major disruption to global oil supplies.

Sei and Arbitrum Surge to Start 2024 as Many DeFi Tokens Struggle

Despite a large number of tokens facing double digit declines this week, some have managed to buck the trend and post significant gains amongst the market troubles.

, the Sei Network’s governance, is trading up +25% over the past seven days and reached a new all time high above $0.80 as the network continues to see growing adoption. The price rise follows similar large jumps we have seen across other Layer-1 blockchains in recent months, including and .

was another outperformer this week, gaining +28% over the past seven days, with the token briefly crossing the $2 mark. Total Value Locked (TVL) has been steadily rising since October, crossing $2.5 billion this week, narrowly stopping short of its all time high of $2.6 billion reached in November 2021. on the network also skyrocketed on Wednesday to $1.8 billion, the volume on Solana.

-From the Gemini Trading Desk

data as of 5:10pm ET on January 4, 2024.

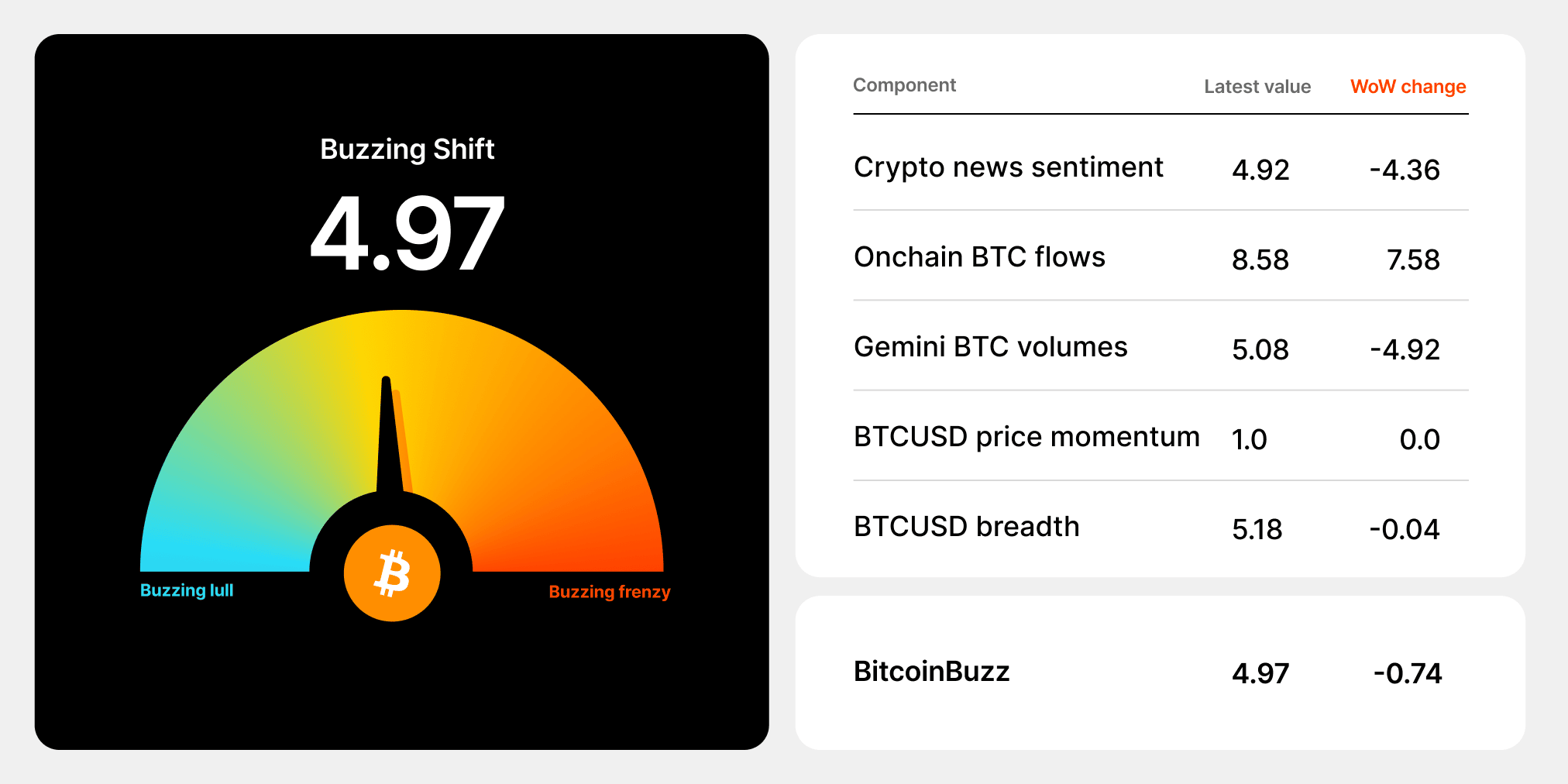

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Layer-1 Blockchains and Scaling Solutions

A Layer-1 blockchain is typically a name used to describe a main blockchain network protocol such as Ethereum or Bitcoin. The name Layer 1 comes from its relationship with Layer-2 scaling solutions such as state channels, rollups, nested blockchains, and plasma sidechains.

Layer-1 blockchains are simply the main network that a Layer-2 scaling solution attaches to in order to improve the scalability and transaction throughput of the mainchain, or Layer 1. Layer-1 blockchains can also be known as the parent chain or root chain, among other classifications.

What are Layer-1 Scaling Solutions?

Layer-1 scaling solutions augment the base layer of the blockchain protocol itself in order to improve scalability.

Here’s how it works: Layer-1 solutions change the rules of the protocol directly to increase transaction capacity and speed, while accommodating more users and data. Layer-1 scaling solutions can entail, for example, increasing the amount of data contained in each , or accelerating the rate at which blocks are confirmed, so as to increase overall network throughput.

Other foundational updates to a blockchain to achieve Layer-1 network scaling include:

Consensus protocol improvements: Some are more efficient than others. is the consensus protocol currently in use on popular blockchain networks like Bitcoin. Although PoW is secure, it can be slow. That’s why many blockchain networks favor the consensus mechanism. Instead of requiring to solve cryptographic algorithms using substantial computing power, PoS systems process and validate new blocks of transaction data based on participants staking collateral in the network.

Sharding: Sharding is a mechanism adapted from distributed databases that has become one of the most popular Layer-1 scaling solutions. Sharding entails breaking the of the entire blockchain network into distinct datasets called "shards" — a more manageable task than requiring all nodes to maintain the entire network. These network shards are simultaneously processed in parallel by the network, allowing for sequential work on numerous transactions.

Further, each network node is assigned to a particular shard instead of maintaining a copy of the blockchain in its entirety. Individual shards provide proofs to the and interact with one another to share addresses, balances, and general states using cross-shard communication protocols.

.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026